About O3

O3 Swap is the first cross-chain aggregation protocol that enables free trading of native assets between heterogeneous chains, by deploying "aggregator + asset cross-chain pool" on different public chains and Layer2, provides users to enable cross-chain transactions with one click. Currently, it has access to Heco, ETH, BSC, Neo, and will expand to Polkadot, Polygon, Solana, and other ecosystems in the future.

Official Website

Social Media

Frequently Asked Questions

What is O3 Swap?

Read MoreO3 Swap is the first cross-chain aggregation protocol that enables free trading of native assets between heterogeneous chains, by deploying "aggregator + asset cross-chain pool" on different public chains and Layer2, provides users to enable cross-chain transactions with one click. Currently, it has access to Heco, ETH, BSC, Neo, and will expand to Polkadot, Polygon, and other ecosystems in the future.

What qualities / benefits does O3 Swap have?

Read More1. Permissionless: In any environment, anyone can access O3 Swap without permission and KYC review.

2. Implement a cross-chain exchange:

We implement proven and possible cross-chain solutions with our aggregation protocol. With this, we can achieve cross-chain transactions where users are able to freely exchange multi-chain assets with a single click.

3. Offer the best price:

In order to provide more efficient and simple trading, we compare different exchanges on the leading chains to find the most cost-effective rates. Users can exchange assets at the lowest rate and via the most efficient trading route.

4. Token incentives:

To promote a high level of activity for our network ecology, O3 Swap will issue a governance token. It is an important mediator to promote the development of the O3 Swap network. Based on the economic model of O3 Swap, all participants and developers are encouraged to invest in the maintenance of the overall ecological network.

What is the background of the O3Labs team?

Read MoreThe O3 Labs was established in Tokyo in 2017 and is one of the early crypto wallet development teams in Neo ecosystem. At present, our team members are from Tokyo, New York, Singapore, and Taipei. O3 Labs has been focusing on providing professional crypto asset management tools and services. Currently, we have provided wallet services for 100,000+ users.

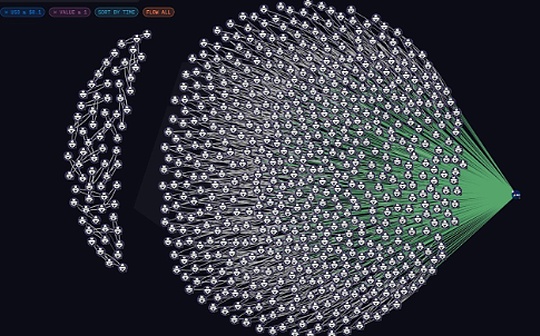

How does O3 Swap work? What are the modules?

Read MoreThe main functional modules of O3 Swap include the exchange aggregator (O3 Aggregator), cross-chain pool (Pool), and asset management center (Dashboard). O3 Aggregators help users find the most effective trading rates and routes in the corresponding network. Pool provides users with cross-chain transaction services and supports users to add liquidity by a single token from different chains to earn income from cross-chain transaction fees and O3 rewards. Dashboard supports users logging in through their own wallet to manage assets and data. The Dashboard displays: total amount of assets, claimable assets, added liquidity, stake, and revenue management.

What is the all-time high price of O3 Swap (O3)?

Read MoreThe all-time high of O3 was 0 USD on 1970-01-01, from which the coin is now down 0%. The all-time high price of O3 Swap (O3) is 0. The current price of O3 is down 0% from its all-time high.

How much O3 Swap (O3) is there in circulation?

Read MoreAs of

, there is currently 56.83M O3 in circulation. O3 has a maximum supply of 100.00M. What is the market cap of O3 Swap (O3)?

Read MoreThe current market cap of O3 is 87,860.97. It is calculated by multiplying the current supply of O3 by its real-time market price of 0.00154609814.

What is the all-time low price of O3 Swap (O3)?

Read MoreThe all-time low of O3 was 0

, from which the coin is now up 0%. The all-time low price of O3 Swap (O3) is 0. The current price of O3 is up 0% from its all-time low. Is O3 Swap (O3) a good investment?

Read MoreO3 Swap (O3) has a market capitalization of $87,860.97 and is ranked #3019 on CoinMarketCap. The cryptocurrency market can be highly volatile, so be sure to do your own research (DYOR) and assess your risk tolerance. Additionally, analyze O3 Swap (O3) price trends and patterns to find the best time to purchase O3.