Author: Terry, Source: Vernacular Blockchain

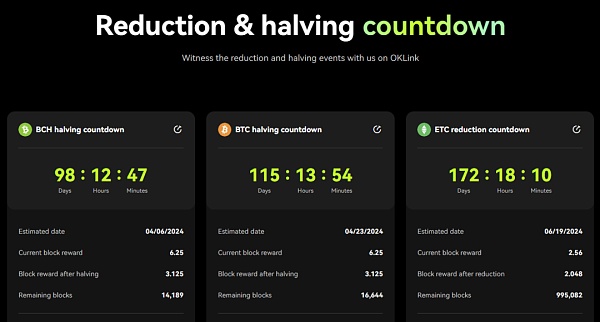

Currently there are less than 4 months left before the fourth Bitcoin halving. month, which is expected to be April 23, 2024, when the block reward will drop from 6.25 BTC to 3.125 BTC.

As one of the most important narratives in the crypto industry, "Bitcoin halving" has always been an important stimulating event that the market has great expectations for.Facing the end of a new halving cycle, What should we expect, and what new variables have emerged in the market?

Source: OKLink

Source: OKLink

01 What impact will the halving have on the crypto market?

For the crypto industry, each round of halving is a grand event, especially the first two halving cycles of Bitcoin, which both saw an astonishing increase of dozens of times (in the short term, After the two halvings, there was a short-term decline accompanied by the exhaustion of profits, but then the adjustment was completed and a long-term upward trend emerged).

However, starting from the third halving in 2020, as the number of industry practitioners, market attention, and the perfection of supporting infrastructure have all improved significantly than before, Bitcoin is no longer a limitation. Niche products in geek circles have begun to interact with more external factors.

A brief summary:

Before the first halving, geeks in the circle were more concerned about the possibility of Bitcoin as electronic cash;

During the second halving cycle, the focus on Bitcoin shifted to its properties as a payment tool, which also triggered a series of debates (the subsequent BCH fork was almost the top trend in the circle);

In the third halving cycle, Bitcoin has become an alternative asset, and attention to the layout of traditional institutions and capital has begun to become the main theme;

So compared with the previous two times Halving, the popularity of Bitcoin’s third halving is also unprecedented. At the same time, the overall political and economic environment of the world during Bitcoin’s third halving also affected its performance:

Under the influence of macro factors, from March 12 to March 13, two months before the halving on May 11, Bitcoin began to decline from $7,600, first falling to $5,500 and fluctuating. Subsequently, it broke through the support point all the way, reaching as low as 3,600 US dollars. The overall market value evaporated by 55 billion US dollars in an instant, and the entire network liquidated more than 20 billion yuan, accurately achieving "price halving".

However, after the halving in May, the DeFi summer started a new bull market cycle, and Bitcoin also hit $60,000, nearly 20 times higher than the lowest point before the halving.

In general, judging from historical experience, it is very likely to start a new bull market cycle after the halving. It may be difficult to achieve an increase of more than 10 times in terms of current volume. However, the $60,000 that exceeds the high point of the last bull market is still worth looking forward to.

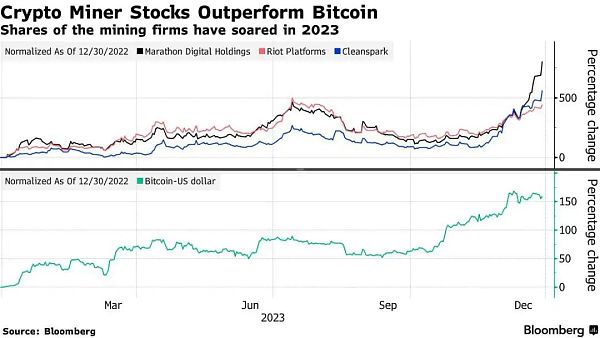

In addition, it is worth noting that before every Bitcoin halving, listed mining companies are also the best "self-leveraged" related targets:

Listed Among the mining companies, there are currently 15 miners listed on Nasdaq and Toronto Stock Exchange. Among them, MARA, as the leader, has risen for 11 consecutive trading days, with an increase of more than 100%. This year’s total increase has exceeded 800%. Riot’s increase this year It also exceeded 400%, while Bitcoin’s increase during the same period was only about 160%.

02 Besides halving New variables

However, at the same time, under the background that Bitcoin has experienced three halvings, the block reward has been reduced to 6.25, and the number of mined coins has reached more than 19 million, in fact, It’s time to reconsider many situations and things from a new perspective.

In particular, the entire industry and Bitcoin itself have seen some new variables worthy of attention compared to previous halvings.

1) The incremental funding impact of spot ETFs

The core factor of the market rise in the past two months is "spot bits" "Currency ETF" is expected to be stimulated.

Judging from the established timetable, the closest time point to the spot Bitcoin ETF application results is January 10, 2024: ARK 21Shares Bitcoin, which has been delayed twice A final decision is coming on ETFs.

In addition, from January 14 to 17, 2024, also There are 7 spot Bitcoin ETF applications that will usher in the time node for the US SEC to make a decision. However, according to past practice, there is a high probability that it will continue to be postponed to the final time window of mid-March.

But even if it is postponed again to mid-March, the dust will eventually settle before the Bitcoin halving in late April, which also means that the final decision on spot ETFs will be made earlier than the Bitcoin halving. Half the time node.

Once the ETF is passed and the halving event is superimposed, Bitcoin may start a new cycle driven by double positive factors. Even if it is not as good as expected, it can still act as a hedge. about.

In addition, there is actually a "quasi-Bitcoin ETF" on the market that is constantly expanding in size - leaving aside the exchange as a custodian, the number of Bitcoins currently held exceeds 100,000 Among the major corporate entities, in addition to Block.one and the long-defunct Mt.Gox, MicroStrategy ranks third.

As a native of Bitcoin, MicroStrategy’s purchase of Bitcoin has long been a well-known strategy. The news of its public purchase of Bitcoin can be traced back to the earliest As of August 11, 2020, this month MicroStrategy and its subsidiaries once again purchased approximately 14,620 Bitcoins for approximately $615.7 million in cash:

The average purchase price was $42,110 as of December 26, 2023 As of today, MicroStrategy holds 189,150 BTC, with an average purchase cost of $31,168.

You must know that the total market value of MicroStrategy's stocks is only US$9 billion, of which Bitcoin assets account for US$6 billion, which means that 2/3 of the net assets can be understood as the value of Bitcoin, which also leads to Many investors allocate MicroStrategy as a "quasi-Bitcoin ETF".

2) Internal evolution of the Bitcoin ecosystem

According to Bitcoin’s halving rule, the block reward starts with 50 Bitcoins, and the rule is that every It is halved once every four years, and it has been halved three times so far, which is 6.25.If this continues to be reduced, Bitcoin will no longer have block rewards by 2140;

And Handling fees will always exist, so with each round of halving, block rewards will gradually decrease or even approach nothing. In the future, miners’ income will become very single, with only handling fee rewards.

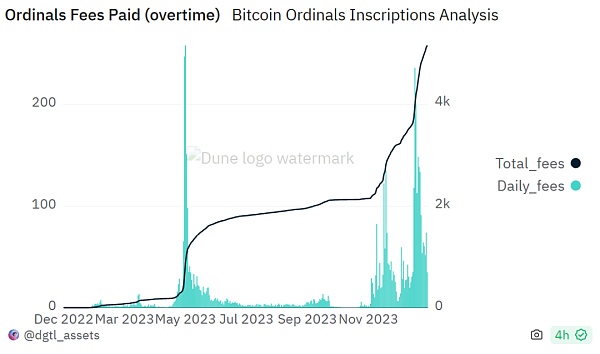

The prosperity of the Bitcoin ecosystem, especially BRC20, this year has set off a new wave of "BitcoinFi", and the activity of transactions within the Bitcoin ecosystem has reached a new peak, thus boosting Bitcoin's fee income.

In this context, protocol innovations such as Ordinals, accompanied by the siege of leading projects such as ORDI and SATS, have profoundly affected the rate model of the Bitcoin network - most directly, it has completely changed Bitcoin’s economic model and incentive model.

Dune’s latest data shows that as of December 29, the cumulative fee for Ordinals inscription casting exceeded 5,135 BTC, exceeding $200 million.

This has also helped BTC mining fee income hit a new high in the past five years. The previous historical average data of miner fee income often accounted for only about 2%, but the average data in the past three months has reached about 8%, setting a historical record.

As subsequent block rewards gradually decrease until they approach zero, the handling fee will become more and more important until it eventually becomes the only source of income.

So this round of BRC20 is equivalent to a preview in advance. Regardless of whether it is successful or not, with the subsequent Bitcoin halving, the future of BRC20 will be The variables are bound to profoundly change Bitcoin’s overall rate model.

03 Summary

In addition to the two main variables, one internal and one external, such as ETF and Ordinals wave, there are also There are some positive potential variables that have never appeared in the previous halving cycle and are advancing rapidly, which may have an impact on the new round of market evolution.

On the one hand, the Bitcoin bond "Volcano Bond" has been approved by the El Salvador Digital Assets Commission and is expected to be issued in the first quarter of 2024.

This is also the first Bitcoin-focused national bond issuance. Half of the funds raised from the bond will be used to purchase Bitcoin and be held for five years, and the remainder will be used to It is worth paying attention to the subsequent ripples of funding Bitcoin-related construction projects.

On the other hand, the Ordinals wave has introduced a huge amount of funds, users, and developers into the Bitcoin ecosystem through the inscription pipeline:

If we talk about the past Bitcoin only has the advantages of "orthodox cognition" and total market capitalization. The inscription trend directly and significantly increases the richness of new assets in the Bitcoin ecosystem. Humanity's demand for new assets is eternal, and it also indirectly improves the development of new assets. number of users and user base.

At the same time, RGB protocol, Slashtags (serving identity accounts, contacts, communications, and payments in the Bitcoin Lightning Network ecosystem), Impervious browser integrating many P2P services, Taproot-based asset protocol Taro, New innovations such as the Lightning Token OmniBOLT are worth looking forward to.

In general, although the footsteps of this halving are getting closer and closer, the expansion of Bitcoin in all dimensions has obviously ushered in new variables, and even once exceeded the halving. Attention, as for where these new variables will eventually lead Bitcoin, it is worth looking forward to.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Sanya

Sanya JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Cointelegraph

Cointelegraph