Author: Revc, Golden Finance

Foreword

Golden Finance reported that according to data tracked by Lookonchain, frenulum.eth earned 274 ETH (about 696,700 US dollars) in 2 days by trading VISTA, with a return rate of 134 times. Frenulum.eth only spent 2.05 ETH (about 5,100 US dollars) to buy 52,822 VISTA and sold it at 276.5 ETH (about 701,800 US dollars). At that timeVISTA's 24hours rose by nearly1100%.

Ethervista is a new type of decentralized exchange (DEX) protocol that aims to address the shortcomings of the existing AMM model (short-term token price speculation and insufficient liquidity provider incentives). By introducing a custom fee structure and a new reward distribution mechanism, Ethervista seeks to promote the long-term growth and sustainability of blockchain projects.

Mechanism features of Ethervista (brief version):

Custom fees: Ethervista uses a custom fee structure that is only paid in native ETH, allowing for more flexible fee allocation.

Reward Distribution: The protocol distributes fees between liquidity providers and token creators based on trading volume, incentivizing long-termism and utility rather than short-term price action.

Protocol Fees: A portion of the fees are allocated to the smart contracts specified by the protocol, thereby supporting a variety of DeFi applications and providing sustainable income for creators.

Liquidity Provider Rewards: Liquidity providers are rewarded based on their contribution to the pool and total trading volume.

Creator Features: Creators can configure pool settings, define metadata, and even restrict token transfers.

VISTA Token: Ethervista's native currency, with a supply cap and deflation mechanism.

Technical Overview:

Euler (reward calculation unit): a series of increasing numbers used to calculate the rewards of liquidity providers based on their contribution and total trading volume.

Fee allocation: Fees are allocated between liquidity providers and protocols based on predefined variables.

Protocol fee allocation: Protocol fees can be allocated to smart contracts of various DeFi applications.

Ethervista Design Concept

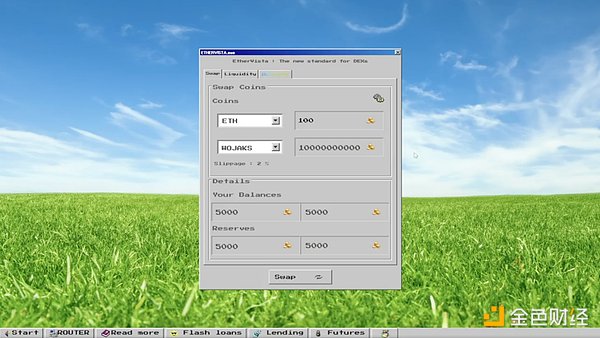

Ethervista uses a custom fee structure that is only paid in native ETH, allowing for more flexible fee allocation. The current AMM standard charges a 0.3% token fee on each swap. The Ethervista Standard is the first to set a custom fee payable only in native ETH. This fee is distributed to all liquidity providers and token creators in a specific pool, and each swap uses a new mechanism that allows Ethervista to distribute rewards to millions of users with minimal gas costs.

The creator fee is a portion of the protocol fee and can be allocated to smart contracts and treasuries. Various use cases include automated purchases, staking rewards, and many other DeFi applications. A key feature of the model is that market makers and creators benefit from trading volume rather than token price, incentivizing long-term rather than short-term price action. Investors benefit from a delayed liquidity exit mechanism that prevents developers from quickly "running away". This approach not only mitigates the risk of sudden market volatility, but also increases the overall success rate of their investments. Eventually, Ethervista will move to building ETH-BTC-USDC pools to provide lending, futures, and fee-free flash loans, aiming to become an all-in-one decentralized application.

How the protocolfees are distributed

As mentioned earlier, each swap charges a native ETH fee, which is distributed between liquidity providers and the protocol. Each pool must initialize four uint8 fee variables, corresponding to the fee distribution of buy and sell transactions. These variables correspond to the USDC amounts, and the corresponding ETH fees are calculated for each swap using an on-chain oracle.For example, a pool can be initialized with a fee of $10 for buying and $15 for selling. A user decides to sell his tokens, and he now has to pay $15 worth of ETH to the protocol and liquidity providers.

The smart contract allocated by the protocol can use this fee to increase perpetual locked liquidity, establish an ever-increasing floor price for the token, and provide a sustainable income for the creator. Liquidity providers can immediately claim their share of the rewards collected by the exchange.

How the protocol fees are calculated

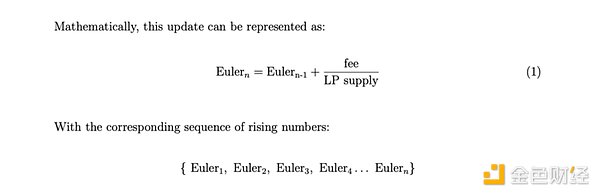

The Ethervista smart contract maintains an ascending sequence of numbers called Euler amounts. These values are updated every time native ETH is transferred into the smart contract. Each Euler amount is determined by adding the previous Euler amount plus the ratio of fees to the current total supply of liquidity provider tokens (LP). The initial Euler amount is set to zero.

Mathematically, this update can be expressed as:

fee Eulern=Eulern-1+ LP supply

Formula (1) is shown below, with the corresponding ascending sequence:

Euler, Euler2, Euler3, Euler... Eulern}

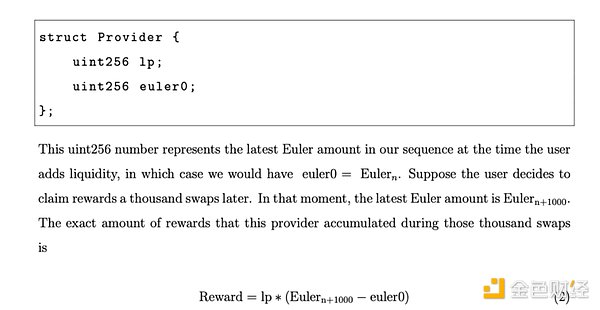

Each provider is represented by a structure that stores each user's LP holdings and a variable called euler0, which is named after the Euler amount in the sequence.

struct Provider { uint256 1p;

uint256 eulero; };

As shown in the figure, the uint256 number represents the latest Euler amount in the sequence when the user adds liquidity. Suppose the user decides to claim the reward after 1000 exchanges. At that moment, the latest Euler amount is Eulern+1000. The exact amount of rewards accumulated by this provider during this period is Reward lp *(Eulern+1000-euler0).

Formula (2) in the figure above This method assumes that the LP balance remains unchanged throughout the period. Therefore, whenever a provider takes any action, such as adding/removing liquidity, the variable euler0 will refresh to reflect the latest Euler amount in the sequence. This measure prevents liquidity providers from manipulating their share of rewards. Therefore, it is recommended that liquidity providers always claim their rewards before adjusting LP balances. LP tokens are non-transferable unless destroyed or added/removed from liquidity. The essence of this mathematical approach is that it accurately determines the share each user receives in each swap, regardless of the ongoing changes in the total supply of LP tokens due to liquidity providers adding or removing liquidity.

LiquidityPool Configuration andIncentives

The person who initiates the liquidity provision becomes the creator, giving them write access to configure the pool settings. This includes determining the pool fee, protocol address, and metadata. The key parameter is the smart contract address assigned by the protocol. While this parameter is optional, it defaults to the creator's address. This address then receives ETH from protocol fees, managed through custom logic in smart contracts, enabling a wide variety of DeFi applications that were not possible before with current AMM standards. This new way of generating revenue shifts the focus from primarily prioritizing short-term gains and price action to primarily prioritizing activity, longevity, and utility.

Creators can define on-chain metadata for their tokens, including details such as website URL, logo, project description, social media handles, and chat URL. Users can access this information through the Ethervista DEX’s Explorer window, along with other relevant details. This enables creators to effectively showcase their projects while ensuring users have access to verified and secure information, reducing the risk of phishing attacks. Developers can seamlessly launch their projects on Ethervista using an integrated launcher window. Ethervista also features SuperChat, a global real-time chat directly integrated into the DEX platform that enables users to quickly exchange information. Access to Super Chat is tier-based, depending on the number of VISTA tokens held by the user.

Creators can also choose to give up their write access, effectively locking all settings forever. Creators who wish to restrict transactions of their tokens to Ethervista can restrict the ERC20 transferFrom function to the Ethervista router address.

In addition to pool and protocol fees, there is a fixed fee of $1 allocated to the continued development of the Ethervista DEX and SVISTA. The fee will be used to implement fee-free flash loans, futures, and lending features, as well as to support potential CEX listings and marketing activities.

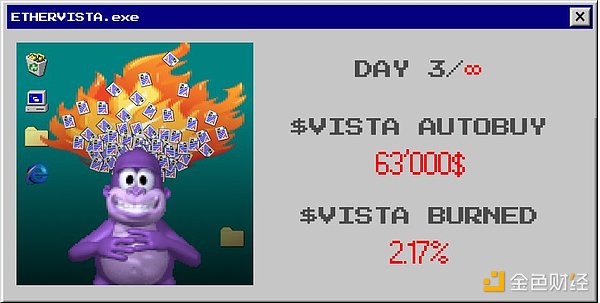

VISTAToken Economics

SVISTA is the native currency of the DEX, with a total supply of 1 million tokens. Ethervista is a value-compounding, deflationary token. The Ethervista protocol’s smart contracts implement an on-chain process where each destruction event not only reduces the circulating supply, but also gradually increases the floor price of the token. This effect is maintained by the continuous acquisition and destruction of tokens, which are funded by the fees generated by the protocol on each transaction. Therefore, VISTA’s mechanism acts as a hedge against inflation by combining activity with supply reductions and floor price growth, thereby strengthening the value of VISTA with each transaction, driving continuous growth and scarcity.

According to the latest data disclosed by Ethervista, 2.17% of the total supply of VISTA has been permanently repurchased and destroyed.

Ethervista future plans:

Expansion of the capital pool: Ethervista plans to provide lending, futures and fee-free flash loans.

Integration with CEX: Ethervista aims to be listed on centralized exchanges.

Summary

Ethervista's design is mainly based on repurchase and lock-up. Transaction fees are collected and dividends are distributed to liquidity providers, which plays a role in reducing selling pressure. However, the premise of dividends is that the protocol has a large number of transactions. This type of design can trigger Fomo sentiment in the short term, but it is not enough to support the value of the protocol in the long term. At present, DeFi protocols should not only focus on the optimization of price curve formulas, but also combine innovations at the scenario and asset levels. In addition, developers of the Ethervista pool can reserve tokens, and investors should be careful when choosing. The risk of the contract not being open source should also be guarded against.

Since liquidity cannot be freely traded during the lock-up period, if holders sell in large quantities after unlocking, it may lead to liquidity depletion, which in turn may lead to the risk of a sharp drop in prices.

According to the latest data from Dexscreener, Ethervista's circulating market value has fallen back to 17.4 millionUSD, the token has increased by 76% in 24 hours, and the 24-hour trading volume has exceeded 53 millionUSD. The trading volume exceeds its market value, indicating that the project is very popular and has a frequent turnover rate. It is also necessary to be vigilant about the risk of market volatility.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo CryptoSlate

CryptoSlate Catherine

Catherine Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph