Author: Revc

The AI Agent track has recently attracted a large number of investors due to extreme volatility, and its high-yield potential has shaped a unique trading experience. MEME trading stimulates the "balance roller coaster jump", and the dopamine released instantly makes people excited and addicted, and investors are tested at the psychological and emotional levels.

For investors, while enjoying the benefits brought by market fluctuations, they must be wary of the erosion of addictive psychology and avoid falling into emotional operations. At the same time, by in-depth research on the long-term value and technical potential of the project, a more stable investment direction can be found in the fluctuations. The market needs to have both rationality and passion, rather than being dominated by a single stimulus.

At present, the screening of MEME projects follows two lines, "speculation" and value discovery. This article analyzes the high-frequency "speculative" operation method to reveal how professional MEME creators consume investors' energy and principal.

1hour15cases

PS: Scalping is a high-frequency trading strategy in which traders make profits by capturing short-term price fluctuations of stocks, futures or other financial instruments. The core concept of Scalping is to use short-term market fluctuations to quickly enter and exit transactions, making a small profit for each transaction, but accumulating profits through multiple transactions.

30seconds to analyze10minutes to zero principal"Strategy"

MEME trading is a high-intensity game of information capture and rapid execution, while PVP trading has evolved a framework indicator system for project screening. In this mode, the analysis and execution links are extremely compressed, usually only taking a few minutes to complete, especially when the project market value has just reached N times the internal market value (about 68,000 US dollars). At this time, N is usually less than 10, that is, the market value is less than 600,000 US dollars, and the market competition is extremely fierce. However, once the project rises and falls, such new projects are often quickly abandoned by investors and the heat drops sharply.

1. Project judgment and screening: In the new project page, sort by launch time. At this time, the project usually has the characteristics of transaction volume 3-5 times the market value, and the blue chip index is in the range of 0-1.2%. When quickly screening on the first-level page, you can focus on the following indicators: fast growth in the number of addresses, low market value (avoid selecting projects with a market value of tens of millions of dollars), and projects that have not experienced a sharp pullback in the 1-5 minute period and are still setting new highs.

2. Release time: 30 minutes is usually a key dividing line. Most projects will begin to show signs of dumping and closing about 30 minutes after release (data collected at around 6 pm Beijing time).

3. Market value: Projects with a market value of around US$300,000 are usually more reasonable, while projects with a market value of tens of millions of dollars may have a higher risk of running away.

4. Risk of running away: The GMGN platform will mark the operation records of developers in historical projects, such as withdrawing from the pool, dumping the market or developers running away. These marks are important indicators for evaluating the stability of the project.

5. Blue chip index: As a growth indicator, the blue chip index reflects the purchasing power and community consensus of investors by analyzing the blue chip tokens held by investors, providing a side basis for judging the health of the project. 6. Order Book Health Indicator (X=Trading Volume/Market Value): Usually in the early stages of a project, the X value is close to 2, and then shows a downward-opening parabola trend. When the parabola reaches its peak, the trading volume hits a new high and the market value approaches the cycle high, which usually indicates that PVP trading activities have reached a climax. After that, the trading volume drops, the market value decreases, and the "smart money" begins to withdraw. In addition, the trading volume can be used to make a preliminary judgment on the token. For example, a new high in the amount of a single transaction may mean the entry of large funds, which is positive for the market. However, many trading platforms have not yet provided statistics on the trend changes of single transaction amounts or transaction frequencies, and relying solely on transaction volume data may not be sufficient to fully analyze market trends. 7. Traders with labels: usually the top MEME communities and DEX platforms, reflecting whether the publicity covers the mainstream community, but usually such addresses also withdraw from the pool quickly.

8. TOP10 address indicator: This indicator is used to analyze the top ten addresses in terms of token holdings, and their holdings as a proportion of the total supply. Generally speaking, it is healthier for the top ten addresses to hold less than 20%, indicating that the token distribution is more dispersed, the community consensus is stronger, and the risk of selling is relatively low.

9. Profit expectation formula: As the token market value grows from $300,000 to $3 million, its success rate is often extremely low. Investors usually invest 1-10 SOL in a single project, but excessive addition of liquidity may cause a surge in prices, triggering greed among holders and prompting them to stop profit quickly. For example, assuming that the success rate of investors in screening projects is P=10%, and the funds return to zero after failure, then according to 1/P=10, a single project needs to achieve a 1000% rate of return to break even. In this case, projects with a market value of hundreds of thousands of US dollars are more like a probability game.

10. New coin priority strategy: As the screening and analysis framework of MEME tokens matures, creators tend to issue new tokens to make it easier to manipulate related indicators. This new coin issuance model not only caters to the market's preference for "innovation", but also increases the possibility of attracting capital inflows in the short term.

11. For the same concept, Base is preferred: Taking the Percy concept recently promoted by Musk as an example, the performance of the Base network is significantly better than Solana. This is because most of the users of the Base network are senior DeFi users, and their purchasing power is usually 3-4 times that of Solana users. In addition, whales enter the market more frequently in transactions on Base, which further enhances its market performance and capital liquidity.

12. Double the capital strategy: Since PVP is a high-frequency and high-risk trading model, users are susceptible to emotional fluctuations in the process. The "double your investment" strategy is a relatively scientific and psychologically light approach. By taking back the initial investment after doubling the returns, investors can more easily hold the remaining assets for a long time, thus getting rid of the pressure and distress caused by short-term emotional fluctuations.

13. Motivation analysis of pool adjustment: In medium and large projects, investors usually pair tokens with SOL into Raydium liquidity pools to obtain a 24-hour APR of up to 999.99%. The core essence of DeFi is to short volatility, and when the paired assets have a one-sided market, liquidity providers may face impermanent losses. Investors adding liquidity pool assets usually means that they are optimistic about the short-term rise of the corresponding assets, but the amplitude may be limited, reflecting a signal of short-term consolidation. When investors reduce pool assets, they are often bearish on a certain asset, which may be accompanied by selling or readjusting the exchange ratio of assets. 14. Observation of the actions of new addresses: Regular market making is considered a danger signal, such as large amounts of buy-sell cross-trading. You can also study the trading habits of the developer's address.

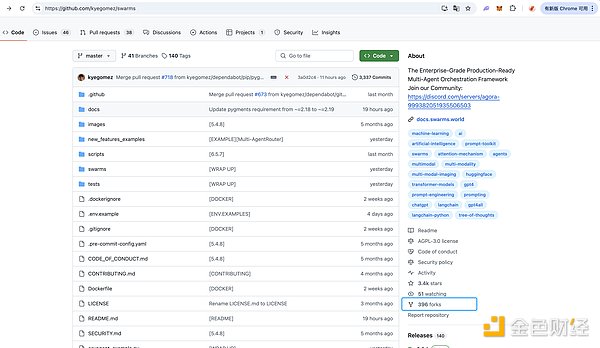

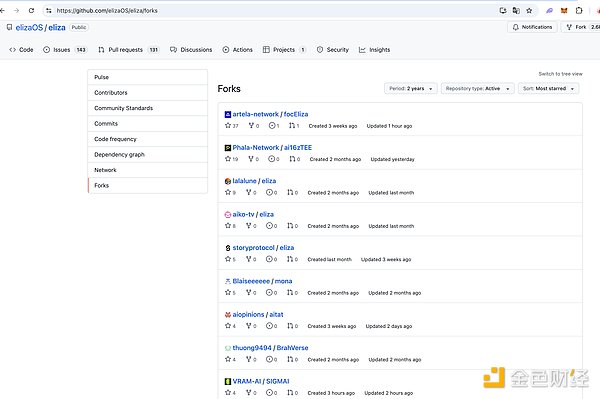

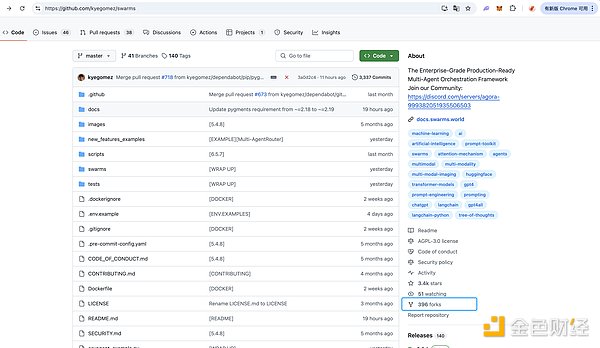

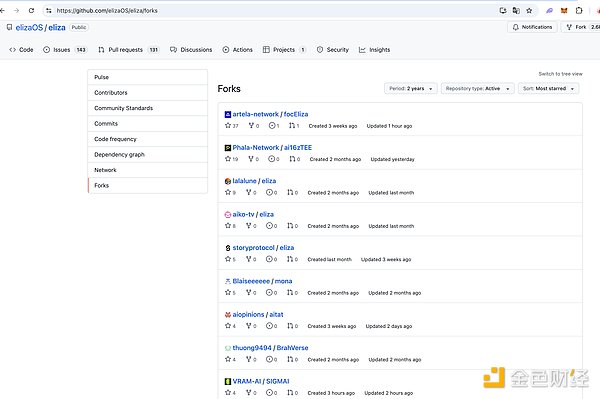

After understanding the above methods and having a preliminary analysis of domestic projects, congratulations, you are about to fall into the trap of professional MEME traders. They will create a perfect MEME based on indicators to fit your project analysis and screening framework, and then create a story, AI + founder interaction + hackathon, etc., plus the emotional ups and downs brought about by high-frequency trading, which makes you lose your judgment on the project quickly, break the trading discipline, and suffer losses. So this article is a "MEME addiction treatment article". No matter which channel investors learn about the "wealth code", the information gap still exists, because PVP must have someone to take over, so new Web3 users should avoid being addicted to the MEME track and slowly cultivate the ability to discover value. For framework AI Agent projects, you can follow the Forks page in the GitHub code library to see which projects have referenced Eliza's code. But even so, it is necessary to carefully evaluate the development progress and actual potential of the project to avoid blindly following the trend of investment.

The last MEME shock suggestion - arrange your time reasonably and pay attention to rest! !

Conclusion

MEME trading is not only a test of innovation and risk tolerance, but also fully demonstrates the potential of cutting-edge concepts such as AI Agent in technological breakthroughs and decentralized narratives. This type of high-volatility market provides keen investors with opportunities to make quick profits, while also promoting the exploration and development of blockchain technology, token economic models, and AI application scenarios. In this environment, investors need to continuously optimize their instant decision-making capabilities and market adaptability, so as to find and apply advantageous strategies in high-risk markets.

However, the high-frequency volatility of the MEME market also contains great risks. Sharp price fluctuations can easily induce emotional trading, causing investors to fall into a cycle of "blind speculation". The dopamine pleasure brought by short-term gains may make people ignore the logic of long-term value investment, and over-reliance on short-term trading often leads to a substantial loss of principal. Especially those projects that lack solid technical support or real application scenarios, after the heat fades, are very likely to become pure speculative tools, causing investors to suffer heavy losses. Such losses not only hit personal investment confidence, but may also have a negative impact on the healthy development of the entire crypto industry, further exacerbating market instability.

For investors, rationality and long-term perspectives are particularly important. When participating in MEME transactions, technical analysis and project value mining should be combined to avoid being swept away by short-term fluctuations. Only by finding a balance between risk and return can we achieve real sustainable profits in this highly volatile market.

Joy

Joy