Unconsciously, 2023 is almost over. In this article, we will conduct a systematic overview and review of the changes that have occurred on the chain this year, and explore how the landscape of Bitcoin, Ethereum, derivatives and stablecoins will evolve in 2023, and how they have laid the foundation for an exciting future. The road ahead.

Abstract

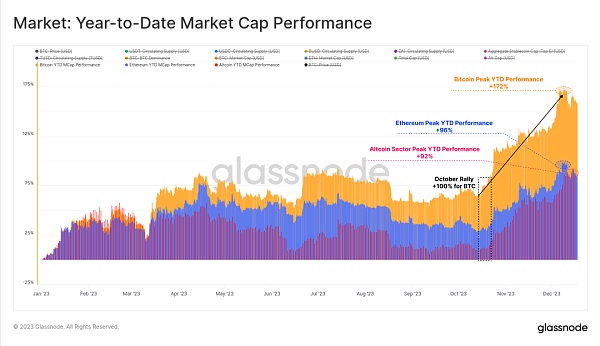

2023 was an unforgettable year for the crypto industry, with Bitcoin rising more than 172% and correcting less than 20%, and massive asset inflows into BTC, ETH, and stablecoins.

In 2023, several important technologies and on-chain pricing models in the encryption market will break new historical records, and October is the month for institutions key node for capital flows.

Currently, the supply of Bitcoin held by long-term holders is almost at an all-time high, and the vast majority of Bitcoin is now in a profitable state.

The market structure is undergoing major changes, such as Tether re-establishing the dominance of stablecoins, CME futures surpassing Binance for the first time, and significant growth in the options market.

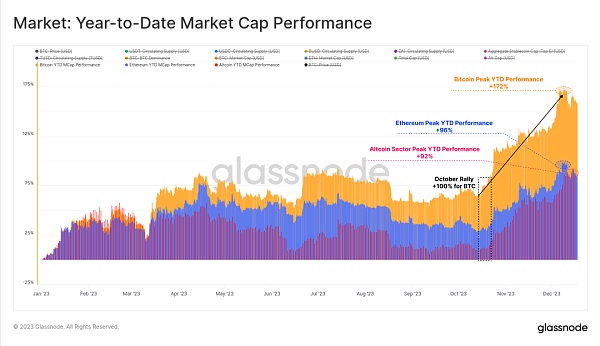

2023 was an unforgettable year for the crypto industry, with Bitcoin rising by more than 172%. Other digital assets have also performed quite strongly, with Ethereum and most altcoins increasing their market capitalization by more than 90%.

As can be seen, Bitcoin's rising dominance is often seen as a sign of market recovery from a prolonged bear market such as 2021-22. Ethereum in particular has had a somewhat slow start relative to Bitcoin, with the ETH/BTC ratio falling to multi-year lows around 0.052, despite the successful launch of the Shanghai upgrade and the development of the L2 ecosystem.

Although digital assets have significantly outperformed traditional assets such as stocks, bonds, and precious metals throughout the year, most of the gains have come from the rebound since the end of October. . Bitcoin first broke through the psychologically important price level of $30,000 after October, as well as many important price levels.

Figure 1: Market capitalization performance year-to-date

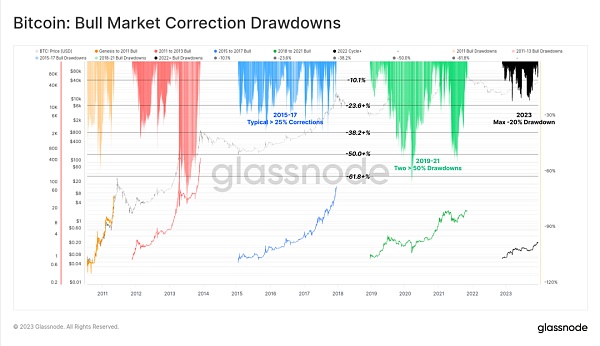

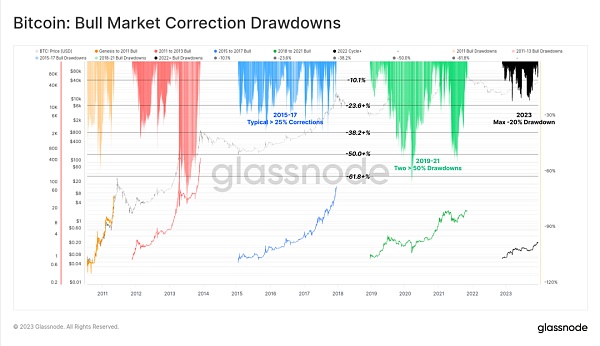

The correction is not obvious

Another unique aspect of 2023 is the very shallow depth of all Bitcoin price corrections. Historically, Bitcoin has typically retraced at least 25% from local highs during bear market recoveries and bull market uptrends, with many periods even exceeding 50%.

However, the deepest pullback in 2023 closed just 20% below the local high, suggesting there is buyer support at this level.

Figure 2: Bitcoin: Bullish Correction

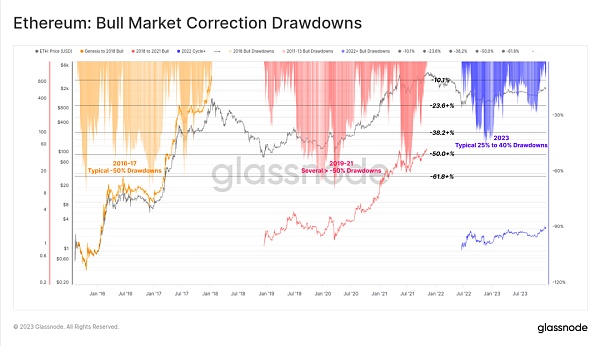

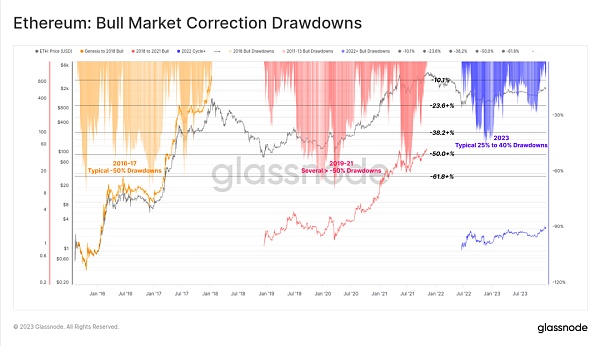

Ethereum’s adjustment depth is also relatively shallow, with the deepest adjustment reaching 40% in early January. Although relatively weak relative to Bitcoin, this also paints a constructive backdrop in which the reduction in Ethereum supply caused by the Merge meets relatively elastic demand.

Figure 3: Ethereum: Bull Market Correction

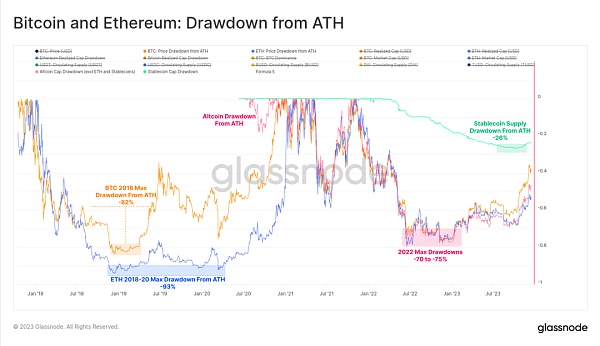

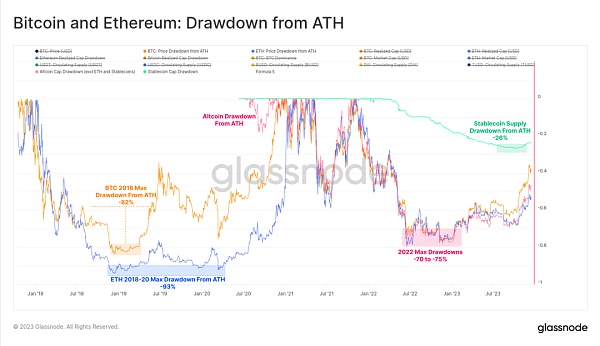

The 2022 bear market will be slightly less brutal than the 2018-20 bear market cycle, with most mainstream digital assets from Both started 2023 down 75% from their ATH, but recent strong performance has made up for most of the losses. Current mainstream digital assets are down 40% (BTC), 55% (ETH), 51% (altcoins, excluding ETH and stablecoins) and stablecoin supply (24%) compared to their ATH.

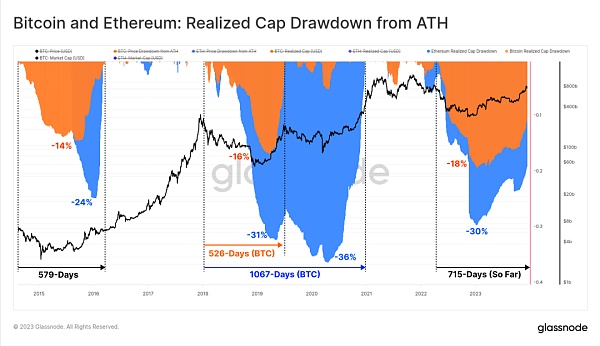

Figure 4: Bitcoin and Ethereum: ATH pullback

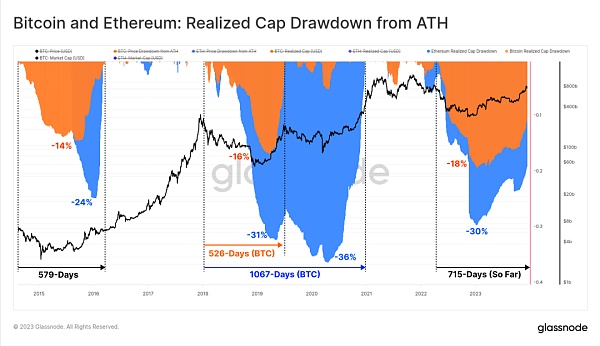

From an on-chain perspective, the realized market capitalization of BTC and ETH can track their respective capital flows Condition. The total realized market capitalization decline during the 2022 bear market reached similar levels to previous cycles, with BTC net capital outflows of 18% and ETH net capital outflows of 30%.

However, capital inflows have been much slower to recover this year, with Bitcoin achieving a market cap of ATH 715 days ago. By comparison, in historical cycles, full recovery in realized market capitalization has taken approximately 550 days.

Figure 5: Bitcoin and Ethereum: Realized market capitalization falls from ATH

October is a major turning point in 2023

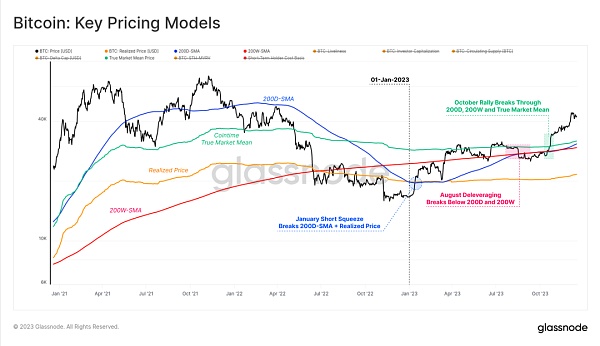

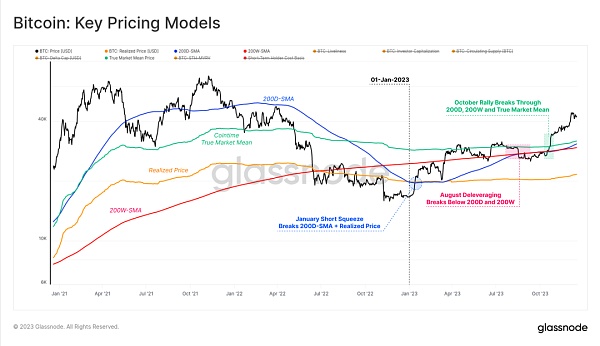

In 2023, the Bitcoin market broke through numerous technologies and on-chain pricing models, all of which help us understand its strong momentum.

The short squeeze that began in January in 2023 pushed Bitcoin above realized prices (orange), which it had held back since June 2022 Price increased. This advance also broke above the 200D-SMA (blue) until it met resistance at the 200W-SMA (red) in March.

In August, Bitcoin price continued to consolidate between the 200D-SMA (blue) and the real market average price (green), entering the most volatile period in Bitcoin history One of the smallest periods. Soon after, Bitcoin price fell from $29,000 to $26,000 in a single day and fell below the average of the two long-term technical price indicators mentioned above.

The rally in October really changed the state of the market, with prices starting to recover and break through the key psychological level of $30,000. Bitcoin has since reached a yearly high of $44,500.

Figure 6: Bitcoin: Key Price Indicators

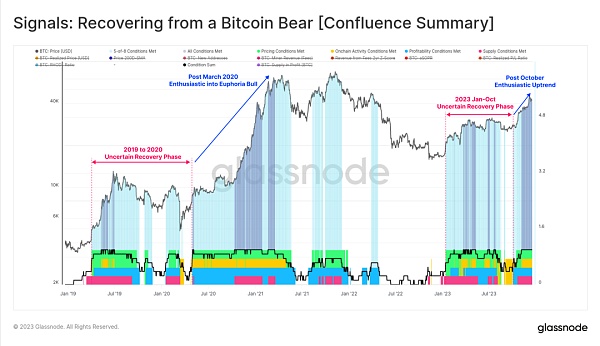

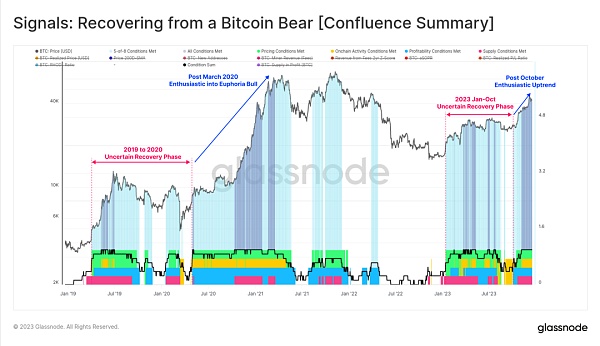

In this article we repeatedly mention a key node: capital flows, market activity and prices since the end of October Performance is accelerating. With Bitcoin price breaking through the key psychological level of $30,000, we can consider the current market to be transitioning from an “uncertain recovery” phase to an “enthusiastic uptrend.”

Notably, the October rally broke through two important technical indicator levels that had charted the course in previous cycles. A shift:

The technical market mid-point: as a bear market Macro price levels that are early support and late bear market resistance. $30,000 was the last major support area in this bear market, and a breakdown below that was followed by a series of capitulation sell-offs that ultimately led to FTX’s collapse.

The Cointime True Market Mean Price: reflects the basic cost of active investors.

Figure 7: Cycle midpoint comparison

We can also clearly see that "Bitcoin recovers from bear market signal", Because since October, all eight indicators (shown below) have entered positive territory. Data across indicators has been mixed throughout much of 2023, showing very similar characteristics to the 2019-20 period.

Eight indicators have now entered positive territory, indicating that the Bitcoin market has entered positive territory associated with a resilient uptrend.

Figure 8: Signals: Recovery from Bitcoin Bear Market (Summary)

Transaction Volume, Fee Growth, and Inscription Emergence< /p>

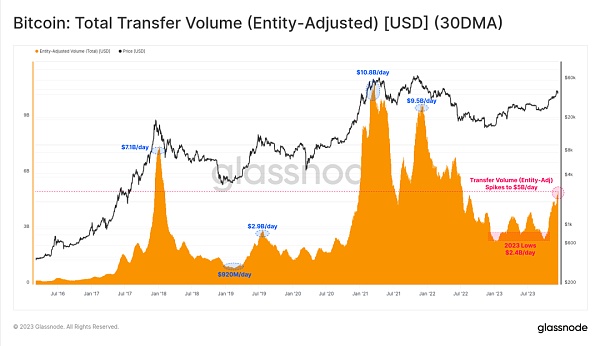

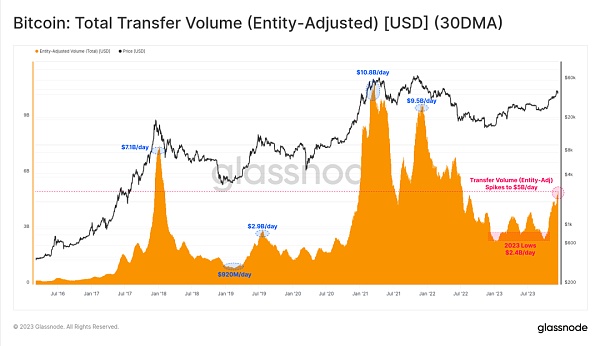

We can see that Bitcoin’s trading volume was relatively stagnant before October. The rise in October prompted Bitcoin’s trading volume to double, from 24 billion increased to over $5 billion per day, the highest level since June 2022. This once again proves to us that "October is somewhat of a phase change in the market."

Figure 9: Bitcoin: Total trading volume (entity adjusted) (30-day moving average)

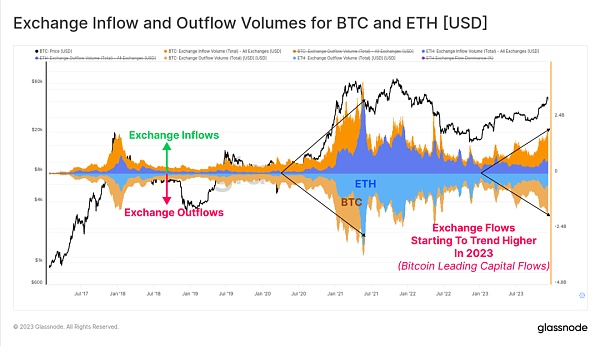

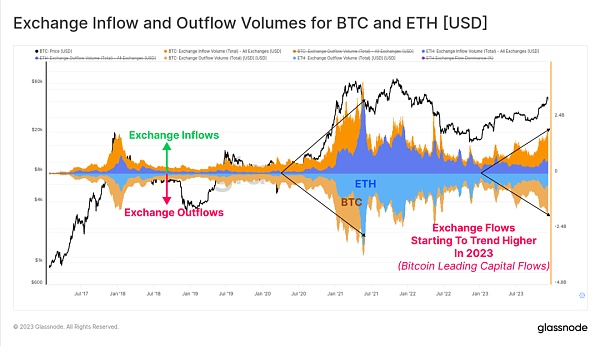

Trading platform inflows for Bitcoin and Ethereum in 2023 and Outflows increased, indicating increased interest in spot trading. Notably, Bitcoin transaction volume is growing significantly faster than Ethereum transaction volume, which is consistent with observations of Bitcoin’s rising dominance. What we often see after a prolonged bear market is Bitcoin leading investor confidence out of the doldrums, and the chart below helps visualize this phenomenon.

Figure 10: Bitcoin and Ethereum trading platform inflows and outflows

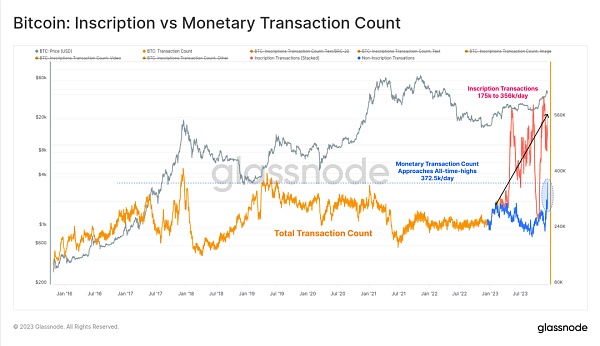

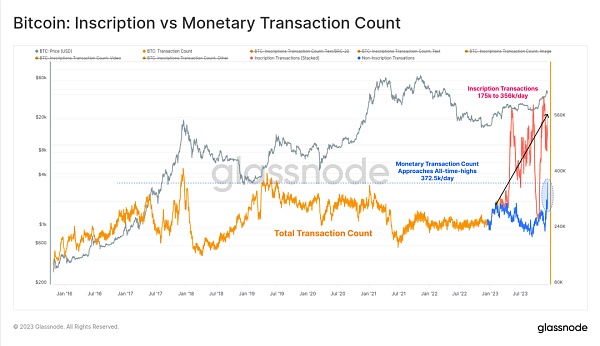

In 2023, the number of Bitcoin transactions hit a record high, mainly due to Ordinals ( Ordinal numbers) and the emergence of Inscriptions. These transactions embed data such as text files and images into the signature portion of the transaction.

Thus, we can now evaluate two types of Bitcoin transactions:

-

(Orange) Total transaction count (unfiltered).

(Blue) Bitcoin transaction volume has reached a multi-year high, almost reaching an all-time high of 372,500 transactions/day.

(Red) Inscription trading adds an additional 175,000 to 356,000 transactions per day to Bitcoin transactions.

Figure 11: Bitcoin: Inscriptions vs. Bitcoin Transaction Volume

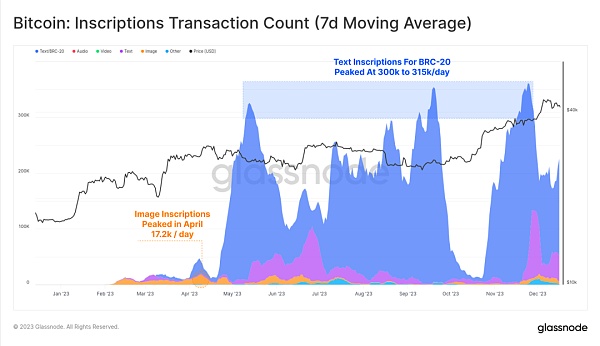

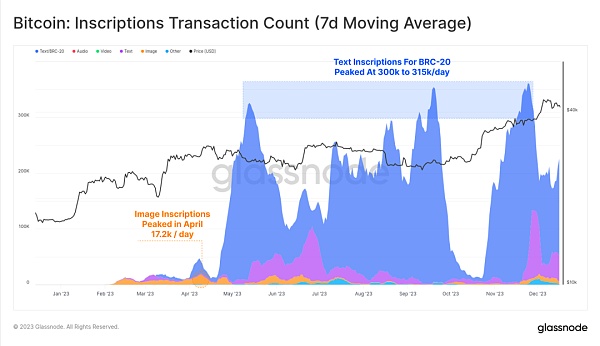

The vast majority of inscriptions tend to be text-based, Related to a new asset (blue) standard called BRC-20. At its peak, the number of daily inscription transactions on the Bitcoin chain exceeded 300,000, far exceeding the April peak of 172,000 per day for image-based inscriptions (orange) (the images are larger, so as fees increase, the cost higher).

Figure 12: Bitcoin: Number of Inscription transactions (7-day moving average)

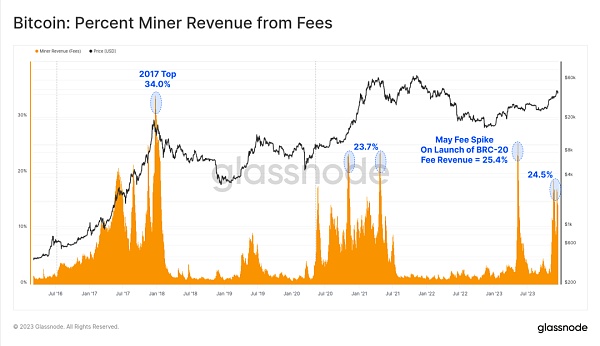

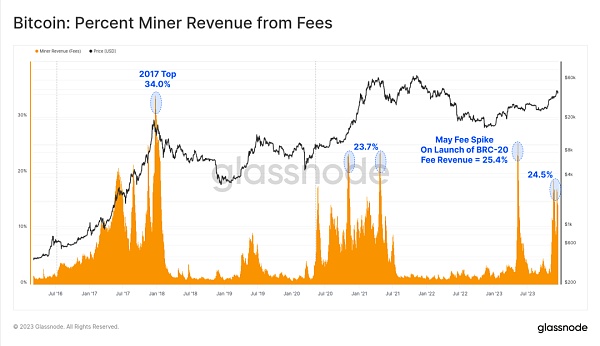

Inscription – New buyer of Bitcoin block space, enabling mining The fee income of users has increased significantly, and several blocks in 2023 even paid more than the block reward of 6.25 BTC. There have been two major fee hikes this year, and fees now account for about a quarter of miners' income. This is comparable to the euphoric phases of the 2017 and 2021 bull markets.

Figure 13: Proportion of miner fee income

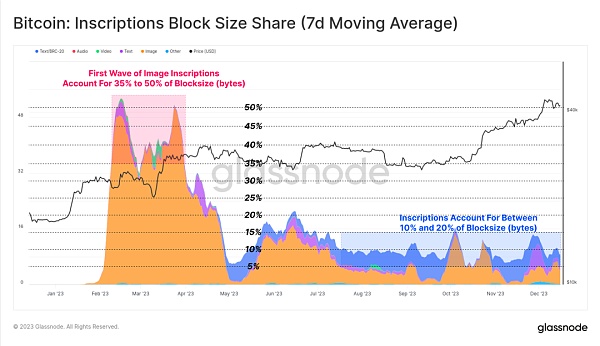

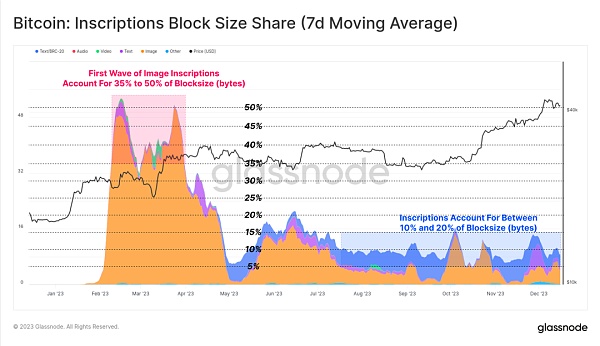

Interestingly, although Inscription transaction volume accounts for approximately 50% of confirmed transactions, it is surprising The great thing is that they only take up about 10% to 15% of the block space. This is due to smaller text files and the data discount with SegWit.

Figure 14: Bitcoin: Inscription block size share (7-day moving average)

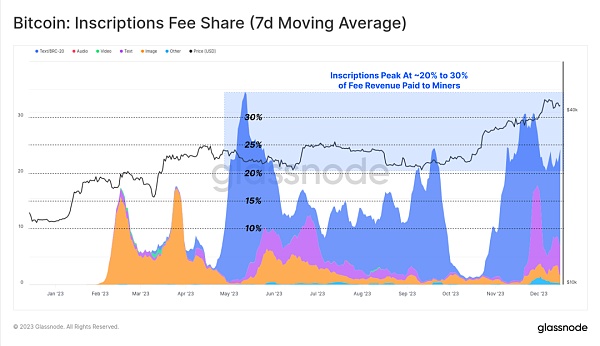

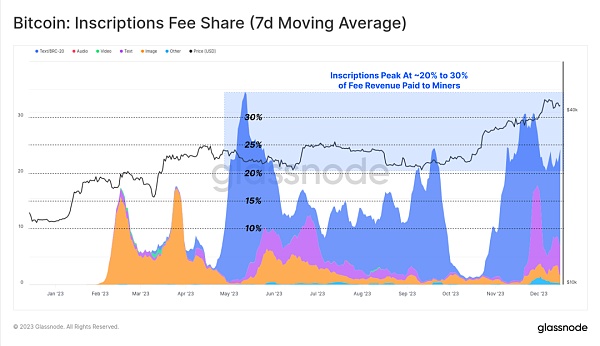

This year, Inscription contributed 15% of total mining transaction fee revenue % to 30%. This intuitively represents the characteristics of SegWit data discounting, where inscription transactions consume a small portion of the block space (in bytes), paying a significant proportion of fees, but also account for about half of all confirmed transactions.

Essentially, inscriptions and SegWit data discounts allow miners to put more transactions into the same max block and thus pay more. If market demand for inscriptions persists, it may improve miners’ returns, especially with the fourth halving approaching.

Figure 15: Bitcoin: Inscription fee share (7-day moving average)

Ethereum locked in cross-chain bridge and pledged< /strong>

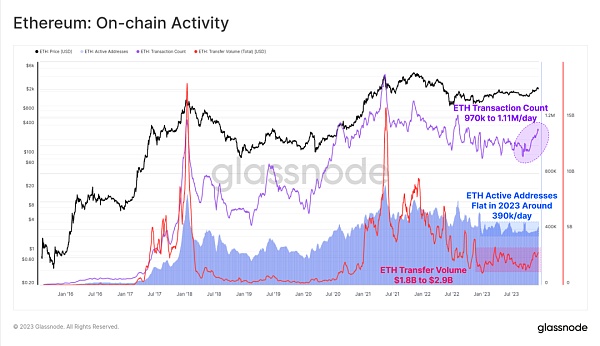

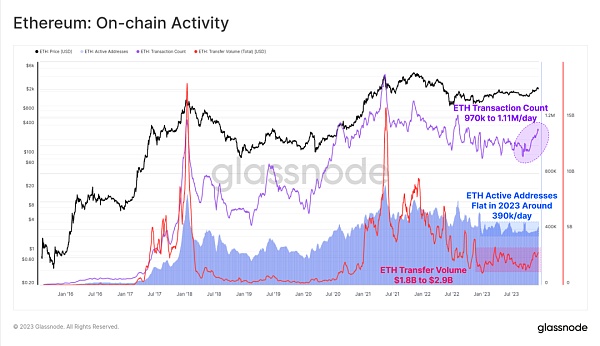

For Ethereum, on-chain activity has been a bit subdued this year, with October once again becoming a significant inflection point.

The active addresses on the chain are relatively stable, about 390,000/day

< /li>Transaction volume recently increased from 970,000 transactions/day to 1.11 million transactions/day

ETH trading volume has increased from $1.8 billion/day to $2.9 billion/day

Figure 16: Ethereum: On-chain activities

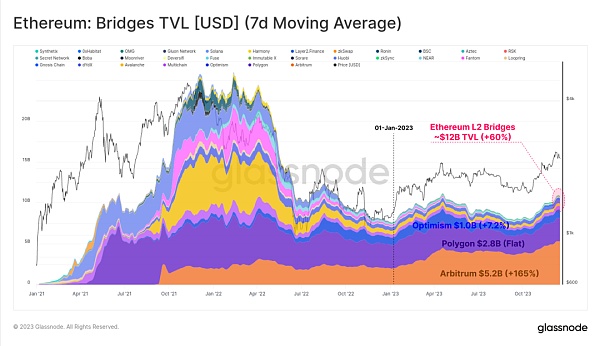

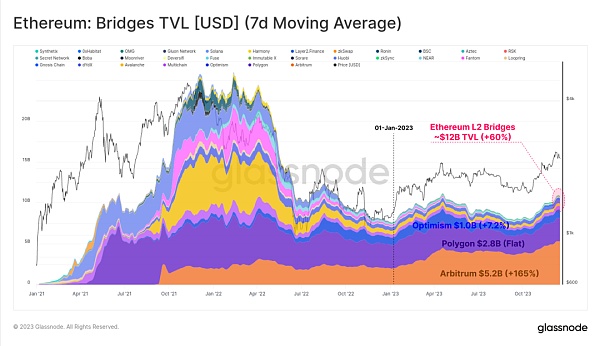

While ETH price performance lags behind most digital assets, its ecosystem continues to expand, mature, and develop. In particular, the total value locked in the expanding Layer-2 blockchain increased by 60%, with over $12 billion locked in cross-chain bridges.

These L2 chains are seeking to expand the Ethereum block space while anchoring their data and calculation results into the Ethereum main chain to maintain their security.

Figure 17: Ethereum: Assets locked in cross-chain bridges (7-day moving average)

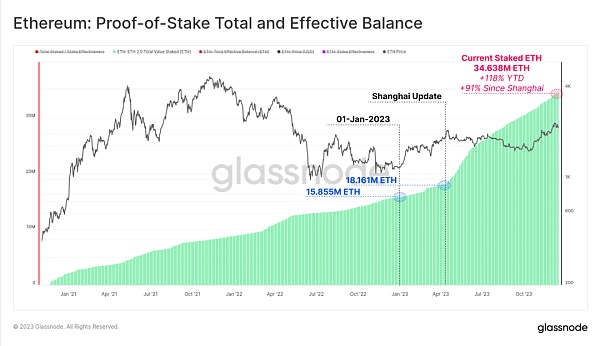

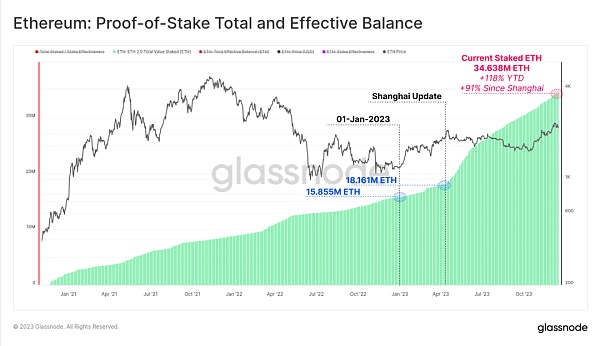

Another key growth area for Ethereum is through PoS The total amount of ETH staked. Since 2023, the number of ETH pledged has increased by 119%, and the number of ETH currently locked in the pledge agreement has exceeded 34.638 million. The Shanghai upgrade was also successfully launched in April, allowing stakers to withdraw cash for the first time since the launch of the Beacon Chain in December 2020, and reshuffling liquidity staking providers.

Figure 18: Ethereum: PoS total effective pledge balance

How does the shard chain connect to the beacon chain?

Although Bitcoin's price performance has many people ready to move, a large portion of Bitcoin remains dormant and reaches . Long-term holding status. Of the total circulating supply of 19.574 million BTC, more than 14.9 million (76.1%) are held outside exchanges and have not been traded for more than 155 days, an increase of 825,000 BTC so far this year. This also brings the short-term holder supply to an all-time low of 2.317 million BTC.

Figure 19: Bitcoin: Long/Short holder supply

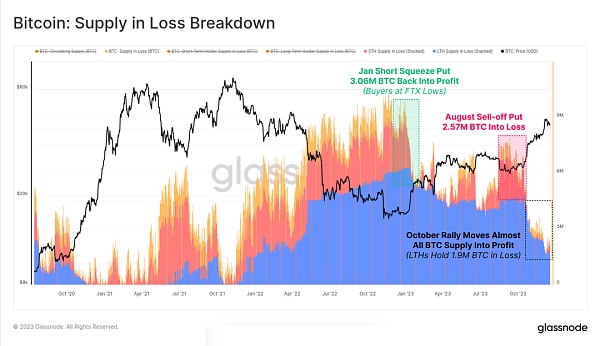

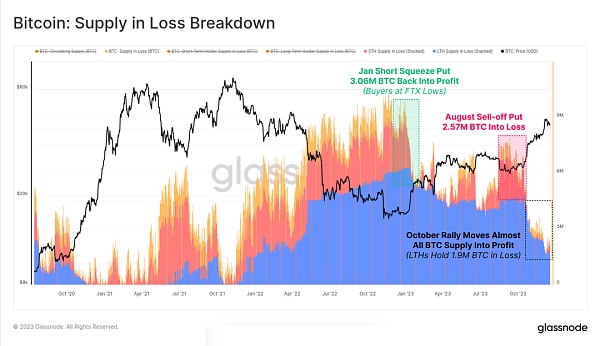

As the market rebounds, the vast majority of investors' assets have returned to "profitability" , either due to transactions or price increases above base costs. The chart below shows how the total amount of “losing” assets has dropped to around 1.9 million BTC, most of which is held by long-term holders who bought near the 2021 highs.

Figure 20: Bitcoin: An Asset in Loss

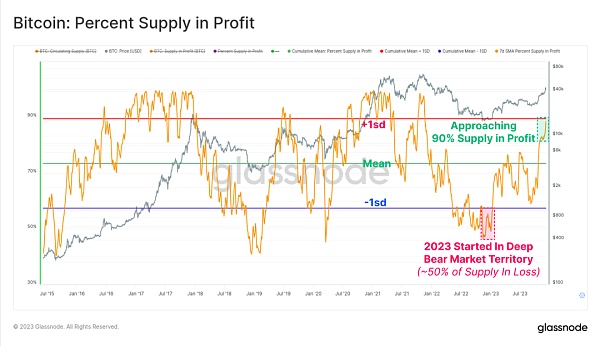

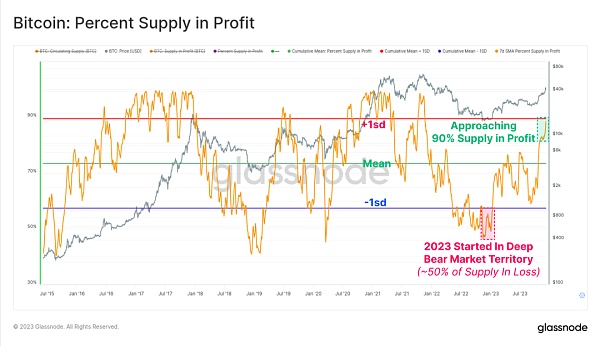

The flip side is that the October rally left a higher share of “profitable” supply than The historical average level accounts for more than 90% of the circulating supply. With over 50% of supply in the red at the start of 2023, this is one of the fastest recoveries in history (second only to the 2019 rebound).

Figure 21: Bitcoin: “Profitable” Supply Percentage

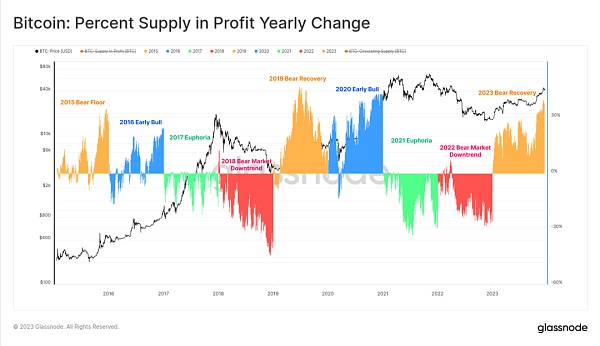

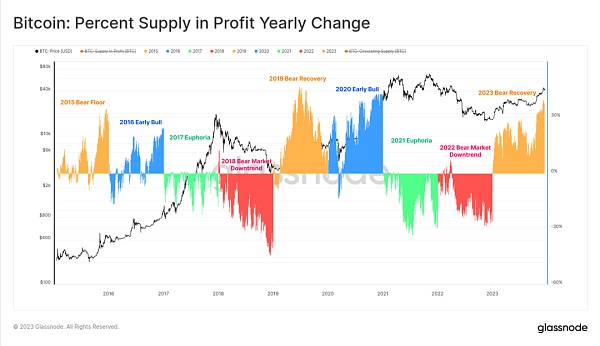

The chart below visually demonstrates the annual percentage change in profitable supply since 2015. Although the breakdown by year is not entirely appropriate, the four-year Bitcoin cycle allows us to discover some interesting patterns:

(Orange) Bear market/recovery phase, as Bitcoin capitulates and sells off near lows, a large number of Bitcoins return to profitability, and the profit supply increases the most.

(Blue) Early bull market, the upward trend makes most assets start to make profits and rebound to new highs.

(Green) Euphoric late-stage bull run, the market is at ATH levels, all tokens are already profitable, and the market is close to drying up.

(Red) A major bear market after the market peaks, with a large number of assets falling into losses.

Although simple in structure, the framework demonstrates progress to date in 2015-16, 2019-20 and 2023 similarities between.

Figure 22: Annual Profitable Supply Proportion

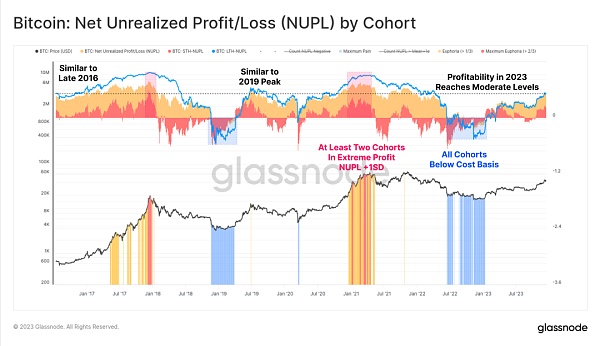

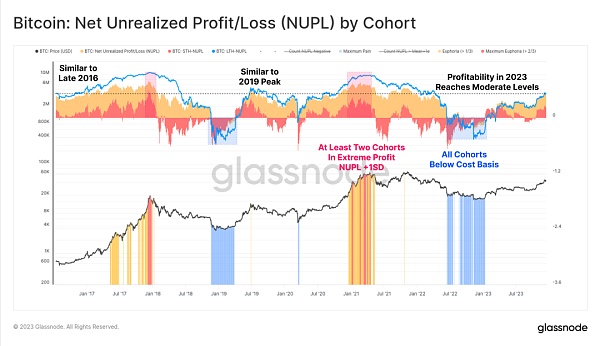

Finally we can discuss the profitability of investors. In 2023, long-term holders and short-term holders investors and ordinary holders from an unprofitable to a moderately profitable state. The NUPL metrics for each group, while not yet reaching exciting highs, are significantly higher than their respective group's base cost levels.

Figure 23: Unrealized gains and losses of each group

The increasingly mature derivatives market

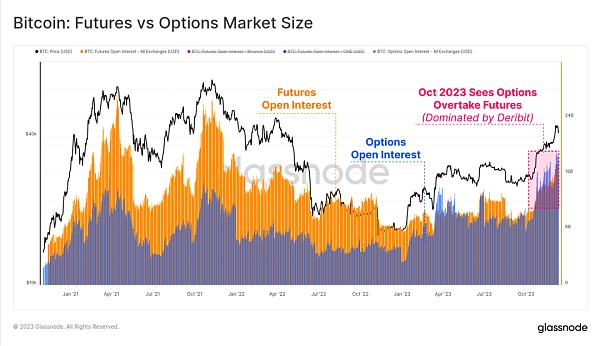

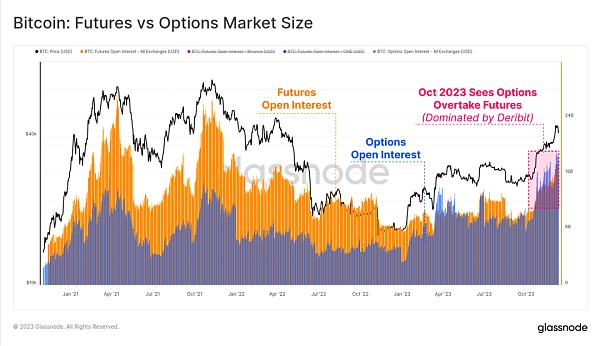

A striking feature of the 2020-23 cycle is that futures and options markets have become the go-to place for price exposure and liquidity. 2023 is proving to be an important year in this development, as the options market’s open interest has grown to rival or exceed the futures market in size.

Both currently have open interest between $16 billion and $20 billion, with Deribit continuing to dominate the options space (90% +). Illustrating the growing interest in Bitcoin from institutional investors, traders and positions often use the options market to deploy more complex trading, risk management and hedging strategies.

Figure 24: Bitcoin: Futures and Options Market Size

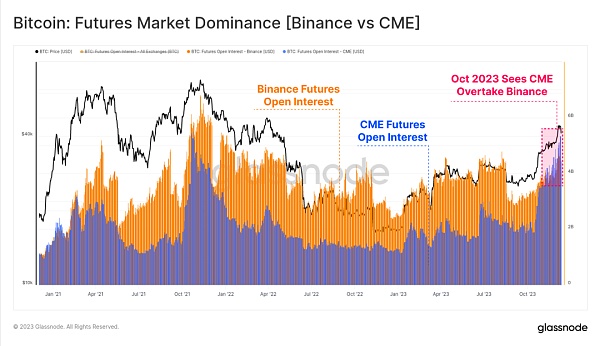

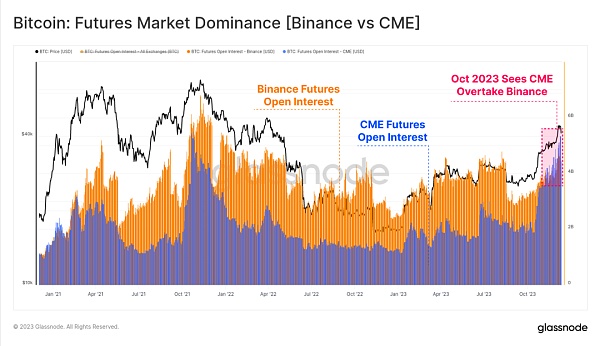

It is worth noting that there has also been a shift in dominance within the futures market, subject to regulation For the first time in history, open interest held by the Chicago Mercantile Exchange (CME) exceeded that of offshore trading platform Binance. October once again appears to be an important moment in this transition, highlighting the influx of institutional capital.

Figure 25: Futures market dominance (Binance vs CME)

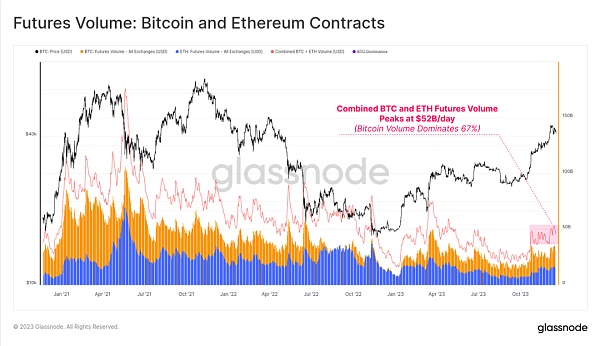

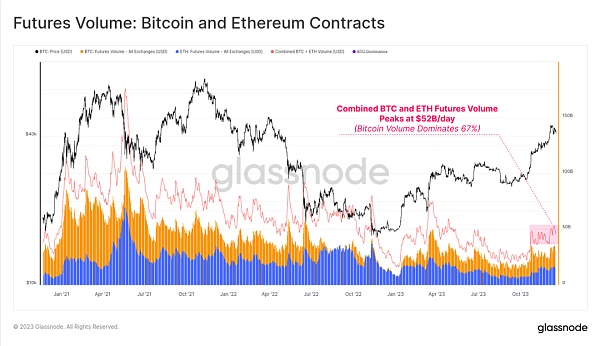

Both BTC and ETH futures trading volumes increased in October, with daily totals Trading volume is $52 billion. Bitcoin contracts account for around 67% of trading volume, while Ethereum contracts account for 33%.

Figure 26: Futures Value: Bitcoin and Ethereum Contracts

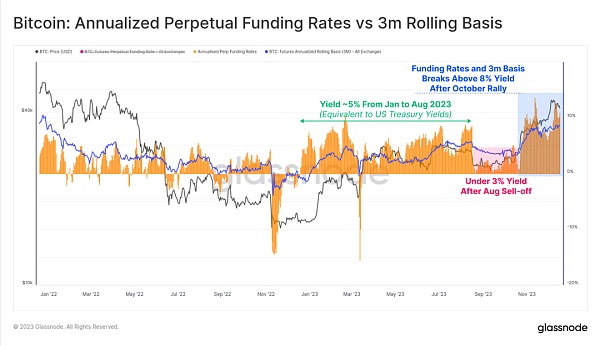

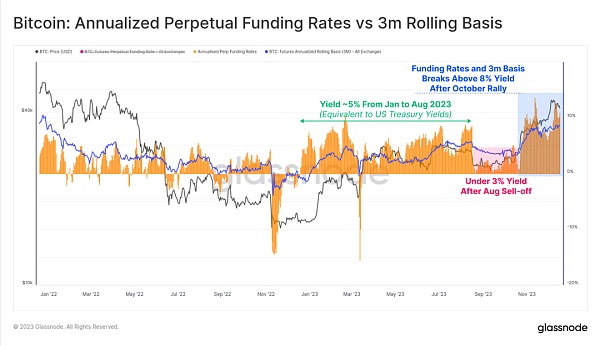

Forward arbitrage option yields in the futures market have experienced three changes in a year Different stages, this also tells the process of capital inflow into this field:

January to In August, yields fluctuated around 5%. This is largely in line with short-term Treasury yields, making the product relatively unattractive given the additional risk and complexity of the trade.

8-October, after sell-off to $26,000, yields were below 3% and volatility was surprisingly low .

Since October, the yield has exceeded 8%. With the futures benchmark currently holding 300 basis points above U.S. Treasuries, market maker capital now has momentum to return to the digital asset space.

Figure 27: Bitcoin: Annualized Permanent Financing Rate and 3-Month Rolling Benchmark

Stablecoin Supply picks up

A relatively new phenomenon from the last cycle is the outsized role that stablecoins play in market structure, becoming traders’ Preferred media asset and primary source of market liquidity.

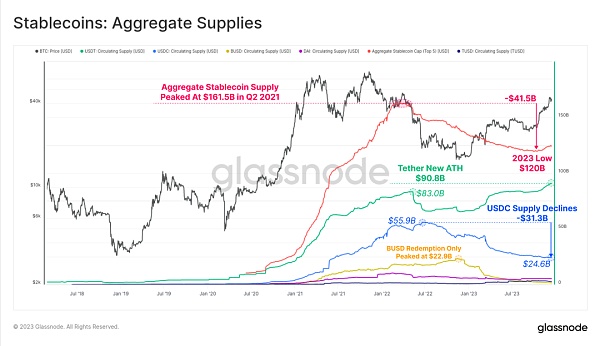

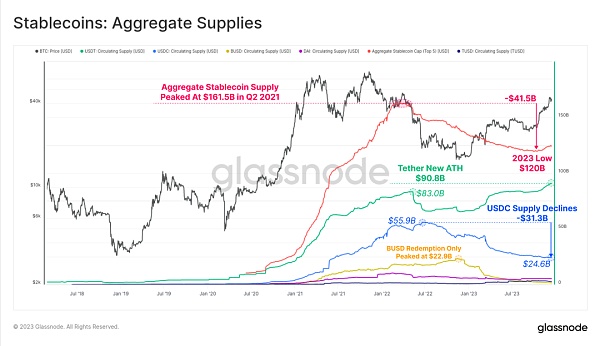

The total stablecoin supply has been declining since March 2022, down 26% from its peak, becoming a major hindrance to market liquidity. This is due to a combination of regulatory pressure (the SEC charged BUSD with being a security), capital rotation (choosing U.S. Treasuries over interest-free stablecoins), and waning investor interest in a bear market.

Figure 28: Stablecoins: Total Supply

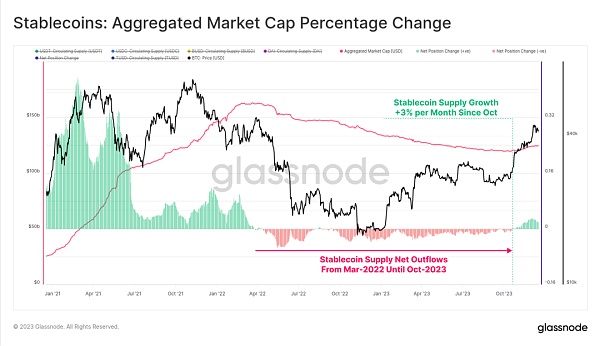

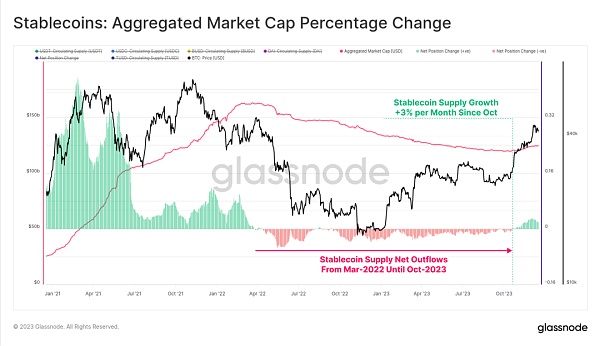

However, October was a critical point, with the total stablecoin supply bottoming out at $120 billion. Start growing at up to 3% per month. This is the first expansion of the stablecoin supply since March 2022 and may also be a sign of returning investor interest.

Figure 29: Stablecoins: Percent change in total market capitalization

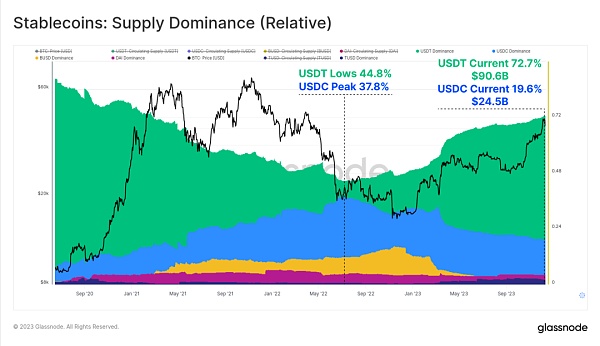

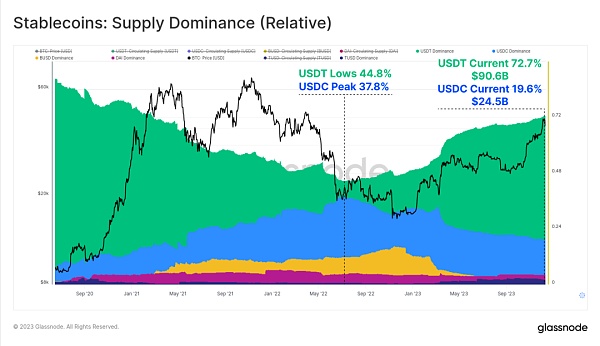

The relative dominance of various stablecoins has also changed significantly between 2022 and 2023 Variety. The dominance of previously rising stablecoins such as USDC and BUSD has shrunk significantly, with BUSD entering redemption-only mode, while USDC’s dominance has dropped from 37.8% to 19.6% since June 2022.

Tether (USDT) is once again the largest stablecoin, with total supply climbing to more than $90.6 billion, accounting for 72.7% of the market.

Figure 30: Stablecoins: supply share (relative)

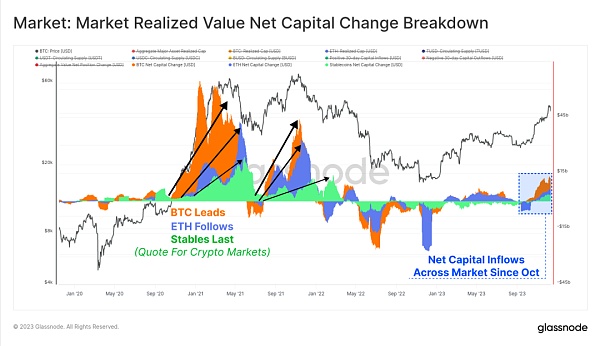

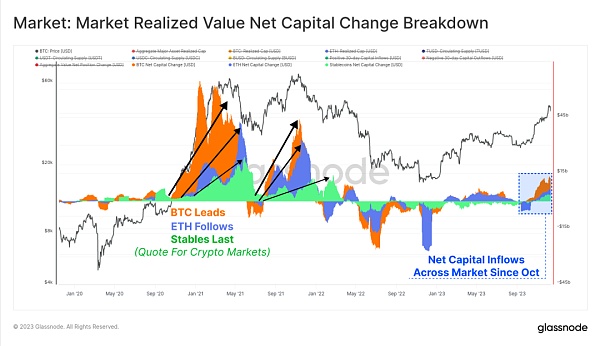

Finally, we can compare the 30-day change in realized market capitalization of BTC and ETH with the stability coins to compare. These three indicators help visualize and measure relative capital flows and rotations between industries.

October became a critical moment again, with capital inflows for the three major assets turning positive. This follows the market’s breakout of the key $30,000 level, expanding institutional interest in the derivatives market, and consistent net capital inflows across the three major digital assets.

Figure 31: Market: Market Realized Value Net Capital

Summary

2023 looks nothing like 2022 with devastating deleveraging and market declines. Instead, this year has seen a renewed interest in digital assets, attributed to their outperformance and the emergence of a new type of asset, Bitcoin Inscription.

Bitcoin supply is currently tightly held by long-term holders, with most investors holding Bitcoin at a profit. With the increasing possibility of the launch of a Bitcoin ETF in the United States and the upcoming Bitcoin halving in April, 2024 is destined to be an extraordinary year.

Alex

Alex