Source: Coingecko; Compiled by: Deng Tong, Golden Finance

Real-world assets (RWA) in cryptocurrencies have a long history, starting with fiat-backed stablecoins such as Tether (USDT). However, since the launch of DeFi in 2020 and the bear market in 2022, more diverse RWAs have been tokenized to meet the needs of on-chain investors. While risk-weighted assets remain primarily focused on debt/credit, other assets such as real estate, art and collectibles also pique investor interest.

Fundamentally, RWA projects sit between the real world and blockchain, issuers and investors of intersection. Their ability to serve as effective middlemen at these intersections will be key to their success. Although it is inevitable to rely on third parties, such as oracles, custodians, credit rating agencies, etc., how to effectively utilize and manage these third parties is still crucial to its continued operations.

Four highlights of this report

pegged to the U.S. dollar assets dominate among stablecoins backed by fiat currencies, accounting for 99% of all stablecoins;

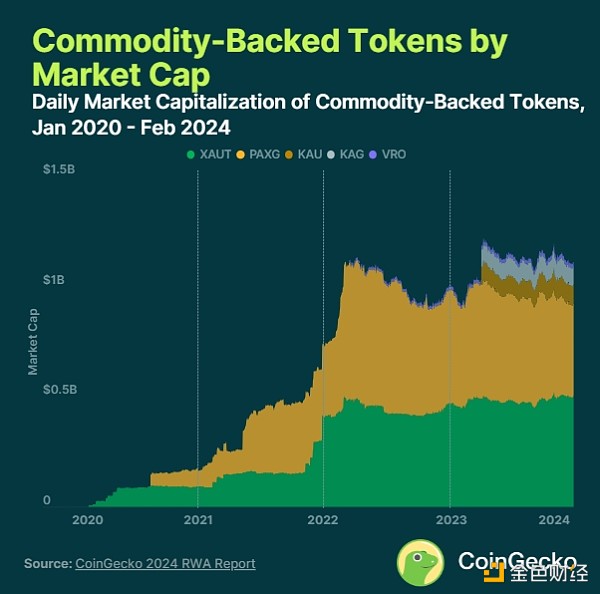

The market value of commodity-backed tokens has reached US$1.1 billion, and gold remains the most popular A welcome commodity;

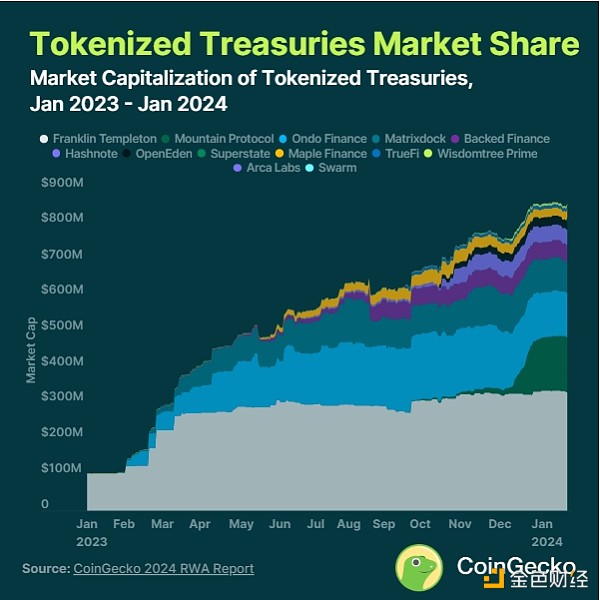

Tokenized Treasury bond products grew 641% in 2023 and are now worth more than $861 million;

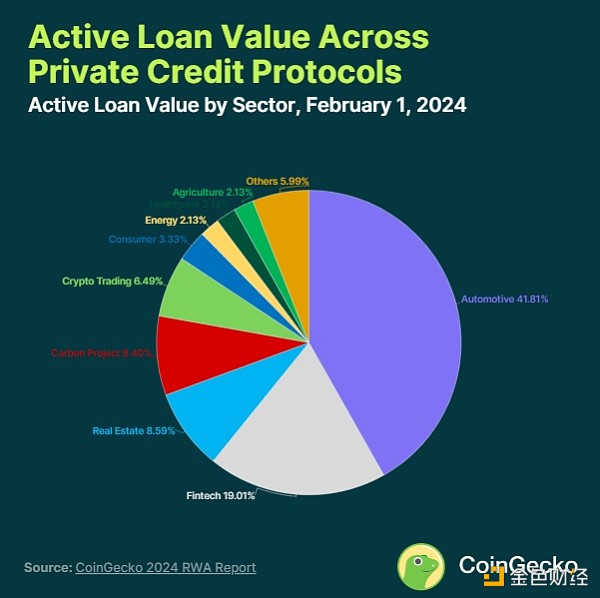

- < p>Private credit demand is mainly concentrated in the automotive industry, accounting for 42% of all loans.

Preface: What are Real World Assets (RWA)?

Real World Assets (RWA) in cryptocurrency refers to tokenizing tangible assets that exist in the physical world and bringing them on-chain. This includes the increasing issuance of on-chain capital markets products, in which digital securities are tokenized and made available to retail clients. Examples include real estate, art, merchandise, and even stocks that users can purchase through the licensed platform.

One of the earliest forms of RWA existed in the form of stablecoins. The existence of stablecoins as tokenized versions of fiat currencies allows for a stable unit of transaction in an unstable environment. Since 2014, companies like Tether and Circle have issued tokenized stable assets backed by real-world collateral like bank deposits, short-term notes, and even physical gold.

In 2021 and 2022, private credit markets emerged through unsecured lending platforms such as Maple, Goldfinch and Clearpool, allowing established institutions to borrow funds based on their creditworthiness. However, these protocols were affected by the collapse of Luna, 3AC, and FTX, which saw significant defaults.

As DeFi yields plummeted in 2023, tokenized Treasury bonds saw explosive growth as users piled into rising U.S. Treasury rates. Providers such as Ondo Finance, Franklin Templeton and OpenEden saw significant inflows as the total value locked in tokenized Treasuries soared from $114 million in January 2023 to $845 million by the end of the year.

1. USD-pegged assets dominate fiat stablecoins

Currently, most real-world assets (RWA) are stablecoins pegged to the U.S. dollar.

The top three US dollar stablecoins alone account for 95% of the market share, among which Tether (USDT) is $96.1 billion, USDC (USDC) is $26.8 billion, and Dai (DAI) is $4.9 billion. USDT continues to dominate, with a market share of 71.4%. Meanwhile, USDC suffered a significant decline in market share after a brief decoupling during the U.S. banking crisis in March 2023, but failed to recover.

Stable assets other than USD-pegged stablecoins account for only 1% of the market. These assets include other fiat currencies such as Euro Tether (EURT), CNH Tether (CNHT), Mexican Peso Tether (MXNT), EURC (EURC), Stasis Euro (EURS), and BiLira (TRYB).

The market capitalization of stable assets has risen rapidly from $5.2 billion at the beginning of 2020 to $150.1 billion in March 2022 peak and then gradually decline throughout the bear market. However, its market capitalization will grow 4.9% in 2024, from $128.2 billion at the beginning of the year to $134.6 billion as of February 1.

2. The market value of commodity-backed tokens has reached US$1.1 billion, and gold is still the most popular Welcome items

Tether Tokenized precious metals such as Gold (XAUT) and PAX Gold (PAXG) account for 83% of the market capitalization of commodity-backed tokens. Tokens like XAUT and PAXG are backed by one troy ounce of physical gold, while Kinesis Gold (KAU) and VeraOne (VRO) are backed by one gram of gold.

While tokenized precious metals dominate, tokens backed by other commodities have also been launched. For example, the Uranium308 project released tokenized uranium, with the price pegged to the price of 1 pound of U3O8 uranium compound. It can even be redeemed, but first requires passing strict compliance protocols.

While commodity-backed tokens have a market capitalization of $1.1 billion, they represent only 0.8% of the market capitalization of fiat-backed stablecoins.

3. Tokenized Treasury bond products grew 641% in 2023 and are currently worth more than $861 million

< p>

Tokenized U.S. Treasuries surged in popularity during the bear market, with their market capitalization increasing by 641% in 2023, from $114 million to $845 million. However, this momentum has stalled since 2024, with growth of 1.9% in January and a market capitalization of $861 million.

Franklin Templeton is currently the largest issuer of tokenized U.S. Treasury bonds, with $332 million in tokens issued by its on-chain U.S. Government Monetary Fund. This gives it a market share of just over 38.6%.

Profitable stablecoin issuers such as Mountain Protocol and Ondo Finance are also popular. As of February 2024, Mountain Protocol has minted $154 million of Mountain Protocol USD (USDM) tokens since its inception in September 2023, while Ondo has a market cap of $132.4 million Ondo USD Yield (USDY).

Most tokenized vaults are based on Ethereum, which holds 57.5% of the market share. However, companies like Franklin Templeton and Wisdomtree Prime have chosen to distribute on Stellar, which currently dominates at 39%.

4. Private credit demand is mainly concentrated in the automobile industry, accounting for 42% of all loans

Of the $470.3 million in outstanding loans issued by private credit agreements, 42%, or $196 million, was for auto loans. Meanwhile, debt in the fintech and real estate sectors accounted for just 19% and 9% respectively.

Auto loans grew significantly in 2023, with more than $168 million in 60 loans originated. During the same period, the fintech sector issued no new loans.

A total of 840 loans were received in the real estate and cryptocurrency trading sectors, but only 10% of the loans are currently active. The rest have been repaid and some have defaulted. Notably, there were 13 loan defaults in the cryptocurrency trading space following the collapse of Terra and Three Arrows Capital (3AC).

In terms of borrower demographics, most companies are from emerging markets such as Africa, Southeast Asia, Central and South America. 42 loans, or 40.8% of all loans, originated from African countries.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance Max Ng

Max Ng Cointelegraph

Cointelegraph