Compiled and edited by @sanqing_rx Copyright and data source: Dune × RWA.xyz, "RWA REPORT 2025." This article is a secondary compilation in Chinese. Data and charts are subject to the original report. TL;DR: Treasury bond scaling → Credit/Stocks/Commodities blossom across multiple sectors: RWA has expanded from the "risk-free rate" to a higher risk-return curve, becoming a collateral and yield-generating layer for DeFi. Composability is a key breakthrough: With the combination of collateral, yield, and secondary liquidity, RWA is moving from "holding" to a programmable capital market. Driven by both institutional and retail players: Institutional products like BUIDL/JTRSY/OUSG serve as the foundation, while xStocks/GM/XAUm enhance retail accessibility; RealtyX introduces real cash flow (real estate) into the DeFi landscape. 1) Key Conclusions: US Treasuries serve as the foundation, expanding to higher-yielding asset classes: Treasury bonds are the first to achieve scale, becoming the "base liquidity" and trusted anchor; funds are then channeled along the yield curve to long-term bonds/private credit/equities/commodities/alternative assets. Composability is a core breakthrough: the integration of staking (Aave / Morpho), yield (Pendle), secondary and derivatives (Ostium / xStocks / Ondo Global Markets) transforms "held assets" into programmable capital market components. A dual-engine approach of institutional and retail: Institutional platforms (BUIDL / JTRSY / OUSG / WTGXX / USYC) provide compliant supply and settlement; retail portals (xStocks / GM / XAUm) expand reach and secondary activity; and RealtyX introduces real real estate cash flows into the DeFi landscape. Accessibility is comprehensively enhanced: lowered licensing thresholds, multi-chain distribution, and widespread near-instant redemption are driving the migration of funds from off-chain instruments to on-chain collateral. Scope: Stablecoins are primarily used for payment/clearance and their volume far exceeds that of yield-oriented RWAs, so they are not included in this report. 2) The Significance of Tokenization Ownership and Settlement: Paper/custodial → Electronic/T+1 → On-chain T+0, real-time NAV, atomic settlement. Collateralization and Return: Customized Margin/Repo → Securities Lending/Money Market Funds → Universal On-chain Collateralization + Programmable Returns (Automatic Reinvestment, Return Tier). Cross-border and Interoperability: Local Market → Cross-border Standardization → 24/7 Global Interconnection. Cross-chain and account abstraction enhance accessibility. Product Type: Direct Holding → Structured Pools → Programmable Asset Pools + Repackaging/Layering (deJAAA, USDY, etc.). 3) Market Overview (as of September 2025) US Treasuries: ≈ $7.3B (+85% YTD) — BlackRock, WisdomTree, Ondo, Centrifuge, etc. lead the way; collateral integration by Aave/Morpho strengthens their "underlying currency" status. Global Bonds: ≈ $0.6B (+171% YTD) — Spiko's EUR money market funds and sovereign assets are breakthroughs, primarily supported by Arbitrum/Polygon. Private Credit: ≈ $15.9B (+61% YTD) – Driven by Figure, Tradable, and Maple, the trend is shifting from "risk-free rate" to "credit spread." Commodities: ≈ $2.4B (+127% YTD) – Gold dominates, with agricultural products/energy diversification taking off. Institutional Funds: ≈ $1.7B (+387% YTD) – Tokenization is accelerating for multi-strategy funds like Centrifuge's JAAA, Superstate's USCC, and Securitize's MI4. Equities: ≈ $0.3B (+560% YTD after excluding noise from EXOD and tokenized private equity) – Strong retail orientation, with secondary and cross-chain liquidity picking up. 4) Eight Sectors and Representative Projects 4.1 U.S. Treasuries BlackRock BUIDL (Securitize Distribution): Since its launch in March 2024, it has grown to $2.2B, becoming the largest single tokenized asset and significantly driving the expansion of the Treasury bond market. Features: $1 NAV, daily distribution, multi-chain inflows (including ETH/Solana/Avalanche/L2/Aptos), and direct USDC withdrawals. Ondo OUSG / USDY: OUSG is for US accredited investors and indirectly holds BUIDL; USDY is for non-US investors. It's a yield-accumulating, natively programmable token with support for multi-chain and on-chain P2P transfers, and boasts active liquidity and minting and redemption. Janus Henderson Anemoy — JTRSY: TVL ~$337M; NAV ~$1.08; 0.25% management fee. It's one of the first Treasury bond tokens accepted as collateral on Aave Horizon, with a cumulative supply of >$28M, demonstrating the composability of RWAs. WisdomTree WTGXX: Registered money market fund with ~$830M AUM; Features: Stable $1 NAV, 7-day SEC yield of ~4.1%; Listed on ETH, Arbitrum, Base, Optimism, Avalanche, and Stellar, supporting USD/USDC/PYUSD redemptions. Franklin Templeton BENJI (FOBXX): Multi-chain issuance, low entry threshold (starting at $20), T+1 redemption, real-time NAV; Cumulative dividends of ~$51M (reaching a new high of $2.7M in July 2025), with significant distribution across chains such as Stellar, Ethereum, and Arbitrum. Circle USYC: Tokenized money market fund with native interoperability with USDC and near-instant redemption. Market capitalization: ~$669M, 73% on BNB Chain (September 4, 2025), with $492M held by three addresses, indicating a more institutional/treasury management use case. Nest Protocol — nTBILL (Plume): A Treasury bond-like underlying asset on Plume, with returns directly factored into the token price. Its decentralized underlying asset allocation (including Janus Henderson, Superstate USTB, etc.) supports DEX, lending, and staking within the Plume ecosystem. 4.2 Global Bonds Spiko — EUTBL (Euro T-Bill Money Market Fund): TVL ~€300M, with Arbitrum accounting for ~50%, followed closely by Polygon (~38%) and Starknet (~9%, 8x growth in one year); cumulative dividends of >€3M per year; active minting and redemption with significant single-transaction sizes, suitable for Eurozone cash management and low-cost L2 use cases. Spiko — USTBL (US Dollar T-Bill Money Market Fund): Active minting and redemption days account for 59%, with an average single minting of ~$0.75M and an average single redemption of ~$0.27M, more closely meeting the needs of treasury-type funds for "low-frequency rebalancing after allocation." Etherfuse Stablebonds (Mexico's CETES / US's USTRY / Brazilian Tesouros, etc.): Focusing on inclusive access and repatriation of localized sovereign bond yields, with >1,200 active addresses (trust lines), CETES leads the way. 4.3 Private Credit Overall: Tokenized private credit ~$15.9B; "risk-free rate → credit spread" will be the main upward trend in 2025. Maple Finance: AUM ~$3.5B (12x year-over-year growth); syrupUSDC ~$2.5B (Spark $400M+ deployed and expanded to Solana); permissioned high-yield pool ~$550M. DeFi deployment ~$833M (>30% of supply), with Spark ~$571M (70%) leading the way. Jupiter Lend, Pendle, Morpho, Kamino, and others form a cross-chain composable yield network. Tradable (zkSync Era): 38 tokenized private lending facilities, ~$2.1B in active loans; tokenized distribution and secondaryization path for institutional-grade assets, emphasizing full compliance and composability. Pact (Aptos): An on-chain credit factory covering issuance, servicing, and layered securitization, focusing on connecting low-cost, compliant credit in emerging markets with global capital. 4.4 Commodities Matrixdock — XAUm (Gold): Supply increased to ~$45M; multi-chain distribution, with active cumulative trading on DEXs over the past year (dominated by the BNB ecosystem). Mineral Vault (Oil and Gas Mineral Rights): Targeting divisible US oil and gas revenue rights, it emphasizes a low-friction, fixed-investment securitization path. The MNRL token has seen increasing on-chain valuation and activity. Spice (Plume): Building a liquidity and data layer for commodity financing, with continuously growing TVL, provides lending/market-making and dashboard capabilities for the DeFi-native nature of commodity RWAs. (Industry Context): Gold remains dominant, with agricultural products, energy, and precious metals gaining momentum. A composable chain from commodity RWAs to derivatives/market-making is emerging. 4.5 Institutional Funds Centrifuge — JAAA (Janus Henderson AAA CLO Fund): Exceeding ~$750M TVL in just two months; primarily ETH, with Avalanche >$250M; reflecting a shift in funds from government bonds to higher-yielding RWAs. deJAAA (transferable packaging): Launched on August 8, 2025, Aerodrome saw ~$1M in trading volume in early September; expanded to Solana on September 12, 2025, integrating with Raydium, Kamino, Lulo, and others. Trading is now available on Coinbase DEX, OKX Wallet, and Bitget Wallet, rapidly increasing secondary composability. Track Size: Tokenized institutional funds total ~$1.7B (as of September 2025), with Centrifuge, Securitize, Superstate, and other leading managers collaborating to increase volume. 4.6 Stocks Ondo Global Markets (GM): Launched on September 3, 2025; first week minting and redemption >$141M, secondary trading ~$40M; platform tokenized stocks and ETFs >$150M, rapidly approaching $200M TVL; supports 24/5 instant minting and redemption at NAV, and cross-chain expansion to Solana/BNB, etc. Backed Finance — xStocks (Solana): AUM >$60M (two months); Tesla leads with $15.3M (25%), followed by SPY (11%), NVIDIA (9%), Circle (8%), and Strategy (8%); Primarily retail-driven, with CEX and DEX leveraging liquidity. 4.7 Real Estate RealtyX: RWA Launchpad (asset on-chain/issuance) + Utility Vault (staking/liquidity/income-generating tools) + DAO governance (listing and platform evolution).

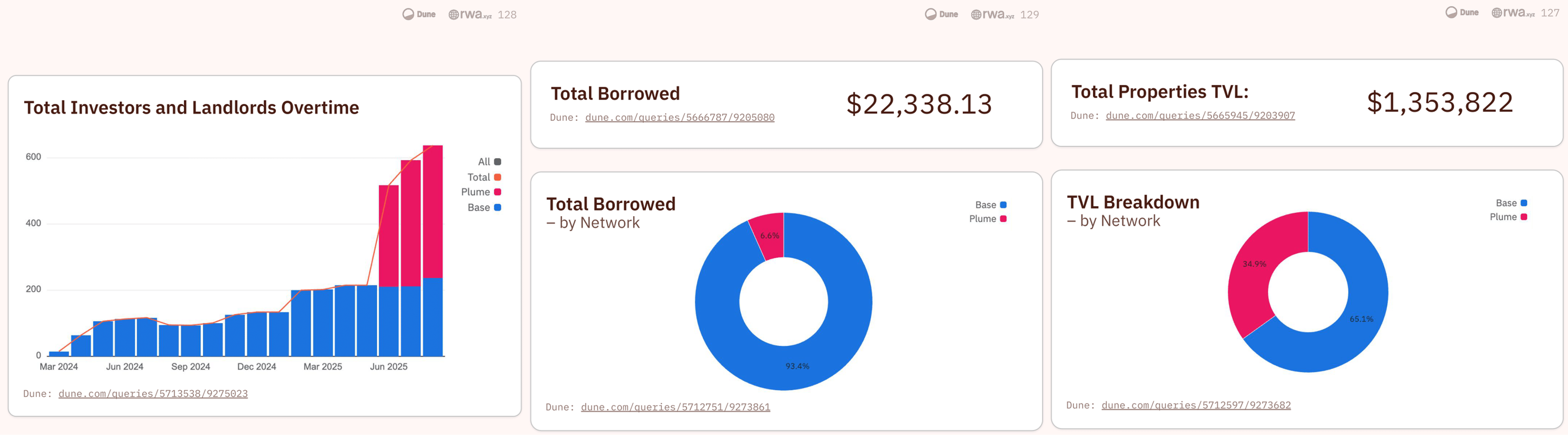

Scale and Network: TVL ~$1.35M (2025-09-10); Base 65% / Plume 35%.

User Structure: Total ~638 (Plume 62% / Base 38%).

Payment and Lending: Average rental yield ~6.9%, cumulative dividends ~$15K+; ~$22K+ borrowed in the Base/Plume lending pool. 4.8 Platforms/Infrastructure (Perps & Aggregators) Ostium (Arbitrum): RWA perpetual contract platform, with cumulative trading volume of ~$17.8B and open interest of >$140M. Providing synthetic exposure to FX/commodities/indices/equities, it brings RWA into the high-frequency trading tier, significantly expanding user reach and liquidity. VOOI: A cross-chain perpetual aggregator, covering EVM and non-EVM platforms, offering account abstraction and a non-custodial experience, and aggregating RWA-related derivative liquidity. 5) Summary: Four Key Focuses for the Next Phase: Composability at Scale: An Integrated Path for Collateralization, Income, and Derivatives. Multi-Currency/Multi-Region Sovereign and Money Market Fund Improvement: Expanding Access and Risk Hedging Tools. DeFiization of Real Cash Flow Assets (Real Estate, etc.): Connecting the Funding and Scenario Sides. Compliance and Multi-Chain Distribution Collaboration: KYC, Taxation, Secondary Market Mechanisms, and Cross-Chain Clearing.

Aaron

Aaron

Aaron

Aaron Davin

Davin Catherine

Catherine Clement

Clement Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Kikyo

Kikyo Clement

Clement Hui Xin

Hui Xin