Polkadot Developer Parity Tech Cuts 30% Of Workforce, Showing That Bear Market Isn't Over

Everyone was celebrating the Bitcoin pump- but is the crypto winter truly over?

Clement

Clement

As we enter 2025, market optimism is running high, underpinned by real progress and breakthrough innovation. This article compiles the core narrative of the year in crypto, blending personal insights and research from industry leaders including Bitwise, VanEck, Ark Invest, a16z, and more.

Let’s explore the trends shaping the future of digital assets.

In 2024, Bitcoin’s market dynamics will occur significant changes, laying the foundation for a key narrative in 2025.

In January 2024, the launch of the Bitcoin Spot Trading Platform Exchange Traded Fund (ETF) marked a milestone in the integration of cryptocurrency and traditional finance. Among them, the iShares Bitcoin Trust (IBIT) managed by BlackRock stands out, attracting nearly $38 billion in net inflows in its first year, becoming the most successful ETF launch in history.

Notably, IBIT's inflows exceeded even those of Invesco QQQ Trust (QQQ), a well-known fund that tracks the Nasdaq 100 Index. IBIT's year-to-year inflows through mid-2024 were around $18.97 billion, slightly ahead of QQQ's $18.9 billion.

BTC ETF fund inflow | Image source: Coinglass

The macroeconomic environment at the end of 2024 is bit Coins and other risky assets provide favorable conditions. In the fourth quarter, the Fed cut interest rates four times in a row, bringing rates down a total of 1%. This monetary easing policy aimed at controlling inflation is expected to continue until 2025.

Rate cuts reduce the opportunity cost of holding non-yielding investments, thereby increasing the attractiveness of risky assets such as Bitcoin and providing strong support for their growth.

2024, Bitcoin market From a pattern dominated by retail speculation to large-scale institutional investment.

Corporate Interest Under the leadership of Michael Saylor, MicroStrategy has significantly expanded its Bitcoin holdings, purchasing approximately 258,320 BTC throughout the year , with a total amount of approximately US$22.07 billion, and an investment return rate of 74.3%. This aggressive accumulation strategy solidifies MicroStrategy's position as a leading corporate holder of Bitcoin while demonstrating the potentially high returns of such an investment, potentially influencing the decisions of other businesses to make similar allocations in 2025.

Government Interest At the government level, President-elect Donald Trump's administration has signaled a pro-cryptocurrency stance and explored establishing a strategic Bitcoin reserve through executive order possibility. While the details and feasibility of this reserve plan are still being discussed, the mere consideration of Bitcoin by the U.S. government as a strategic asset could prompt other countries to explore the possibility of including Bitcoin in national reserves, further increasing crypto’s Legality and stability of currency markets.

Trump pledged to establish a Bitcoin strategic reserve at the Bitcoin Nashville Conference | Image source: "Financial Times"

The successful launch of Bitcoin ETFs, favorable macroeconomic policies, and increased institutional interest indicate that Bitcoin is in a transformative period . As 2025 unfolds, these narratives will drive Bitcoin’s transformation from a speculative asset to a mainstream financial instrument, attracting a more diverse set of investors and solidifying its place in the global financial ecosystem.

In traditional finance, "safe haven" assets refer to safe assets that investors tend to choose during periods of economic uncertainty or market fluctuations. Government bonds and gold are representatives of this category, favored for their relative stability and backing from sovereign entities.

Government Bond: A debt security issued by a national government that promises periodic interest payments and the return of principal at maturity. Low default risk and predictable returns make them attractive during market declines.

Gold: As a store of value, gold is prized for its scarcity and intrinsic value, often retaining or appreciating during financial crises.

In recent years, analysis from ARK Invest in particular has shown that Bitcoin is gradually evolving into a safe-haven asset, showing promise for investors during turbulent times. Shelter potential. Here are the key observations:

Inherent hedging properties

Bitcoin provides financial sovereignty, reduces counterparty risk, and enhances transparency. Its decentralized nature ensures that it is not controlled by a single entity, mitigating the risks associated with centralized financial systems.

Advantages over traditional assets

Bitcoin’s Decentralization, limited supply, high liquidity and convenience are far superior to bonds, gold and cash. These attributes make Bitcoin a versatile asset in the digital age, enabling seamless global transactions.

In the past seven years, Bitcoin’s annualized The yield is 60%, well above the 7% average yield on bonds and other major assets. Over the five-year holding period, Bitcoin investors have consistently made profits. And bonds, gold and short-term U.S. Treasuries have lost 99% of their purchasing power over the past decade.

Adaptability to interest rate changes

Bitcoin’s Price appreciation has persisted across a variety of interest rate environments, demonstrating strong resilience and potential to hedge against monetary policy swings.

Performance during risk-off periods

In the recent financial crisis (such as regional bank failures), the price of Bitcoin rose by more than 40%, demonstrating its potential as a safe-haven asset.

Low correlation with other asset classes

In Between 2018 and 2023, Bitcoin’s correlation with bonds was only 0.26, while bonds’ correlation with gold was 0.46. This low correlation suggests that Bitcoin can effectively enhance portfolio diversification.

Potential to disrupt safe-haven asset markets

Current Bits The currency is valued at approximately US$1.3 trillion, accounting for only a small part of the US$130 trillion fixed income market, indicating that it has huge room for growth after its acceptance as a safe-haven asset.

Bitcoin’s unique positioning and strong performance as a safe-haven asset is redefining the global financial market and providing investors with an unprecedented diversified choice.

The recognition of Bitcoin as a safe-haven asset is increasing | Image source: Ark Invest

Although Bitcoin's high volatility in the past has led many people to classify it as a "risk asset" , but as it matures and the above characteristics become more prominent, people’s perceptions are changing. As the global economic environment evolves, Bitcoin's role in investment portfolios may further expand or even redefine traditional asset allocation strategies.

In 2024, crypto companies are on Wall Street Making waves, becoming one of the sectors with the highest gains of the year. Many companies plan to go public in 2025, and others may surpass traditional financial (TradFi) institutions in market capitalization.

Analysts expect that 2025 will be "The Year of the Crypto IPO", the following companies are expected to have initial public offerings:

Circle: The issuer of the USDC stablecoin has announced plans to move its headquarters to New York City ahead of its IPO.

Kraken: A cryptocurrency trading platform expected to be publicly listed in 2025.

Anchorage Digital: a digital asset platform that is about to enter the public market.

Chainalysis: a blockchain data platform expected to be launched.

Figure: Fintech companies planning IPOs.

As Coinbase's assets under management grow rapidly, many believe it could surpass Charles Schwab to become the world's largest broker by 2025. This potential shift is attributed to Coinbase’s diverse revenue streams, including its Ethereum Layer 2 network Base, staking services and stablecoin operations.

Increase industry legitimacy: The entry of well-known crypto companies into the public markets will increase the legitimacy of the cryptocurrency industry and attract previously hesitant investors.

Broader investor access: Public listings allow more investors to access the crypto industry through investment vehicles such as traditional stocks. No need to buy cryptocurrencies directly.

Changing market dynamics: The inclusion of crypto companies like MicroStrategy and Block in major indexes like the S&P 500 could attract index funds, ETFs and Investor funds further integrate cryptocurrencies into mainstream finance.

Evolution of the competitive landscape: As crypto companies grow in market value and influence, traditional financial institutions may face greater competition , thereby promoting innovation and adaptive changes in the financial industry.

These changes mark the maturity of the cryptocurrency industry, demonstrating its evolution from a niche market to an important component of the global financial ecosystem. Partial transition.

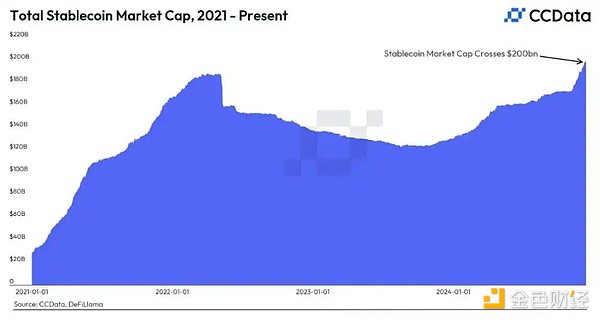

In 2024, the stablecoin market It has achieved significant growth, with its market capitalization crossing the $200 billion mark. This expansion is expected to accelerate in 2025, with the market likely to double in growth.

2024, stablecoin market value Surge to $200 billion, reflecting its increased adoption and integration with various financial systems.

Growth Drivers: Increasing demand for digital assets that provide the stability of traditional fiat currencies while facilitating seamless transactions while serving as an alternative to crypto Currency volatility hedging tools.

As adoption rates increase, the market prospects for stablecoins remain broad, and 2025 may be a turning point in their growth.

The market value of stablecoins will reach $200 billion in 2024 | Image source: CoinDesk

Industry analysts predict that by the end of 2025 , the size of the stablecoin market may double. This prediction is based on several factors:

Growth in widespread acceptance of digital payments

p>The rapid development of blockchain technology

A clearer regulatory framework

These factors together create a more favorable environment for the popularity and use of stablecoins.

Contrary to early concerns that stablecoins may weaken the US dollar Opinions on status differ, with new analysis from Reuters suggesting that stablecoins may actually strengthen the dollar’s dominance.

USD-anchored stablecoins can support cross-border transactions denominated in US dollars, improving the utility of the US dollar in the global financial system.

This development highlights the U.S. dollar’s ability to adapt in an ever-changing digital economy.

Enhancing financial inclusion stablecoins for banks Access to financial services is provided in areas with limited infrastructure, facilitating broader economic participation.

Improving transaction efficiency The use of stablecoins simplifies cross-border payments, significantly reducing costs and settlement times compared to traditional banking systems.

Regulatory factors With the rapid expansion of the stablecoin market, regulators are accelerating the development of frameworks to ensure financial stability and prevent illegal activities.

Integration with traditional finance The increasing acceptance of stablecoins by financial institutions shows that the integration between traditional finance and digital assets is accelerating. This may lead to more innovative financial products and services.

Real World Assets (RWA) Tokenization is developing rapidly, digitizing traditional assets such as credit, US Treasury bonds, commodities and stocks, and improving the liquidity, transparency and accessibility of financial markets.

According to data from Bitwise, the RWA market Tokenization has grown to approximately US$13.7 billion from less than US$2 billion three years ago. As adoption increases and technology advances, Bitwise predicts this market will grow to $50 billion by 2025.

Venture capital firm ParaFi predicts that the RWA market may reach US$2 trillion by 2030, while the Global Financial Markets Association (GFMA) estimates that by 2030 Its potential market value may be as high as US$16 trillion.

Excellent asset management

Tokenization provides instant settlement, lower costs than traditional securitization, and continuous liquidity. Enhance transparency and provide easier access to multiple asset classes.

Institutional adoption

More and more large financial institutions Accept RWATokenization. For example, BlackRock partnered with Securitize to tokenize the USD Institutional Digital Liquidity Fund on Ethereum, which currently holds $515 million in assets and is the largest tokenized fund for U.S. Treasury bonds.

Technological Progress

Blockchain technology and smart contracts The development has promoted the efficient and secure tokenization of assets, attracting more investors and issuers.

Enhanced liquidity

Tokenization enables assets to be divided and held, and investors can buy and sell part of the assets, thereby increasing market liquidity.

Expand investment access

Investors can have access to Diversify asset classes that were previously illiquid or difficult to invest in, thereby democratizing investing.

Improve operational efficiency

Through smart contract automation processes, Reduces the administrative burden and costs associated with asset management and trading.

Regulatory considerations

As the market grows, regulatory The framework is constantly evolving to address security, compliance and investor protection challenges.

Tokenization of real world assets (RWA) is reshaping finance pattern, bringing greater efficiency, accessibility and mobility. This area is expected to grow significantly by 2025 and beyond, and tokenized RWA will become a cornerstone of modern finance, attracting institutional and retail investors seeking innovative investment opportunities.

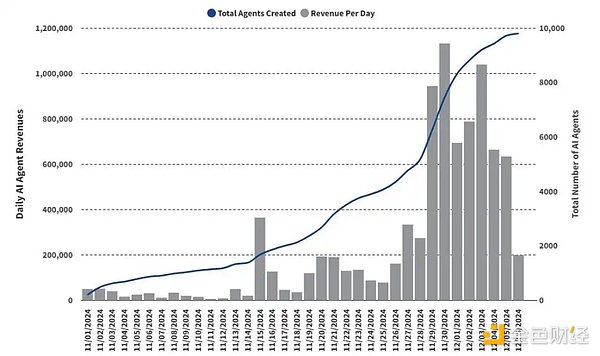

In 2024, AI agents will become A popular narrative in the cryptocurrency space, this trend is driven by platforms such as Virtuals and ai16z. These platforms develop code-free solutions that make the deployment of AI agents easier. These specialized AI bots are designed to understand user intent and perform complex tasks, streamlining processes in a variety of applications.

It is expected that in 2025, AI agents will be Integration in the crypto ecosystem will expand significantly, no longer limited to decentralized finance (DeFi), but into multiple areas:

AI-based analysis tools in the field of financial analysis provide investors with in-depth insights to help them navigate the highly volatile crypto market Make smarter decisions.

Entertainment and interactive applications AI agents are used to create interesting content and interactive experiences, enriching user participation in the crypto community .

With the The number of AI agents is expected to surge as they become more available and cost-effective to develop. There are currently over 10,000 AI agents with millions of daily active users. It is expected that the number of AI agents may grow to 1 million by the end of 2025, indicating its widespread use across platforms.

AI agents will achieve exponential growth in 2024 | Image source: VanEck

The integration of AI technology and meme culture has given rise to AI-themed meme coins, adding a new dimension to the encryption market. The success of projects like Terminal of Truths and the $GOAT meme coin has inspired the emergence of more similar initiatives that combine humor with advanced AI capabilities. This trend is expected to continue to heat up in 2025, attracting the attention of investors and crypto enthusiasts.

AI agents and AI-themed meme coins The rapid growth heralds profound changes in the crypto space:

Promoting accessibility to no-code platforms Enable users with non-technical backgrounds to develop complex AI tools, thereby democratizing innovation.

Diversified application scenarios The expansion of AI agents in multiple fields promotes a closer and diversified ecosystem, accelerating more Widespread adoption.

Changing market dynamics and the rise of AI meme coins have brought new investment opportunities and challenges, affecting market sentiment and investor behavior. have a profound impact.

AI agent integration and The rise of AI-themed meme coins will play a key role in the crypto narrative in 2025, driving innovation and expanding the boundaries of the digital asset market.

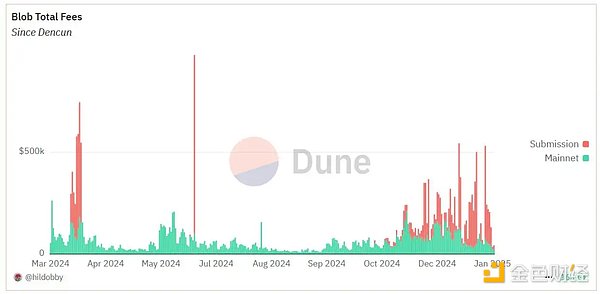

EIP- 4844 (also known as Proto-Danksharding) significantly improves the scalability of Ethereum, introduces "transactions carrying Blob data", and optimizes the data storage of the Layer 2 (L2) network. This development also introduces an independent fee market called the "Blob Gas Market".

EIP-4844 passes a New transaction types (“blobs” that carry large amounts of data) improve Ethereum’s scalability. These blobs of data are temporarily stored in Ethereum’s beacon nodes, allowing L2 solutions to publish the data without competing with Layer 1 (L1) transactions for gas fees.

Result: reduce costs and improve L2 operation efficiency.

With the development of Blob data transactions Introduction, Ethereum currently runs two parallel fee markets:

Layer 1 fee market: Handles traditional transactions and smart contract execution.

Blob Gas Market: Dedicated to L2 transactions leveraging Blob data.

Both markets adopt the basic fee destruction mechanism established by EIP-1559. Under this mechanism, a portion of transaction fees are burned, thereby reducing the overall supply of ETH and potentially increasing its value.

Since November 2024, Validators publish more than 20,000 blobs of data on Ethereum every day.

Prediction: If this trend continues or accelerates, Blob fees could destroy over $1 billion worth of ETH in 2025. This milestone will further solidify Ethereum’s evolving security and economic model.

Blob Gas Market Gains Significant Growth in Q4 | Image Source: Dune Analytics

The following key factors are expected to drive the rapid expansion of Blob space usage in 2025:

The explosive growth of A.L2

Surge in transaction volume: Ethereum Layer 2 (L2) transaction volume year The growth rate has exceeded 300%. In order to save costs and enjoy high throughput, users are migrating to L2 platforms to use DeFi, games and social applications.

Popularization of consumer DApps: The increase in decentralized applications (DApps) on L2 will lead to more transactions returning to the Ethereum main network for final settlement, thus significantly This increases the demand for Blob space.

B.Rollup optimization

Technological progress: Rollup technology Improvements, such as more efficient data compression and lower data publishing costs, will encourage L2 to store more transaction data in Ethereum's Blob space, achieving higher throughput while maintaining decentralization.

C. Introduction of high-cost use cases

Enterprise level Rise of applications: The rise of financial solutions based on zk-rollup and high-value transactions such as tokenized real assets will prioritize security and non-tamperability, while increasing the willingness to pay for blob space.

Improving scalability by converting L2 Data storage is moved from the Ethereum main chain to Blob space, and the network is able to process more transactions without congestion, thereby improving user experience.

Economic Impact Blob fees burn ETH, which will reduce supply and may put upward pressure on ETH prices, benefiting holders and network participants.

Security considerations The increase in Blob space usage highlights the need for continuous monitoring to ensure that the consensus security of the network remains robust under higher data throughput. .

The implementation of EIP-4844 and the development of the Blob Gas market it promotes , marking a major advancement in Ethereum’s scalability and economic model. Utilization of the blob space is expected to grow significantly in 2025 as Layer 2 adoption accelerates and new use cases emerge, further solidifying Ethereum’s position as the leading platform for decentralized applications.

Looking back at the transformative trends shaping the cryptocurrency field, It's hard to see how much potential 2025 holds. However, in the face of this rapidly developing market, we must maintain an attitude of optimism and caution.

Innovation and Growth

The rapid development of AI agents, the expansion of Ethereum Layer 2 solutions, and the tokenization of real-world assets highlight the vitality and dynamics of the crypto ecosystem.

Mainstreaming process

Cryptocurrency is integrated into the traditional financial system The acceleration of the process, the increase in institutional investment and the rise of stable coins show that digital assets are being more widely accepted and recognized.

Regulatory developments

It is expected that under the current U.S. administration , changes in regulatory policies will profoundly affect the development path of the encryption market, which may bring new opportunities as well as new challenges. This reminds us of the need to remain cautious in the face of rapidly changing markets.

In-depth research

Before making any investment decision, it is important to fully understand the underlying assets and technologies.

Avoid excessive leverage

Leveraged trading may magnify returns. It will also aggravate losses. It is recommended to adopt a conservative leverage strategy to reduce potential risks.

Diversification

Avoid concentrating your portfolio in a single assets or industries. Diversification helps spread risk and increases potential returns.

Keep information updated

The crypto market is highly dynamic. Regularly monitor the latest developments, regulatory changes and market trends.

Although the cryptocurrency market brings unprecedented opportunities, with Self-discipline and an informed mindset when investing are critical. By maintaining caution amid optimism, investors will be able to more effectively navigate this evolving market, capturing its potential while avoiding inherent risks.

Everyone was celebrating the Bitcoin pump- but is the crypto winter truly over?

Clement

ClementRecent media reports have raised concerns about Deputy Premier Cheng Wen-tsang from Taiwan, suggesting he may be involved in a deepfake scandal. A circulating video seemingly shows Cheng in a compromising situation with a woman in a hotel room. Cheng strongly denies the video's authenticity, alleging manipulation and editing, and has threatened legal action.

Joy

JoyJudge Torres has issued a directive for Ripple and the SEC to jointly propose a briefing schedule concerning the matter of XRP institutional sales. Consequently, the trial has been adjourned.

Catherine

CatherineThe FTX founder is set to address the jurors directly, seeking to substantiate his assertion that he neither committed nor conspired to commit fraud.

Kikyo

KikyoAccording to ZachXBT, Yahya Maghrab's role primarily involved conducting lookups on X/Twitter accounts through his panel, facilitating scammer Skenkir in identifying potential US targets for SIM swap attacks.

Davin

DavinIn the midst of a crypto market rally, the NFT sector stands apart, resolutely bearish despite the broader crypto surge.

Jasper

JasperSpain strategically positions itself within the realm of the digital euro, signaling a transformative trajectory for the financial landscape.

Hui Xin

Hui XinCrypto Sleuth ZachXBT has unveiled that an entity conducted a sizable transfer, about 4,800 BTC, from the depths of the Abraxas darknet market to a Bitcoin mixer.

Catherine

CatherineCapital A Bhd, the parent company of AirAsia, led by CEO Tony Fernandes, is in the process of securing over $1 billion in financing through a combination of debt and equity. This strategic move is aimed at reshaping the company's future and expanding its financial horizons.

Joy

JoyMastercard and MoonPay are looking at ways to make online payments even smoother. They teamed up to pioneer Web3 technologies in experiential marketing & consumer engagement.

YouQuan

YouQuan