Since its inception, cryptocurrencies have sparked both enthusiasm and panic on their tumultuous journey toward mainstream acceptance. After years of being unfairly beaten, it's time to defend digital currencies.

Sadly, when it comes to cryptocurrencies, first impressions count. Bitcoin (BTC) gained notoriety in its early days as the currency of choice for illicit activity — due to its worldwide popularity with dark web users, ransomware hackers, drug dealers and money launderers.

But the world has changed a lot since the first bitcoin was mined in January 2009. According to cryptocurrency data tracker Bitinfocharts, there are more than 18 million bitcoins in circulation and more than 90,000 people own $1 million or more in bitcoin.

Indeed, there are signs that cryptocurrencies are finally gaining mainstream acceptance. Just last September, El Salvador declared Bitcoin legal tender. In October of the same year, the first U.S. exchange-traded fund (ETF) linked to bitcoin futures began trading on the New York Stock Exchange. Payment giant Visa also launched a global encryption consulting business in December last year to help financial institutions advance their encryption journey.

There are even rumors that cryptocurrencies will become a medium of exchange in Afghanistan, providing a very real example of how cryptocurrencies can enable financial transactions at a time when the monetary system itself is collapsing.

Hurdles facing cryptocurrencies

Despite these successes, cryptocurrencies have lingering public misgivings and opposition from politicians who worry that such decentralized currencies will give ordinary people control over their money. In September last year, China outlawed the trading of cryptocurrencies to prevent their misuse for gambling and money laundering. Politicians across the globe have warned about its potential to change the current landscape of the existing financial ecosystem.

The underlying factor behind all this is fear. Recent research suggests it may be a fear of the unknown. Nearly a third (31%) of Brits surveyed are curious about investing in cryptocurrencies, but 62% of them have not bought any cryptocurrencies because they don’t understand the market, according to a survey commissioned by money app Ziglu. However, in a sign of cryptocurrencies gaining legitimacy in the public eye, the survey also found that bitcoin is now considered a smarter investment than real estate.

It’s time to recognize that, despite their inherent risks, cryptocurrencies are also a force for good in the world. In an era where savings rates are plummeting, this relatively new asset class offers us all the opportunity to invest in cryptocurrencies without the traditional barriers that exist in traditional finance, whether we have the money or not to participate.

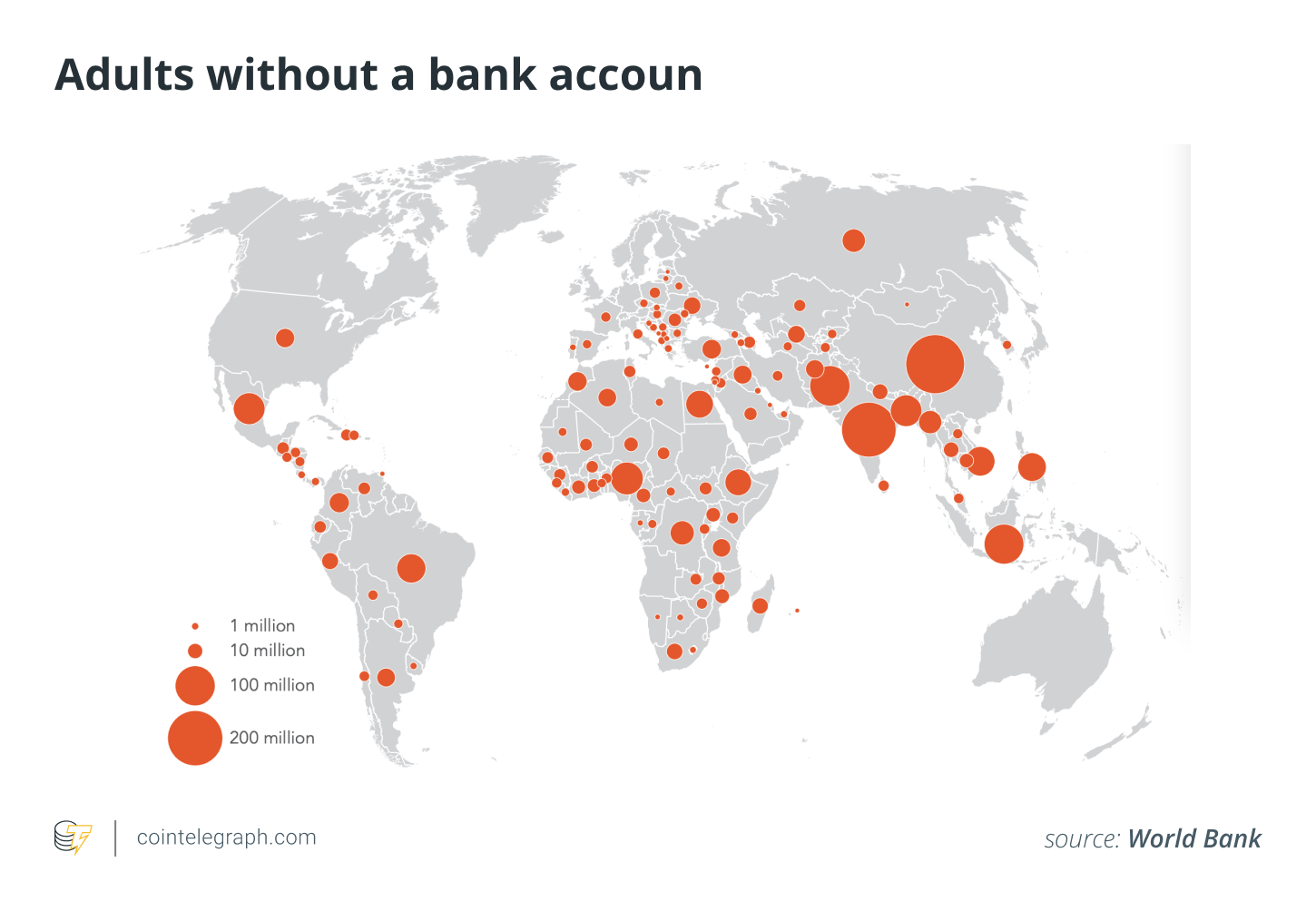

Some people don't even have a safe place to store their hard-earned money. According to the World Bank, 1.7 billion people worldwide are unbanked. Many of us take it for granted that credit cards and bank transfers — the ability to send large sums of money to our friends and family with just a tap of our smartphone — are a reality for the unbanked. is impossible.

More than 80% of the world's population owns a smartphone, and that's all they need to send crypto money across international borders. Cryptocurrencies promote financial inclusion by allowing millions of people without access to platforms like PayPal or Venmo to move money for pennies. It's also a good option for those who hate high bank fees because, unlike traditional payment methods, this new infrastructure is not limited by the profit motive.

Advantages of cryptocurrencies

Smart contracts can replace the services of banks, money transfer companies or legal firms, while cryptocurrencies and digital wallets can provide customers with flexibility such as credit and financial sovereignty without the need for a centralized entity.

Cryptocurrencies also protect citizens from economic turmoil. A good example is Venezuela, where many citizens are already suffering from high inflation and the effects of U.S. sanctions that have also affected their banks. More and more of them convert their salaries into cryptocurrencies and use the blockchain for transfers and payments.

For developing countries, Bitcoin is an excellent way for societies to eliminate corruption, because when people use Bitcoin to transfer money, the community can track any Bitcoin transactions in a public ledger.

More importantly, cryptocurrencies also democratize finance. The barriers to entry are low and no brokers or high net worth are required. Anyone can invest and create wealth for themselves. As a result, people are learning concepts such as annual interest rates, borrowing and lending, and the history and uses of money.

The disadvantages of cryptocurrencies

But any defense of cryptocurrencies cannot escape an obvious problem: crime. Blockchain has long been associated with fraud and ransomware, but the truth is, blockchain is the perfect system to thwart this type of criminal activity.

Cryptocurrencies are not anonymous, they are pseudonymous. The public ledger upon which cryptocurrencies exist and are transferred allows law enforcement to track and trace the movement of funds in real time, providing unprecedented visibility into the movement of funds. Criminals also need to convert cryptocurrencies to fiat currency, which not only creates an opportunity to blacklist wallet addresses, but also proactively catches criminals.

This is why law enforcement was able to track down and eventually confiscate the ransom, as happened in the June 2021 ransomware attack on the Colonial Pipeline in the United States. The money was recovered only because the blackmailers used cryptocurrencies as a payment medium.

The advantage of blockchain is its tamper-proof nature. Through a process known as consensus, each transaction is independently verified by multiple parties. Entries are immutable, meaning they cannot be modified, only updated by adding appendices.

We advocate for the creation of a dedicated group within cybercrime law enforcement. Why do you need it? This makes it possible to have the dedicated technical and human resources to proactively help companies that have been hacked and demanded to pay ransom in cryptocurrency. Dedicated teams are able to contact and notify all cryptocurrency exchanges, allowing them to identify when and if criminals want to cash out on exchanges.

Another problem with cryptocurrencies is their environmental impact: Mining proof-of-work currencies such as bitcoin requires constantly running powerful mining machines, which consume a lot of electricity.

However, this situation has changed. Currently, more than half of all Bitcoin miners use sustainable energy. A bitcoin mining company uses cheap hydropower to run its mining machines northeast of Niagara Falls, home to the last operating coal-fired power plant in New York state. Meanwhile, President Nayib Bukele of El Salvador has announced a more creative plan to use the geothermal energy of the Conchagua volcano to power his "Bitcoin City" project.

Now, cryptocurrencies have almost reached mainstream acceptance. So now is the time to overcome our often unfounded fears and embrace the financial freedom, security and convenience it has to offer.

Cointelegraph Chinese is a blockchain news information platform, and the information provided only represents the author's personal opinion, has nothing to do with the position of the Cointelegraph Chinese platform, and does not constitute any investment and financial advice. Readers are requested to establish correct currency concepts and investment concepts, and earnestly raise risk awareness.

Alex

Alex

Alex

Alex Catherine

Catherine Anais

Anais Weatherly

Weatherly Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang