Author: shivsak

Source: shivsak's twitter

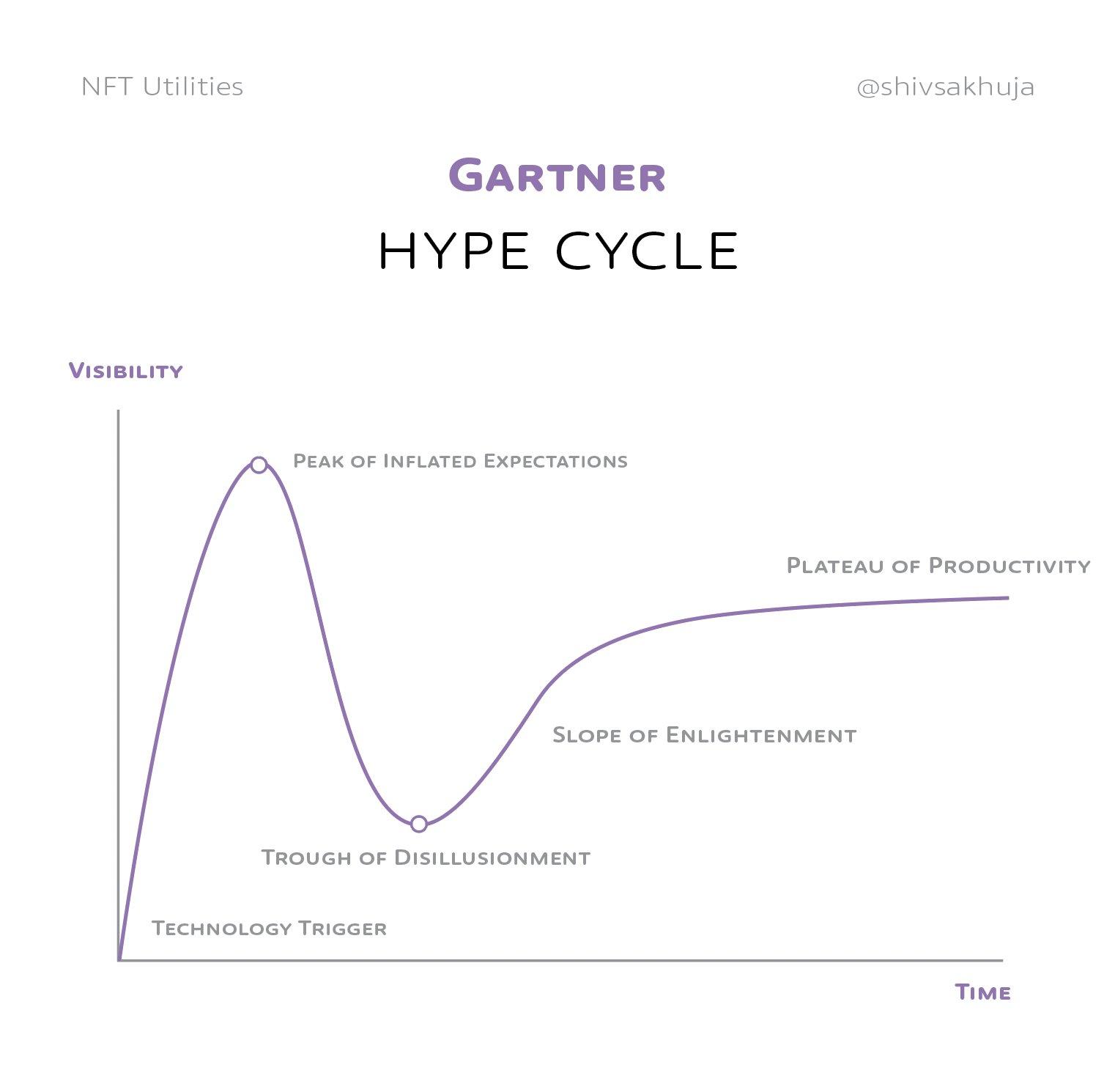

Right now, NFTs have limited real use cases, but they have a lot of untapped potential. As with every new technology, there will be a similar hype cycle before real use cases emerge.

Have you heard of the Gartner Hype Cycle Curve? According to Gartner's hype cycle curve, disruptive technologies often go through five key stages. As shown below:

Now, NFT has gone through 1-2 such hype stages.

In the NFT speculative bubble of 2021, Beeple sold his art collage "Everydays: the First 5000 Days" for $69 million. Similarly, NBA Top Shot has sold video highlights worth hundreds of millions of dollars.

This may fall under the "Peak of Inflated Expectations" in the graph above.

Most people think of NFTs as just that - a speculative bubble, "worthless" jpegs bought by Degen and rich people.

You may also have seen profile picture NFTs on Twitter. For example, my NFT avatar can distinguish my account from fake accounts.

But that's just the beginning. NFTs are a way of representing proof of ownership. Proving ownership of digital assets with NFTs is easy (though perhaps not as useful) compared to physical assets.

That's why artwork and avatars are the most obvious use cases for NFTs.

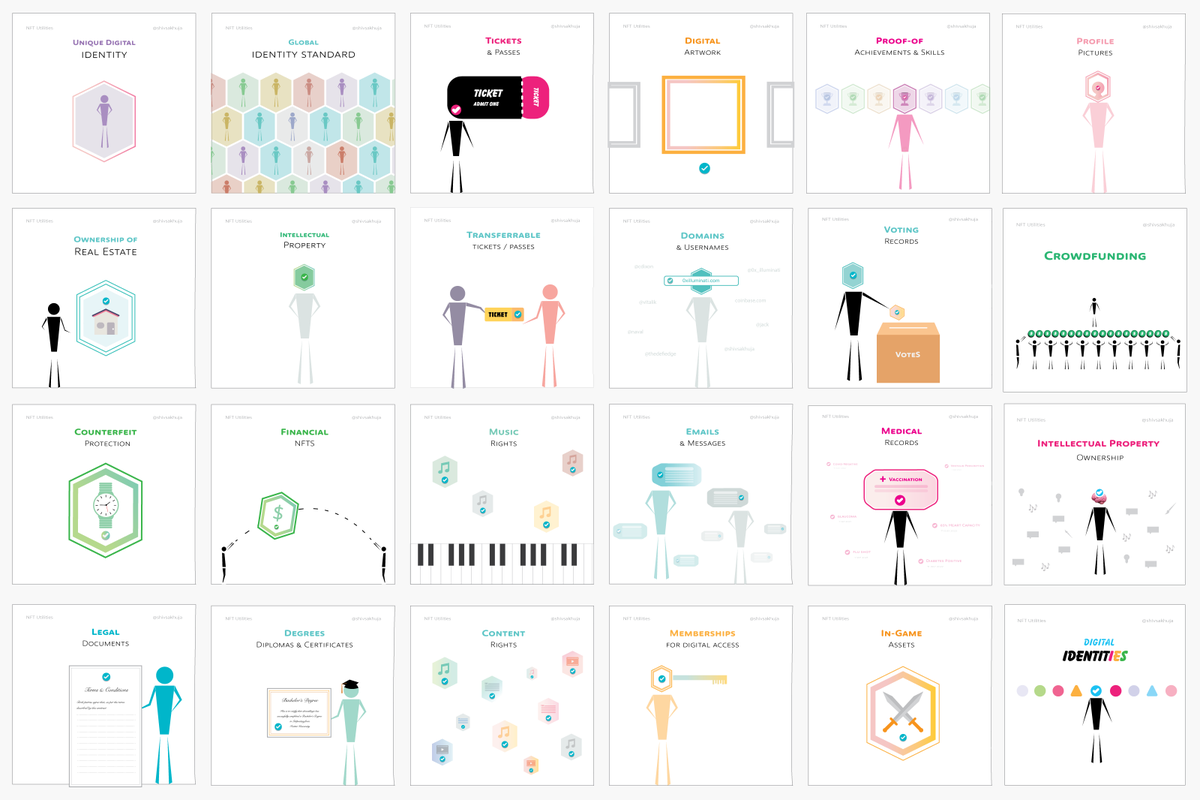

But NFT can have more applications. NFTs can be used to represent any of the following:

• Unique

• owned

• Requiring or benefiting from digital proof of ownership

Such as domain names and usernames. You can buy NFT domains on Unstoppable, ENS, Raible.

One of the great benefits of NFT domains is that they are transferable and tradable. Domains from Godaddy and other web2 providers are not easy to transfer or sell. In many cases, you are simply leasing the domain name rather than buying it.

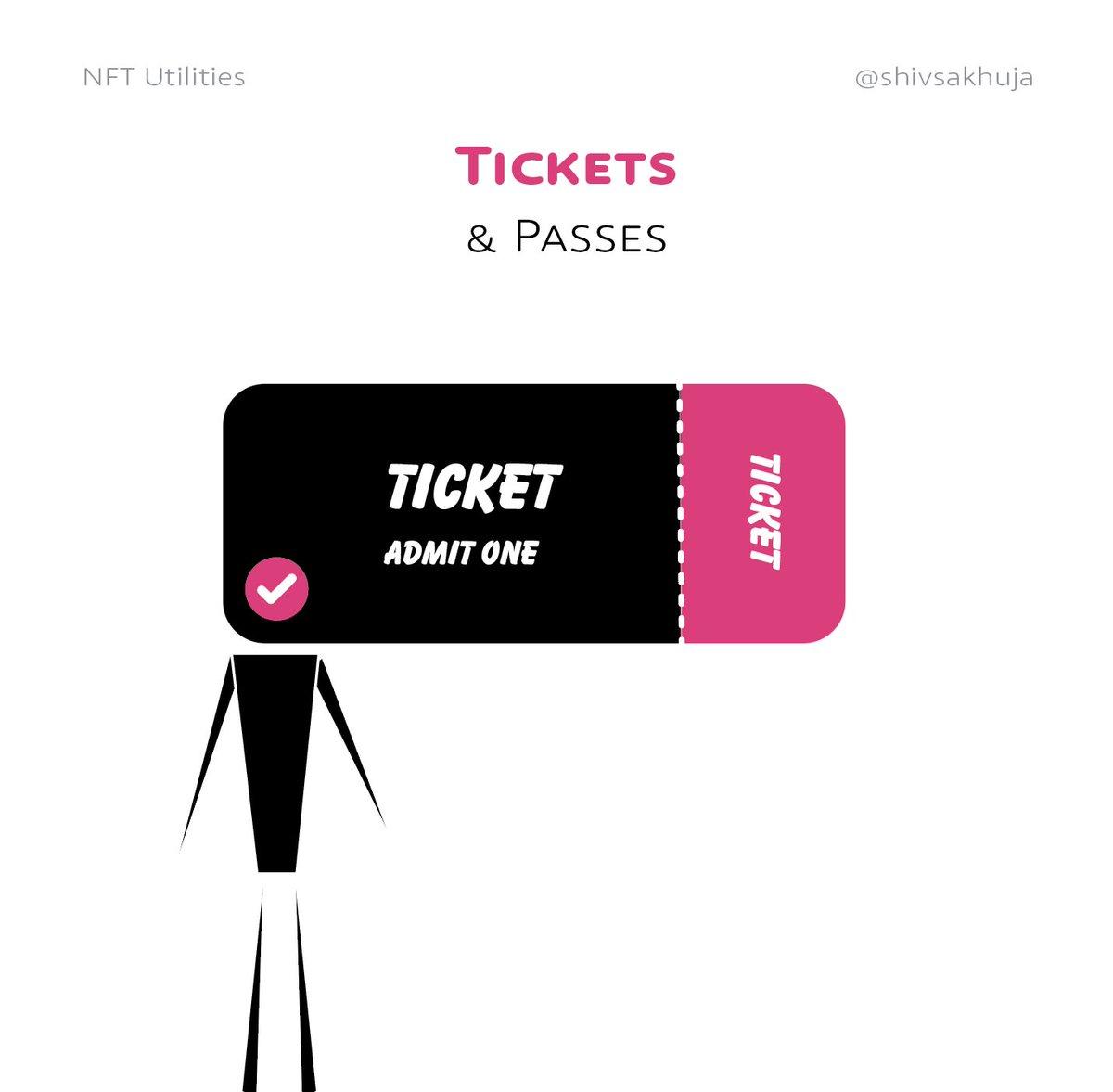

Likewise, concert tickets and other event passes are a good fit to be represented by NFTs. Their number is limited, and entry to the event requires a ticket as proof. NFTs could eliminate the problem of counterfeit tickets and make it easier to verify authenticity and ownership.

NFT tickets can also be traded on the secondary market, which will unlock some content:

1. A standardized marketplace with buyer-seller protection. Currently, tickets trade on inefficient marketplaces like Facebook and Craigslist, with no guarantees for buyers.

2. Free market pricing

3. Original author's royalties (see below for details)

4. Historical ownership data for tickets means performers can airdrop future passes, discounts, giveaways, etc. to fans.

5. NFT passes can also be used as a kind of badge to show that you are a fan.

The online ticketing market is estimated to be worth more than $30 billion — and growing fast.

The NFT-based ticketing projects I know are:

GET Protocol

SeatlabNFT

Yellow Heart

GUTS Tickets

Wicket Events

In-game assets benefit from NFTs for the same reason. Imagine someone spent 2 years collecting the rare collectible swords in the game. For players, this collectible clearly has value. This means it can be exchanged for USD or other game assets.

The games industry is on track to generate $200 billion in revenue this year, with much of that coming from in-game purchases. The royalties from the secondary market transactions of these game assets provide an incentive for game companies to create NFT-based ecosystems.

But digital assets capture only a fraction of the potential, and real-world assets can derive much of the same value from on-chain NFT representations.

For example: real estate is unique, has only one owner, and requires proof of ownership. Real estate tokenization has multiple benefits:

Properties can be subdivided, lowering barriers to entry and increasing liquidity

Can be mortgaged for capital efficiency (e.g. easy access to property-backed loans)

Proof of ownership is especially important in countries with weak legal systems

Global investors can invest in specific properties, neighborhoods, towns, etc.

The global real estate market is worth hundreds of trillions of dollars, and NFTs are the most effective way to prove ownership, resolve disputes, and lower barriers to entry for investors and homeowners around the world. It's still early days, but it's already started.

For example, Michael Arrington, the founder of TechCrunch, sold the world's first real estate NFT through Propy as early as 2021.

The above mentioned are all about the benefits of transferable asset NFT, so what about non-transferable NFT?

Many people are now discussing "Soul-Bound Token" (Soul-Bound Token, referred to as SBT). Like I said, NFTs are essentially digital certificates that anyone can verify. This is great for using cases like degrees and diplomas - of course you don't want these to be tradable. Therefore, they are best represented by non-transferable NFTs (SBTs).

Having standardized, public proof of diplomas, degrees, skills and chains of achievement means anyone can verify their legitimacy. The same is true for all other types of certificates.

For example:

• LinkedIn can put an accreditation stamp on your degree.

• You can get NFTs of freelancers to show proof of work done, skills used, time spent and samples. It can then be used as your portfolio on sites like Upwork, Fiverr, etc.

Because NFTs are an open standard, this means NFTs acquired through Upwork can also show up on your Fiverr profile.

NFT can also be used for anti-counterfeiting.

Counterfeiting is the largest criminal activity in the world, costing an estimated $2 trillion a year and growing. Therefore, anti-counterfeiting technology has great value. ORIGYN Foundation is working on the cause of anti-counterfeiting.

Speaking of counterfeiting, identity theft/verification is another huge real-world problem that can be solved using NFTs.

In the United States, more than 15 million citizens face identity theft each year, suffering losses of more than $50 billion annually. This is not surprising since in the US all you need to steal identity information is a 9-digit number (social security number) which often shows up in emails, documents, phone calls.

How can identity NFTs solve this problem?

• NFTs are unique and cannot be forged.

• NFT provides global standards.

• NFTs are easy to verify.

• Non-transferable NFT (SBT) locked to a specific wallet.

• NFTs can be revoked in case of wallet loss or theft.

This could be one of the largest global use cases for NFTs.

Because your identity is not just your citizenship, you may have multiple identity NFTs. Now, projects including Polygon and Civic are researching on-chain identities.

Digital and physical members can also use NFTs to verify access requirements.

NFT identities can also solve problems such as voting verification.

If you remember the 2020 US election, there is no need to explain why this is a problem worth addressing. Simple online voting can also increase turnout.

NFTs can also be used to protect intellectual property.

This allows creators to earn royalties from their creations.

NFTs:

• Verifiable → IP ownership is clearly defined and publicly verifiable.

• Standardized/Composable → Opens the door for platforms to allow creators to earn royalties from their IP.

Monetization without filing for copyright = more opportunities for all.

Music is an obvious example.

Currently, most artists earn very little from platforms like Spotify and Apple Music.

Average Creator Earnings:

- Spotify ($636 per artist)

- YouTube ($405 per channel)

- Facebook ($0.10 per user)

- NFT ($174,000 per creator)

Creators can also use NFTs for crowdfunding.

For example, investors can acquire NFTs that represent rights to future earnings. This is especially useful in fields where people who aren't in the top 1% can't make money (like aspiring artists, athletes, actors, etc.).

Likewise, NFTs can also be used to crowdfund social impact projects. NFT will be a badge of honor for selfless contribution.

This leads to a broader concept of financial NFTs (fNFTs).

Many financial contracts are unique.

For example:

• Individual basket of assets (unique investment portfolio)

• Partial debt repayment agreement with lender

• Time-locked tokens (eg: veCRV)

In general, any legal contract or document can benefit from an NFT. The existing paper/PDF certification system has the risk of being PS.

Verbal agreements via emails and messages can also be represented with NFTs.

Medical records can also be represented in NFTs:

• Vaccination certificate

• COVID-19 test results

• Prescription

While I'm trying to cover most use cases I can think of, I think this has only scratched the surface. There are other creative use cases for NFTs. Widespread adoption of NFTs will enable massive tokenization of off-chain value that could eventually dwarf the cryptocurrency market.

"Ultimately, NFTs will authenticate the world."

Joy

Joy