After Ethereum, Solana also cannot escape the market FUD.

When it comes to the most eye-catching public chain in this round of bull market, Solana, which is jokingly called the "computer room chain", is absolutely the best choice. The heavy blow brought by FTX has become the soil for Solana's rebirth. With its excellent performance and precise positioning, SOL has created a rare growth miracle riding on the east wind of MEME, rising from $8 to a maximum of more than $290, which has stunned the market. Active participants, active funds, and active projects constitute an active ecology, and the slogan of surpassing Ethereum has frequently appeared when talking about Solana.

But recently, the performance of the "king of retail investors" has been less than satisfactory. In the past month, the price of SOL has fallen from a high of $295.83 to the current price of $169, with a maximum drop of more than 45%, nearly halving. The depressed prices, the cooling of MEME, and the unlocked tokens are in sharp contrast to the surging crowds at the SOL venue at the conference.

People can't help but wonder, is Solana a good idea or not?

From the perspective of price alone, the sluggish performance of SoL is mainly due to two direct inducements, one is MEME, and the other is the unlocking of tokens. Previously, SOL had turned around with MEME and successfully became a big casino on the chain, but success and failure are also due to Xiao He. The recent MEME circle has really disappointed the market.

The root cause is the explosive celebrity coins, Trump coin, Mrs. Trump coin, and LIBRA, which is closely related to the Argentine president, one after another. Celebrities use their influence to harvest and harvest, which makes the market, which is already short of liquidity, feel powerless. In terms of price performance, Trumpcoin has fallen 76% from its highest point, with 800,000 people standing guard on the top of the mountain, MELANIA has fallen by 90%, and LIBRA, which has a less influential influence, has fallen by 92% to almost zero. Nearly 30% of large investors have taken over at high prices, and more than 70,000 addresses have been harvested.

The threshold for token issuance is too low. The presidents chose their own MEME between Bitcoin and Ethereum, which undoubtedly shattered the market's confidence in liquidity injection. This emotion cannot be expressed to the project party, but it is directly reflected in the infrastructure, especially considering the controversy between Jupiter and Meteora in LIBRA, Solana has also suffered an undeserved disaster.

Of course, Solana is not entirely innocent. Since it became a MEME casino, major institutions, robots, and market makers have made billions of dollars through MEME on Solana. According to statistics from 0xngmi, the founder of DeFiLlama, the total profit is between $3.6 billion and $6.6 billion, of which MEV (maximum extractable value) is $1.5 billion to $2 billion, trading robots and applications are $1.09 billion, automatic market makers are between $0 and $2 billion, Trump-related insiders are $500 million to $1 billion, and the Pump.fun platform is also full of money, earning $492 million.

MEME on Solana has become a cash cow for high-frequency traders, arbitrageurs, and insiders. As the market becomes increasingly sluggish, many people have directly chosen a simpler way of confrontation-quitting. According to monitoring by crypto analyst Ali, the number of active addresses on the Solana chain has dropped significantly from 18.5 million in November 2023 to the current 8.4 million, a drop of 54.6%. According to Nansen data, the number of active addresses on February 18 was only 5.17 million, a 30-day drop of 22.37%.

With fewer people, the price of the currency is naturally affected, not to mention that even Bitcoin is now in a half-dead Schrödinger state. However, to fall 40% in a month and become the worst performing token among the top 30 currencies by market value, the market blow of MEME alone is not enough.

Token unlocking has become another mountain that lies on SOL. As early as last month, anonymous crypto commentator artchick.eth shared Solana's 2025 token unlocking schedule on social media, mentioning that Solana's current token inflation rate is 4.715%, but in the next three months (February-April), more than 15 million SOL tokens worth more than $7 billion will enter the circulation supply. And on March 1, the largest amount of unlocking will come, and 11.2 million SOL tokens worth about $2.06 billion will be unlocked.

SOL unlocking schedule, source: artchick.eth

To trace the source of this unlocking, we still have to go back to FTX. As part of the bankruptcy process, FTX liquidated 41 million SOL in three auctions. The largest buyer was Galaxy Digital, which acquired 25.52 million SOL at $64 per token, accounting for 62.24% of the total. The second largest buyer was Pantera, whose buyer consortium purchased 13.67 million SOL at $95 per token, with a return rate of 93%. Other buyers purchased 1.8 million SOL at $102 per token.

The unlocking on March 1 was also part of the liquidation of SOL. The only thing to be happy about is that FTX has started to repay the money on February 18, and Kraken has completed the first fund distribution of FTX estate, paying more than 46,000 creditors. The creditors are happy, but the holders of SOL are quite frightened.

In the current market, which is not good, the large amount of unlocked SOL will inevitably be regarded as selling pressure, thus undermining investor confidence. Cryptocurrency trader RunnerXBT bluntly stated that now is a "dangerous" time to buy Solana. He also emphasized that once the SOL unlocking occurs, companies such as Galaxy, Pantera and Figure will extract unrealized gains of US$3 billion, US$1 billion and US$150 million.

With the external environment turbulent and the internal environment unstable, the market took quick action. In addition to selling in exchange for stable assets, short selling became the only option. Not only did the total open interest and funding rate diverge, but the long-short ratio also differed greatly. As the position increased and the funding rate turned negative, the current short-long ratio was 4:1, and most of the positions were added after SOL fell to $190, which means that the new buyers were bearish. The trading data shrank significantly. After reaching a daily trading volume peak of $35.5 billion on January 17, Solana's on-chain activity dropped sharply to $3.1 billion on February 17.

Against this backdrop, SOL also fell as expected, from $290 on January 19 to a low of $160, a 45% drop in January, which is not an exaggeration to describe as falling flowers and running water. Is Solana, the king of retail investors, going to fall?

Interestingly, at the Consensus Conference held a few days ago, the Side Event held by Solana was still crowded and lively. Some people represent attention, and attention in the currency circle means capital flow. In sharp contrast, the activities of inscriptions and NFTs, which were once popular concepts, now have only a few participants.

In this regard, most industry professionals still seem to show a strong interest in Solana. In the final analysis, no matter how much complaints there are, the Solana ecosystem is still relatively strong. Looking at its ecosystem, it covers the fields of payment, DeFi, LSD, Meme, games, NFT, and DePIN, and many star projects are gathered. In terms of total TVL, SolanaTVL reached 8.24 billion US dollars. Although it is far behind Ethereum's 57.3 billion US dollars, it has successfully jumped from the 2023 no such person to the second place of the public chain, accounting for 7.72% of the total TVL. It is worth mentioning that in the past two weeks, affected by the unlocking, Solana TVL fell by 19% in the past two weeks, and Jito, Kamino, Marinade Finance and Sanctum are rapidly flowing out.

A single machine chain can return to the peak again from below $10. In addition to the so-called technical and positioning advantages, the power of capital is the real invisible hand. Strong Western capital such as A16z, Multicoin, Galaxy, and Pantera constitute the confidence of the strong dealer, which also makes Solana like a duck in water in many payment fields. In the previous 2025 forecasts of the institutions, all of them expressed high confidence in SOL without exception.

Returning to the fundamentals, except for the increasingly downward MEME which is difficult to repair, the impact of token unlocking is still relatively controllable in the short term. This unlocking has already started in early February, and the market has long expected it. The upcoming unlocking only accounts for 2.31% of the total supply and market value. Compared with the spot trading volume of about US$3.6 billion in 24 hours, the selling pressure is not strong. Of course, if the capital side chooses to sell a large amount in the market at one time, SOL will undoubtedly suffer a heavy blow, but for personal benefit considerations, the capital side will not choose this method. Most of them will control the frequency of sales. Even if they sell at one time, they will choose the form of OTC to minimize the impact on the market and maximize personal interests. Of course, it may not be completely optimistic. In addition to the unlocking on March 1, there will be more selling pressure in the future starting from this year.

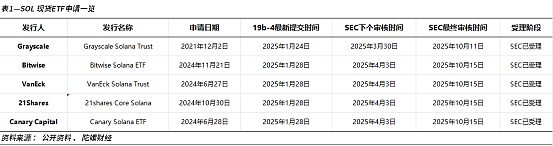

From the perspective of the positive news, there will be another wave of speculation on SOL ETF. As of now, five institutions have submitted SOL spot ETFs, namely Grayscale, Bitwise, VanEck, 21Shares and Canary Capital. Although SOL ETF failed last year, with the coming of the new regulator, SOL ETF has ushered in a glimmer of hope. At present, the SEC has accepted the 19b-4 application of Grayscale Solana ETF, and the latest approval date is March 30, but according to general procedures, the SEC usually postpones the acceptance of applications for a maximum of 240 days. In view of the fact that the nature of SOL as a security has been clearly named, the subsequent approval needs to wait and see. In terms of possibility alone, Litecoin and Dogecoin are more likely to be approved, but in any case, as long as the ETF is still under review, the narrative will not stop.

On the other hand, this does not mean that Solana does not have problems. Judging from the current structure, although DeFi and DePin are also hot, Solana is indeed highly dependent on the MEME ecosystem. According to data released by Messari in the fourth quarter of 2024, Solana application revenue jumped from US$268 million in the third quarter to US$840 million in the fourth quarter at the end of the year, an increase of 213%, and this growth was mainly attributed to MEME. Among them, Pump.fun generated revenue of US$235 million in the fourth quarter, and DeFi trading terminal Photon and decentralized exchange Raydium recorded revenues of US$140 million and US$74 million, respectively.

Objectively speaking, although MEME has become an important narrative sector of cryptocurrencies with long-term effects, in the final analysis, the carnival of MEME still stems from the industry's continued sluggish boom cycle. In other words, MEME is more like a lottery effect in the crypto market, a behavior of betting on small gains and big losses, and the MEME cycle is a phased product under the background of insufficient liquidity. However, the market is tired of VC-style profiteering, but despite the seemingly fair launch, MEME preemption, insider trading, and banker harvesting can be seen everywhere. This high-frequency, one-wave-like harvesting has, to some extent, seriously damaged the industry ecology. Take LIBRA as an example. The team behind it even tried to establish contact with the president of Nigeria, which means that perhaps presidential tokens will be all over the streets in the future, and there is no way to talk about scarcity.

Against this background, Solana's MEME dependence is too high, and it is inevitable that it will fluctuate with MEME. The market's anger after the LIBRA explosion, the doubts about Jupiter and Meteora, and the blow to SOL all confirm this point. The market's speculative sentiment has been suppressed, and the related SOL is inevitably in danger of losing its teeth. Coupled with the most critical unlocking and selling expectations, SOL is continuing to decline.

Admittedly, from the current stage, Solana is still one of the public chains with the most active funds in the market. Emotional venting is difficult to last for too long. Solana, which is backed by capital, is still "doing things" Bulid, but in the crypto market full of FUD, the time left for SOL may not be as long as imagined.

Kikyo

Kikyo

Kikyo

Kikyo Brian

Brian Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Brian

Brian Kikyo

Kikyo Alex

Alex Kikyo

Kikyo