Author: Stacy Muur, Crypto Analyst; Translator: xz@Jinse Finance

Once upon a time, managing crypto assets meant scrambling between multiple wallets, struggling through complex exchanges, incurring high exchange fees, and racking your brains to meet real-world consumer needs.

Now, a new generation of crypto banks is reshaping this experience. Through a single application, users can hold interest-bearing stablecoins, spend directly at merchants, and achieve near-frictionless global fund flows.

Some platforms function like fintech banks with crypto channels, while others are entirely built on-chain—integrating stablecoins, DeFi protocols, and self-custodied wallets into a unified ecosystem.

This article will delve into the current state, operational mechanisms, and service matrix of crypto banks, and analyze the leaders in user experience, profitability, and market penetration within this field.

1. Plasma One

Plasma One is a digital bank and encrypted debit card platform centered on stablecoins, integrating the savings, spending, transfer, and value-added functions of digital dollars into a single application.

This platform is built on the Plasma Layer 1 blockchain and touts itself as the world's first digital bank designed entirely around stablecoins, primarily serving global users (especially in emerging markets) who rely on USD stablecoins for daily financial management.

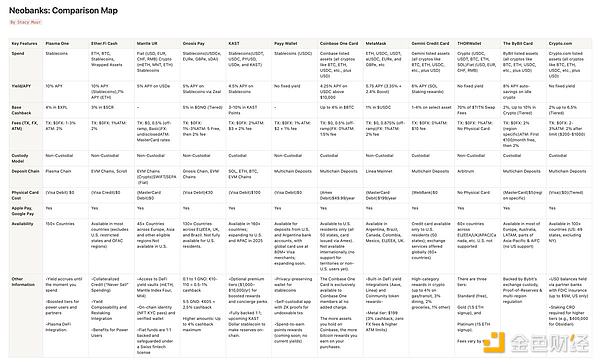

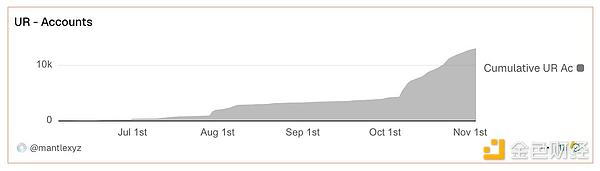

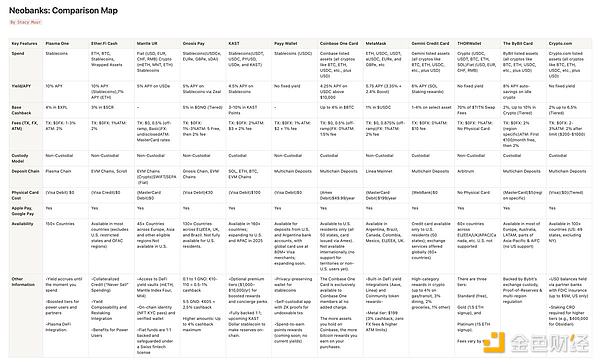

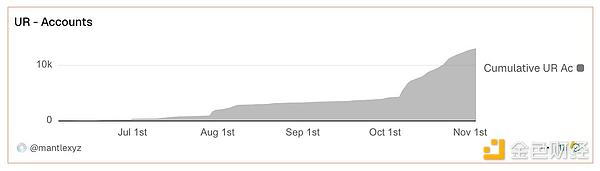

The project is well-funded, supported by Peter Thiel's fund and Tether CEO and other well-known investors. It has completed a $24 million funding round, and its native token XPL was oversubscribed by $3.73 billion. Core Functions: Non-custodial Stablecoin Wallet: Users hold their own private keys, no mnemonic phrase required; High-Yield Savings: USDT annualized yield exceeds 10%, with yield accumulating in real-time until the moment of purchase; Visa Debit Card (Virtual + Physical): Directly use stablecoins for purchases at over 150 countries and over 150 million merchants; 4% Cashback on Purchases: Rewards are paid in XPL, with higher tiers available for active users and partners; Instant Stablecoin Payments: Global fee-free on-chain USDT transfers (ideal solution for cross-border teams); Seamless DeFi Integration: Yield sources are integrated with liquidity staking strategies such as EtherFi. Fee Structure: Stablecoin transfers and spending are free; No monthly fees or account management fees are charged; No deposit requirements: directly use your earned balance for spending; Currency exchange is settled at Visa network standard exchange rates; Withdrawal fees may only be charged by third-party partners. Other Information: Service covers over 150 countries (Visa network reachable areas); Initially supports USDT (Tether), will gradually expand to more stablecoins; Received investment support from Peter Thiel's Founders Fund and Tether executives; Cards are issued by Signify Holdings (Visa partner issuer); Security measures: hardware-level key protection, encrypted storage, continuous auditing, real-time fraud monitoring. 2. EtherFi Cash: EtherFi Cash is a non-custodial encrypted digital bank and Visa card service that allows users to spend, borrow, and grow their assets using ETH, BTC, and stablecoins while maintaining full control over their assets. This platform is designed specifically for crypto-native users and institutions, integrating DeFi yield strategies with real-world financial functions, allowing users to participate in staking, restaking, and credit-backed liquidity acquisition without selling their tokens. The following are the EtherFi Cash ecosystem metrics as of October 20th (data source: Dune Analytics, DeFiLlama): Since its launch in mid-2025, EtherFi Cash has become one of the most active crypto card products on the market. The platform manages over $200 million in deposits, with over 2,300 daily active users and an average of 12,500 card transactions per month. The product boasts a huge untapped potential market and an abstract layer design, capable of attracting both sophisticated investors and ordinary users, who are likely to gradually migrate to other products within the EtherFi ecosystem. Core Functions: A Visa credit card backed by crypto assets; 3% instant cashback on all-channel spending (up to 20% during promotions); Spend directly from the DeFi yield vault (earn while you spend); High-yield DeFi vault (approximately 10% annualized return for stablecoins, approximately 7% for ETH); Fully non-custodial model; Supports automatic repayment using staking/re-staking yields; Virtual and physical cards are compatible with Apple Pay/Google Pay; Provides a corporate card system with fund management for DAOs and crypto teams. Fee Structure: Card issuance fee and account management fee waived; Overseas transaction fee: 1%; ATM withdrawal fee: 2%; Promotional period credit line with 0% interest (subsequent interest rates will be anchored to the DeFi market); No hidden fees or dormant account fees. Other Information: Services cover most countries (excluding restricted states in the US and OFAC-sanctioned regions); Operates on the Scroll Chain; Cashback is paid in cryptocurrency (SCR or ETHFI), automatically credited to your account for each transaction; All vaults and logic contracts are on-chain verifiable and audited; Cards are issued by licensed US bank partners on the Visa network; Optional Nexus Mutual DeFi insurance service is available. 3. Mantle UR (pronounced "You Are"), launched by Mantle, is the world's first fully blockchain-based digital bank, aiming to unify fiat currency and crypto assets into a single account. UR connects traditional finance and decentralized finance through borderless smart currency applications, enabling seamless spending, savings, and fiat currency exchange. The platform offers fully compliant Swiss regulatory accounts, allowing users to earn on-chain rewards, access fiat currency deposits and withdrawals, and spend cryptocurrency globally. Since its launch in mid-2025, UR has demonstrated strong early growth momentum, with nearly 10,000 accounts opened and ecosystem activity continuing to increase. Daily transaction volume has remained stable between 250 and 300 transactions, with daily card transaction volume for mainstream assets exceeding $40,000.

With the support of Mantle's over $2.3 billion treasury and strategic partners such as Bybit, UR fully leverages Mantle's infrastructure to integrate stablecoin yields, compliant banking channels, and global payment services, becoming a "liquidity chain" connecting institutional and retail users.

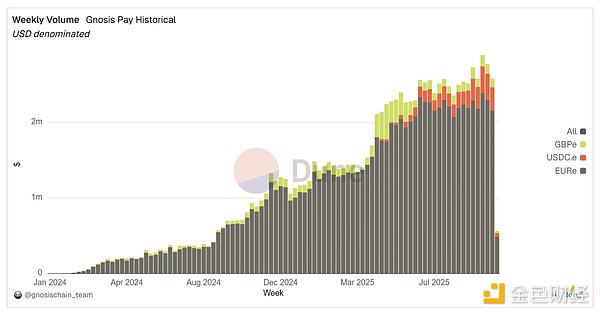

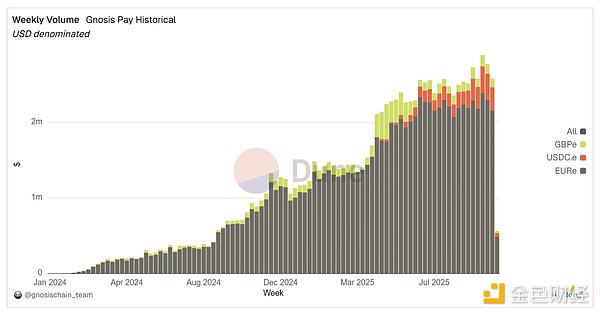

Currently, the platform supports over 21,000 active fund addresses, with a weekly settlement volume of approximately $2.5 million, primarily driven by European users using the EURE stablecoin for consumption.

Core Functions:

Personal credit card for US residents, supporting global spending;

High-category crypto rewards (up to 4% cashback on gas/transportation, 3% on dining, 2% on groceries, and 1% on other items);

Mastercard credit card (physical/virtual card, offering themes such as Bitcoin/XRP/Solana) for spending;

Rewards are deposited into your Gemini account in real time for trading or holding;

Solana-themed version automatically stakes SOL rewards.

Fee Structure: No annual fee or overseas transaction fees; Late payment fee: up to $8; Cancellation fee: up to $35; High floating annual interest rate: 19.24%-35.24% (avoidable with full repayment; no fees for reward earnings). Other Information: Service Area: Credit cards are only valid for US residents (50 states); exchange services cover over 60 countries worldwide; Custody Mechanism: Gemini uses offline cold storage to safeguard assets and provides hot wallet insurance; Security Certification: Audited by SOC 2, supports two-factor authentication and address whitelisting, USD assets are covered by FDIC through-the-loop insurance. 10. THORWallet Thorwallet is a self-custodied, multi-chain wallet that integrates a Swiss-regulated IBAN account (via Fiat24) and a virtual Mastercard compatible with Apple Pay, Google Pay, and Samsung Pay. Users can exchange cryptocurrency for Euros, Swiss Francs, US Dollars, and Chinese Yuan balances for global spending, maintaining complete self-custodial control over their digital assets until a transaction occurs. Core Functions: Self-custodial wallet (supports multiple chains); Cards: Virtual Mastercard (no physical card currently); Supports Apple/Google/Samsung Pay; Real-time deductions from fiat currency sub-accounts; No pre-charge required for segregated accounts; THORChain Savings Pool (supports single assets such as BTC/ETH) → Generates floating "real returns" through exchange fees (settled with the same asset); Stablecoin Vault (USDC/USDT on the EVM chain) → Fee-driven floating annualized returns. Fee Structure: Account/Card: 0 monthly fee, 0 annual fee, no dormant account fees; Cryptocurrency → Fiat Deposit/Foreign Exchange Rates: Standard Edition (Free): 1.0%; Gold Edition: 0.5% (one-time upgrade fee approximately 1.54 ETH); Platinum Edition: 0.25% (one-time upgrade fee approximately 15 ETH). Other Information: Service Area: Covers over 60 countries including the EU, EEA, UK, Asia Pacific, and Canada; does not support the US. Banking/card services require KYC; wallet/DeFi functions remain license-free; Limits (Standard): Approximately $100,000 USD per month for bank transfers; $20,000 USD per month for card spending (maximum approximately $10,000 USD per day). Higher limits are available for paid tiers; Transfers: SEPA/IBAN transfers on the ThorWallet are free; Network Costs: Charged normally according to the respective chain's Gas fee/THORChain transaction fee (application automatically optimized; some support "zero Gas" paths); ATMs: Not supported (virtual cards only); Protocol Staking (TITN) → Receive stablecoin yield sharing; staking weight can increase yield multiples. 11. Bybit Card Bybit Card is a Mastercard crypto debit card launched by the global cryptocurrency exchange Bybit. Users can directly use cryptocurrency for purchases at over 90 million merchants worldwide. The card supports real-time cryptocurrency-to-fiat currency conversion, high cashback rewards, and passive income, aiming to meet the needs of crypto-native users who seek convenience and performance. **Core Functions:** Virtual and physical Mastercard debit cards (supports chip, contactless payment, and ATM withdrawals); Real-time cryptocurrency to fiat currency conversion at points of sale; Supports BTC, ETH, USDT, USDC, XRP, and TON (more assets coming soon); Cashback up to 10% (depending on Bybit VIP level); Up to 8% annualized return on idle cryptocurrency through automatic savings integration; Compatible with Apple Pay, Google Pay, and Samsung Pay; 3D security verification, instant card freeze/unfreeze, and transaction alerts; Supports ATM withdrawals, subscription cashback (Netflix, Spotify), and loyalty points. Fee Structure: No annual fee, monthly fee, or account dormancy fee; Cryptocurrency exchange fee: Approximately 0.9% per transaction; Foreign currency transaction fee (non-Euro settlement): Approximately 0.5%; ATM withdrawals: First €100 per month free, 2% charged on subsequent withdrawals; Virtual card: Free | Physical card: Approximately €5 (free for VIP users); Cashback rewards are issued in Bybit points (redeemable for cryptocurrency or privileges). Other Information: Service Area: Covers most of Europe, Australia, Latin America, some Asia-Pacific countries, and the Astana International Financial Centre (not available in the United States); Open to non-US users who have completed full KYC (identity verification + address verification); Funds are held in Bybit custodial exchange accounts; Earnings, rewards, and spending functions are achieved through a unified crypto asset panel; Backed by Bybit exchange custody, proof of reserves, and multi-regional regulatory compliance; Best suited for active traders, advanced DeFi users, and those seeking high cashback without sacrificing liquidity. 12. Crypto.com Card Crypto.com offers a prepaid Visa card with integrated digital banking functionality (including a rewards cash account). The card supports cryptocurrency (via fiat currency exchange channels) or fiat currency transactions at Visa locations worldwide and offers tiered rewards in $CRO tokens based on tier. The bank provides an insured USD account (insured by Green Point Bank in the US), supports IBAN/ACH transfers, and offers up to 5% annualized return on the balance. Together, they form a crypto-friendly card-based banking service system covering users in multiple countries. Core Functions: Covering users in over 40 countries, supporting global Visa network transactions; Tiered cashback on spending (Black Gold level can earn up to 8% $CRO rewards); Prepaid Visa cards (all levels have metal card faces), supporting spending and ATM withdrawals; A one-stop application integrating trading, wallet, NFT marketplace, and lending functions; Providing returns on locked assets through "crypto interest generation"; Premium privileges such as Spotify/Netflix reimbursement, airport lounge access, and exclusive events; Custodial ecosystem supporting fiat currency deposits and payroll services. **Fee Structure:** No annual fee, monthly fee, or foreign exchange fee; Monthly free ATM withdrawal limit varies by tier (US$200-1000), with a 2% fee charged on amounts exceeding this limit; In-app transaction fees as low as 0.075%; No top-up fees or core transaction fees; Higher tiers require CRO collateral (e.g., Black Gold tier requires a $400,000 collateral); **Other Information:** Service covers over 100 countries (49 US states, excluding New York); USD funds are held in escrow by a partner bank and insured by the FDIC (up to $5 million, US users only); Default escrow wallet; A separate DeFi wallet is also available for non-escrow use; Reward levels require holding CRO tokens; Higher levels require staking/locking CRO; CRO rewards are credited to your crypto wallet in real time and can be traded/realized at any time; Full KYC compliance; Regulated by the US, EU, Singapore, and UK. How to choose the right crypto card? Ultimately, we present the advantages of each crypto card through an objective decision matrix. The evaluation criteria focus on the core concerns of real users: actual received returns, a stable reward mechanism, escrow model, fee structure, and the current availability of the product. Each model reflects a different prediction of the future direction of DeFi—whether focusing on returns, reward mechanisms, compliance, or privacy protection; but a common development trajectory is clearly visible: crypto-native currencies are rapidly merging with the usability standards of modern financial technology. The winning products will be those that can strike a balance between regulatory clarity, user control, and global accessibility, without sacrificing security and transparency. As the digital banking ecosystem matures, these will become the operational layer of the digital economy. Its success doesn't depend on brand marketing or token incentives, but on its ability to consistently provide reliable and flexible services and create real value for users worldwide. Have you entered the new era of digital banking?

Anais

Anais