Compiled by: Deng Tong, Golden Finance; Source: Blast, Golden Finance

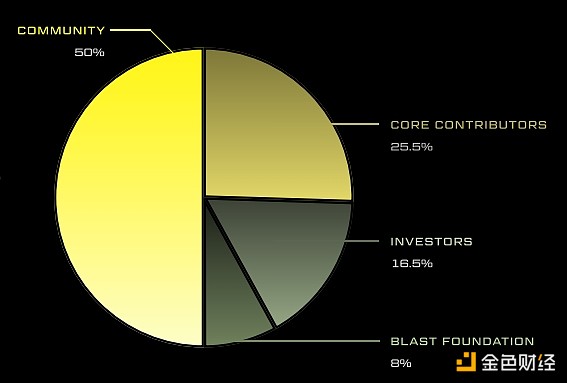

On June 26, 2024, Blast announced its token economics. The total supply of BLAST is 100 billion, 50% of which will be airdropped to the community, with an initial airdrop of 17 billion. Golden Finance has compiled detailed information on Blast's token economics for readers.

I. Introduction to Blast

Blast is a Layer 2 blockchain where users can earn income by bridging assets. It offers incentives such as points, coins, airdrops, and income to attract users and developers to participate. There are many mining opportunities in the Blast ecosystem, such as Ambient, Juice, Synfutures, nftperp, and Munchables.

Blast was developed by Pacman and supported by Paradigm, with the goal of creating native income for L2. When we deposit tokens into L2, we are actually hosting the corresponding tokens in the smart contract corresponding to L2 on L1. These are idle tokens and are not used to earn yield. Blast proposes to convert ETH and stored stablecoins into stETH and DAI respectively, earning yield from staking rewards and vaults.

II. Blast Token Economic Model

1. Community – 50,000,000,000 (50%)

Blast’s success is attributed to the community of users and builders who contribute to the ecosystem. 50% of the total BLAST supply is reserved for the community and will be distributed through incentive activities. 100% of this distribution will go directly to the community. The community allocation is unlocked linearly over 3 years from the date of the TGE, and any allocation will be made according to the schedule determined by the Blast Foundation.

2. Core Contributors – 25,480,226,842 (25.5%)

All tokens allocated to Core Contributors have a 4-year lockup period, with 25% of Core Contributor tokens unlocking 1 year after the TGE date, followed by a linear monthly unlock over the next 3 years.

3. Investors – 16,519,773,158 (16.5%)

All tokens allocated to Investors have a 4-year lockup period, with 25% of Investor tokens unlocking 1 year after the TGE date, followed by a linear monthly unlock over the next 3 years.

4. Blast Foundation – 8,000,000,000 (8%)

The Foundation allocation will be reserved for critical infrastructure and further development of the Blast ecosystem. The Foundation allocation unlocks linearly over 4 years from the date of the TGE.

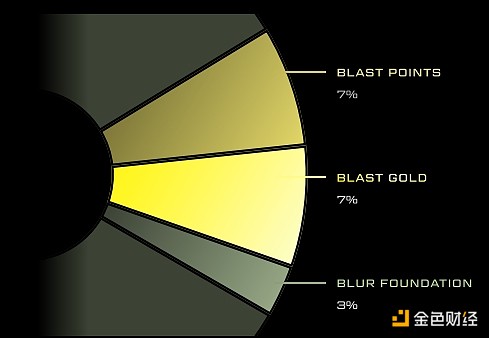

III. Blast Phase 1 Airdrop 17,000,000,000 (17%) Plan Details

1. Blast Points – 7,000,000,000 (7%)

Users who connected ETH or USDB to Blast bootstrapped the initial liquidity of the Blast ecosystem and earned Blast Points in Phase 1. These users will be rewarded with 7% of the total BLAST supply.

2. Blast Gold – 7,000,000,000 (7%)

Users who contribute to the success of the Dapp will be awarded Blast Gold and will be rewarded with 7% of the total BLAST supply.

3. Vesting

The top 0.1% of users (~1000 wallets) will vest a portion of the airdrop linearly over 6 months. Vesting is subject to reaching monthly point thresholds based on Phase 1 activity.

4. Blur Foundation – 3,000,000,000 (3%)

The Blur Foundation will receive 3% of the total BLAST supply to distribute to the Blur community for retroactive and future airdrops.

IV. Current status and future prospects of Blast

According to data disclosed by Token Terminal, the monthly active users and stable currency USDB supply of L2 network Blast have increased by 2 times in the past 90 days, among which the user growth is mainly driven by Blur, Thruster, Spacebar, YOLO Games, etc. Blast ecological stable currency USDB is the fifth largest stable currency in the world in terms of trading volume, all of which comes from the on-chain DEX trading volume. According to the latest data from Coingecko, the market value of USDC is about 405 million US dollars, and the circulating supply is 406,046,631 pieces.

Blast pays great attention to crypto users and crypto builders. Bringing the two together forms an ecosystem that is growing explosively. The Blast ecosystem is a superpowered economy with groundbreaking DAPPs.

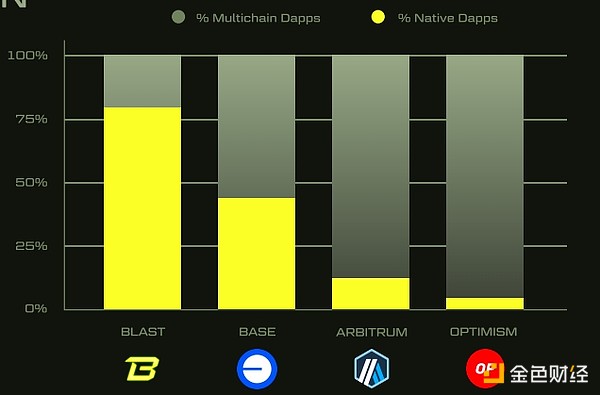

Blast is unique in providing builders with new building blocks: local yield and Gas revenue sharing. By integrating with Lido and MakerDAO on the backend, Blast offers 4% and 5% annualized yields for ETH and stablecoins, respectively, anywhere on the chain. As a result, Blast has a higher percentage of native dapps than any EVM chain, both L1 and L2.

Blast has mastered the intricacies of crypto and has a penchant for exploring new forms of it.

Blast is particularly well-suited for SocialFi projects, i.e. those looking to build at the intersection of social networking and DeFi, some of which have recently emerged on Blast.

Fantasy Top, a competition where users “pick” teams of their favorite crypto personalities to compete in a tournament based on rankings such as Twitter engagement, is set to launch soon after the airdrop announcement.

EarlyFans, a SocialFi platform that further tokenizes the relationship between content creators and their audiences through speculative upside, has just launched in Beta ahead of an upcoming airdrop.

DistrictOne caters to communities and influencers looking to expand and leverage their influence through money games featuring sharing, investing, and jackpots.

Blast has the opportunity to become an integral DeFi hub.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo Olive

Olive