Author: Pavel Paramonov; Translation: Deep Tide TechFlow

Cryptocards Have No Future: Why Are They Just a Stopgap Measures?

My overall view is that cryptocards are merely a temporary solution to two problems we all know well: bringing cryptocurrency into the public eye and ensuring its global acceptance as a payment method.

However, a cryptocard is still a card. If someone truly agrees with the core values of cryptocurrency but still believes in a future dominated by cards, then they may need to rethink their vision.

All Cryptocard Companies Will Eventually Die

In the long run, cryptocard companies are likely to die out, but traditional bank cards will not. Cryptocards actually add a layer of abstraction: they are not a true application of cryptocurrency. The issuer of the card is still the bank.

While these cards may have different logos, designs, or user experiences (UX), they are ultimately just an abstraction. Abstraction certainly makes the user experience more convenient, but the underlying processes remain unchanged. Currently, various Level 1 (L1) blockchains and Rollup solutions are keen to compare their transaction per second (TPS) and infrastructure with Visa and Mastercard. For years, their goal has been to "replace" or, more aggressively, "overthrow" the positions of Visa, Mastercard, American Express (AmEx), and other payment processing institutions. However, this goal cannot be achieved with crypto cards—crypto cards do not replace existing payment networks; instead, they add more value to Visa and Mastercard. Traditional payment networks like Visa and Mastercard remain key "gatekeepers," wielding the power to set rules and define compliance standards. More importantly, they retain the option to ban your card, shut down your company, and even shut down the banks you work with. Therefore, crypto cards are not the ultimate solution for the future payment revolution, but rather a transitional tool that will eventually be replaced by purer, more decentralized technologies. Why is the crypto industry, which has always pursued "permissionless" and "decentralized" principles, now willingly handing all that over to payment processors? Your card is Visa, not Ethereum; your card is from a traditional bank, not MetaMask; you're spending fiat currency, not cryptocurrency. In fact, most of the "crypto card" companies you like do almost nothing except print their logo on the card. They're just riding the hype and will likely disappear in a few years. And even digital cards issued now might not be usable by 2030. Making crypto cards is becoming increasingly easy. Making your own crypto card is incredibly easy these days—and even in the future, you could make one yourself! Same problems + more fees. The most fitting analogy I can think of is "App-Specific Sequencing" (ASS). Yes, the idea of applications autonomously processing transactions and profiting from them sounds cool, but it's only temporary: infrastructure costs are decreasing, communication technologies are maturing, and the economic issues lie at a higher level, not a lower one. The same applies to crypto cards: yes, you can deposit cryptocurrency and have the card convert it to fiat currency for payments, but the issues of centralization and authorized access remain. Undeniably, crypto cards are useful in the short term: retailers don't need to adopt new payment methods, and cryptocurrency spending becomes "invisible." However, this is merely a transitional phase towards the true goal of cryptocurrency believers: **Goal:** Direct payments using stablecoins, Solana, Ethereum, Zcash, etc. **No need for:** Indirect payment methods via USDT → crypto card → bank → fiat currency. Each additional layer of abstraction means an additional layer of fees: exchange rate spreads, withdrawal fees, transfer fees, and even a share of custody revenue. These fees may seem insignificant, but they accumulate over time—"every penny saved is a penny earned." Crypto cards may be a short-term solution, but in the long run, they are not the ultimate answer to decentralized payments. Using a crypto card doesn't mean you're "unbanked" or "bankless." There's a popular view that people who use crypto cards are "unbanked" or "bankless." But this isn't the case. Banks still exist behind crypto cards, and these banks are required to report some user information to their respective national governments. Of course, not all the data, but at least some. If you are an EU citizen or resident, the government will have access to information such as your bank account interest income, large suspicious transactions, certain investment income, and account balances. If the underlying bank is US-based, they have even more information. From a cryptocurrency perspective, this situation has both advantages and disadvantages. **The good side:** Transparency and verifiability have improved, but these rules still apply to standard debit or credit cards issued through your local bank. **The bad side:** It's neither anonymous nor pseudo-anonymous: the bank still sees your real name, not an EVM (Ethereum Virtual Machine) or SVM (Solana Virtual Machine) address. You still need to complete KYC (Know Your Customer) verification. **Restrictions still exist.** One might argue that the advantage of crypto cards lies in their convenience: download the app, complete KYC, wait 1-2 minutes for verification, top up with cryptocurrency, and you're good to go. Indeed, this convenience is a major highlight, but it's not available to everyone. Citizens of Russia, Ukraine, Syria, Iraq, Iran, Myanmar, Lebanon, Afghanistan, and half of Africa—countries where cryptocurrency cannot be used for everyday purchases without residency in another country—are unable to use it. But you might argue that this only applies to 10-20 countries where most crypto cards are unavailable; what about the other 150+ countries? The issue isn't whether the "majority" can use it, but rather the core values of cryptocurrency: a decentralized network, equal nodes, equal access to finance, and equal rights for all. Crypto cards don't align with these values because they aren't true cryptocurrency products. Max Karpis offers a brilliant analysis of this in his analysis of why "neobanks" are destined to fail. In fact, my only real experience using cryptocurrency for payment was booking a flight on Trip.com. They recently added a stablecoin payment option, allowing you to pay directly from your wallet, and this payment method is available to everyone globally. My sincere recommendation: Don't use Booking, use Trip.com for a true crypto payment experience. Here, you'll find a genuine cryptocurrency use case and payment experience. I believe the final form will be something like this: wallet user experience (UX) optimized for payments and spending, or (unlikely) they will evolve into crypto cards (if crypto payments become widespread in some way).

Cryptocards function similarly to cross-chain liquidity bridges

Another interesting observation is that self-custodial crypto cards function very similarly to cross-chain liquidity bridges.

This only applies to self-custodial cards: cards issued by centralized exchanges (CEXs) are not self-custodial cards, so exchanges like Coinbase have no obligation to mislead users into believing that their funds are entirely in their control.

A useful use case for CEX cards is providing proof of funds for government, visa applications, or similar activities. When you use a crypto card linked to your CEX balance, technically you are still in the same ecosystem.

But the situation is different with self-custodial crypto cards: they function more like liquidity bridges.

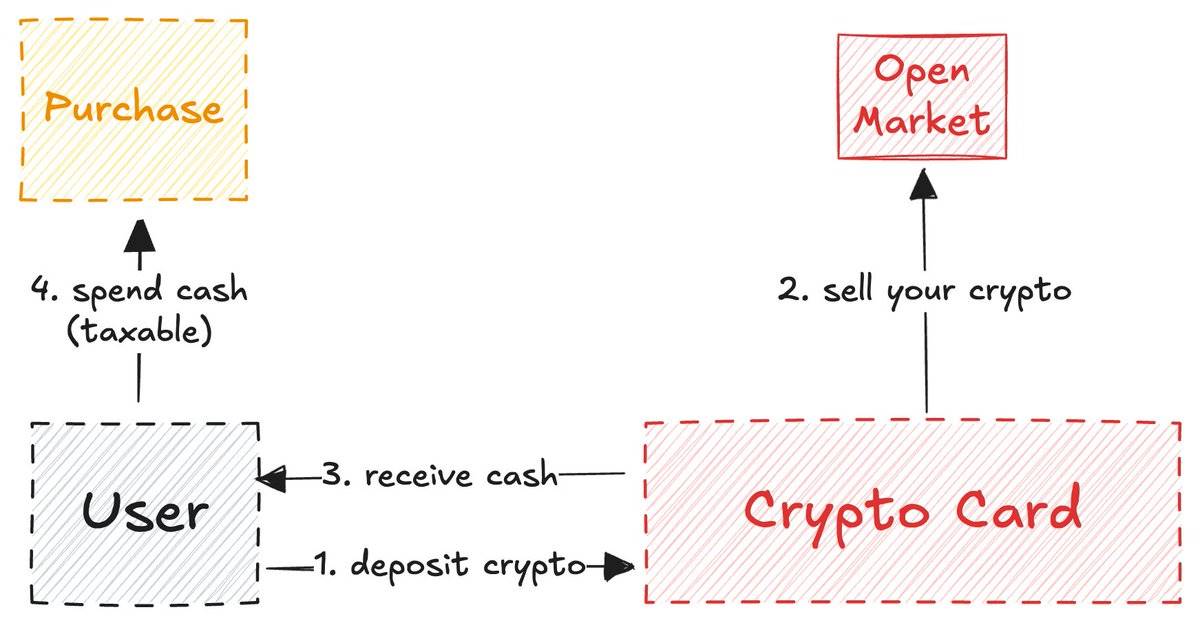

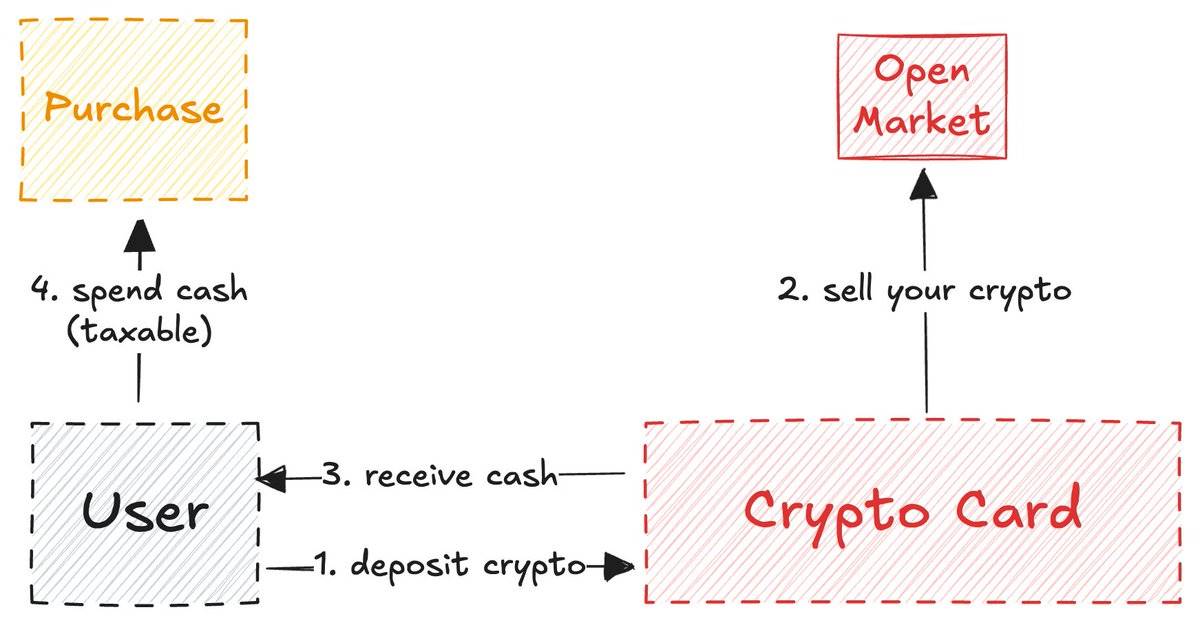

In this model, you lock your funds (cryptocurrency) on Chain A (crypto balance) and unlock them for fiat currency on Chain B (the real world). This bridging mechanism acts like a shovel during the California Gold Rush—a valuable link connecting crypto natives with businesses looking to issue their own cards. @stablewatchHQ has analyzed this bridging mechanism in depth, defining it essentially as a "Card-as-a-Service" (CaaS) model. This is a crucial point that many people overlook when discussing crypto cards. These CaaS platforms provide the infrastructure for issuing your own branded cards. Rain: The Core Protocol Behind Crypto Cards You might not know that half of your favorite crypto cards are likely powered by @raincards. Rain is one of the most fundamental protocols in neobank systems because it handles virtually all the technical support behind encrypted cards. All those encrypted card companies do is add their own branding to the cards (it might sound harsh, but that's the truth). To help you understand how Rain works and how simple it is to set up an encrypted card, I created this chart. (It's clearer when zoomed in.) Rain empowers businesses to issue their own encrypted cards, and frankly, Rain's operational model can even transcend the cryptocurrency space, becoming a broader infrastructure. Therefore, don't mistakenly believe that a team needs to raise tens of millions of dollars to launch a crypto card. They don't need that; they just need Rain. I've mentioned Rain repeatedly because people generally overestimate the effort required to issue crypto cards. Perhaps I'll write a separate article about Rain in the future, as this technology is truly severely underestimated. Crypto Cards: No Privacy, No Anonymity Crypto cards lack privacy and anonymity, not because of crypto cards themselves, but because those pushing for crypto cards ignore this issue under the guise of so-called "crypto values." Privacy is not a widely adopted feature of cryptocurrency. Pseudo-privacy (pseudo-anonymity) does exist because we see addresses, not names. However, if you have strong on-chain analytics skills like ZachXBT, Igor Igamberdiev of Wintermute, or Storm of Paradigm, you can significantly narrow down the possibilities between an address and its true identity. Of course, compared to traditional cryptocurrencies, the situation with crypto cards is even worse—it doesn't even offer pseudo-privacy. Because when you open a crypto card, you need to complete KYC (Know Your Customer) verification, and you're not actually opening a crypto card, but rather a bank account. If you're in the EU, your crypto card provider will still submit some data to the government for tax or other purposes of government interest. Now, you're essentially giving the government an extra opportunity to track you: directly linking your crypto address to your real identity. The Money of the Future: Personal Data? Cash still exists (currently the only anonymous payment method, except the seller can see you) and will continue to exist for a long time. But eventually, everything will become digital. And the current digital payment system offers no benefit to consumer privacy: the more you spend, the higher you pay, and in exchange, the more they know about you. What a "good deal"! Privacy has become a luxury, and this will likely continue in the crypto card ecosystem. An interesting idea is that if we can achieve truly good privacy protection, even to the point where businesses and institutions are willing to pay for it (not exploiting user data like Facebook, but based on our voluntary consent), then privacy could become a form of currency in the future, perhaps even the sole form of money in a jobless, AI-driven world. If the future of crypto cards is uncertain, why develop Tempo, Arc Plasma, and Stable? The answer is simple—to lock users into the ecosystem. Most non-custodial cards choose to use L2 networks (like MetaMask on @LineaBuild) or independent L1 networks (like Plasma Card on @Plasma). Ethereum and Bitcoin are generally unsuitable for this type of operation due to high fees and long transaction confirmation times. While some cards do use Solana, it remains a minority (this is not intended to spark another debate). Of course, companies choose different blockchains not only for infrastructure reasons but also for economic considerations. For example, MetaMask chose Linea not because it's the fastest or most secure, but because both Linea and MetaMask are part of the larger ConsenSys ecosystem. I specifically cite MetaMask here because it chose Linea. As most people know, almost no one actually uses Linea; it lags far behind other L2s like Base or Arbitrum. But ConsenSys made a smart decision to use Linea as the underlying support for its cards, as this locks users into the ecosystem. By providing a good user experience (UX), users gradually become accustomed to using it without needing to use it daily. Linea thus naturally attracts liquidity, trading volume, and other metrics, rather than through liquidity mining or begging users to bridge cross-chain. This strategy is similar to what Apple did when it launched the iPhone in 2007, keeping users on iOS and gradually making them unable to easily switch to other ecosystems. Never underestimate the power of habit. EtherFi: The Only Crypto Card That Truly Embraces the Crypto Spirit After some thought, I've concluded that @ether_fi may be the only truly viable crypto card that best embodies the core principles of cryptocurrency. (This research was not sponsored by EtherFi, but I wouldn't mind if it were.) In most crypto cards, the cryptocurrency you deposit is sold, and the balance is then topped up in cash (similar to the liquidity bridge model I mentioned earlier).

EtherFi is different: It never sells your cryptocurrency; instead, it uses your cryptocurrency as collateral to provide you with cash loans while earning yield on your crypto assets.

EtherFi's model is similar to Aave. Most DeFi users want seamless access to cash loans using crypto assets, and EtherFi has achieved this.

EtherFi's model is similar to Aave. Most DeFi users want seamless access to cash loans using crypto assets, and EtherFi has made this possible.

You might ask, “What’s the difference between this and a regular crypto card? I can just top up my cryptocurrency and use it like a regular debit card; this extra step seems unnecessary.” In short, the difference lies in taxation: Selling your cryptocurrency is a taxable activity, sometimes even more so than everyday purchases. With most crypto cards, every transaction is taxed, ultimately requiring you to pay more to the government. (Again, using a crypto card doesn’t mean “de-banking.”) EtherFi improves on this because you’re not actually selling your cryptocurrency; you’re using it to obtain a loan. For this reason alone (plus no USD foreign exchange fees, cashback, and other benefits), EtherFi becomes the best example of the intersection of DeFi and TradFi (traditional finance). Most crypto cards attempt to masquerade as "crypto-native," but are actually just liquidity bridges. EtherFi's goal is primarily to serve crypto users, not simply to promote cryptocurrency to the masses. Their strategy is to bring cryptocurrency to native users, let them spend it in front of the masses, until the masses realize how cool this approach is. Of all crypto cards, EtherFi may be the only product that can withstand the test of time. I prefer to see crypto cards as an experimental field, but unfortunately, most teams are just using narrative hype without giving the underlying systems and actual developers the recognition they deserve. We'll wait and see where technological progress and innovation will lead us. Currently, while the crypto card sector is indeed expanding globally (horizontal growth), it has seen little progress in vertical growth. Vertical growth is crucial for early-stage technologies like crypto cards that focus on consumer payments.

Kikyo

Kikyo