“If I knew where I would die, I would never go there.”—— Charlie Munger

The market has been a little crazy recently, with interest rate cuts, regulatory relaxation, Trump’s coin issuance, and BTC’s new high. Crypto has once again proven to be one of the best choices in this polarized era. Yes, as long as we don’t leave the table, we will all get rich in the end. —— But the problem is, it’s too easy to leave the table.

Half is fire, half is sea water. There are myths of getting rich every day in this industry, and there are also people who are doomed every day. Before the violent bull market begins, let’s take a look at the different stories of returning to zero of our predecessors. I hope everyone can protect their precious principal before the next big opportunity comes.

Wallet security

Private key lost: the paper backing up the private key was burned (Los Angeles fire), the hard drive containing the wallet was thrown away (A British man is still looking for his BTC in the garbage dump), the multi-signature threshold setting is invalid (A multi-signature address was lost/suddenly passed away, permanently locked)

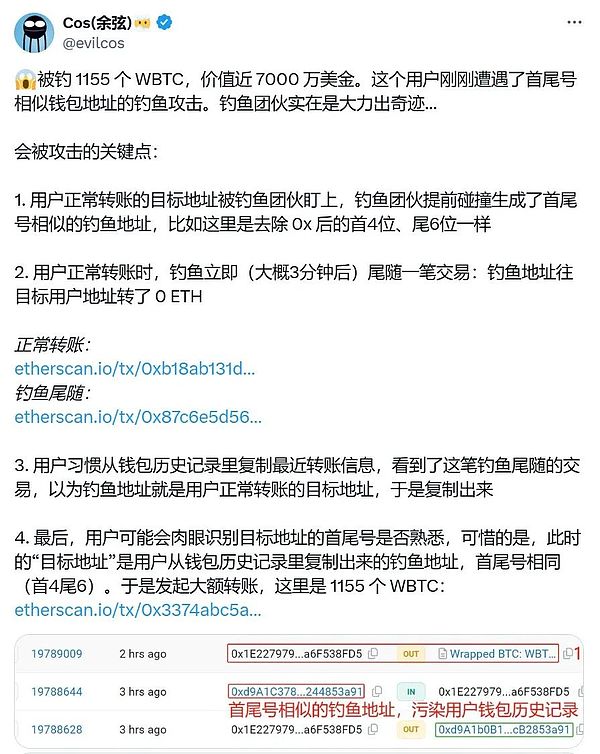

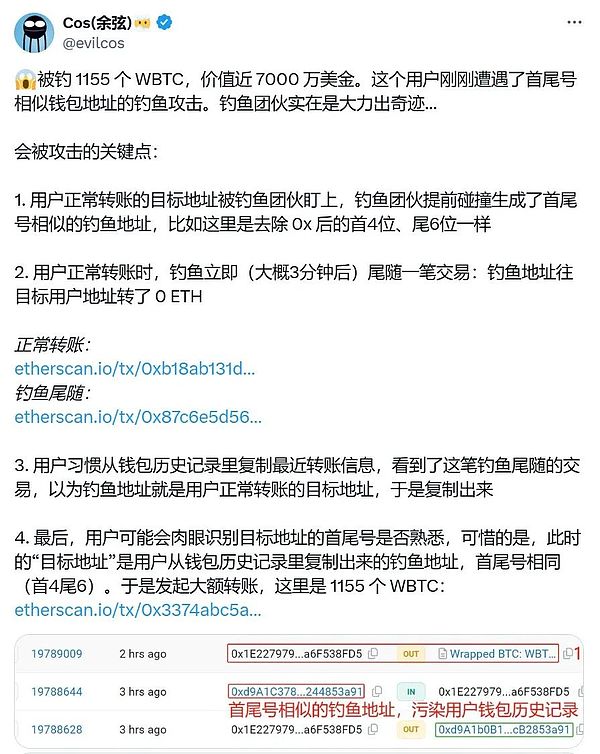

Wallet stolen: private key leaked (Put on the network disk and hacked, copied and pasted at will), connected to a phishing website, downloaded a fake wallet APP with a virus ( text="">Twitter, Telegram scams), being attacked by social engineering (Be careful of the people around you)

Operational errors

Deposit and withdrawal/transfer errors: Deposit and withdrawal of the wrong currency, deposit to the wrong chain, transfer to the wrong address, deposit to the test network, black hole address (God can't save you)

Personal safety

Information leakage : leading to being tracked or even threatened in real life (especially some big brothers who like to wear exchange T-shirts and pull exchange suitcases)

Overdraft: staying up late for a long time + poor work and rest schedule, leading to serious health problems or even sudden death (stroking hair, sitting and beating dogs)

Trading and investment

Falling into a scam: being scammed by empty projects, ground-based promotions, Pixiu projects, insider trading, and blindly trusting the project party (Your opponent is the project party that issued the currency, what can you use to play with them? )

Exchange

Exchange crash: Exchange runs away, unable to withdraw cash (FTX)

Withdrawal is trapped: Triggering the exchange's risk control, the account is locked (

WithdrawalFrozen card: Triggering anti-money laundering, bank card is frozen (they say it is to protect you)

U merchants run away: Encountering unreliable U merchants who absconded with the money (lost contact after transfer, there are also many offline OTC)

On-chain interaction

Contract loopholes: The interactive project contracts have loopholes and are hacked (cross-chain bridge), attacked by flash loans, manipulated by oracles (lending), and maliciously authorized to empty wallets

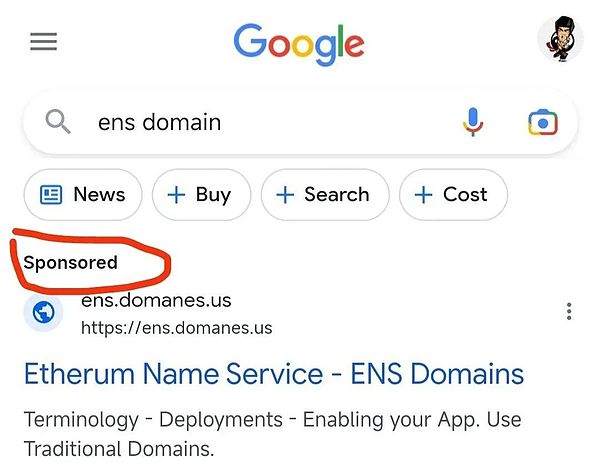

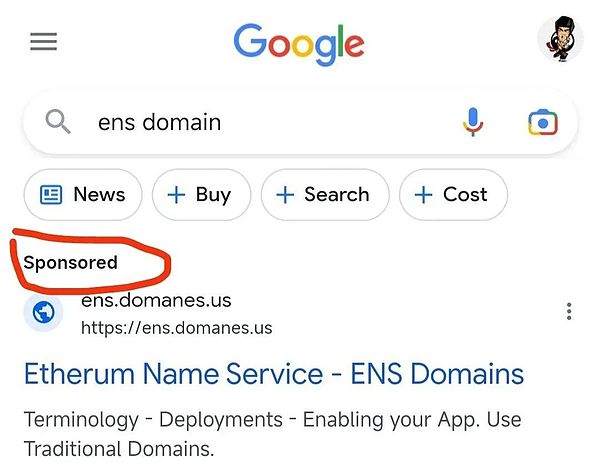

Clone website: Front-end fraud, paid search engine advertising, fake domain names, fake customer service (Discord, Telegram)

Rug: After getting the funds in pre-sale, they disappear, or they are dumped immediately after launch (the last words of the project party are never Rug)

MEV: Being preempted, clamped, arbitrage (manpower cannot compete with technology)

Launch your own project

Wrong direction: Investing a lot of manpower and material resources to solve false needs, financing failure and project abortion (Metaverse, GameFi, Polkadot Ecosystem)

Compliance nightmare: Being troubled by regulatory agencies and law enforcement agencies in different countries (Multichain, deep-sea fishing)

There are thousands of ways to die. Have you heard any other versions of the story? Welcome to share. Behind the abyss there is a wealth of gold. I hope you don’t step into any pits and don’t leave the poker table.

Weiliang

Weiliang