Author: Lisa

Background

In recent years, more and more politicians have been involved in the field of cryptocurrency, issuing digital currencies in the name of "national economic revival" or "innovation", trying to endorse tokens through the "celebrity effect" and promote the popularity of cryptocurrency. Although these tokens are under the banner of economic reform and technological innovation, they often hide huge risks and become a "wealth trap" for speculators and ordinary investors. From TRUMP launched by the Trump family to the recently controversial LIBRA, these politicized cryptocurrencies have undoubtedly become the focus of the market. But at the same time, they also bring security risks and potential financial crises that cannot be ignored.

As a company focusing on blockchain security, we will take LIBRA as an example to reveal the potential risks of these politicized cryptocurrency projects and provide users with clearer security warnings.

"Politicized" Cryptocurrency - LIBRA

On February 15, Argentine President Milei launched a Memecoin called LIBRA, claiming that the move would help promote the revival of Argentina's economy and announced the relevant contract address. After the news was released, many Memecoin enthusiasts rushed to participate in the project, and the price of LIBRA soared rapidly, with a market value of nearly $5 billion. However, only a few hours after the token was launched, the project conveniently withdrew liquidity, causing the market value to plummet rapidly to $590 million, causing huge losses to investors. After the incident, Milei deleted the relevant promotional tweets and claimed that he did not know the specific details of the LIBRA project and would launch an anti-corruption investigation. As the incident developed, not only did a lawyer file a lawsuit against Milei for suspected fraud, but it also triggered calls from the political opposition for an impeachment trial against him.

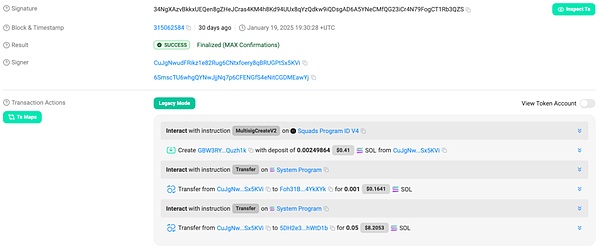

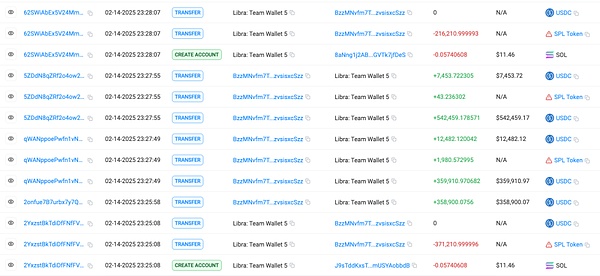

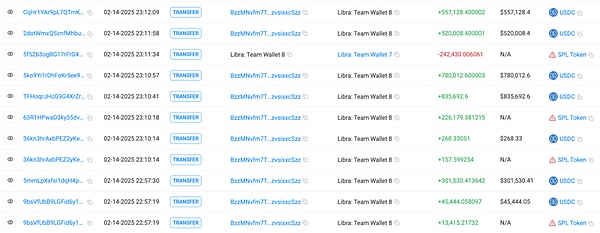

According to the analysis of the on-chain anti-money laundering and tracking tool MistTrack, the 8 wallets related to the LIBRA team have currently made a profit of more than 100 million US dollars. The specific situation is as follows:

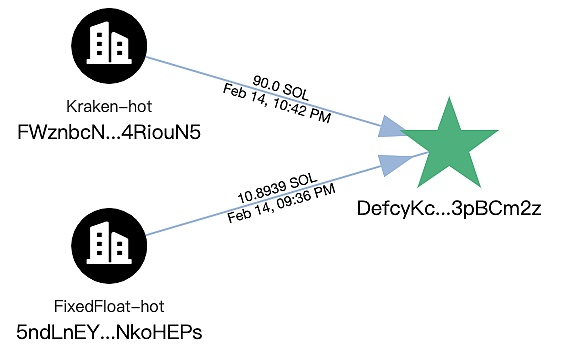

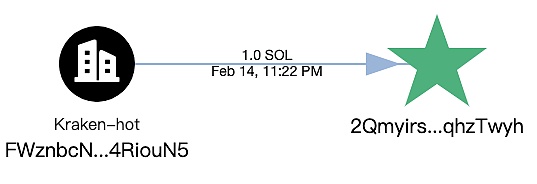

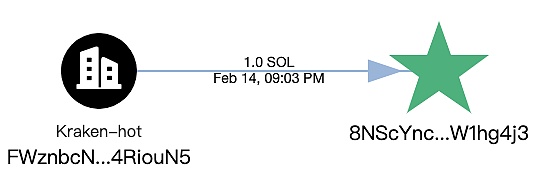

2025-02-14 21:36:54 (UTC), this address withdrew 10.89 SOL from FixedFloat as initial funds, and had withdrawn SOL from Kraken:

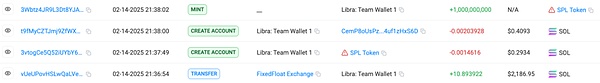

2025-02-14 21:37:49 ~ 2025-02-14 21:38:02(UTC), create a new SPL Token, that is LIBRA(Bo9jh3wsmcC2AjakLWzNmKJ3SgtZmXEcSaW7L2FAvUsU), then Mint 1 billion SPL Token:

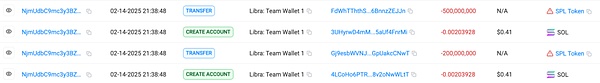

2025-02-14 At 21:38:48 (UTC), 200 million LIBRA was transferred to the address Gj9esbWVNJyy55SDJzYudMAznewqmW3Xb6GpUakcCNwT in the same transaction and has not been further transferred; 500 million LIBRA was transferred to the address FdWhTThthSN7mbcmBgh18dzogi1dXqQqBb6BnnzZEJJn and finally stopped at the address 42rex5yRsP1mdAKHzB5avDzagT6mqB5uYPergUFZ2Tgn.

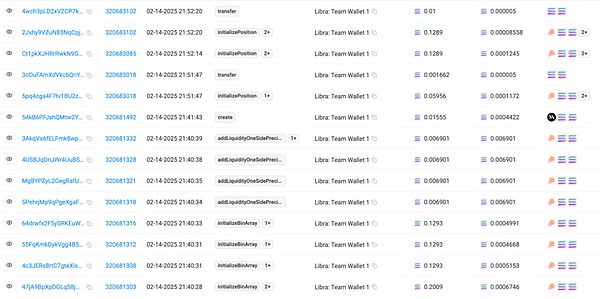

2025-02-14 21:40:24 ~ 2025-02-14 21:52:20(UTC), create DLMM Config and Token Metadata:

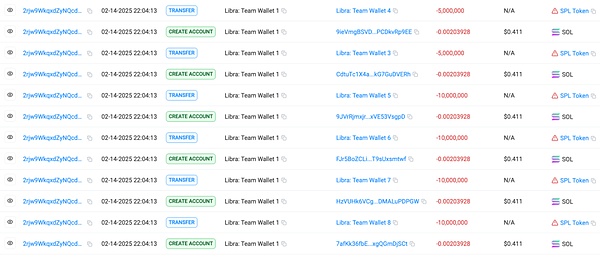

22:01, tweet. At 22:04, relevant accounts were created and LIBRA was transferred:

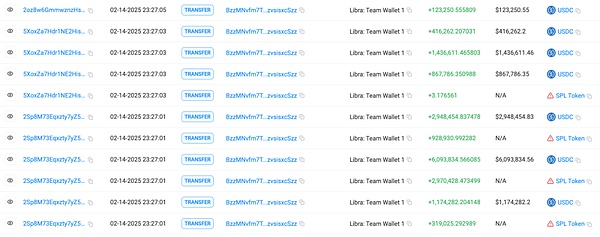

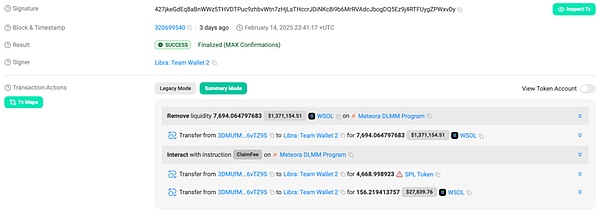

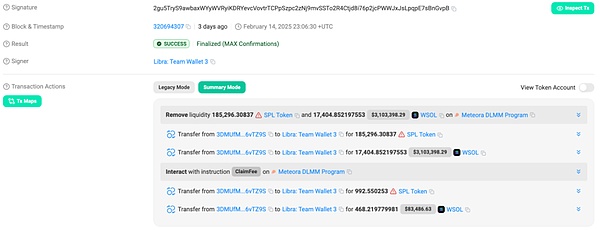

Profit address 1 made a profit of approximately 13.06 million USDC through claimFee, which has not yet been transferred out:

In addition, profit address 1 also transferred 650,000 LIBRA to address 3apupKwTisjy4Wx1zVndXVegmxtR9majPEgHatBRZ1LF at 22:30:34. The owner of this address is currently unknown.

Profit of about 32,052 SOL, not yet transferred out, worth about 6.4 million US dollars:

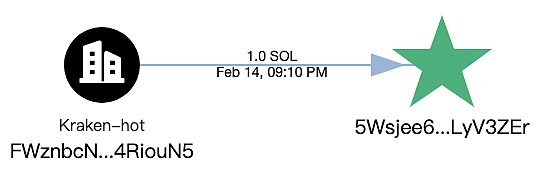

This address has withdrawn SOL from Kraken:

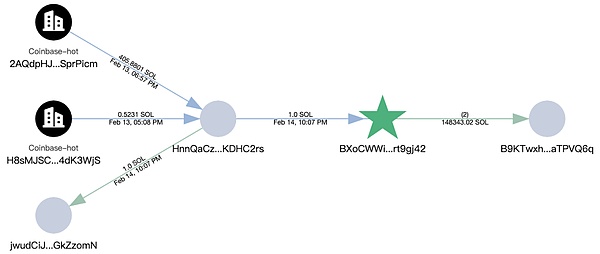

Profit of approximately 148,343 SOL, worth approximately 28.84 million US dollars:

This address transferred 148,343 SOL to the address B9KTwxhc9e6qrjw5nfmhgcN38oKFTBtnef8AwaTPVQ6q, and has not yet been transferred out.

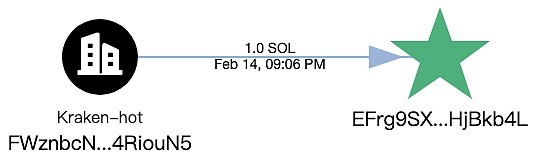

In addition, the initial funds of this address came from 1 SOL transferred from address HnnQaCzoFBSkT1xgksM6biyAZSyZgiorYsE6ZKDHC2rs. Address HnnQ also transferred 1 SOL to profit address 4, and the initial funds of address HnnQ came from Coinbase.

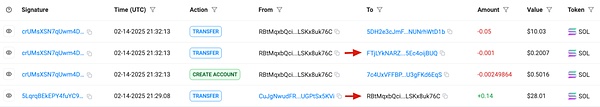

Profit of approximately 69,276 SOL, worth approximately 13.47 million US dollars:

This address transferred 69,276 SOL to the address FTjLYkNARZHnqekpKj5mHzbJx7EqW1fSr15Ec4oijBUQ, and has not yet been transferred out. The initial funding of address FTjL came from the transfer of 0.14 SOL from address CuJgNwudFRikz1e82Rug6CNtxfoery8qBRUGPtSx5KVi.

It is worth noting that the initial funding of address CuJgNwudFRikz1e82Rug6CNtxfoery8qBRUGPtSx5KVi came from Bybit, and this address funded the deployment of Memecoin MELANIA, launched by Trump's wife Melania.

Profit of about 1.85 million USDC:

This address once extracted SOL from Kraken:

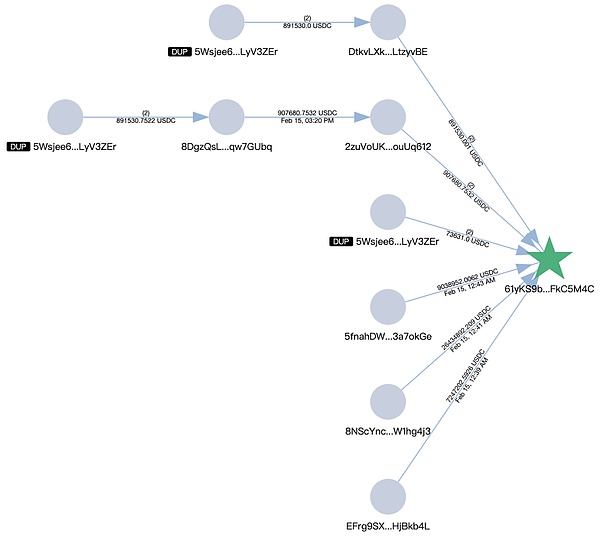

After multiple transfers, USDC finally stayed at address 61yKS9bjxWdqNgAHt439DfoNfwK3uKPAJGWAsFkC5M4C. In addition, we found that other sources of USDC in address 61yK were transfers from profit addresses 6, 7, and 8, and the current total balance is 44.59 million USDC.

Profit of about 7.25 million USDC, transferred to address 61yKS9bjxWdqNgAHt439DfoNfwK3uKPAJGWAsFkC5M4C, and the SOL of address 6 comes from Kraken:

Profit of about 26.43 million USDC, transferred to address 61yKS9bjxWdqNgAHt439DfoNfwK3uKPAJGWAsFkC5M4C, and the SOL of address 7 comes from Kraken:

Profit of about 9 million USDC, transferred to address 61yKS9bjxWdqNgAHt439DfoNfwK3uKPAJGWAsFkC5M4C, and the SOL in address 8 comes from Kraken:

As a newly launched project, LIBRA has not been audited by the market at all, and there is no public technical white paper or compliance guarantee, lacking value support. It is worth noting that some media pointed out that Milei’s social account has had controversial remarks in the past, and this behavior may be caused by hackers. Another user revealed that crypto KOL Threadguy had previously admitted in a live broadcast that he knew about the issuance of LIBRA tokens a few weeks in advance, which may be another insider trading, making the legality and security of this "coin issuance action" even more confusing. In addition, it was revealed that one of Milei's confidants received a $5 million bribe to push the token project to the president and facilitate the president's promotion of LIBRA. All of the above further exposes the possible manipulation and opacity behind politicians launching tokens, and also highlights the core problem of the lack of effective supervision behind the project.

The risks behind the celebrity effect

Milei is not the first politician to get involved in cryptocurrency. In January 2025, Trump also launched a Memecoin called TRUMP, which successfully triggered a market boom based on his personal brand effect alone. On the day of its launch, the market value of $TRUMP soared by 1250%, and the trading volume exceeded $5 billion.

Users' FOMO about $TRUMP has also triggered new scams. An account named @TrumpDailyPosts has more than 1.6 million followers. The account not only synchronizes Trump's posts on Truth Social to Twitter, but also publishes news and other tweets related to Trump. According to the analysis of the SlowMist security team, the account has posted at least 4 tweets about Memecoin, which were deleted a few minutes after being sent, and only the accounts mentioned in the tweets were allowed to comment.

This is not the first time that the Trump family's behavior has caused controversy. As mentioned above, the launch of MELANIA, launched by Trump's wife Melania, caused the price of TRUMP to be halved, and the market value of MELANIA evaporated by $7.5 billion in just 10 minutes, causing huge wealth losses to users. Although Trump and his family claim that these measures are "supporting cryptocurrency innovation", such tokens often lack value support, the core of hype relies on the celebrity effect, and the market lacks judgment on the true value of the project. Once the market heat subsides, the value of the token will collapse rapidly, causing ordinary investors to suffer heavy losses. The surface is bright, but the risks are actually numerous.

Politicized cryptocurrency is not equal to economic innovation, but is often just a tool to divert contradictions and attract attention.

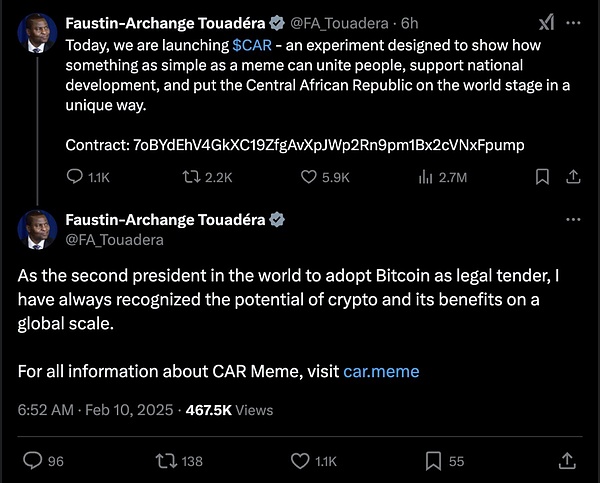

In February 2025, Faustin Archangel Touadera, President of the Central African Republic, launched Memecoin called CAR, claiming that this move will promote national development through crypto assets. However, the SlowMist security team found that CAR's official website was only registered for 4 days, and 80% of the tokens were concentrated in 6 associated addresses. The funds came from Binance, and there was a lack of security audits and technical support.

In the same month, the social media account of the former Malaysian Prime Minister @chedetofficial also posted a tweet announcing the launch of $MALAYSIA, and it was suspected that the account was hacked.

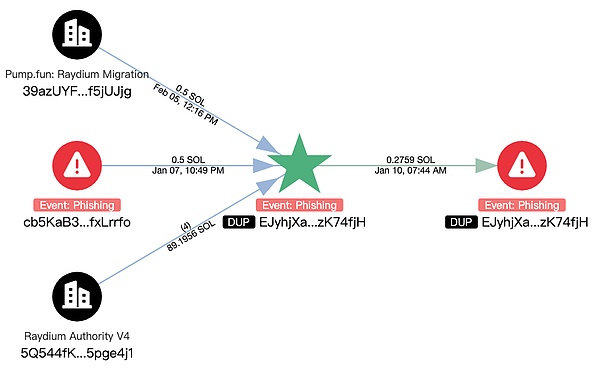

We used MistTrack to track and found that the creator of the CA (smart contract address) released by the account had been associated with a historical malicious group.

On February 17, a fake X account claiming to be an official of the Saudi Crown Prince has been posting tweets about Memecoin:

In addition to the above-mentioned "coin issuance" incident, some politicians have also tried to increase fiscal revenue through cryptocurrency mines, and Iran is one of them. The Iranian government once announced that it would allow domestic cryptocurrency mines to operate legally in order to bring more foreign exchange income to the country. However, this move not only failed to effectively alleviate Iran's economic pressure, but due to the lack of effective supervision and policy guarantees, it led to large-scale waste of resources and illegal electricity consumption, which ultimately further reduced the government's credit in the international community.

These tokens often raise prices through hype and capital manipulation in the early stages of their release, but when the market bubble bursts, investors often become the biggest victims. We have seen that investors have suffered heavy losses in a very short period of time. This vicious cycle not only damages the market image of cryptocurrencies, but also poses a great threat to the wealth of ordinary investors.

Beware of "politicized" cryptocurrency scams

Cryptocurrency innovation should be based on a transparent and fair regulatory framework, rather than becoming a tool for politicians to use their personal influence and capital to hype. Although the celebrity effect can attract a large number of investors in the short term, there is often a lack of value support behind this hype, and these projects are usually not audited and regulated, and lack reliable technical guarantees. In this case, investors blindly follow the trend, and once market sentiment reverses, token prices will quickly collapse, and ordinary investors will eventually become the biggest victims.

We remind users to be vigilant when facing these projects. Carefully evaluate its authenticity and security from multiple perspectives, avoid blindly following the trend, and try to choose a platform that has been strictly audited and compliant. To better protect their assets, users can use professional on-chain tracking tools such as MistTrack (https://misttrack.io/) to monitor and analyze funds. MistTrack can help users track transactions in real time and analyze the flow of funds, thereby reducing the risk of fraud or rug pull incidents and better protecting asset security.

Anais

Anais

Anais

Anais JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Beincrypto

Beincrypto Bitcoinist

Bitcoinist Beincrypto

Beincrypto Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph