Author: Jian Wu Talks Blockchain

Abstract

The JPEX incident is known as the biggest cryptocurrency collapse in Hong Kong history. Since the Securities and Futures Commission (SFC) issued a warning in September 2023 about unlicensed operations and the platform freezing withdrawals, it triggered a wave of investor reports and police arrests within days. Two years later, in November 2025, the police formally prosecuted 16 people and issued arrest warrants for 3 masterminds, bringing the total number of arrests to 80, with the amount involved exceeding HK$1.6 billion. The case revealed the systemic risks of unlicensed platforms and false advertising, and also propelled Hong Kong's virtual asset regulation into a new phase.

This article reviews the entire incident, outlining its background, process, and impact, aiming to provide a warning to investors. On September 17, 2023, the JPEX platform suddenly froze withdrawals. The Hong Kong Securities and Futures Commission (SFC) publicly warned it of operating without a license, triggering a wave of panic reports from investors. Just two days later, police arrested eight people in the first batch, including KOL Joseph Lam (with over 150,000 Instagram followers). Joseph Lam is suspected of using false statements to lure people into investing in JPEX between July and September 2023, including claims that the platform had obtained licenses in multiple jurisdictions and that he possessed exclusive information about the platform, thus enticing investors to deposit funds. On September 22, 2023, Joseph Lam held a press conference regarding the alleged JPEX cryptocurrency fraud case. Photo credit: HKFP. Two years later, on November 5, 2025, police formally charged 16 people, including Lin Zuo and YouTuber Chan Wing-yee (with over 100,000 followers), with charges of conspiracy to defraud, money laundering, and obstruction of justice. Six of them were core members of JPEX, seven were OTC executives and KOLs, and three were nominee account holders. Interpol issued red notices for three fugitives (27-year-old Mo Jun-ting, 30-year-old Zhang Jun-cheng, and 28-year-old Guo Hao-lun), who were alleged to be the masterminds and had fled overseas. To date, the case has resulted in the arrest of 80 people, with over 2,700 victims and losses exceeding HK$1.6 billion (approximately US$206 million). Police have frozen HK$228 million in assets, including cash, gold bars, luxury cars, and virtual assets. The incident exposed the chaotic promotion practices of unlicensed platforms and prompted regulatory authorities to strengthen controls on virtual assets. The Rise and Illusion of JPEX: High Returns, Fake Licenses, and Overwhelming Advertising JPEX was founded in 2020 and is headquartered in Dubai, claiming to be a "global digital asset cryptocurrency trading platform." In Hong Kong, it promoted itself through extensive advertising (such as in subway stations, on buses, and on shopping mall facades), with some advertisements labeling it a "Japanese cryptocurrency exchange." The platform claimed to hold financial licenses in the United States, Canada, Australia, and Dubai's VARA, but an SFC investigation revealed that these "licenses" were limited to foreign exchange and could not support virtual asset trading. The Japanese Financial Services Agency (FSA) and VARA also clarified that JPEX was not authorized to operate. JPEX's core appeal lay in its "Earn" product, promising high returns of 20% annualized for BTC, 21% for ETH, and 19% for USDT, attracting a large number of investors. The platform promoted itself through over-the-counter (OTC) trading and social media KOLs, building an image of "low risk, high return." Early SFC warnings indicated that JPEX had been suspected of making false statements since July 2023, but promotional activities continued until the eve of its collapse. Regulation and Crisis: Unlicensed Chaos Under Hong Kong's New System In June 2023, the Hong Kong government introduced a licensing system for Virtual Asset Trading Platforms (VATP), requiring all platforms to obtain approval from the Securities and Futures Commission (SFC) before providing services to retail investors. This system aimed to balance innovation and risk control, but JPEX did not apply for a license and continued to operate without one. In July 2023, mainland users began reporting difficulties withdrawing funds. Complaints from mainland users regarding "failed withdrawals" began circulating on the popular Hong Kong social media platform LIHKG, alleging that the platform lured victims to Hong Kong to "handle funds" and then sent people to ambush them. Police stated that a man surnamed Yu, holding a Chinese ID card, attempted to withdraw cash but failed. He was then invited to a Hong Kong OTC store to "resolve the matter face-to-face." Upon arrival in Hong Kong, he was ambushed and assaulted by unidentified individuals near Cambridge Plaza at the intersection of San Wan Road and Cheuk Wan Street in Sheung Shui on July 18th, sustaining abrasions to his forehead and nose. Police subsequently issued arrest warrants for four individuals, including a Chinese man who is the head of an investment company; and three other Chinese men aged between 30 and 40, approximately 1.7 meters tall, wearing black shirts and black trousers; other details are unknown. Such incidents spread rapidly, triggering rumors of a collapse. Promises of high returns and a liquidity crisis began to emerge. An internal investigation by SFC indicated that JPEX was suspected of making false statements, but promotional activities continued.

JPEX user Mr. Yu was beaten by several people (provided by the interviewee). Photo source: hk01.com

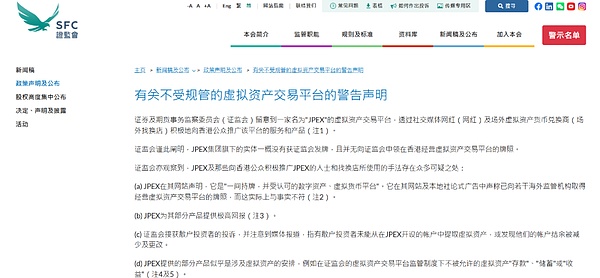

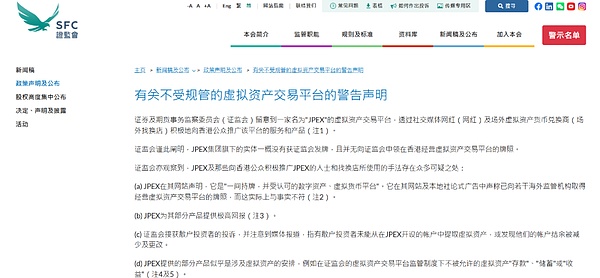

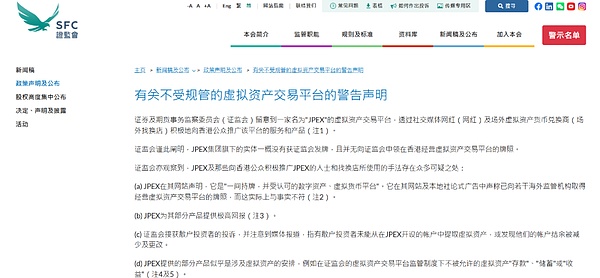

On September 13, 2023, the Hong Kong Securities and Futures Commission (SFC) issued a public warning statement regarding JPEX, titled "Warning Statement on Unregulated Virtual Asset Trading Platform". ... style="text-align:center">

JPEX user Mr. Yu was beaten by several people (provided by the interviewee). Photo source: hk01.com

On September 13, 2023, the Hong Kong Securities and Futures Commission (SFC) issued a public warning statement regarding JPEX, titled "Warning Statement on Unregulated Virtual Asset Trading Platform".

Image source: Hong Kong Securities and Futures Commission (SFC)

Hours after the statement was released, JPEX quickly responded on its official website and blog, stating that the SFC's actions "The unfair suppression by the SFC has prompted us to consider withdrawing our license application in Hong Kong and adjusting our future policy development accordingly. The SFC should also bear full responsibility for undermining the prospects for cryptocurrency development in Hong Kong."

In a blog post, JPEX claimed that it had publicly announced its intention to seek a cryptocurrency trading license in Hong Kong as early as February 2023, considering Hong Kong a key market. However, due to a statement from the SFC stating that it "conflicted with Web3 policies," it considered withdrawing its Hong Kong license application and adjusting its regional policies. This response further exacerbated investor panic, with complaints surging from hundreds before the announcement to over 1,600. Many users flocked to OTC stores for help, making the platform's liquidity crisis public and marking the shift from regulatory warning to the eve of collapse. On September 17, 2023, JPEX released an announcement on its official blog, declaring that its third-party market makers had "maliciously frozen" platform funds, exacerbating the liquidity crisis. The announcement accused Hong Kong regulators of "unfair treatment" and negative news of prompting market makers to demand more information, restrict liquidity, and significantly increase operating costs, thus leading to operational difficulties. JPEX emphasized that this was not a problem with the platform itself, but rather caused by external factors, and promised to restore liquidity and gradually adjust fees. The announcement also confirmed that the Earn service (a product where users deposit assets to earn high returns, such as 20% annualized return on BTC) would be completely delisted on September 18th, preventing users from placing new orders. This move marked a shift from a regulatory warning from the SFC to a public collapse, escalating user panic. More notably, JPEX drastically increased the USDT withdrawal fee from 10 USDT to 999 USDT (with a maximum withdrawal limit of 1000 USDT), effectively limiting users to only 1 USDT. This move was seen as a "de facto freeze" of assets, sparking strong user dissatisfaction and heated discussions on social media, with many calling it a "disguised escape." JPEX explained the adjustment as "in response to business changes," but did not provide a timeline for recovery.

JPEX user screenshot, USDT withdrawal fee soars to 999 USDT (maximum withdrawal limit 1000 USDT)

Complete collapse and police intervention: KOLs arrested, funds frozen

On September 18, 2023, five days after the SFC warning was issued, the Hong Kong Police Commercial Crime Bureau (CCB) launched a raid codenamed "Operation Iron Gate," arresting the first batch of 8 people.

Joy

Joy