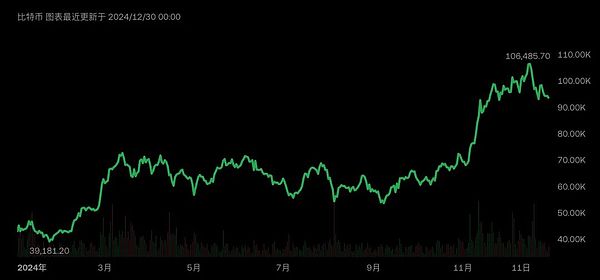

It's time for the year-end summary again. The market in 2024 is complicated. The approval of the Bitcoin spot ETF, the halving event is coming as expected, the price has soared, the computing power has reached a new high, the ecology has emerged, the political situation has changed, and there are continuous positive factors... Many factors have driven BTC to set off a global investment boom. The price of the currency has repeatedly set new highs, breaking through the 100,000 US dollar mark, and the Google trends index has more than doubled compared with last year, opening a highlight moment! For the entire crypto industry, 2024 is a milestone year. Each major event is engraved with the future trajectory of Bitcoin and even the entire cryptocurrency market.

This report takes time as the context and events as nodes. MetaEra will take stock of the key moments that affect the fate of Bitcoin one by one. Let us walk into the Bitcoin Chronicle of 2024 together and experience the glory and hardship of this year.

Crypto Opening Moment: Bitcoin Spot ETF Approved

On January 10, the U.S. financial stage ushered in a milestone change - the approval of BTC ETF. This allows institutional investors such as listed companies, pension funds, and various funds in the United States to openly enter this mysterious field through this financial tool, opening a new era of public purchase and holding of Bitcoin.

In April, the first batch of Hong Kong Bitcoin and Ethereum spot ETF products applied by the Hong Kong subsidiaries of China Asset Management, Bosera and Harvest Fund were officially approved by the Hong Kong Securities Regulatory Commission. Subsequently, on April 30, these highly anticipated products were officially listed on the Hong Kong Stock Exchange.

The market cheered the launch of ETFs, the depth of crypto market products increased, and institutions entered the market in large numbers. The past doubts turned to the pursuit of value storage. Traditional capital poured into the crypto world, and crypto investment became closer to the Web 2.0 market.

In the short term after the news was released, the overall performance of the Bitcoin market was stable, and there was no shock. Many people questioned the weakness of ETFs, and institutional conspiracy theories emerged frequently, and the argument of "all kinds of things, but no real work" came and went. All these unknowns, like a magnet, attracted the attention of countless investors and industry observers, and became the most suspenseful chapter in the future development of Bitcoin. In the undercurrent, Bitcoin adheres to the "time machine theory", waiting for new thrust, and using time to prove its value.

Image source: SoSoValue

Bitcoin halving: a key turning point in fate

On April 20, Bitcoin halved at block height 840,000, and the block reward will drop from 6.25 bitcoins to 3.125 bitcoins after the halving.

Usually, the price of BTC will rise after the halving. After all, the price has hit a new high after the previous three halvings without exception. Many investors also have the same expectations for the halving in April 2024, believing that this is undoubtedly a new driving force for the price of the currency after the ETF action.

However, combined with the price of Bitcoin in the months after the halving, after a short-term small retracement period, the price of Bitcoin did not immediately reach a new historical high. Instead, it took off and rose significantly after a series of actions such as halving, conferences, political elections, regulatory changes, and industry strategic reserves. From the perspective of the halving mechanism and past halving history, halving has a large impact, usually leading to market volatility and increasing speculative activities in the crypto field; reshaping the mining industry, and reducing miners' profit points; stimulating technological innovation and community development within the blockchain ecosystem. Halving events may also hedge inflation and enhance the attractiveness of Bitcoin as a long-term investment asset.

The above information shows that although halving helps to strengthen the scarcity narrative of Bitcoin, macroeconomic factors will also have a significant impact on Bitcoin prices. Bitcoin, this mysterious power, cannot be accurately predicted and inferred according to history. At each stage, it is refreshing the world's cognition, and we cannot stop it. As Binance CEO Richard Teng said: We need to look further ahead and look at the performance of the market from the perspective of market cycles. We should not be anxious about when the bull and bear markets will come, but should focus on the long-term trends and fundamentals of the cryptocurrency market. Bitcoin always goes to the moon unexpectedly in the moments of doubt, calmness and anxiety, and reaps a mythical increase. We just have to wait, Bitcoin is still great.

BTC Ecological Basic Service Provider: Miners, strong confidence vs. survival crisis?

From the perspective of miners, Bitcoin mining in 2024 is changing. Not only has the halving hash price dropped, but the development of inscriptions and runes in the first half of the year has quietly changed the main source of income for miners, like an ecological enlightenment. In the past, mining relied on a single traditional block reward, but as these emerging things have sprung up, the main focus of income has slowly shifted to infrastructure service gas fees. Taking the fourth Bitcoin halving as an example, transaction fees soared sharply, and Rune tokens paid high fees on halved blocks, becoming an important part of miners' income. According to statistics, since January 1, 2024, standard financial transactions accounted for 67% of the overall miners' fee income, Runes accounted for 19%, BRC-20 and Ordinals transactions accounted for 14% in total, and the proportion of Gas fee income has increased day by day.

Against this background, the role of miners is undergoing a profound transformation. They are no longer simple block producers, but more like infrastructure service providers for the Bitcoin ecosystem. With the advantages of network resources and infrastructure accumulated by mining, miners can provide services for various transactions and obtain Gas fees. This transformation has enabled miners to deeply integrate into all aspects of the Bitcoin ecosystem. While promoting the development of the ecosystem, they have closely linked their own destiny with the entire ecosystem and explored a more sustainable development path under the new economic model.

Bitcoin Conference: Origin of Market Movement

At the mid-term, on July 27, the Bitcoin 2024 Conference landed in Nashville. On this stage that attracted global attention, well-known politicians such as Trump and Robert Kennedy Jr. made their debut. Their remarks and proposed measures around Bitcoin were like heavy bombs, which set off a thousand waves at the conference site and even the entire cryptocurrency industry.

Trump delivered a speech for nearly an hour. Although it was an hour later than the scheduled time, tens of thousands of spectators were still enthusiastic. In his speech, Trump fully recognized the status of BTC as a scarce asset and a safe-haven asset, and agreed that BTC will surpass gold to become the world's largest asset class in the future. He also said that the United States must maintain its status as a cryptocurrency superpower. He also emphasized that if elected, he would fire SEC Chairman Gray Gensler, who has been hindering the development of cryptocurrency at the compliance level, on the first day of his inauguration, and made 13 major promises about cryptocurrency:

● On the first day, I will fire Gary Gensler and appoint a new SEC Chairman.

● If elected, establish a strategic national Bitcoin reserve for the US government.

● The US government will retain 100% of what it owns

● Than Bitcoin will fly to the moon.

● Never sell your Bitcoin.

● Bitcoin could one day surpass the market cap of gold.

● I reiterate my commitment to commute Ross Ulbricht’s sentence.

● There will never be a CBDC during my tenure as President of the United States.

● Bitcoin and cryptocurrencies will soar like never before.

● Bitcoin is not a threat to the dollar, it is the current U.S. government that threatens the dollar.

● The United States will become the global cryptocurrency capital and the Bitcoin superpower of the world.

● Bitcoin represents freedom, sovereignty, and independence from government coercion and control.

● I promise the Bitcoin community that the day I am sworn in, Joe Biden and Kamala Harris’ anti-crypto campaign will end.

Whether it was his personality or just to make you laugh, he obviously improvised at the end: “I wish you all a good time, whether it is Bitcoin, cryptocurrency, or anything else.” Taking advantage of the momentum of the conference, he pulled a lot of votes for his political blueprint.

It was like a star-studded political and financial feast. The market price performance during and after the Bitcoin conference sometimes jumped to new highs like a light jump; sometimes it pulled back briefly to accumulate strength. The conference was like a huge vortex of encrypted information, where various information about Bitcoin’s technological innovation, policy interpretation, and market trends converged and merged, and then spread like ripples to the entire cryptocurrency field. There are also many different opinions in the industry about the remarks and actions of politicians, and we look forward to the test of time.

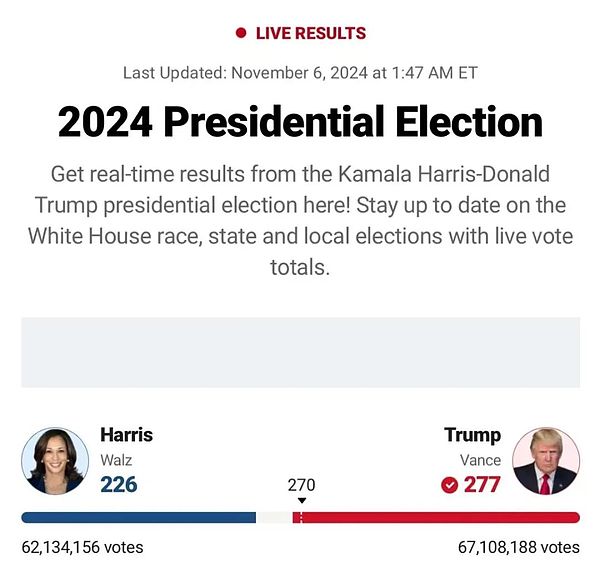

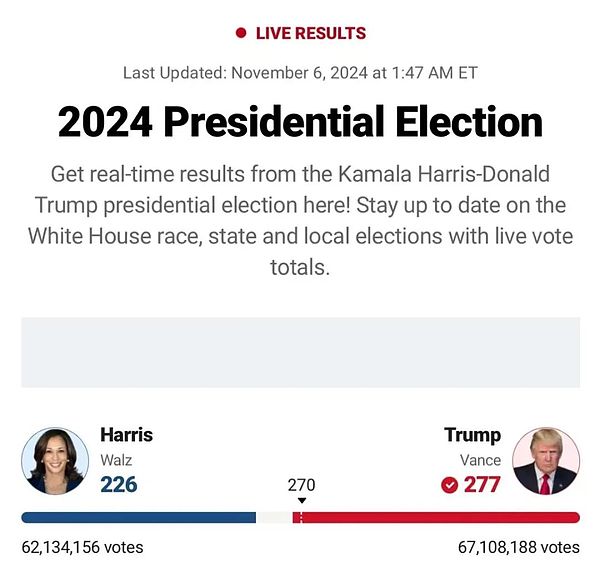

Bull market outlook: Positive impact of the US election

On November 6 at 14:27, the US presidential election was settled, and Trump became the final winner. The 78-year-old returned to the White House with the support of encryption forces.

Trump's victory and his subsequent series of measures to benefit the encryption industry have brought extremely significant positive effects on Bitcoin prices. After the election results were determined, the Bitcoin market was the first to move, and investors, based on strong expectations of future favorable policies, poured into the market.

After taking office, he announced that he would take a number of measures that would benefit the crypto industry, including the repeal of the SAB 121 Act after taking office on January 20 next year, clearing obstacles for traditional financial institutions to enter the market and promoting the institutionalization of crypto assets, so that a large amount of potential funds have a legal and compliant channel to flow into the Bitcoin market, which will expand the market capacity and capital depth of Bitcoin; following the promise made at the Bitcoin Conference, on the first day of taking office, he plans to abolish the former SEC Chairman and appoint crypto-friendly Paul Atkins as the next SEC Chairman, sending a strong signal of regulatory relaxation to the market and boosting investors' confidence; promoting the establishment of a strategic Bitcoin reserve to influence the market from the perspective of supply and demand, retaining Bitcoin ownership and expanding the scale of expectations, reducing the selling pressure of Bitcoin in the market, and increasing its attractiveness as a strategic asset; planning to stop government Bitcoin sales and use Bitcoin as an investment holding asset; its subsidiaries are also negotiating with the Intercontinental Exchange to discuss the proposed acquisition of the cryptocurrency exchange Bakkt, which has also injected new vitality and imagination into the Bitcoin trading ecosystem, attracting more investors to participate, and indirectly helping to increase prices.

Bitcoin is riding on this US policy wind and galloping on the upward track of price. Its future development space and potential are becoming more and more vast under the interweaving of this series of positive factors. Welcome to the new era of cryptocurrency promoted by Trump!

New political situation: core politicians have expressed their views, and government reserves have entered the game

Driven by the historic market rise, some countries are considering establishing national Bitcoin reserves. We are pleased to witness a significant trend: more and more politicians are beginning to recognize its value.

US President-elect Trump said that he would make the United States the world's cryptocurrency capital and proposed that the Bitcoin held by the US government would not be sold, but would be held as a strategic reserve asset for a long time.

Russian President Vladimir Putin signed the Digital Currency Taxation Law, which stipulates that digital currency is property and applicable to foreign trade payments. Mining and sales are exempt from value-added tax. Mining infrastructure operators must report to the tax authorities, and personal income tax is levied on physical income. Putin also emphasized at the forum that no one can ban Bitcoin and other electronic payment methods because they are new technologies and will continue to develop.

Japanese Prime Minister Shigeru Ishiba: Reorganize the Web3 and encryption policy departments. The ruling Liberal Democratic Party disbanded the existing Web3 project team and established a special department in the party's digital society promotion department, led by the former Secretary-General of the Web3 project team, but the responsibilities of the new department have not yet been clarified.

The South Korean State Council passed the "Virtual Asset User Protection Act" executive order, which came into effect on July 19, stipulating that virtual asset service providers must guarantee user deposits through banks and have the right to stop user cash and virtual asset deposits and withdrawals based on reasonable grounds.

El Salvador President Nayib Bukele proposed leasing the country's volcanoes to miners for sustainable Bitcoin mining, using geothermal energy to reduce mining costs. The country has previously successfully used geothermal energy to mine about $46 million worth of Bitcoin.

Argentine President Javier Milei advocates separating cryptocurrencies from state control, criticizes central bank digital currencies, advocates private management of cryptocurrencies, and warns against government overexpansion.

The Monetary Authority of Singapore announced its support for the asset tokenization commercialization plan, convened multinational financial institutions and others to conduct industry trials, and encouraged the formulation of industry standards to promote the commercialization and promotion of tokenized capital market products.

Surinamese presidential candidate Maya Parbhoe promised that if she wins the election in 2025, she will make Bitcoin a legal tender and gradually replace the Surinamese dollar. She plans to dissolve the central bank, cut taxes, privatize public services, and use Bitcoin's transparency to combat corruption, saying that Bitcoin is the key to rebuilding the country's financial infrastructure.

Polish presidential candidate Sławomir Mentzen promised to establish a strategic reserve of Bitcoin if elected.

The efforts and statements of these politicians indicate that Bitcoin will soon occupy a more important position in the future financial landscape. It is steadily stepping into the grand vision of the global economic system, like a shining new star, attracting the attention of the political world.

Changes in regulatory direction: institutions are coming one after another

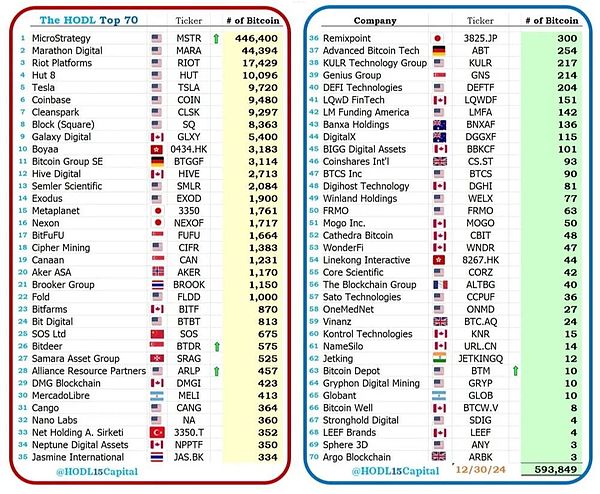

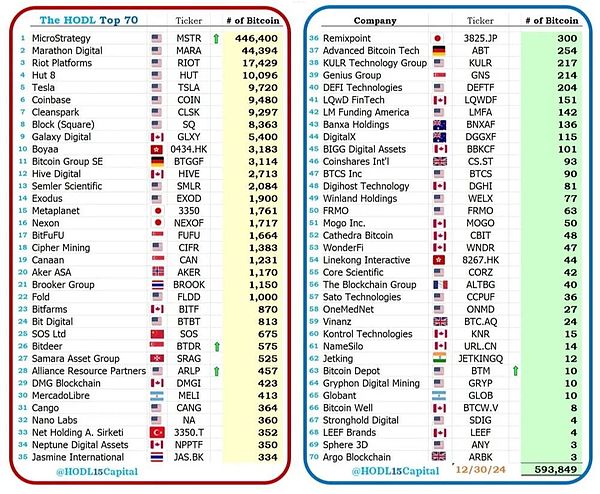

As the regulatory environment becomes more open and transparent in 2024, the crypto industry is entering a new era. Under such a wave, the "coin-stock dual cultivation" model has gradually become a new favorite of listed companies, and many companies have included Bitcoin in their strategic asset reserves. Among them, Tesla and MicroStrategy are the best, and they have won the "Diamond Hand Victory" with their firm holding strategy. The share price of MSTR has soared from about US$194 to nearly US$500 in just about a month, an increase of about 150%; the "twin stars" of the Hong Kong stock market, Boyaa and Meitu, two Bitcoin whales, are the two heroes, holding 2,641 and 940 BTC respectively; the first stock of the crypto exchange Coinbase BTC has a total profit of 804 million, and the stock price profit multiple is about 7.88 times.

Such results have attracted more listed companies to follow suit. On November 19, Nano Labs Ltd (Nasdaq: NA) announced its intention to allocate a portion of its remaining cash flow to Bitcoin and hold it as a long-term strategic reserve asset; on the same day, Genius Group Limited (GNS), a U.S.-listed company, announced that it had spent $10 million to buy 110 BTC at an average price of $90,932; LQR House Inc. (LQR), a niche e-commerce platform focusing on the spirits and beverage industry and a U.S.-listed company, announced that its board of directors had approved the purchase of $1 million worth of Bitcoin as part of its fund management strategy; on November 20, the board of directors of Acurx Pharmaceuticals (ACXP), a U.S.-listed biopharmaceutical company, approved the purchase of $1 million worth of Bitcoin as a reserve asset; on the same day, another U.S.-listed company, Hoth Therapeutics (HOTH), announced that the company's board of directors approved the purchase of up to $1 million in Bitcoin... It can be seen that many listed companies have fully recognized BTC's value storage function and stock price boosting effect, and have joined this "BTC strategic reserve competition" one after another.

Image source: HODL15Capital

BTC ecology: dormant in the cold winter, waiting for flowers to bloom

The Bitcoin ecology is like an accelerated version of the currency circle. From the birth of the Ordinals protocol at the end of 2022, to the small climax of NFT at the beginning of 2023, and then to the short bear market in 2023, everyone was active in various spaces to chat and imagine the future, and then BRC20 detonated the second small bull market climax. In the autumn of 2023, the market returned to silence, followed by the third climax in early 2024, and then it has been dormant and brewing until now. In just two years, the entire currency circle has gone through 342 years of bull and bear alternation.

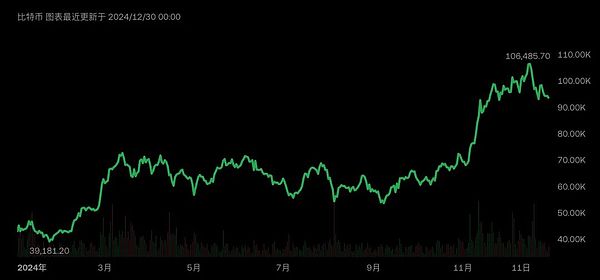

In the past year, Bitcoin's market dominance has increased significantly, from 45.27% to 56.81%. Its spot ETF holdings have increased significantly. The new market with Bitcoin as the core asset, ETFs and US stocks as channels for capital inflows, and US-listed companies as carriers has been fully opened, highlighting the need to develop its ecology and improve capital efficiency. In terms of Layer 2, 77 projects have taken action in the past three years. In the first half of 2024, the ETF boom has driven the transaction volume and token prices of some old projects to rise, and a variety of solutions have emerged, with a total locked value of US$3 billion, which is expected to grow significantly in the future. New execution standards have emerged in the Layer 1 execution layer, and activities have grown steadily, but the momentum has not continued. Among other infrastructures, bridging and WBTC are the mainstream in terms of interoperability, and more solutions are expected to be launched; in terms of security layer, interoperability may threaten asset security, and related security solutions such as Babylon's Bitcoin timestamp and pledge protocol have emerged, and new technologies such as the data availability layer (DA layer), such as Nubit, have released the potential value of Bitcoin. The Bitcoin ecosystem is still in a relatively disharmonious position. However, compared with the situation last year, there has been significant progress. The Bitcoin ecosystem will definitely not miss the violent bull market, and there are too many narratives waiting to be explored in the Bitcoin ecosystem. The previous dormancy and precipitation have accumulated enough strength. A large number of innovative projects are on the way. Witness history: Bitcoin broke 100,000 for the first time, where is the next stop?

Around 10:30 on December 5, the price of BTC once surged to more than $100,000, with a 24-hour increase of nearly 5%, which also means that Bitcoin has lived up to expectations and exceeded the $100,000 mark for the first time. At the same time, Ethereum broke through 3,800 USDT, with a 24-hour increase of 5.35%; SOL broke through 230 USDT, and the 24-hour decline narrowed to 2%.

Image source: OKX

The media effect caused by the price of Bitcoin breaking through $100,000 has successfully brought Crypto and decentralization into the mainstream public's field of vision. The public can't help but look back at its past. From its insignificance at the beginning of its birth to its proud standing today, its price climbing path is like a magnificent legend. If we count from that iconic pizza day, it has gone through the baptism of sixteen years.

It gradually moved from the edge to the center. When Bitcoin first broke through $1, perhaps many people did not expect it to have such amazing potential in the future; and when it crossed important thresholds such as $100 and $1,000, the whole world was surprised. Now that it has broken through $100,000, it has pushed Bitcoin to a whole new height.

Finally, I wish Bitcoin can continue to write miracles, and I wish us who believe in Bitcoin can create miracles.

Jasper

Jasper