Introduction: A Historical Turning Point for the Stablecoin Ecosystem

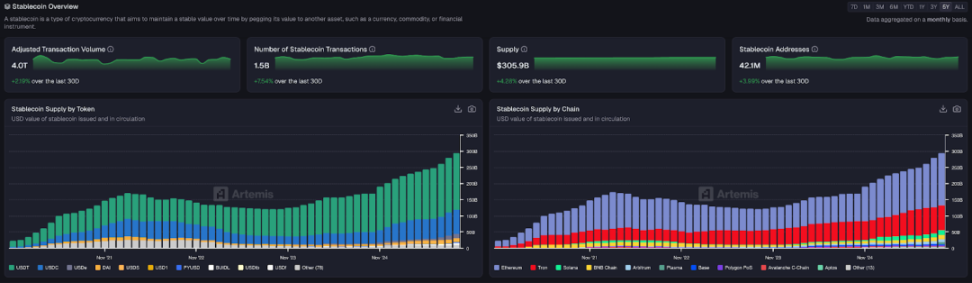

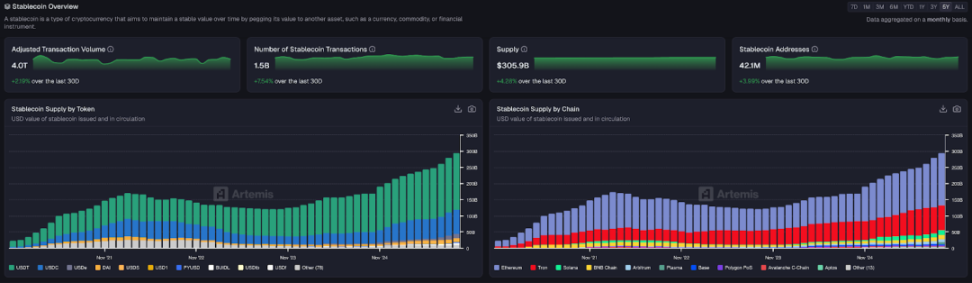

From 2024 to 2025, the global stablecoin market is experiencing unprecedented explosive growth. As of October, the total market capitalization of stablecoins has exceeded US$300 billion, representing an annual growth rate of 82.9% compared to US$166.3 billion at the end of 2024. This growth not only breaks historical records but also marks a fundamental shift for stablecoins from fringe speculative tools to mainstream financial infrastructure.

Current Market Stablecoin Total Supply and Transaction Volume Data https://app.artemisanalytics.com/stablecoins

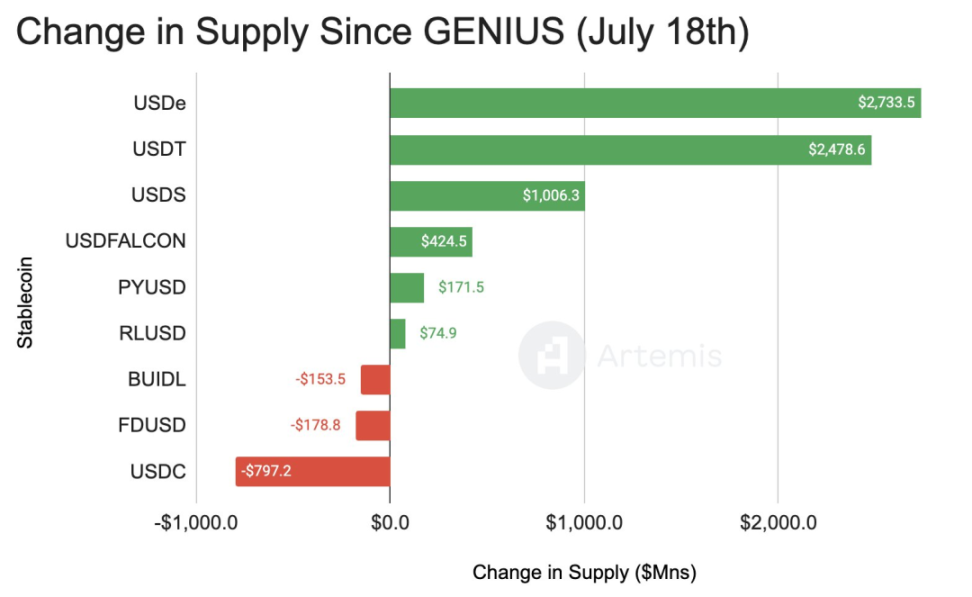

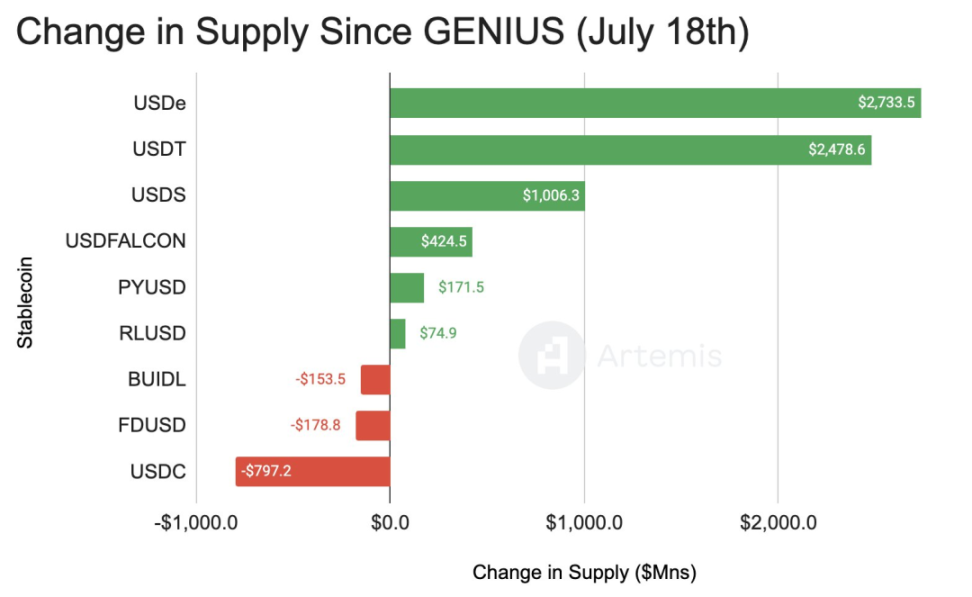

The historic breakthrough in the regulatory environment has provided a strong impetus for this growth: In July 2025, the US GENIUS Act was officially signed into law, establishing the first federal-level stablecoin payment framework. At the same time, the EU MiCA Regulation came into full effect in December 2024, laying a solid foundation for the standardized development of the stablecoin industry.

Stablecoin Growth After the GENIUS Act https://x.com/artemis/status/1952074174001795316

While USDT and USDC still dominate, their market share has declined from 91.6% to 83.6%.

Dedicated Public Chains for Stablecoins: An Infrastructure Revolution

Traditional blockchains have exposed significant pain points when processing stablecoin transactions: Ethereum's high gas fees often reach tens of dollars, and transaction confirmation times range from seconds to minutes; while Tron has lower fees, it faces centralization risks and technical limitations.

The new generation of dedicated stablecoin public chains has achieved a qualitative breakthrough through technological innovation. These public chains generally support high throughput of 1000+ TPS, zero or extremely low transaction fees, and sub-second transaction confirmation. More importantly, they design stablecoins as native gas tokens, completely eliminating the impact of cryptocurrency price volatility on user experience.

Plasma: The Flagship Project of the Tether Ecosystem As a leading project in the field, Plasma has raised a total of $75.8 million, including a $20.5 million Series A funding round led by Bitfinex and Framework Ventures in February 2025, as well as participation from well-known investors such as Peter Thiel and Bybit. After the mainnet test launch on September 25, 2025, its TVL quickly reached $5.3 billion. Technically, Plasma uses a customized PlasmaBFT consensus mechanism, achieving sub-second final confirmation and a processing capacity of 2000+ TPS. Its core innovation lies in the Paymaster system, enabling truly zero-fee USDT transfers while supporting custom gas tokens and confidential payment functionality. This project has integrated Chainlink oracles and bridged pBTC with non-custodial Bitcoin, building a complete DeFi ecosystem. Stable: An Institutional-Grade USDT Optimization Solution. Stable positions itself as a "real-world payment track," focusing on institutional-grade USDT applications. In July 2025, the project secured $28 million in seed funding from Franklin Templeton, Hack VC, PayPal Ventures, and Bitfinex. The project uses StableBFT consensus, supporting 10k TPS and second-level finality while maintaining EVM compatibility. Stable's key technical feature is the use of USDT as the native gas token, enabling zero-fee P2P transfers through account abstraction. Enterprise features include bulk transfer aggregation, compliant private transfers, and cross-chain USDT0 support. The project has integrated PayPal's PYUSD stablecoin, focusing on developing fiat currency deposit and withdrawal channels and debit card issuance business. Arc: Circle's Dedicated Ecosystem. Developed by Circle, Arc is positioned as "the home of stablecoin finance," deeply integrated into the Circle ecosystem. The project uses USDC as its native gas token, ensuring a predictable fee structure denominated in USD. Technically, it employs the Malachite BFT consensus engine, supporting 3000 TPS and sub-second finality. Arc's unique feature is its built-in FX engine, supporting query-based stablecoin conversion, and optional privacy features for compliance protection. The project is also exploring reversible USDC trading to address fraud issues and is collaborating with the German Stock Exchange to promote adoption in the EU market. In terms of funding scale and technological progress, Plasma holds a leading advantage thanks to the support of the Tether ecosystem and its earliest mainnet launch. Stable builds its differentiated competitiveness through its institutional positioning and partnership with PayPal, while Arc relies on Circle's compliance advantages and its position within the USDC ecosystem. All three projects adopt the BFT consensus mechanism, which is more suitable for payment scenarios compared to the probabilistic finality of traditional PoS. Interest-bearing stablecoins: Innovative yield models. Interest-bearing stablecoins provide users with a yield experience that surpasses traditional bank savings by directly embedding yields into the stablecoin itself. Ethena USDe's market capitalization surged from $86 million in January 2024 to $11.04 billion in October 2025, an astonishing increase of 13,750%, making it the world's third-largest stablecoin. USDe's technological innovation lies in its delta-neutral strategy to maintain stability. By staking assets such as ETH and WBTC and simultaneously opening hedging futures positions on exchanges, it creates a directionless risk exposure. sUSDe offers holders an annualized return of 2.56%-3.72%, with returns derived from Ethereum staking rewards, perpetual contract funding rates, and fixed stablecoin income. Sky Ecosystem (formerly MakerDAO) has reshaped the decentralized stablecoin lending market through brand upgrades and product innovation. USDS, a reward-based stablecoin with a market capitalization of $8 billion, offers users an annualized return of 4.75% through the Sky Savings Rate mechanism. Returns are derived from protocol surpluses, including lending fees and liquidation income, distributed to savers through the SSR mechanism. The project also launched the Endgame program, a restructured SubDAO, providing different services through specialized sub-protocols such as Spark, Grove, and Keel. Stablecoin Payment Infrastructure: Global Financial Reshaping By 2025, stablecoin cross-border payment processing volume is projected to reach $46 trillion, equivalent to more than 50% of Visa's throughput. Traditional cross-border payment fees typically range from 2-7%, including transfer fees, exchange rate differences, and intermediary fees. Stablecoins, however, can reduce costs to 0.5-2%, saving 50-80% in high-frequency cross-border scenarios. More importantly, stablecoin settlement times are shortened from the traditional 3-5 business days to less than 3 minutes, significantly reducing pre-financing needs and cash flow disruptions. The Rise of BVNK As a stablecoin infrastructure provider, BVNK achieved strong business growth in 2025, processing over $20 billion in transactions annually, primarily serving enterprise clients such as Worldpay, Flywire, and dLocal. Citi Ventures made a strategic investment in BVNK in October 2025, supporting its expansion into global stablecoin payments. Simultaneously, Coinbase and Mastercard are in talks to acquire BVNK at a valuation of $1.5-2.5 billion, which would be the largest stablecoin acquisition in history, highlighting its central role in enterprise-grade stablecoin payments. Stripe's Innovative Strategy: Stripe has launched a stablecoin subscription payment feature, supporting automatic deductions of USDC on the Base and Polygon chains, targeting the needs of AI and SaaS companies. This feature halves settlement costs, and AI companies report that 20% of their payment volume has shifted to stablecoins. Stripe has also launched the Open Issuance platform to help businesses issue custom stablecoins and integrate AI agent payment tools. Stablecoin AI Integration Applications: The Future of Finance: With the rise of the AI agent economy, traditional API keys and subscription models can no longer meet the needs of autonomous machine-to-machine transactions, giving rise to payment protocols and infrastructure specifically optimized for AI agents. KITE AI: Building the Layer-1 of the Agent Internet KITE AI, a leading project in this field, is dedicated to building the first Layer-1 blockchain optimized specifically for the AI agent economy. KITE has completed an $18 million Series A funding round, led by PayPal Ventures and General Catalyst. The project's core innovation lies in three technological pillars: the Cryptographic Agent Identity Resolution (AIR), programmable permission management, and on-chain attribution smart proofs (PoAI). AIR, acting as an agent application store, solves the trust problem between AI agents, allowing developers to deploy custom agents and access the ecosystem marketplace through a low-code interface. Recently, KITE and Brevis announced a strategic partnership to enhance the transparency and autonomy of agent identity and payment modules using zero-knowledge proof technology. The initial modules of this collaboration are deployed on BNB Chain and will later be expanded to KITE L1 to achieve cross-chain proof relay. The x402 Protocol: Redefining the HTTP Payment Standard The x402 protocol is driven by tech giants like Coinbase, Google, and Cloudflare. When a client (such as an AI agent or application) accesses a protected resource, the server returns a 402 status code and payment details in JSON format, including the amount, currency, and receiving address. The client then constructs a signed payment transaction and resends the request with an X-PAYMENT header. After a third-party facilitator like Coinbase verifies the on-chain payment, the server grants access to the resource. The entire process achieves trustless execution, with payments settled on-chain to ensure auditability. The technological advantages of x402 lie in its native HTTP integration and extremely low transaction costs. USDC settlement based on Base can be completed in under 2 seconds, with gas fees below $0.0001 and protocol fees of zero. Investment Outlook and Risk Assessment The stablecoin sub-sector is moving from concept to reality, and from speculation to application. Among the four emerging sectors, dedicated stablecoin public chains demonstrate the clearest investment value. Plasma, supported by the Tether ecosystem and with a $5.3 billion TVL, has validated market demand and possesses a clear technological moat. With the explosive growth in enterprise-level payment demand, such infrastructure projects are expected to receive premium valuations. Enterprise-level payment solutions benefit from improved regulatory environments; BVNK's $1.5-2.5 billion acquisition valuation reflects the recognition of stablecoin infrastructure by traditional financial giants. While AI integration applications are in their early stages, the speed of technological innovation and application scenario validation is exceeding expectations, making them suitable for investors with higher risk tolerance. Interest-bearing stablecoins have the most complex risk-reward ratio; the risk of de-anchoring of synthetic models under extreme market conditions cannot be ignored. Regulatory risk remains the biggest variable. While the GENIUS Act and MiCA regulations provide a framework for industry development, specific implementation details and enforcement standards are still evolving. Stablecoin projects need to continuously monitor compliance costs and policy changes. Competitive risks intensify with the entry of traditional financial giants; the strategic deployments of companies like Stripe, Visa, and Mastercard will reshape the market landscape. Emerging projects need to maintain a leading edge in technological innovation and ecosystem development. Investing in the new stablecoin sector requires finding a balance between technological innovation, regulatory compliance, and market demand. With the launch of key projects in 2025 and the further clarification of the regulatory framework, this round of stablecoin infrastructure upgrades is expected to reshape the global payment landscape and bring substantial returns to early participants.

Anais

Anais