Source: Golden Finance, Binance, Thena official website, white paper Compiled by: Golden Finance

On November 26, 2024, Binance announced that the Binance HODLer airdrop has now launched the second phase of the project Thena (THE), a DEX built on BNB Chain and opBNB and a network that provides liquidity. Users can use BNB to subscribe to the regular and/or current products of the Earn Coin Platform from November 06, 2024 08:00 to November 14, 2024 07:59 (Eastern Time Zone 8), and they will receive airdrop allocations. THE HODLer Airdrop page is expected to be live within twelve hours, and the new tokens will be distributed to users' spot wallets 1 hour before trading begins.

About Binance HODLer Airdrop

Binance HODLer Airdrop takes a historical snapshot of users' BNB capital preservation and profit-making holdings and rewards BNB holders with token airdrops. By using BNB to purchase the HODLer platform's regular and/or current products, users will automatically be eligible for the HODLer Airdrop (as well as Launchpool and Megadrop rewards).

Unlike other ways to earn coins that require continuous operation, HODLer Airdrop rewards users in a retroactive manner, providing a simpler way to earn additional coins. Users can automatically receive token rewards by using BNB to purchase HODLer platform products.

1. THE HODLer Airdrop Details

Token Name: Thena (THE)

Total Current Token Supply: 206,863,770 THE

Maximum Token Supply: 326,120,291 THE

Total HODLer Airdrop Tokens: 21,750,000 THE (7% of the Maximum Token Supply)

BNB holding hard cap: average BNB holdings of a single user / total average BNB holdings*100% ≤ 4%, (if the holding ratio is greater than 4%, the BNB holding ratio will be calculated as 4%)

II. Introduction to Thena

THENA is a community-driven decentralized exchange that uses a self-optimizing ve3,3 model to provide liquidity needs for the BNB Chain project. Founded by a group of experienced DeFi developers, THENA is committed to breaking through the barriers of the current DeFi market and building a more inclusive, easy-to-use and efficient decentralized financial platform. The team's vision is to make THENA a "SuperApp" in the DeFi space, meeting the needs of various assets through modular liquidity solutions, including stablecoins, liquid staking tokens (LSTs), real-world asset tokenization (RWAs), Memecoins, and AI tokens. At the same time, THENA is committed to making on-chain transactions easier, so that everyone from novices to experienced users can enjoy a CEX-level user experience. Based on the trading center and liquidity layer built on BNB Chain and opBNB, THENA ecosystem covers a comprehensive range of products and services, including: THENA: A spot DEX where users can exchange, acquire digital assets, and generate passive income.

ALPHA: Perpetuals DEX offers trading in over 270 cryptocurrency pairs with up to 60x leverage.

ARENA: A social platform for trading competitions that provides a gamified experience for users and growth hacking tools for THENA's partners.

WARP: (Launchpad – Coming Soon)

III. Thena Token Economics

1. Tokens (THE, veTHE, theNFT)

$THE

$THE is the protocol’s BEP-20 utility token, issued with two main goals:

1. Promote Liquidity: By serving as a liquidity mining reward, $THE is used to incentivize deep liquidity, thereby achieving optimal trading conditions.

2. Support decentralized governance: $THE can be used to participate in the governance of the platform and promote its continued development. The long-term goal is to achieve true decentralization.

veTHE

veTHE is the ERC-721 governance token of $THE, which exists in the form of NFT (non-fungible token).

• Users can lock their $THE for up to two years to obtain veTHE. The longer the lock-up period, the more veTHE voting rights they obtain.

• To encourage users to continue locking and participate in the long term, the user's veTHE balance will decrease over time until it returns to zero at the end of the lock-up period.

• veTHE positions can be increased, split, and resold on the secondary market.

• veTHE holders can share platform revenue (including 90% of total transaction fees and 10% of voting incentives deposited by the protocol).

theNFT

theNFT is an ERC-721 founder token, which exists in the form of NFT and is a non-dilutable NFT collection.

• theNFT can be used for staking to participate in revenue sharing.

• The staking pool will receive 10% of the total transaction fees from THENA, as well as royalty income from theNFT's trading in the secondary market.

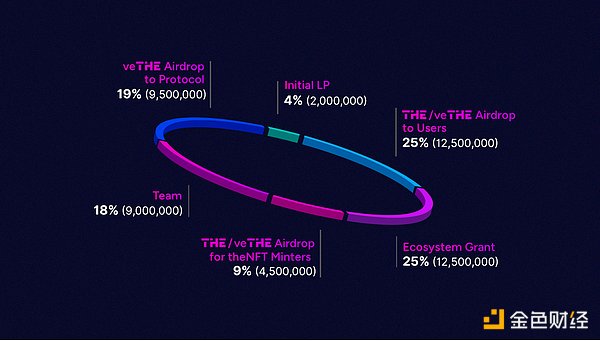

2. Initial Supply and Issuance Plan

Initial Supply

veTHE Protocol Airdrop

19% of the initial supply is allocated to protocols that demonstrate a willingness to cooperate with the THENA liquidity layer as airdrops. When evaluating available protocols, multiple factors were taken into account, such as TVL (total value locked), trading volume and product performance, while seeking to strike a balance between native BNB protocols and cross-chain protocols. The list of protocols receiving airdrops will be updated after finalization.

$THE / veTHE User Airdrop

• 25% of the initial supply is allocated to regular users of existing BNB chain protocols and new users joining through THENA.

• Users are selected based on the following behaviors that promote the long-term stability of the protocol:

• Locking, stacking, holding

• Participating in governance

• Continued support in times of challenges

$THE / veTHE airdropped to theNFT minters

• 9% of the initial supply is allocated to theNFT minters and can be claimed directly when THENA goes online.

• The distribution ratio of $THE and veTHE in theNFT minter airdrop:

• 40% is veTHE locked for 2 years

• 60% is $THE

Ecosystem Funding

• 25% of the initial supply is allocated to a dedicated fund to support various projects aimed at accelerating the development of THENA.

• The core team will provide comprehensive support to the selected projects, including smart contract development, marketing and business development.

Team Allocation

• 18% of initial supply is allocated to the team to ensure their long-term commitment to THENA’s success.

• The team allocation in veTHE and $THE is as follows:

• 60% is veTHE locked for 2 years

• 40% is $THE released linearly over 2 years (1 year lockup)

• The core team ensures alignment with THENA’s interests through the allocation of voting escrow tokens, allowing them to participate in the protocol growth with a long-term perspective.

Initial Liquidity Providers

• 4% of the initial supply is used to pair with $BUSD or $BNB to provide sufficient initial liquidity.

2. Token Issuance

ve(3,3) Dynamic Model

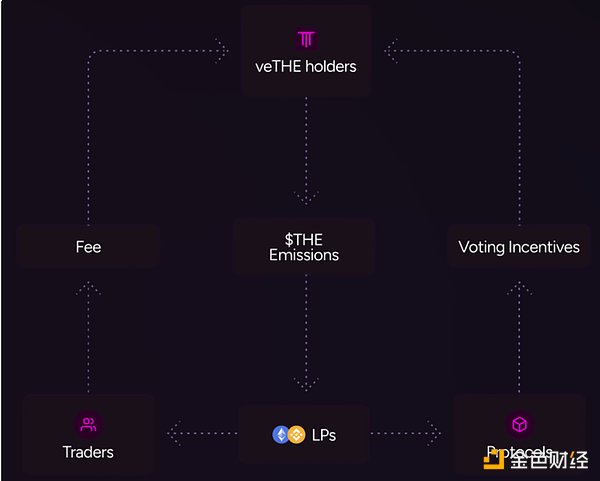

• THENA’s ve(3,3) dynamic model aligns the main stakeholders of a typical AMM on the BNB chain, including veTHE holders, liquidity providers (LPs), traders, and the protocol itself.

veTHE holders:Incentivize voting for the pool with the largest trading volume (the larger the trading volume, the more fees generated) or the pool where the protocol deposits voting incentives to start liquidity. The protocol can form a positive feedback loop in this way, especially when the token trading volume is large.

Liquidity Providers (LPs):Participate in liquidity provision through token issuance incentives based on the "real return" metric.

Traders:Benefit from low slippage, thanks to liquidity powered by advanced vAMM and sAMM technologies.

Protocols:Access a partnership-oriented liquidity layer, enjoy capital-efficient trading conditions, and can incentivize liquidity through "bribes" to veTHE holders.

Issuance Specs

• Weekly issuance (initial): 2,600,000 $THE

• Weekly issuance decay: 1%

• Developer wallet allocation: 2.5% (down from 4%)

• Weekly veTHE rebase: up to 30%

• Allocation to liquidity providers: 67.5% (additional 1.5% from developer allocation)

• Maximum supply with 1% weekly decay: 310,000,000 $THE (corrected data, originally 315M)

Total supply over time. Note: The number of circulating tokens will be significantly reduced.

4. ThenaRoadLine diagram

Bitcoinist

Bitcoinist

Bitcoinist

Bitcoinist Coinlive

Coinlive  Others

Others Tristan

Tristan Coinlive

Coinlive  Beincrypto

Beincrypto Coindesk

Coindesk Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph