Source: Liu Jiaolian

Jiaolian Note:This is the latest article by Giovanni Santostasi, one of the researchers of power law theory.

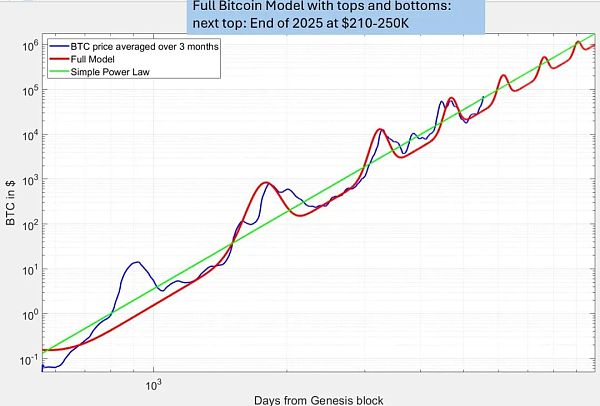

The following article is Giovanni Santostasi's micro-modeling of cyclical bubbles based on the power law growth model for the halving cycle of Bitcoin every 4 years.

We have demonstrated in previous articles that Bitcoin's long-term performance is a time power law.

Given that the power law has the property of scale invariance, this gives us great confidence in predicting the next order of magnitude or two of change, because Bitcoin already has nearly 9 orders of magnitude of scale invariance (if we include some of the earliest known dollar-to-bitcoin transactions, in which 1 dollar is exchanged for 10,000 bitcoins).

Another important property of Bitcoin that is predictable is cyclicality. A system with strong known cyclicality is also predictable.

Bitcoin exhibits precise cyclicality, the Bitcoin cycle, over a period of 4 years. These cyclicalities are related to halving of production.

The halving is usually followed by a bullish-than-usual period of about 1.5 years.

A large deviation from the general power-law trend is observed for about 1.5 years after the halving, corresponding to a local maximum or peak of the cycle. Then, the price drops rapidly for another year or so, reaching the lowest point or minimum level of the cycle. The price rises slowly again until the next halving, and the cycle repeats.

This particular sequence has occurred 3 times in Bitcoin’s 15-year history, with a very similar pattern.

There was a pre-halving bubble that was not associated with any halving. It occurred 4 years after Bitcoin’s creation, earlier than the first halving. This bubble behaved irregularly compared to the others (in terms of timing, bubble height, and other details), so we excluded it from the analysis.

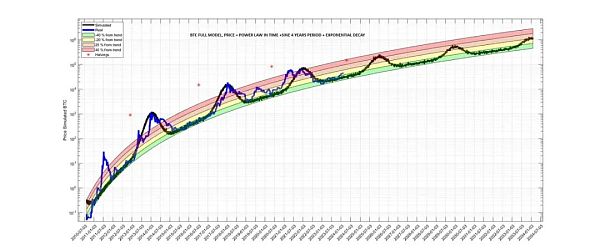

Chart: Bitcoin's power-law behavior deviates from the trend. The full model is also shown in the figure. Clear oscillations in the 4-year cycle can be seen.

By observing Bitcoin's price action, it is not difficult to find that the height of the peak seems to decrease over time. A natural way to estimate this height is to observe the change from the regular bottom of the trend.

We naturally ask whether there is a specific pattern to this decrease in the height of the peak.

This question has been discussed many times in the past, but one particular attempt that caught my attention recently was made by Peter Brandt on X.

Lecture chain note: Peter Brandt's point of view is that based on the decline in the increase from bottom to top in each cycle, the top of this cycle is 72k - that is, this round of bull market has passed the top. And he believes that the subsequent market may pull back to the mid-term low of 30k in 2021.

If you want to use clock time instead, 12 o'clock is the top, 3 o'clock is the bottom, 6 o'clock is the transition from bear market to bull market, and 9 o'clock is the transition to a full bull market.

We have just passed 6 o'clock and have not entered a full bull market. It is still far from the time when the top usually appears in the cycle.

Peter Brandt's conclusion comes from the following observations.

If we measure the change from bottom to top of each cycle (he includes the period before the halving, which we will exclude for the reasons stated above), then we get the following table:

If expressed as a percentage change from the bottom, it would appear that each cycle is 5 times lower in height. If we exclude the period before the halving, we only have 3 data points; if we consider the ratio, we actually only have 2 data points. This is not enough data to conduct any significant statistical analysis. However, if we want to make some educated estimates of the size of the next possible Bitcoin bubble, this is an acceptable approach given that we only have this data.

So if we take the above table at face value, we would conclude that this Bitcoin bubble will only be 4.5 times higher than the bottom of the historical cycle at $16,500, which means that the top should be around $70,000. Given that we have already reached this value, the conclusion would be that we have already reached the top, so it is only down from now on.

In addition to the problem of cycle time that has been observed, we have another problem. This analysis does not take into account the long-term power law trajectory of Bitcoin.

There are about 3 years between the bottom and the top. During these years, Bitcoin will fluctuate greatly along the power law trajectory, and then there will usually be a 1-year full bull run.

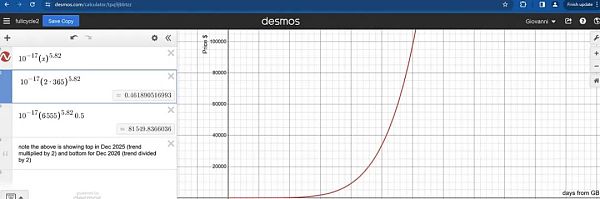

We can use the Desmos calculator application to understand this.

The formula that has been entered in the application will tell us the power law estimated price for a certain day after the Genesis Block (GB). The bottom of the first cycle should have occurred about 3 years after the genesis block, so the trend value would be about $0.46.

The actual value of Bitcoin is about $0.3.

3 years after the bottom we have the first real bubble, with a value of $1242. The ratio between tops and bottoms should be closer to 4000 times, not 572 times as reported. This breaks the claimed rule of a 5-fold decrease in peaks from bottom to top.

This is due to measuring bottoms and tops related to periodic events in the Bitcoin cycle, without considering the bubble before the halving as a real bubble.

This demonstrates the arbitrariness of this method of picking cycle bottoms and tops to estimate the size of the peak.

In addition, the trend value at the time of the peak was close to $100.

Given the general power-law trend, it seems more natural to measure the top by the degree of deviation from the general power-law trend. This can be done by calculating the percentage difference in price relative to the power-law trend.

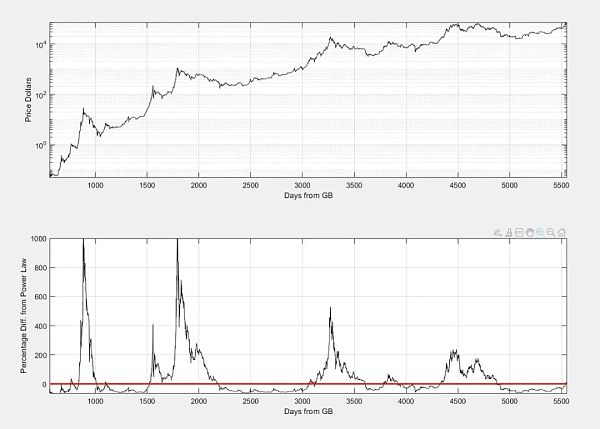

The following figure shows the percentage difference as a function of time.

We can observe that the bottoms are very regular and seem to occur at around -60% of the overall trend.

The tops seem to show the typical decay we observe in regular Bitcoin price action charts.

Let’s measure these deviations and see if we can observe a pattern.

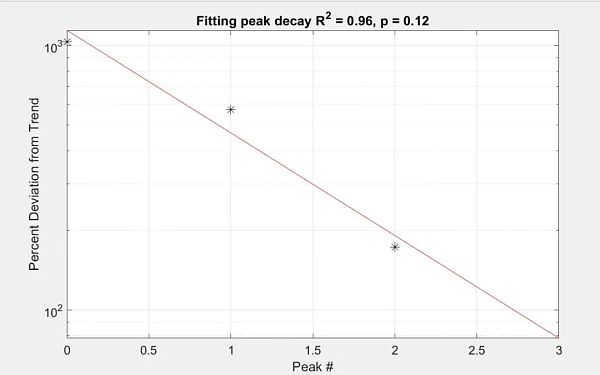

Instead of calculating ratios, let’s see if we can plot these data points and find a pattern. The rapid decay indicates an exponential trend, which should appear as a straight line in a semi-log plot. We fit the data using the number of peaks, rather than a function of time.

Indeed, we see a pretty good fit, with an R² value of 0.96. The Pearson coefficient needs to be at least 0.05 for the data to be statistically significant, but given that we only have 3 data points, a relatively small value of 0.12 is promising even if it is not significant at this point.

After all, that is all we have. Therefore, we can extrapolate the decay to the next peak, which will be a deviation from the trend of about 78%, basically close to 2 times.

We can go back to the Desmos application and calculate the trend value for the next cycle peak, which should be at the end of 2025.

By the way, here is a good way to find the number of days between two dates:

The uncertainty of the peak can be as long as 2-3 months, but this should give us a rough estimate.

So there are about 6201 days between January 3, 2009 (the genesis block) and the estimated 4 cycle tops.

Let's input this into the Desmos app:

The app shows a trend value of about $118,066.

So the estimated top is

Top = 118,000 + 78 / 100 * 118,000 = $210,000.

So this seems to be a scientifically valid way to estimate cycle tops if everything else remains constant.

We also add in an estimate for the bottom, which is typically 50% of the historical trend or slightly below. The power law theory predicts the bottom much more strongly than the top.

The trend value is close to $165,000 and the bottom should be around half of that value. Rounding to the next integer, we get

The bottom of the next cycle = 165,000 * 0.5 = $83,000.

These are rough estimates, but consistent with our full model, which attempts to incorporate general power law trends, 50-60% hard bottoms, 4-year cycle sine wave oscillations, and exponential decay similar to the above calculations.

See the figure below:

Conclusion

Of course, these are rough estimates, but are based on our understanding of Bitcoin's scaling properties and its very reliable (so far) cyclicality. These predictions should be treated with caution, but hopefully useful to Bitcoin investors.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Coindesk

Coindesk Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph