Author: Olivia Moore, Partner at a16z; Translated by: Deep Thought Circle. Have you ever wondered why the consumer AI products that have emerged in the past two years have grown from zero to millions of users and exceeded $100 million in annual revenue in less than two years? This growth rate was almost unimaginable before AI. On the surface, this is due to faster distribution and higher average revenue per user. But I've discovered a deeper change that most people overlook: AI has fundamentally changed the revenue retention model for consumer software. I recently read an analysis by a16z Partner Olivia Moore, titled "The Great Expansion: A New Era of Consumer Software." She calls this phenomenon the "Great Expansion," and I think she captures a crucial trend. After pondering this idea, I realized that this isn't just a business model adjustment; it's a fundamental shift in the rules of the game for the entire consumer software industry. We're witnessing a historic turning point: consumer software companies no longer need to contend with user churn; instead, they can rely on the continuous expansion of user value to achieve growth. The boundaries between the consumer and enterprise markets are, in a sense, blurring.

The implications of this shift are enormous. Traditional consumer software companies expend enormous effort and capital annually replacing churned users simply to maintain the status quo. However, companies that seize the AI opportunity are finding that each new user not only doesn't lose value, but actually contributes more revenue over time. It's like going from a leaky bucket to an expanding balloon: the growth model is completely different.

Analyzing from this perspective,I personally believe that this is a huge opportunity for companies going overseas,because consumer-grade products can use PLG to achieve growth and revenue,perfectly avoiding the shortcoming of Chinese teams in SLG overseas. Although it is aimed at the enterprise market, the entire growth model is similar to that of C-end products.I personally feel the same way.My own project has been online for a month. It is a B-end Vibe coding product that is completely oriented towards enterprises, but it relies on PLG to acquire customers and grow, and has received good data feedback. Let's first review how consumer software monetized before AI. Moore outlines two primary models in her analysis, which I think is a very accurate summary. The first is the advertising-driven model, primarily used in social apps. This model is directly tied to usage, so the value of each user is typically flat over time. Instagram, TikTok, and Snapchat are all examples of this model. The second is the single-tier subscription model, where all paying users pay the same fixed monthly or annual fee for product access. Duolingo, Calm, and YouTube Premium all employ this approach. In both models, revenue retention is almost always below 100%. A certain percentage of users churn each year, while those who remain continue to pay the same amount. For consumer subscription products, maintaining a 30-40% user and revenue retention rate by the end of the first year is considered "best practice." These numbers sound despairing. I've always felt this model suffers from a fundamental structural flaw: it creates a fundamental constraint, requiring companies to constantly replace lost revenue to maintain growth, let alone expand. Imagine a leaky bucket. Not only do you have to keep adding water to maintain the level, you have to add more than you're losing to keep the level rising. This is the dilemma facing traditional consumer software companies: they're trapped in a perpetual cycle of customer acquisition, churn, and reacquisition. The problem with this model isn't just a numerical one; it affects the company's overall strategy and resource allocation. Most of the effort goes into acquiring new users to replace churn, rather than deepening relationships with existing users or improving the value of the product. This is why we see many consumer apps frantically pushing notifications and employing various tactics to increase user stickiness, knowing that revenue will disappear immediately if users stop using the app. I believe this model fundamentally underestimates the potential value of users. It assumes that user value is fixed, and once they subscribe, their potential revenue contribution is capped. The reality is, as users become more familiar with a product, their needs tend to grow, and so does their willingness to pay. Traditional models fail to capture this opportunity for value growth. The AI Era: A Game-Changing Game The advent of AI has completely changed the game. Moore called this change the "Great Expansion," and I think it's a very apt name. The fastest-growing consumer AI companies are now seeing revenue retention rates exceeding 100%, which is almost unimaginable in traditional consumer software. This phenomenon is happening in two ways: first, consumer spending is increasing as usage-based revenue replaces fixed "access" fees; and second, consumers are bringing tools into the workplace at an unprecedented rate, where they can be reimbursed and supported by larger budgets. A key change I've observed is a fundamental shift in user behavior. In traditional software, users either use the product or they don't; they subscribe or they cancel. But with AI products, user engagement and value contribution grow incrementally. They may start out with occasional use of basic features, but as they discover the value of AI, they become increasingly reliant on the tools, and demand expands. The trajectory of this difference is dramatic. Moore noted that at a 50% revenue retention rate, a company must replace half of its user base each year to maintain retention. At over 100%, however, each user base is expanding, with growth compounded upon growth. This isn't just a numerical improvement; it represents a whole new engine of growth.

I think there are several deep reasons behind this change. AI products have a learning effect, and they become more useful with use. The more time and data users invest, the more valuable the product becomes to them. This creates a positive feedback loop: more use leads to greater value, and greater value leads to more use and a higher willingness to pay.

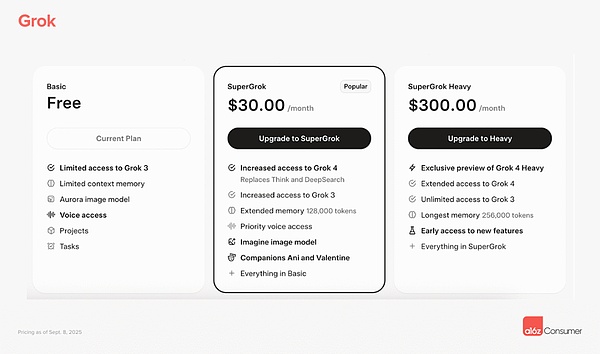

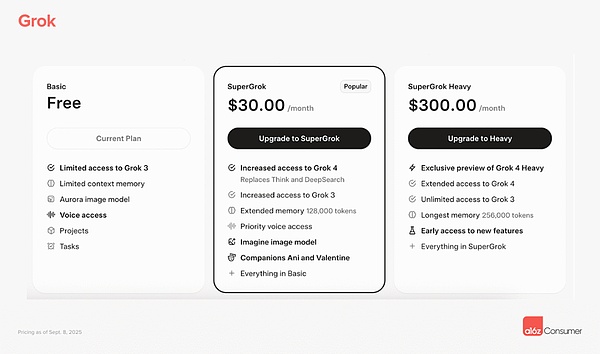

Another key factor is the practical nature of AI products. Unlike many traditional consumer applications, AI tools often directly solve users' specific problems or improve their productivity. This means that users can easily see the direct benefits of using these tools, and they are more willing to pay for this value. When an AI tool can help you save hours of work, paying for additional usage becomes very reasonable. Let me delve deeper into how the most successful consumer AI companies structure their pricing strategies. Moore notes that these companies no longer rely on a single subscription fee, but instead use a hybrid model with multiple subscription tiers and a usage-based component. If users exhaust their included credits, they can purchase more or upgrade to a higher plan. I believe there's an important lesson here from the gaming industry. Gaming companies have long derived the majority of their revenue from high-spending "whale" users. Limiting pricing to one or two tiers is likely a wasted revenue opportunity. Smart companies structure tiers around variables such as the number of builds or tasks, speed and priority, or access to specific models, while also offering credits and upgrade options. Let me look at some specific examples. Google AI offers a Pro subscription for $20 per month and an Ultra subscription for $249 per month, with additional charges for Veo3 credits when users (inevitably) exceed the included count. Extra credit packs start at $25 and scale up to $200. I understand that many users spend as much on extra Veo credits as they do on the base subscription. This is a perfect example of how revenue can scale with user engagement. Krea's model is also interesting. They offer plans ranging from $10 to $60 per month, depending on expected usage and training jobs. If you exceed the included compute units, you can purchase extra credit packs for $5 to $40 (valid for 90 days). The beauty of this model is that it offers both a reasonable entry price for casual users and room for expansion for heavy users. Grok's pricing takes this strategy to the extreme: the SuperGrok plan costs $30 per month, while the SuperGrok Heavy plan costs $300 per month, the latter unlocking new models (Grok 4 Heavy), extended model access, longer memory, and new feature testing. This 10x price difference is almost unimaginable in traditional consumer software, but it becomes reasonable in the AI era because the needs and value perceptions of different users vary greatly.

I believe the success of these models lies in their recognition of the diversity and dynamic nature of user value. Not all users have the same needs or ability to pay, and the needs of the same user may change over time. By offering flexible pricing options, these companies are able to capture the full spectrum of user value.

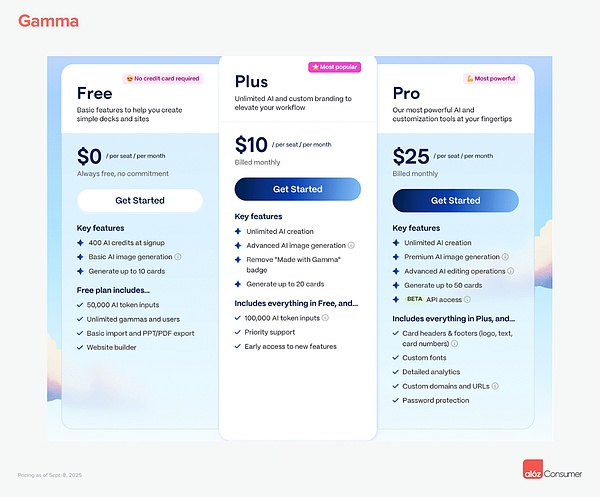

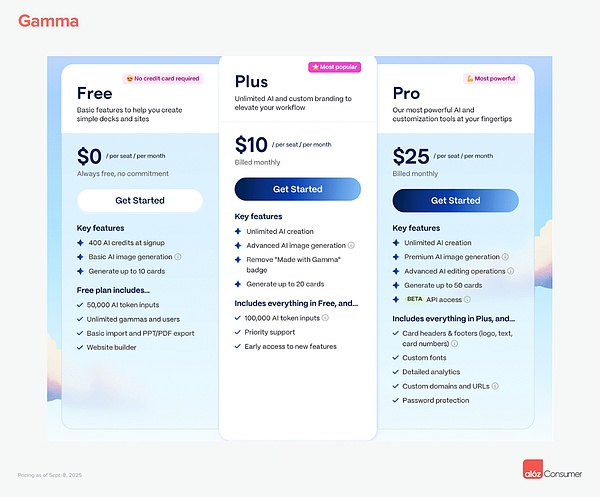

Moore mentioned that some consumer companies have achieved revenue retention rates exceeding 100% using this pricing model alone, even before considering any expansion into the enterprise. This demonstrates the power of this strategy. It not only solves the churn problem of traditional consumer software, but also creates an inherent growth mechanism. Another key trend I've observed is the unprecedented pace at which consumers are bringing AI tools into the workplace. Moore highlights this point in her analysis: consumers are actively rewarding the introduction of AI tools into the workplace. In some companies, failing to be "AI-native" is now considered unacceptable. Any product with potential workplace applications—basically, anything that's not NSFW—should assume that users will want to bring it into their teams, and when they can be reimbursed, they will pay significantly more. The speed of this shift has impressed me greatly. In the past, the transition from consumer to enterprise typically took years and required significant market education and sales efforts. But the utility of AI tools is so obvious that users are spontaneously introducing them into their workplaces. I've seen many cases where employees first purchase AI tools individually and then convince their company to purchase the enterprise version for their entire team. This shift from price-conscious consumers to price-insensitive enterprise buyers creates a huge expansion opportunity. However, this requires fundamental sharing and collaboration features like team folders, shared libraries, collaborative canvases, authentication, and security. I believe these features are now essential for any consumer AI product with enterprise potential. With these features, the pricing differential can be significant. ChatGPT is a great example. While not widely considered a team product, its pricing highlights the difference: individual subscriptions start at $20 per month, while enterprise plans range from $25 to $60 per user. This 2x-3x price differential is rare in traditional consumer software but is becoming commonplace in the AI era. I suspect some companies are even pricing individual plans at break-even or a slight loss to accelerate team adoption. Notion effectively used this approach in 2020, offering unlimited free pages to individual users while charging aggressively for collaborative features, which fueled its most explosive growth. The logic behind this strategy is: build a user base by subsidizing individual use, then achieve profitability through enterprise features. Let me look at some specific examples. Gamma's Plus plan costs $8 per month and includes watermark removal—a requirement for most enterprise use—along with other features. Users then pay for each collaborator added to their workspace. This model cleverly capitalizes on the enterprise demand for a professional look.

Replit offers a $20 per month plan for Core users. Team plans start at $35 per month and include additional credits, viewer seats, centralized billing, role-based access control, private deployment, and more. Cursor offers a $20 per month Pro plan and a $200 per month Ultra plan (with 20 times more usage). Team users pay $40 per month for the Pro product, which comes with an organization-wide privacy mode, usage and management dashboard, centralized billing, and SAML/SSO. These capabilities are important because they unlock enterprise ARPU (average revenue per user) expansion. I believe any consumer AI company that isn't considering an enterprise expansion path is missing a huge opportunity. Enterprise users not only pay more, they're also generally more stable and have lower churn rates. Invest in enterprise-grade capabilities from day one. Moore offers a seemingly counterintuitive but actually very sensible suggestion: Consumer companies should consider hiring a sales leader within the first year or two of their founding. I wholeheartedly agree with this, although it does run counter to traditional consumer product strategy. Individual adoption can only take a product so far; ensuring widespread organizational adoption requires navigating enterprise procurement and closing high-value contracts. This requires expert sales expertise, rather than simply relying on organic product adoption. I've seen too many excellent consumer AI products miss out on significant opportunities due to a lack of enterprise sales capabilities.

Canva, founded in 2013, waited nearly seven years to launch its Teams product. Moore points out that in 2025, this delay will no longer be feasible. The pace of enterprise AI adoption means that if you delay enterprise features, competitors will seize the opportunity instead. This competitive pressure is greatly accelerated in the AI era because the market is changing faster than ever before.

I think there are several key features that often determine the outcome. On the security and privacy side, you need SOC-2 compliance and SSO/SAML support. On the operations and billing side, you need role-based access control and centralized billing. On the product side, you need team templates, shared themes, and collaborative workflows. These may sound basic, but they are often key factors in enterprise purchasing decisions. ElevenLabs is a great example: the company started with heavy consumer adoption but quickly built enterprise-grade capabilities, adding HIPAA compliance to its voice and conversational agents and positioning itself to serve healthcare and other regulated markets. This rapid enterprise transformation allowed them to capture high-value enterprise customers rather than relying solely on consumer revenue. An interesting observation I've made is that consumer AI companies that invest in enterprise capabilities early on tend to build stronger moats. Once enterprise customers adopt a tool and integrate it into their workflows, switching costs are high. This creates stronger customer stickiness and a more predictable revenue stream. Furthermore, enterprise customers provide valuable product feedback. Their needs are often more complex, driving product development towards higher levels of sophistication. I've seen many consumer AI products discover new product directions and feature requirements by serving enterprise customers. My Deeper Thoughts on This Change: After carefully analyzing Moore's insights and my own observations, I believe we're witnessing not just a recalibration of business models but a fundamental restructuring of the entire software industry. AI not only changes product capabilities but also transforms how value is created and captured. What I find most interesting is that this change challenges our traditional assumptions about consumer software. For a long time, it was believed that consumer software was inherently low-priced, had high churn, and was difficult to monetize. However, the reality of the AI era shows that consumer software can achieve enterprise-level revenue scale and growth rates. The implications of this shift are profound. From a capital allocation perspective, this means investors can now invest more money earlier in consumer AI companies, as these companies can achieve meaningful revenue scale more quickly. Traditionally, consumer software companies needed to wait until they reached significant user scale before effectively monetizing, but now they can achieve strong revenue growth with a relatively small user base. I've also considered the impact of this shift on startup strategy. Moore mentioned that many of the most important enterprise companies we believe will emerge in the AI era likely began with consumer products. I think this is a profound insight. The traditional B2B software startup path typically involves extensive market research, customer interviews, and sales cycles. However, starting with the consumer side allows for faster product iteration and market validation. Another advantage of this approach is that it creates a more natural product-market fit. When consumers voluntarily use and pay for a product, it's a strong signal of product-market fit. Then, when these users bring the product into the workplace, enterprise adoption becomes more organic and sustainable. I've also noticed an interesting shift in competitive dynamics. In the traditional software era, the consumer and enterprise markets were typically separate, with different players and strategies. But in the AI era, these boundaries are blurring. A single product can compete in both markets simultaneously, creating new competitive advantages and challenges. From a technical perspective, I believe this dual nature of AI products (consumer-grade ease of use + enterprise-grade functionality) is driving new standards in product design and development. Products need to be simple enough for individual users to easily get started, yet powerful and secure enough to meet the needs of enterprises. This balance won't be easy to achieve, but those that do it well will gain a significant competitive advantage. I've also considered the impact of this trend on existing enterprise software companies. Traditional enterprise software companies now face competition from AI companies that originated in the consumer market, and these new entrants often offer a better user experience and a faster iteration rate. This could force the entire enterprise software industry to raise its product standards and user experience. Finally, I believe this change also reflects a fundamental shift in the way people work. Remote work, increased personal tool choice, and higher expectations for productivity tools have all contributed to a blurring of the lines between consumer and enterprise tools. AI is simply accelerating this already-underway trend. Future Opportunities and Challenges While I'm excited about the "Great Expansion" phenomenon described by Moore, I also see several challenges and opportunities that require attention. Regarding challenges, I believe competition will become more intense. As the path to success becomes clear, more companies will attempt to follow the same strategy. Those who can establish strong differentiation and network effects will prevail in the long run. From a regulatory perspective, the rapid adoption of AI products in enterprise environments may raise new compliance and security challenges. Companies will need to ensure that their AI tools comply with various industry standards and regulatory requirements. This may increase development costs and complexity, but it will also create new barriers to competition. In terms of opportunity, I see enormous room for innovation. Companies that can creatively combine consumer-grade ease of use with enterprise-grade functionality will carve out new market categories. I also see significant opportunity in specialized AI tools; deeply optimized tools for specific industries or use cases may be more valuable than general-purpose tools. I also see opportunities in network effects from data and AI models. As users increase and usage deepens, AI products can become more intelligent and personalized. These data-driven improvements can create powerful competitive advantages, as this accumulated intelligence is difficult for new entrants to replicate. From an investment perspective, I believe this trend will continue to attract significant capital. However, investors will need to become more astute in identifying companies with truly sustainable competitive advantages, not just those experiencing rapid growth. The key will be understanding which companies can build true moats, rather than simply capitalizing on early market opportunities. Ultimately, I believe the "Great Expansion" Moore describes is just the beginning of the AI revolution. We are redefining the very nature of software—from tools to intelligent companions, from features to outcomes. Companies that seize this shift and execute successfully will build the next generation of technology giants. This isn't just about business model innovation; it's about reimagining the relationship between people and technology. We live in an exciting era where software is becoming smarter, more useful, and more indispensable. The End Feel free to leave a comment and share your thoughts! If you find this content useful, please like and share it. Every time you share, it inspires me to continue producing better content.

Alex

Alex