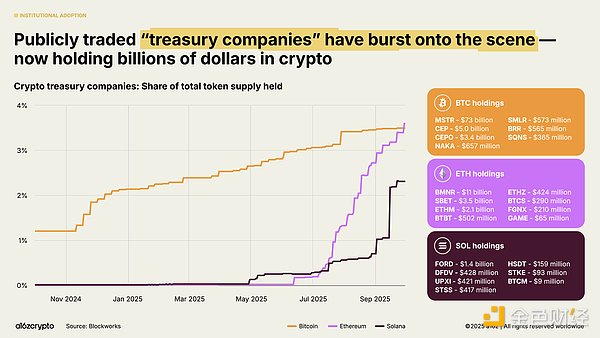

Encryption and artificial intelligence technologies are deeply integrated. 1. The crypto market has achieved scale, globalization, and sustained growth. In 2025, the total crypto market capitalization surpassed $4 trillion for the first time, demonstrating the industry's overall growth. The number of mobile crypto wallet users surged 20% year-over-year, reaching a record high. The dramatic shift from regulatory resistance to policy support, coupled with the accelerated adoption of technologies like stablecoins and the tokenization of traditional financial assets, will define the trajectory of the next cycle. According to our analysis based on updated methodology, there are currently approximately 40 to 70 million active crypto users worldwide, an increase of approximately 10 million from last year. This number only accounts for a small proportion of the 716 million global crypto asset holders (a year-on-year increase of 16%) and is far lower than the approximately 181 million monthly active addresses on the chain (a year-on-year decrease of 18%). The gap between passive holders (those who own crypto assets but don't transact on-chain) and active users (those who regularly transact on-chain) presents a significant opportunity for crypto builders: how to reach potential users who already hold crypto assets but haven't yet engaged in on-chain activities. So where are these crypto users? What activities are they doing? The crypto ecosystem is global in nature, but usage patterns vary across different regions of the world. Mobile wallet usage, an indicator of on-chain activity, has grown fastest in emerging markets such as Argentina, Colombia, India, and Nigeria (particularly in Argentina, where crypto mobile wallet usage surged 16-fold amidst the ongoing currency crisis over the past three years). Meanwhile, our analysis of the geographic origins of token-related network traffic shows that token interest indicators are more skewed towards developed countries. Compared to user behavior in developing countries, activity in countries like Australia and South Korea may be more concentrated in trading and speculation. Bitcoin (which still accounts for more than half of the total crypto market capitalization) has gained favor among investors as a store of value, reaching a record high of over $126,000. Meanwhile, Ethereum and Solana have recovered most of the ground lost after their 2022 plunge. As blockchain continues to scale, the fee market matures, and new applications emerge, certain metrics are becoming increasingly important. One such metric is "real economic value," which measures the actual fees users pay for using the blockchain. Hyperliquid and Solana currently account for 53% of revenue-generating economic activity, a significant shift from the earlier dominance of Bitcoin and Ethereum. From a developer perspective, the crypto world remains multi-chain, with Bitcoin, Ethereum and its Layer 2 network, and Solana forming the three core developer hubs. By 2025, Ethereum and its Layer 2 network will be the top targets for new developers, while Solana will be one of the fastest-growing ecosystems, with developer interest increasing by 78% over the past two years. This data comes from a16z's crypto investment team's research and analysis of entrepreneurs' preferred development platforms. 2. Financial institutions fully embrace crypto assets. 2025 can be considered the year of institutional adoption. Just five days after last year's "State of Crypto" report declared stablecoins had achieved product-market fit, Stripe announced its acquisition of stablecoin infrastructure platform Bridge, marking the beginning of traditional financial companies' public deployment of stablecoins. Months later, Circle's $10 billion IPO marked the official entry of stablecoin issuers into the ranks of mainstream financial institutions. In July, the bipartisan-backed GENIUS Act was officially enacted, providing clear guidance for developers and institutions. Since then, the frequency of mentions of stablecoins in SEC filings has increased by 64%, and major financial institutions have seen a surge in announcements regarding their plans. Institutional adoption is accelerating. Traditional financial institutions such as Citigroup, Fidelity, JPMorgan Chase, Mastercard, Morgan Stanley, and Visa have begun (or plan to) offer crypto products directly to consumers, enabling them to buy, sell, and hold digital assets alongside traditional instruments like stocks and exchange-traded products. Meanwhile, platforms like PayPal and Shopify are doubling down on payments, building the infrastructure for everyday transactions between merchants and consumers. In addition to offering products directly, major fintech companies like Circle, Robinhood, and Stripe are actively developing or have announced plans to develop new blockchains focused on payments, real-world assets, and stablecoins. These initiatives could drive more payment flows onto blockchains, promote enterprise adoption, and ultimately build a larger, faster, and more global financial system. These companies have vast distribution networks. If development continues, crypto technology has the potential to be fully integrated into the financial services we use every day. Exchange-traded products (ETFs) have become another key driver of institutional investment, with on-chain crypto asset holdings now exceeding $175 billion, a 169% surge from $65 billion a year ago. BlackRock's iShares Bitcoin Trust is hailed as the most actively traded Bitcoin exchange-traded product in history, and the subsequently launched Ethereum exchange-traded product has also seen significant inflows in recent months. (Note: Although often referred to as exchange-traded funds, these products are actually registered with the SEC as exchange-traded products using S-1 filings, indicating that their underlying assets do not include securities.) These products have significantly lowered the barrier to entry for crypto-asset investors, opening up avenues for large-scale institutional capital that has historically lingered on the periphery of the industry. Publicly traded “digital asset reserve” companies—entities that hold crypto assets on their balance sheets (similar to how corporate treasuries hold cash)—currently hold a combined approximately 4% of all Bitcoin and Ethereum in circulation. These digital asset reserve companies and exchange-traded products currently hold a combined total of approximately 10% of the circulating supply of Bitcoin and Ethereum.

3Stablecoins Enter the Mainstream

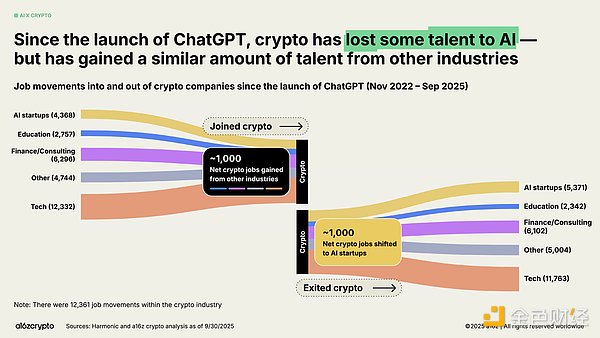

The most defining sign of the crypto market's maturity in 2025 will be the rise of stablecoins. Previously used primarily to settle speculative crypto transactions, stablecoins have become the fastest and lowest-cost method of transferring US dollars globally in the past two years, processing millions of transactions per second at a cost of less than one cent per transaction and covering the vast majority of regions globally. This year, stablecoins have become a pillar of the on-chain economy. Stablecoin transaction volume reached $46 trillion over the past year, a 106% year-on-year increase. While this primarily represents fund flows (as distinct from retail payments through card schemes), it is three times the size of Visa and approaching the ACH network, which connects the entire US banking system. Adjusted (excluding bots and artificially inflated data), actual stablecoin transaction volume over the past 12 months reached $9 trillion, an 87% year-on-year increase. This represents more than five times the volume processed by PayPal and more than half the size of Visa. Adoption is accelerating. Adjusted monthly stablecoin trading volume has soared to a record high, reaching nearly $1.25 trillion in September 2025 alone. Notably, this activity has a low correlation with overall crypto trading volume—indicating that stablecoins are being used for non-speculative purposes and, more importantly, confirming their product-market fit. The total stablecoin supply also reached a record high, now exceeding $300 billion. The market is dominated by leading stablecoins: Tether and USDC account for 87% of the total supply. In September 2025, the Ethereum and Tron blockchains processed $772 billion in adjusted stablecoin transaction volume, representing 64% of all transactions. While these two major issuers and blockchains account for the majority of stablecoin activity, emerging blockchains and issuers are also gaining momentum. Stablecoins have become a significant force in the global macroeconomy: over 1% of the US dollar exists in tokenized stablecoins on public blockchains, and their ranking in US Treasury holdings has risen from 20th last year to 17th. Stablecoins currently hold over $150 billion in US Treasury bonds—more than many sovereign nations. Meanwhile, despite weakening global demand for U.S. Treasuries, the national debt continues to surge. This is the first time in 30 years that foreign central banks' gold reserves have exceeded U.S. Treasuries. However, stablecoins are bucking this trend: over 99% of stablecoins are denominated in U.S. dollars, and their size is projected to grow tenfold to over $3 trillion by 2030, potentially providing a strong and sustainable source of demand for U.S. debt in the coming years. Even as foreign central banks reduce their holdings of U.S. Treasuries, stablecoins are solidifying the dollar's dominance. 4. The resilience of the U.S. crypto ecosystem has reached a historic peak. The United States has reversed its previous opposition to the crypto sector and restored the confidence of builders. The passage of the GENIUS Act and the House approval of the CLARITY Act this year signal a bipartisan consensus that crypto assets will not only survive in the United States but also have the conditions to thrive. Together, these two bills establish a framework for stablecoin regulation, market structure, and digital asset oversight that balances innovation and investor protection. At the same time, Executive Order 14178 rescinded earlier anti-crypto directives and established an interagency working group to modernize federal digital asset policy. The regulatory environment is paving the way for builders to fully unleash the potential of tokens as a new digital primitive—much as websites were to previous generations of the internet. As the regulatory framework becomes clearer, more network tokens will complete the economic cycle by generating returns that accrue to holders, creating a self-sustaining new economic engine for the internet that allows more users to share in the system's dividends. If you are a translation expert in the fields of cryptography and blockchain, please translate the following English text into Chinese. Keeping the formatting consistent between the translated text and the original. 5. Global Acceleration of On-Chain Transformation Once a niche testing ground for early adopters, the on-chain economy has evolved into a diverse ecosystem with tens of millions of monthly active participants. Nearly one-fifth of spot trading volume now occurs through decentralized exchanges. Perpetual swap trading volume has surged nearly eightfold over the past year, demonstrating explosive growth among crypto speculators. Decentralized perpetual swap exchanges like Hyperliquid have processed trillions of dollars in trading volume and generated over $1 billion in annualized revenue this year—figures comparable to those of some centralized exchanges. Real-world assets—including traditional assets such as U.S. Treasury bonds, money market funds, private credit, and real estate, which are tokenized on-chain—are connecting crypto and traditional finance. The total market size of tokenized RWAs has reached $30 billion, having grown nearly fourfold over the past two years. Beyond finance, the most ambitious blockchain frontier in 2025 will undoubtedly be Decentralized Physical Infrastructure (DePIN)—decentralized physical infrastructure networks. Just as DeFi is reshaping the financial system, DePIN is reshaping physical infrastructure such as telecommunications networks, transportation systems, and energy grids. This sector holds enormous potential: the World Economic Forum predicts the DePIN market will reach $3.5 trillion by 2028. The Helium network is a prime example. This grassroots-driven wireless network currently provides 5G cellular coverage to 1.4 million daily active users via over 111,000 user-operated hotspots. Prediction markets broke into mainstream popularity during the 2024 US presidential election cycle, with leading platforms Polymarket and Kalshi achieving billions of dollars in monthly trading volume. Despite initial concerns about their ability to maintain activity in a non-election year, these platforms have seen their trading volume increase nearly fivefold since the beginning of 2025, approaching historical peaks. In an environment lacking clear regulation, Memecoin has seen explosive growth, with over 13 million Memecoins created in the past year. However, this trend has cooled in recent months, with issuance down 56% in September compared to January, as positive policies and bipartisan legislation have paved the way for more constructive blockchain use cases. Although NFT market transaction volume has not returned to its 2022 peak, the number of monthly active buyers continues to grow. These trends seem to indicate that consumer behavior is shifting from speculation to collection, and the lower block space costs on chains such as Solana and Base provide the conditions for this. 6. Blockchain Infrastructure Reaches a Critical Point of Maturity. All of these activities would be impossible without significant advancements in blockchain infrastructure. In just five years, the total transaction throughput of major blockchain networks has increased over 100-fold. Previously, blockchains processed fewer than 25 transactions per second; today, they process 3,400 transactions per second, on par with Nasdaq's transaction speed and Stripe's global processing volume during Black Friday, all at a fraction of the historical cost. Solana has become one of the most prominent representatives in the blockchain ecosystem. Its high-performance, low-cost architecture now supports a wide range of applications, from DeFi projects to NFT marketplaces. Its native applications generated $3 billion in revenue over the past year. Planned upgrades are expected to double the network's capacity by the end of the year. Ethereum continues to advance its scaling roadmap, with most economic activities migrating to second-layer solutions such as Arbitrum, Base, and Optimism. The average transaction cost of L2 has dropped from approximately $24 in 2021 to less than one cent today, making Ethereum-related block space both cheap and abundant. Cross-chain bridges are enabling blockchain interoperability. Solutions like LayerZero and Circle's cross-chain transfer protocol enable users to transfer assets across multiple blockchain systems. Hyperliquid's Regulated Bridge has generated $74 billion in transaction volume year-to-date. Privacy protection is returning to the forefront and may become a prerequisite for widespread adoption. Signs of growing interest include a surge in Google searches related to crypto privacy in 2025, the growth of Zcash's shielded pool supply to nearly 4 million ZEC, and Railgun's monthly transaction volume exceeding $200 million. Further signs of momentum include the Ethereum Foundation's establishment of a new privacy team, Paxos partnering with Aleo to launch a private and compliant stablecoin (USAD), and the Office of Foreign Assets Control lifting sanctions on the decentralized privacy protocol Tornado Cash. We expect this trend to gain momentum in the coming years as crypto continues to become more mainstream. Similarly, zero-knowledge proofs and succinct proof systems are rapidly evolving from decades of academic research into critical infrastructure. Zero-knowledge systems are now integrated into Rollups, compliance tools, and even mainstream web services—as exemplified by Google's new ZK identity system. Meanwhile, blockchain is accelerating its quantum-resistant computing roadmap. Currently, approximately $750 billion worth of Bitcoin is stored in addresses vulnerable to future quantum attacks. The U.S. government plans to transition federal systems to quantum-resistant cryptographic algorithms by 2035. 7. Deep Integration of Encryption and Artificial Intelligence Technologies Among numerous technological advancements, the launch of ChatGPT in 2022 has thrust AI into the spotlight—creating clear opportunities for the crypto space. From tracing and IP licensing to providing payment channels for intelligent agents, encryption technology could be the answer to AI's most pressing challenges. Decentralized identity systems like Worldcoin, which has verified over 17 million users, can provide "proof of human identity" and help distinguish real users from bots. Emerging protocol standards like x402 are becoming the potential financial infrastructure for autonomous AI agents, enabling micropayments, API calls, and intermediary-free settlements—an economy Gartner predicts could reach $30 trillion by 2030. Meanwhile, the computing layer of AI is consolidating around a handful of tech giants, raising concerns about centralization and censorship. Currently, OpenAI and Anthropic alone control 88% of "AI-native" enterprise revenue. Amazon, Microsoft, and Google hold 63% of the cloud infrastructure market, while Nvidia holds 94% of the data center GPU market. This imbalance has led to the "Big Seven" companies achieving double-digit net profit growth for several consecutive quarters, while the earnings growth of the remaining 493 companies in the S&P 500 has generally failed to outpace inflation. Blockchain technology provides a check on the centralized power exhibited by AI systems. Amid the AI boom, some crypto builders have pivoted. Our analysis shows that approximately 1,000 jobs have moved from the crypto industry to the AI field since the launch of ChatGPT. However, this loss has been offset by an equal number of builders joining the crypto industry from other fields, such as traditional finance and technology.

8Future Outlook

Where are we now? As the regulatory framework becomes clearer, the path for tokens to generate real revenue through fees is becoming clearer. Crypto adoption by traditional finance and fintech will continue to accelerate; stablecoins will upgrade the traditional financial system and promote global financial inclusion; and new products will usher in the next wave of users into the on-chain world. We already have the infrastructure and distribution network, and we expect to soon gain regulatory certainty to drive the technology mainstream. Now is the time to upgrade the financial system, rebuild global payment channels, and build an ideal internet. After seventeen years of development, the crypto industry is leaving its adolescence and entering maturity.

Alex

Alex

Alex

Alex Joy

Joy Alex

Alex Joy

Joy Joy

Joy Brian

Brian Kikyo

Kikyo Joy

Joy Brian

Brian Kikyo

Kikyo