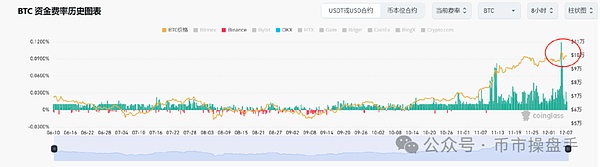

On December 5, as Bitcoin broke through $100,000, the market's bullish sentiment reached a staged climax. According to Coinglass market data, the weighted average funding rate of OKX and Binance on that day reached an annualized 116%, a record high in nearly three years. Subsequently, Bitcoin fell back from $104,000 to $90,500 within 12 hours, a drop of 13%, resulting in the liquidation of nearly $700 million in long positions in the market. This huge shock was also considered by many to be a signal that sentiment had peaked and chips were loosening. So, is the big drop coming?

From the perspective of trading, the adjustment on December 5 is still a technical adjustment in the bull market. The main reasons are as follows: First, Bitcoin stayed in the range of 95,000-90,500 US dollars for only 5 minutes. The main purpose of the pin was to clean up the leveraged longs, which is in line with the characteristics of "slow rise and sharp fall" in the bull market; Second, during the adjustment of Bitcoin, altcoins are still active, and ETH has set a new stage high. The market's money-making effect continues to spread, which shows that risk appetite has not cooled down due to Bitcoin adjustments. However, although there is no momentum for continuous decline in the short term, the market still needs some time to digest the profit-taking. Therefore, Bitcoin is likely to continue to fluctuate in the range of 88,000-105,000. Even if it breaks through (or falls below) the range in the short term, it will be pulled back quickly.

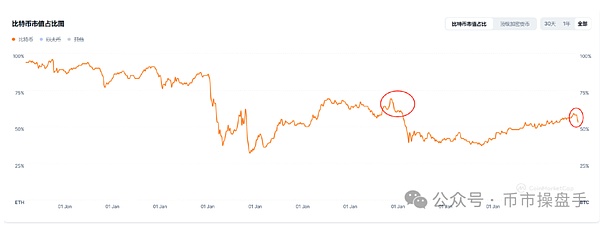

Since November 5, Bitcoin's market share has fallen all the way to 53.7% after reaching 59.3%, while the market value share of altcoins has risen from 8.67% to 12.45%, and the transaction share has also increased from 23% to 41%. This change shows that funds are shifting from pursuing absolute value to focusing on price elasticity. It is worth noting that when this phenomenon occurred in the previous cycle, altcoins started a violent market that lasted more than a month. For example, from March to April 2021, Bitcoin entered a range of fluctuations, and its market share peaked and fell back, while many currencies in sectors such as distributed storage, metaverse, and Layer2 saw a monthly increase of more than 10 times. Interestingly, the sector that ignited the last altcoin season was the "bull market flag bearer" DeFi, which is quite similar to the current surge in HYPE, UNI, SUSHI, CRV and other currencies.

However, although the altcoin market still has a large fermentation space, the stage of general rise in funds that swept the market indiscriminately and eliminated low prices has basically ended. First, as of December 8, about 60% of the top 150 currencies by market value have rebounded to near the highs of March this year, which means that the pressure to cash in profits in the short term will be more obvious. Secondly, the annualized funding rates of most altcoins have reached their highest level in the past three years, and the bullish sentiment bar is full. According to the experience of the last bull market, when the sentiment-driven market reaches its climax, the market usually enters a period of shock, and the fundamental narrative is likely to stand out in the differentiation stage.

In addition to the change in market risk preferences, there are frequent news in favor of altcoins at the policy level. On December 6, US President-elect Trump announced that he would appoint David Sacks as the White House Director of Artificial Intelligence and Cryptocurrency. Trump also said that Sacks will be responsible for formulating the legal framework for the crypto industry, which means that his value proposition will have a profound impact on the future crypto policy of the United States. It is worth noting that David Sacks has not only publicly expressed his support for Bitcoin many times, but also invested in multiple crypto projects through his venture capital fund Craft Ventures, including dYdX, Lightning Labs and River Financial. In addition, he is also a staunch supporter of SOL. From his past views, we can summarize three core propositions:

1. Bitcoin is a highly liquid and non-confiscable storage tool, and its potential value lies in hedging the risk of depreciation of legal currency. For Bitcoin to become a global reserve currency, it may take a large-scale legal currency crisis.

2. Cryptocurrencies are changing traditional financing and incentive models. Many cryptocurrencies have practical application scenarios in the ecosystem and should not be regarded as securities. Asset tokens are securities and need to be issued in a legal and compliant manner.

3. In the future, almost all illiquid assets may be blockchained and tokenized, which will significantly improve market liquidity and price discovery efficiency. Even traditional liquid assets such as stocks may turn to this platform because of the advantages of blockchain technology.

First, David Sacks clearly affirmed the value and long-term growth potential of Bitcoin as a decentralized storage currency, but he believed that Bitcoin needed a crisis as a catalyst to become a global reserve currency. Therefore, after the "crypto czar" joined the White House think tank, Polymarket did not raise the probability of the United States listing Bitcoin as a national reserve (still maintained at around 30%). Therefore, investors who bet on Bitcoin becoming a national reserve may need to lower their expectations.

Secondly, the identification of the attributes of cryptocurrencies should be more flexible, and many tokens with application scenarios should not be listed as securities. This will facilitate the re-unbinding of tokens previously identified as securities by the SEC.

Finally, Sacks believes that asset tokenization will improve asset liquidity and price discovery efficiency, and may even subvert existing asset issuance models and trading platforms. This can also explain why institutions such as BlackRock, Franklin Templeton, Tether, and Visa have recently deployed asset tokenization.

As a16z's policy director Brian Quintenz, regulatory director Michele Korver, and general counsel Miles Jennings mentioned in a joint article: The channel for constructive engagement with regulators and legislatures has now been opened. As the regulatory system becomes clearer, it has become possible for project parties to explore blockchain services and issue coins. Therefore, after Trump takes office, RWA may become the new narrative main line.

In terms of operation, the main line of the altcoin market has been repeatedly strengthened, and the trend will not end easily once it is formed. If there is a sharp drop in the short term, it must be an opportunity to buy low. After entering the differentiation stage, adhering to the logic of "the strong will always be strong" (the largest increase and the smallest adjustment) will help traders reduce mistakes in the second stage of the altcoin market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Catherine

Catherine Catherine

Catherine Weiliang

Weiliang Xu Lin

Xu Lin Davin

Davin Catherine

Catherine Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph