Author: NingNing, independent researcher Source: X, @ 0xNing0x

Today’s market has a consensus: after the Cancun upgrade, the average gas fee of Ethereum L2 will be 10 times lower or even higher.

After the deployment of the upgraded core protocol EIP4844 in Cancun, the Ethereum mainnet will add 3 new blobs dedicated to saving L2 transactions and status data space, and these blobs have independent Gas Fee markets. It is estimated that the maximum size of state data stored in 1 Blob space is approximately equal to 1 mainnet block, which is ~1.77M.

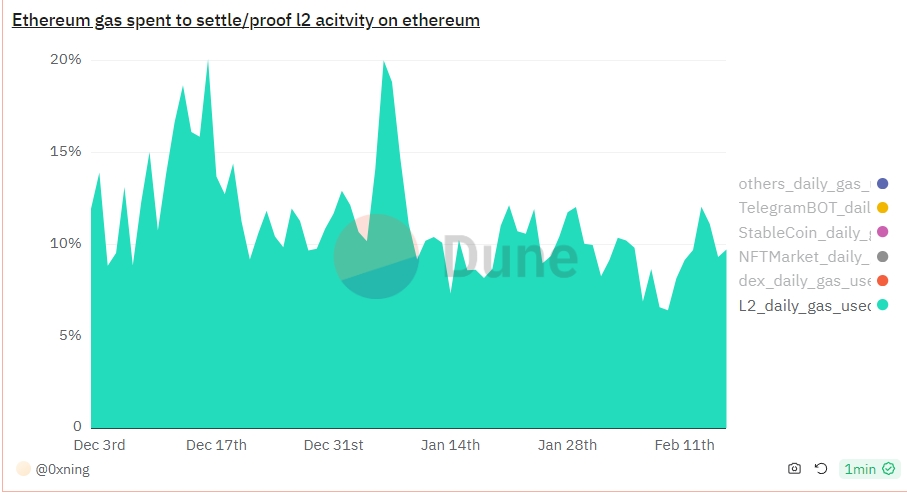

The current daily Gas consumption of the Ethereum main network is 107.9b, and the Gas consumption of Rollup L2 accounts for ~10%.

According to the economic supply and demand curve:

Price = total demand/ Total supply

Assuming that the total gas demand of Rollup L2 remains unchanged after the Cancun upgrade, and Ethereum can sell block space to L2 From the current ~10% of 1 block to 3 complete Blob blocks, which is equivalent to a 30-fold expansion of the total supply of block space, then the price of Gas will be reduced to 1/30 of the original.

But this conclusion is unreliable because it presupposes too many linear relationship assumptions and abstracts away too many detailed factors that should be included in calculations and considerations. , especially the impact of competition among Rollup L2s on Blob space and gaming strategies on Gas prices.

Rollup L2's gas consumption is mainly composed of two parts: data availability storage fee (status data storage fee) + data availability verification fee. Among them, data availability storage costs currently account for ~90%.

After the Cancun upgrade, for Rollup L2 people, the three new Blob blocks are equivalent to three new public lands. According to Coase's commons theory, in a market environment with completely free competition in the Ethereum Blob space, there is a high probability that the currently leading Rollup L2 players will abuse the Blob space. This can ensure their market position on the one hand, and squeeze the living space of competitors on the other.

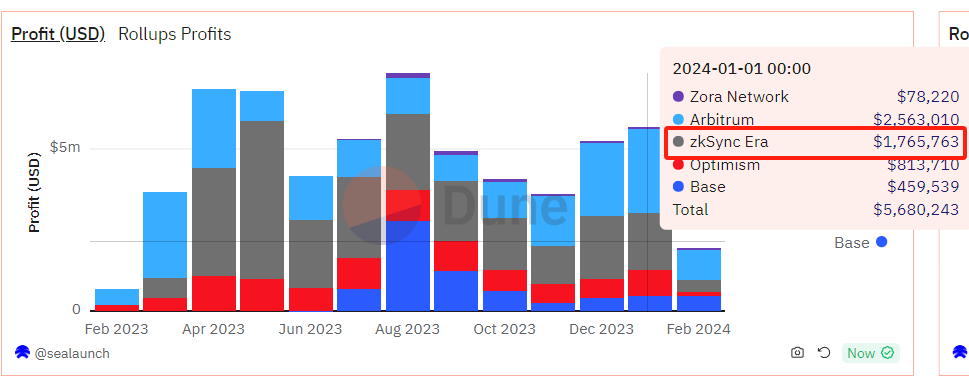

The picture below shows the profit statistics of five Rollup L2 companies for one year. It can be found that their monthly profit scale shows obvious seasonal changes without obvious overall growth. trend.

< /p>

< /p>

In such an involution market with ceiling restrictions, Rollup L2 is in a state of highly tense zero-sum game, which is challenging developers, funds, users and Dapps. fierce competition. After the Cancun upgrade, they compete fiercely with three more new blob spaces.

In the market situation of "there is only so much meat, if others eat one more bite, you will eat one less bite", it is difficult for Rollup L2 to find the Pareto optimal Excellent ideal situation.

How will the leading Rollup L2s abuse the Blob space?

My personal guess is that the head Rollup L2 will modify the Batch frequency of the Sequencer and shorten the Batch frequency of once every few minutes to ~12 seconds. times, keeping pace with the block production speed of the Ethereum main network. This can not only improve the quick confirmation of transactions on your own L2, but also occupy more blob space to suppress competitors.

Under this competitive strategy, the verification fees and batch fees in the Gas fee consumption structure of Rollup L2 will surge. This will limit the positive impact of the new blob space on L2 Gas fee reduction.

< /p>

< /p>

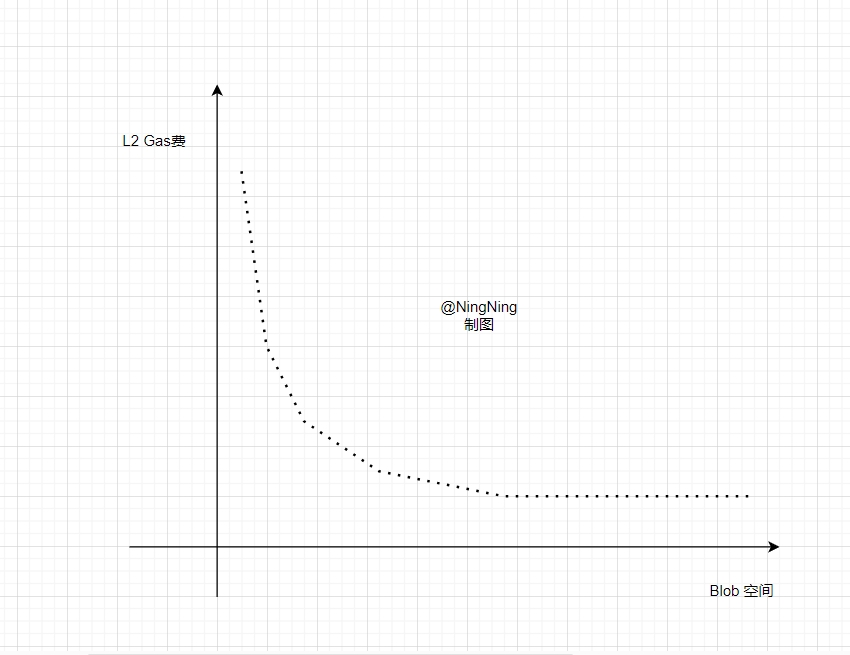

The results are shown in the figure above. When the Blob space increases, the positive impact on L2 Gas fee reduction will decrease at the margin. And after reaching a certain threshold, it will almost fail.

Based on the above analysis, I personally judge that the gas fee of Ethereum L2 will decrease after the Cancun upgrade, but the decrease will be less than market expectations.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Aaron

Aaron Brian

Brian Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist