Author: @thedefiedge; Compiler: Vernacular Blockchain

There will most likely not be a full-blown “altcoin season”, where all currencies rise at the same time.

This is mainly because of the fragmentation of altcoins - there are too many types of tokens now, and liquidity is not enough to support all of them to rise (even if retail funds flow back).

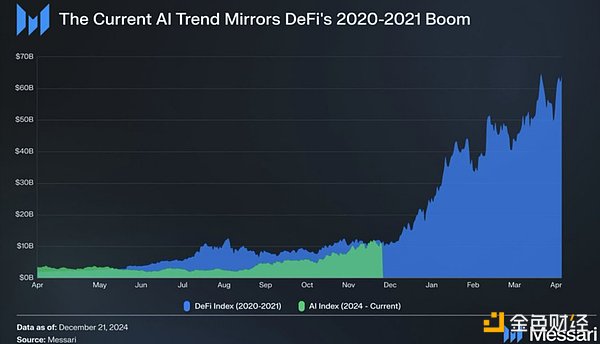

Only some specific industries will usher in a full-blown altcoin season. Currently, artificial intelligence agents are that industry.

Despite the bloody market, this field is setting new all-time highs. It is like a black hole, attracting liquidity and attention. If you missed the DeFi Summer in 2020, or the “Alt Layer 1” market in 2021…

The universe is giving you another chance. Don’t try to buck the trend, don’t try to be clever.

If you’ve been on the sidelines for a while, you might be worried if it’s “too late” to enter the market now. I don’t think so:

Right now the market is falling, but AI infrastructure and agents are hitting all-time highs. What do you think will happen once the market recovers?

This whole trend has only just started for about two months (from the release of GOAT). These AI agents are at their worst right now. New features are being unlocked every day. Imagine what will happen once they can optimize your portfolio for you and trade on-chain for you?

Think of these infrastructures as alt-Layer1s and AI agents as decentralized applications (Dapps). We may see some of these protocols reach alt-Layer1 market caps ($10B+). The big difference? Most of these are not VC-backed, so you don’t have to worry about huge unlocking risks.

No top protocols are currently listed on centralized exchanges (CEX). I have some real-life friends who are interested in this opportunity, but they are having some trouble getting access.

I will mainly talk about investment opportunities in AI infrastructure because they offer the best risk/reward ratio right now.

Instead of choosing a single agent, you are owning the entire casino. In a gold rush, the richest people are those who sell shovels and pickaxes.

Let’s take a deeper look:

1. The two kings of AI infrastructure

1) @virtuals_io (market cap $4.6 billion) - The current king

Virtuals has established itself as a launch platform for AI agents.

It dominates on Base, but it has the potential to expand to other blockchains as well. Co-founder @ethermage once revealed that they are ready to launch the platform on Solana. They are also exploring expansion into @HyperliquidX and @AbstractChain in 2025.

They recently published content on high-level strategic plans, including attracting top agent developers, improving technology, and making Virtuals the fairest agent investment platform. Keep an eye on how they turn these plans into reality.

Will we see revenue sharing for AI agents soon?

Three core advantages:

Token economics: Virtuals are required to create an agent, and Virtuals are also required for liquidity pairing of all tokens. Every new proxy launch platform is imitating their token economics.

Network Effects: All eyes are on Virtuals right now. Launching a proxy here means you have both Virtuals and Base.

Largest Proxy: @AIXBT is the first large proxy to break $500 million in market cap.

I don’t like to make price predictions, but Virtuals has the potential to be in the top 10 in market cap this cycle.

2) Ai16z ($2.2 billion market cap) “Dragon Slayer”?

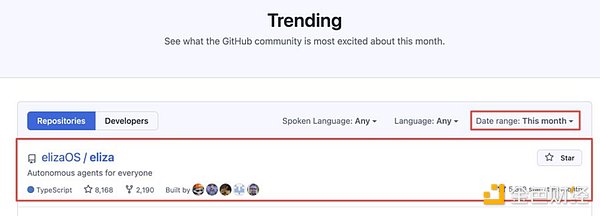

Ai16z has experienced quite a bit of volatility since its inception. It is the home of ElizaOS, a leading proxy framework, and is currently the most watched codebase on Github.

The biggest complaint before was their token economics, specifically that they did not capture value very well. Now they are planning a radical overhaul, with a brand new Launchpad expected to launch in Q1 2025.

Projects launching on the Eliza framework will:

Pay a launch fee (part of which flows back to $AI16z via buybacks and burns).

Requires $AI16z holding for access and liquidity pairing.

Pairs tokens with $AI16z in a liquidity pool to stabilize the market.

It’s like owning part of a casino, with each new agent paying a fee to participate.

Treasury Strategy & Strong Moves: Plans to diversify across major L1 tokens, stablecoins, and project tokens, while providing liquidity for $AI16z pairings.

The goal is long-term sustainability, not a fire sale.

Agent Colonies: What is the key focus? Collaboration of AI agents in a cluster. This is where decentralized AGI starts to become real.

Ecosystem Incentives: Developers building on Eliza will receive: Ecosystem funding and fee sharing opportunities.

The core idea? $AI16z is the glue that holds the entire decentralized AI stack together. Think of it like $ETH or $SOL, but for autonomous agents.

3) Which is better, Virtuals or Ai16z?

Virtuals: I am very bullish on their strategy. They are taking the long view and it does feel like everyone else is catching up to them. They are also riding on the momentum of the Base ecosystem.

Ai16z: From what I've seen, ElizaOS is indeed a technology that is more suitable for developing agents. And their token economics reform will solve many of the problems encountered before.

I know this industry likes tribalism, but you don't have to stand on the side. I'm not sure who will win in the long run - it's better to hold both at the same time (my personal investment is more inclined to Virtuals and its ecosystem).

Many industries will eventually merge and become a "two-strong competition". For example, Apple and Android, Coca-Cola and Pepsi. Will a similar situation appear in this field?

2. Competitors

Virtuals and Ai16z are leading, but it's still early stages. If you want higher returns, you can consider some beta projects.

1) ZereBro (market value $632 million) - Transformation has arrived

ZereBro started out as a general AI agent that was also able to compose music. But now, it is transforming into a complete framework for creating other agents.

Zerepy is an open source agent framework based on Python. Python is very important:

It is the most popular programming language in the world.

Most AI tools and libraries are written in Python.

It will let you launch a ZereBro-like agent.

The biggest catalyst is the upcoming Zentients Agent Platform, launching in early 2025. This new launch platform will tie value directly to ZEREBRO. Each agent created will have value flowed back through launch fees, liquidity pool bonding, and an innovative mechanism (locking liquidity).

Now that ZereBro is part of the thriving Virtuals ecosystem, plans to launch a ZereBro/Virtual liquidity pool on @Base to expand their reach.

They are executing a similar strategy to the current market kings, but now at a much lower valuation than the former.

2) ARC (@arcdotfun) - $358M Market Cap - Rust-based AI Agent Framework

Arc .fun is building an open source agent framework called Rig. This framework is currently the only agent framework built on Rust. This is very important because Rust is the native language of Solana.

Why ARC is worth paying attention to?

Rust language helps optimize performance through zero-cost abstractions.

Rig framework has been shown to outperform Langchain in memory usage and cold start time.

@0xCygaar is contributing to Rig's GitHub and is also a core contributor to Abstract Chain.

In short, Arc = Rust and excellent code base.

3) GRIFFAIN (market cap $457 million) — Solana’s AI App Store

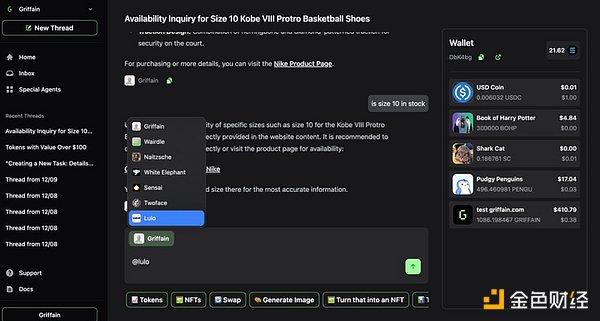

Griffain allows you to interact with your agents through natural language to search and operate on-chain.

Key Points:

Griffain agents can autonomously execute preset on-chain transactions, such as hourly fixed investments (DCA), or set limit orders to buy or sell. You can also receive real-time reports on the tokens held by an address and changes to its portfolio via email.

The project is publicly backed by @aeyakovenko and Solana Labs. Their goal is to build Griffain on Solana Mobile like Siri on the iPhone.

Griffain was built by @tonyplasencia3, who previously built Underdog and Blink on Solana.

This project is very interesting.

I'm trying to keep an eye on future developments. Agents are always criticized for being "chatbots" and lacking practical use. Griffain is laying the foundation for agents that can be actually useful on-chain.

4) REI (market cap $153 million) – A smarter AI agent

In essence, REI is not just another AI agent robot. It is a full-stack framework that combines AI innovation with blockchain.

Think of it as an AI that can not only perform tasks, but also learn, reason, and adapt.

What can it do?

REI interacts with users primarily through X, and its cognitive architecture enables natural, context-aware communication.

How does it work?

Her Oracle Bridge connects off-chain data, while the ERCData Standard structures it for efficient use on-chain.

Combined with REI s four-layer cognitive model(thinking,reasoning,decisions,actions),this enables her to learn,adapt,and perform deterministic tasks.

Recent developments drive REI potential:

AI Stack SDK: Phased rollout, making it easier for developers to create agents.

Expanding the Oracle Network: This is key to building real-world AI applications on-chain.

Scaling the Oracle Network: This is key to building real-world AI applications on-chain.

Scaling the Oracle Network: This is key to building real-world AI applications on-chain.

Scaling the Oracle Network: This is key to building real-world AI applications on-chain.

Phase 2 Catalysts: Full testnet launch, advanced validation protocols, and mainnet plans for 2025.

Macro Perspective:

REI is more than just smarter robots. It is shaping decentralized intelligence through the precise combination of artificial intelligence and blockchain.

If you are looking for the future of autonomous agents, REI is a framework worth paying attention to.

5) VAPOR (market cap $154 million) - The first and only AI agent launchpad on Hyperliquid

Vapor is a native AI agent launchpad on Hyperliquid, built using @ai16zdao's Eliza framework.

Key Takeaways:

While $AI16Z represents approximately 1.2% of Solana’s fully diluted market cap, $VAPOR’s market cap is only $132M, equivalent to 0.47% of Hyperliquid’s fully diluted market cap.

Once launched, users will need to burn $VAPOR to launch proxies. This means $VAPOR is deflationary and the total supply will continue to decrease.

All proxy tokens launched on the Hyper EVM will be traded against $VAPOR in the native DEX liquidity pool. As more proxies come online, more $VAPOR will be locked in the liquidity pool.

It is now online on the test network, and all agents have been approved without token gating.

6) MODE (market value of $114 million) - a combination of artificial intelligence agents and decentralized finance

Mode Network can be seen as an ETH Layer 2, focusing on expanding decentralized finance (DeFi) to billions of users through on-chain AI agents.

"By 2026, more than 80% of on-chain transactions will be conducted through AI agents." If you think this holds true, then Mode will provide you with exposure.

Key Stats:

500M+ TVL: #3 chain in the OP Superchain ecosystem.

User Growth: 367,000 users, 24M+ transactions.

Undervalued: Market Cap to TVL Ratio Shows Potential Upside.

What’s Happening on Mode?

Synth Testnet Launch: Bittensor Subnet for Financial Prediction, Unlocking DeFi Intelligence.

AI Agent Hackathon: The first hackathon attracted 667 registrants and launched more than 10 Eliza plugins in 6 days.

AI Agent App Store Updates: Currently hosting a number of live agents, including:

Amplifi: Bitcoin abstraction layer, scaling Bitcoin to billions of users with AIFi.

Arma: Optimizing yield farming for USDC.

Brian: Executing trades and contracts through natural language.

Sturdy: Aggregating AI-driven yield vaults for higher yields.

QuillAI Network: Secure AI agents powered by D-LLM and EigenLayer AVS.

Mode’s vision?

Building infrastructure for an on-chain agent economy. Advancing this vision through Synth testnet, BitcoinOS integration, and growing AI agents.

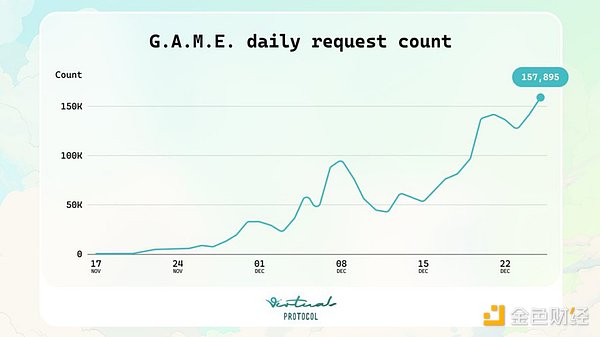

7) GAME (@game_virtuals) - Market value: $390 million - Virtuals Framework

G.A.M.E is the first infrastructure project that allows developers to integrate AI agents into games.

Description from Virtuals:

"Every society has its core infrastructure that is vital to its growth and development. @game_virtuals plays the role of Shopify for Virtuals, and @base is similar to SWIFT."

Notable Developments:

Developed by the Virtuals Protocol team themselves.

$$GAME is the backbone of the Virtuals economy. Every time an AI agent runs, it actually pays $$GAME fees to keep the ecosystem running.

G.A.M.E already supports over 200 projects, and over 150,000 requests are sent through G.A.M.E every day.

In the Virtuals ecosystem, G.A.M.E is the #1 performer in the last 30 days, up nearly 400%.

G.A.M.E has surpassed 2.2 million lifetime inferences on the Virtuals protocol.

G.A.M.E is still underrated because people don’t really understand what it does. And the G.A.M.E team themselves doesn’t really promote it (only 5 tweets total from the official account, and they haven’t even updated their Twitter avatar, haha).

A similar but riskier project is CONVO, which powers conversations on Virtuals.

8)Soul Graph (@soulgra_ph) $GRPH - Market cap $36 million - Make agents more human

Imagine that if other frameworks shape the "hard skills" of an agent, Soul Graph shapes its "soft skills" to make it more human. Its framework is designed to add personality to new or existing AI agents.

“We are building open source tools and providing infrastructure that enables developers to give their agents evolving personalities, persistent memories, and real-time communication capabilities.”

Key Points:

It has already created over 2,000 “souls” and over 15,000 minutes of voice conversations in the Soulgraph Playground.

Soulgraph recently integrated with the AI16Z plugin.

85% of the total supply is allocated to the community, and the developer share is locked and will be unlocked in 1 year.

I think this project is going to be huge.

Argument:

Character AI is huge. Regular people log on to that website and spend hours text chatting with AI. Google just acquired it (Character AI) for $2.7 billion. Imagine what it would be like if people could have real-time conversations with AI agents that had human-like personalities and memories.

That's exactly what Soul Graph does. You can visit their website and experience it for yourself.

9) Other projects worth noting:

This post is already a bit long, and I can't finish writing all the protocols. Here are some other protocols worth paying attention to:

Bully (@dolos_diary): Originally a parody account, it now showcases @dolion_ai, a social media AI agent framework.

TopHat (@tophat_one): An agent launch platform on Solana.

Swarm Node (@Swarmnode): Think of it as AWS Lambda, but specifically for AI agents and frameworks.

Cookie Fun (@cookiedotfun): An A.I. agent data tracking platform similar to DeFiLlama/Kaito, tracking data such as thought sharing, smart interactions, and market capitalization. Some advanced features require token thresholds.

3. How to choose?

First, everyone should pay attention to Virtuals and AI16z. These projects are clearly dominant, and I don't see any signs of them slowing down. Don't underestimate the network effect.

If you're considering making some Beta investments, here's what I'm looking at:

LaunchPad on emerging chains: This is a strategy from 2021. Virtuals dominates Base. So, betting on LaunchPad of other popular chains is a good choice. This is also why Vapor's price has skyrocketed, because Hyperliquid is currently very hot.

Do you focus on a certain niche? : It's difficult to launch a general Layer 1 or Layer 2 now. Instead, you have to focus on a specific field, such as becoming a "game chain." This is why I find Mode interesting, with its focus on AI agents and DeFi, or Griffain's focus on natural language.

Programming languages: Infrastructure projects need agents, agents need developers, and developers have their own preferred programming languages. This is why Zerebro (Python) and Arc (Rust) stand out.

4. A.I. Portfolio Recommendations

Conservative Portfolio: 50% Virtuals and 50% ai16z. This combination is simple and will probably outperform 80% of people.

Alpha/Beta Hybrid Portfolio: Virtuals as an Alpha investment, you can choose a competing framework as a Beta investment, such as Arc or Griffain.

Medium-to-high risk portfolio: Virtuals and ai16z as "safe" investments, then higher risk A.I. agent investments.

All-round investment: infrastructure Alpha investment and some Beta investment, plus some A.I. agent investment with different risk curves. You can choose some Alpha projects, such as @aixbt, and invest in some projects with a market value of less than 100 million US dollars.

5. Negative news about AI Agent

"Too many startup platforms and frameworks" - Brothers, look at how many Layer 1 and Layer 2 there are now? We are doing well. This whole industry is new and developing rapidly. If you are building a new city, it makes sense to build roads, bridges and pipelines first.

“Most of it is garbage and will eventually go to zero” - that’s the crypto industry. Most things will collapse, but those that survive will eventually change the rules of the game.

“The AI industry has reached its peak” - you won’t succeed. Don’t give up halfway.

“All AI agents are terrible” - someone used to be terrified of online shopping. I also remember when the first iPhone came out, you couldn’t copy and paste. We are in the early stages now. This is a bet on the future.

6. Summary

As expected, we all know that there will be a bull market in this round, but I’m not sure which new original technology will emerge that can change the rules of the game.

What will be the “DeFi” or “NFT” moment of this round? Which sector will reignite all the developers' enthusiasm? Which sector will give retail investors an epiphany and cause them to rush in?

I'm not sure there will ever be such a moment. But the good news is... it's coming.

This may very well be your chance to succeed - do your research and don't screw it up.