Author: IntoTheBlock Source: medium Translation: Shan Ouba, Golden Finance

In the cryptocurrency market, there is a market dynamic that is recognized by all "old players":Every four years, the price of Bitcoin soars, and investors turn to speculative small-cap coins after taking profits, which eventually drives the explosion of altcoins. But what if this assumption is wrong?

This article will analyze historical market cycles, evaluate the effectiveness of this model, and delve into the current market state to predict what may happen in the future.

Over the past decade, Bitcoin has usually been the pioneer of the market's rise, and then altcoins will follow the rise. This trend has shaped a market consensus: "When Bitcoin rises, altcoins will eventually rise even more."

However, not every market cycle strictly follows this pattern, and the intensity and timing of altcoin movements also vary greatly.

Therefore, those who believe that "the surge in altcoins is inevitable" actually deserve a deeper discussion. After analyzing past market cycles, we will combine on-chain data to assess the true state of the current market and look for signals that may indicate the arrival of the altcoin season.

Is the altcoin season really just around the corner, or is this time different?

Looking back at past altcoin seasons

The 2017 boom

During the 2017 bull run, small-cap coins saw massive gains, often rising by hundreds of percentage points in a short period of time, following Bitcoin’s surge. This was largely driven by the initial coin offering (ICO) frenzy and a flood of new market participants looking to make a fortune on the next big coin.

Key drivers: Early ICO hype and rapid user growth.

Data point example: Litecoin’s daily active addresses (DAA) climbed from about 10,000 to about 440,000 in a year, highlighting how speculation can affect user adoption.

2021 DeFi and NFT Craze

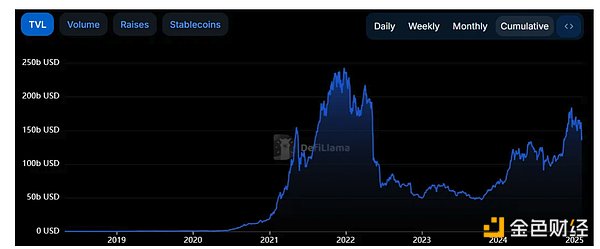

In 2021, decentralized finance (DeFi) and non-fungible tokens (NFTs) took center stage. Retail and institutional investors alike sought yield in DeFi protocols and traded NFTs in hopes of a quick profit.

Key Drivers: Growing demand for on-chain yields and speculation in new digital assets.

Sample Data Points: The total value locked (TVL) in DeFi has expanded dramatically—from about $600 million in 2020 to more than $300 billion at its peak in 2022.

Current Situation: Altcoins Underperform

Following these explosive times, many expected another altcoin season in the current cycle - but the results so far have been mixed.

Challenges in a New Cycle: Many altcoins are struggling to recover or surpass their previous all-time highs.

Market Cap Distribution: Bitcoin remains dominant, accounting for more than 60% of the total cryptocurrency market cap. Despite occasional signs of a potential turnaround, altcoin dominance has generally been trending downward since 2023.

Potential factors leading to poor performance of altcoins

1. Lack of practical applications: Many altcoins cannot provide real real-world value. Although some DeFi protocols have potential, a large number of small projects and meme coins contribute very limited value.

2.ETF and institutional capital flows: Bitcoin spot ETF has attracted a large amount of new funds to BTC, making the altcoin market marginalized and difficult to obtain the same capital support.

3. Macroeconomic environment: Rising global inflation and economic instability have strengthened Bitcoin's "safe haven asset" narrative, but at the same time tightened investors' capital investment in high-risk speculative assets (such as small-cap altcoins).

Key on-chain indicators

Although there has not yet been a large-scale altcoin season, based on historical data, completely ignoring altcoins may not be wise. Here are a few important indicators worth paying attention to:

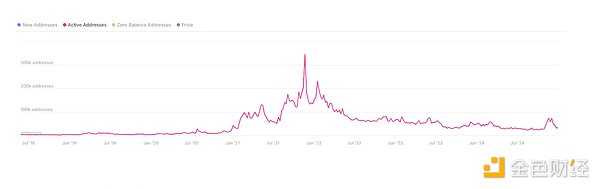

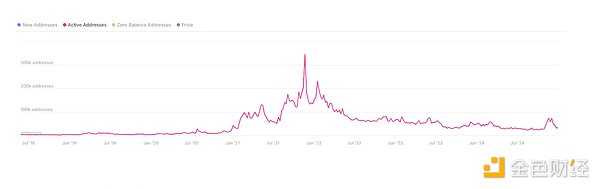

Daily Active Addresses (DAA)

Function:Reflects the participation of real users.

Current Trend: Ethereum's DAA is about 700k/day, not far from the peak of 820k/day in 2021.

Activity for most altcoins is still well below their all-time highs, some examples are as follows:

Cardano (ADA): 34,000 vs. 345,000 in 2021

Chainlink: 9.4k vs. 14.6k

Shiba Inu: 5.4k vs. 60k

TRON: 2.4m vs. 2.1m (slight increase)

If the number of daily active addresses for multiple altcoins continues to grow, this may be an early signal of rising market interest.

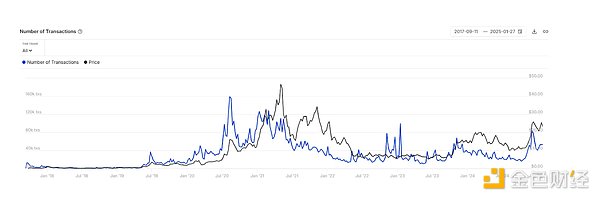

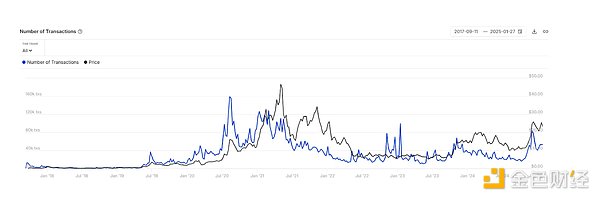

Transactions & Volume

Purpose: Shows how active users are in trading and the settlement volume of each blockchain. The large increase in trading volume and especially medium-sized transactions indicate strong retail interest.

Current Trend: Similar to DAA, trading volume has not yet reached historical highs for the entire market. However, in past bull markets, retail-driven bursts in these metrics have often preceded the market’s eventual top.

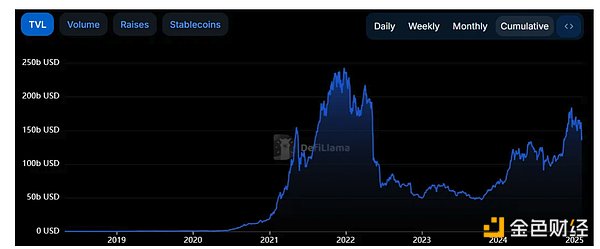

Total Value Locked (TVL) in DeFi

Purpose: Measures capital flowing into decentralized applications — likely a leading indicator of altcoin demand.

Current Trend: Overall multi-chain TVL is ~$141 billion, above bear market lows but still well below 2021 peak of ~$240 billion.

Market is more mature - lending and staking use cases in DeFi are seeing real adoption. However, for another explosive season of altcoins, TVL may need to climb higher to reflect the retail frenzy of past cycles.

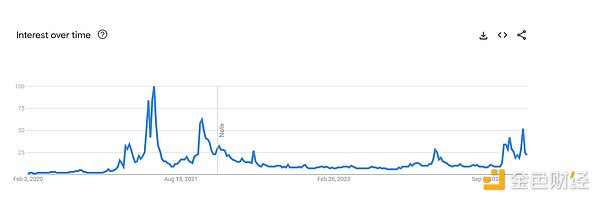

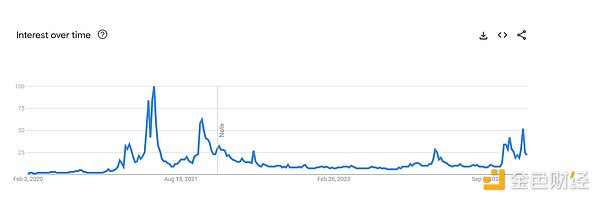

Search data

Purpose: Measures broader mainstream attention without considering on-chain data.

Current Trends: Google keywords related to retail attention for cryptocurrencies, such as “buy crypto” or “binance,” have seen modest growth this year, but are only around 50% of their 2021 peak. This suggests that the decline in on-chain activity may be due in part to a general decline in public interest.

Is Alt Season Coming?

Altcoin seasons are often driven by a perfect storm: a rise in Bitcoin prices, a surge in new market participants, and a compelling story that attracts mainstream attention. Several factors are currently delaying a broad altcoin rally, including macroeconomic uncertainty, concerns about Bitcoin ETFs, and a more selective investment environment.

The current conclusion is: while individual opportunities exist (e.g. memecoins or certain Solana projects), a broad altcoin boom doesn’t seem to be coming soon without a decisive shift in macro conditions and investor sentiment.

What to look out for when confirming:

On-chain data (DAA, transaction volume) is generally up across multiple altcoins.

TVL has increased significantly, indicating growing capital commitment.

Surges in social metrics, such as Google Trends or social media engagement, transcend isolated tokens or niche sectors.

Long-term: Altcoins remain the driving force of innovation in the cryptocurrency space. As protocols evolve and real-world use cases grow, altcoins have the potential to generate renewed interest—perhaps with more deliberateness and utility than in previous cycles. Builders continue to develop, and if broader conditions stabilize, another altcoin season could emerge, although its timeline and characteristics may not match past patterns.

Hui Xin

Hui Xin