Author: Gregory Mall, Head of Investment Solutions at AMINA Bank, CoinDesk; Compiled by: Deng Tong, Golden Finance

In the main After the cryptocurrency's massive rally led by Bitcoin, it's fair to say that the approval of a Bitcoin spot ETF in the United States in January was a game-changer. Since January 10, the total cryptocurrency market capitalization has surged from $1.5 trillion to $2.4 trillion, a 60% increase. Still, cryptocurrencies are an emerging niche asset class — only a fraction of the size of gold (10%) and smaller than Microsoft ($3.1 trillion).

Many opponents predict that ETF approval will be a classic "buy the rumor, sell the fact" situation. However, that couldn't be further from the truth considering the massive price increase.

The most pressing question now is: What is the future direction of cryptocurrency?

ETFs and Supply and Demand Imbalances

U.S. ETFs alone attracted approximately $19 billion in inflows. Including all ETPs, the year-to-date numbers are significantly higher. The Blackrock IBIT ETF is the fastest ETF to reach $10 billion in assets. In just two months since 2020, the ETF has accumulated more Bitcoin than Microstrategy.

These large inflows create an imbalance between supply and demand, thereby increasing the prices of related assets. Bitcoin ETFs in the United States alone account for around 4% of all Bitcoin in circulation. Add to this the fact that approximately 29% of the Bitcoin supply has not been touched for more than five years, or may be gone forever, and these ETFs now represent a significant source of demand.

Once the Bitcoin halving occurs in mid-April, current supply and demand Dynamics may intensify. Just like pre-announced corporate actions in the traditional world, the event should not have any price impact. However, if past experience is any guide, the halving cycle has become a psychological catalyst for price increases, triggering a rally not only in Bitcoin but also in the altcoin market.

“Cryptocurrencies are solutions looking for problems”

Most of the inflows into ETFs Funding comes from institutional investors, while retail investors prefer to purchase tokens directly. This may be a key reason why this rebound is still sustainable. Unlike retail investors, institutional investors tend to have longer investment horizons and are less likely to sell all of their ETF holdings during a market correction. While they do systematic rebalancing from time to time, they are less susceptible to day-to-day fluctuations than retail investors.

In this sense, the arrival of institutions may reduce the volatility of the asset class overall, making the Asset classes are becoming more integrated into the traditional financial system. It’s still a slow and gradual process, and while a Bitcoin ETF is certainly a catalyst, it won’t be enough to make the entire asset class mainstream.

Although the crypto ecosystem is rich in applications, including use cases for payments, settlement, market making, lending, gaming, metaverse, logistics, art, copyright enforcement, etc., it seems that the majority of use cases are still either The early stages are still focused on niche target groups. In order for cryptocurrencies to become mainstream, more real-world uses need to emerge that not only impact tech-savvy problems or user groups, but also provide tangible innovations in our daily lives.

Where are we in the cycle and how can we participate?

Looking at Google Trends, search results for terms like “cryptocurrency” or “Bitcoin” have increased in recent weeks, but There is still a long way to go from the peak of the last bull market in 2021. Furthermore, the recent rally has been dominated by Bitcoin and Ethereum. Altcoins are yet to have their moment of glorywith most trading at a fraction of their November 2021 all-time highs. Bitcoin dominance still hovers around 50%. Generally speaking, altcoins tend to outperform Bitcoin and Ethereum in the later stages of the cycle. There still seems to be some room for this rebound given favorable macroeconomic conditions.

Figure 1 – Bitcoin dominance and halving

From a risk/reward perspective, cryptocurrencies appear to be comparable to early-stage venture capital Compare. Given that there are over 9,000 cryptocurrencies in the world, it’s safe to assume that relatively few of them will have a profound economic impact on our daily lives, justifying long-term investment.

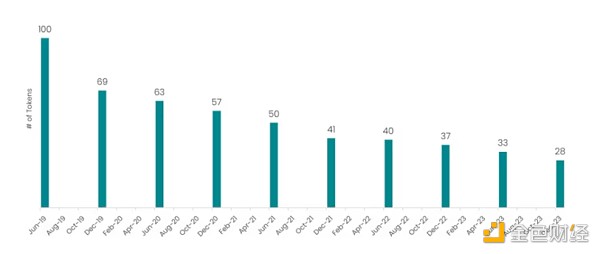

In Figure 1, we show how many of the top 100 coins in June 2019 have maintained their position on the leaderboard over time. These figures are sobering. In a similar way, the dot-com bubble showed how difficult it is to pick winners. Who would have thought that Amazon and Google would become the dominant companies in their industry by the late 1990s?

Figure 2 – How many of the top 100 coins in June 2019 have remained in the top 100 over time?

Avoid excessive concentration of stakes One way to be aware of and avoid chasing short-sighted trends is to invest over the long term in a broadly diversified buy-and-hold index. After spending a lot of time on index design, we can see that a combination of quantitative and qualitative inclusion criteria, coupled with a smart-beta weighting approach, provides the best results throughout the market cycle.

Similarly, not many growth stock pickers have outperformed the Nasdaq since the late 1990s, and it’s hard to imagine that individual token pickers will be able to outperform the Nasdaq over the long term. A discretionary market timer will exceed a strictly designed index.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Beincrypto

Beincrypto Beincrypto

Beincrypto Bitcoinworld

Bitcoinworld cryptopotato

cryptopotato Beincrypto

Beincrypto

Finbold

Finbold Ftftx

Ftftx Cointelegraph

Cointelegraph