Shibarium Soars Past 411M Transactions, Forges Key K9 Finance Partnership

SHIB's surges past 411M txs while linking with K9 Finance amid token volatility.

Alex

Alex

●In April 2025, the Trump administration announced the launch of the "reciprocal tariff" policy, imposing a uniform "minimum benchmark tariff" of 10% on global trading partners, which triggered a sharp shock in global risk assets.

●Bitcoin is a public chain that mainly adopts the PoW (proof of work) mechanism. The PoW mechanism relies on physical mining machines for mining. Mining machines are not on the US tariff exemption list, so mining companies face greater cost pressure.

●The decline of mining machine manufacturers in the past month is the most obvious. The core reason is that mining machine manufacturing has suffered from tariff policies on both the supply side and the demand side.

●Self-operated mining farms are mainly affected by the supply side, and the business process of selling Bitcoin to cryptocurrency exchanges is less affected by tariff policies.

● Cloud computing power mining farms are relatively least affected by tariff policies because the essence of cloud computing power is to pass on the cost of purchasing mining machines to customers through computing power service fees, so the erosion of platform profits is significantly weaker than the traditional mining model.

● Although the tariff policy has hit the US Bitcoin mining industry, Bitcoin spot ETF funds represented by BlackRock IBIT and US stock hoarding companies represented by MicroStrategy still have the pricing power of Bitcoin.

● Bitcoin price is no longer the only indicator. Policy trends, geopolitical security, energy scheduling, and manufacturing stability are the real keys to the survival of the mining industry.

Keywords: Gate Research, tariffs, Bitcoin, Bitcoin mining

On April 2, the Trump administration announced the launch of the "reciprocal tariff" policy, imposing a uniform "minimum benchmark tariff" of 10% on global trading partners, and imposing "personalized" high tariffs on countries with significant trade deficits. The policy triggered a sharp shock in global risk assets, with both the S&P 500 and Nasdaq recording their largest single-day declines since March 2020; assets in the cryptocurrency industry also shrunk significantly. Since Trump announced the tariff policy, China has announced an 84% retaliatory tariff on the United States, the European Union has imposed a 25% tariff on 21 billion euros of US goods, and the total market value of global stock markets has evaporated by more than $10 trillion in a single week.

On April 9, the tariff policy reversed, and Trump announced a 90-day suspension of additional tariffs on 75 countries except China. The EU also suspended additional tariffs and started negotiations with the US. On the same day, the S&P 500 rose 9.51%, the Nasdaq rose 12.02%, the price of Bitcoin rebounded 8.19% to $82,500, and the price of Ethereum rebounded to $1,650.

Among the many tracks of crypto assets, Bitcoin mining has become one of the on-chain economic modules most directly affected by the tariff policy due to its strong dependence on hardware equipment, wide global supply chain span, and high capital intensity. The global trade frictions caused by the US reciprocal tariffs have multiple impacts on the crypto mining industry. Since most of the world's Bitcoin mining machines are manufactured in China, the Sino-US tariff war will push up the import cost of mining machines. China's export tax rate to the United States has risen to 145%, which will reduce the expansion plan of North American mines. The depreciation of the RMB has increased the pressure on Chinese mining companies' dollar debts. Coupled with the fluctuations in electricity and energy prices, operating costs continue to rise. At the same time, the fluctuation of the currency price has also affected the miners' income. The price of Bitcoin has retreated from US$82,500 before the tariff announcement to below US$75,000.

At the macro level, the Federal Reserve's concerns about stagflation and risk aversion are superimposed. The high yield of 10-year US Treasury bonds has suppressed risk appetite, the financing environment has tightened, and the stock prices of mining companies have fallen simultaneously with the technology sector. Against the background of geopolitical tensions, the global mining layout is facing reconstruction, and companies may accelerate their transfer to tariff-friendly regions such as Southeast Asia and the Middle East. In the short term, policy uncertainty will continue to amplify the risks of Bitcoin mining, and the industry may enter a new round of reshuffle.

Bitcoin is a public chain that mainly adopts the PoW (proof of work) mechanism, and it is also the crypto asset with the highest market value. It is widely regarded as "digital gold". Since the PoW mechanism relies on physical mining machines for mining, and mining machines and their upstream key components such as semiconductors are not on the tariff exemption list, related mining companies are facing greater cost pressure. The upstream impact brought by the tariff policy may indirectly affect the medium- and long-term trend of Bitcoin prices through the cost transmission mechanism.

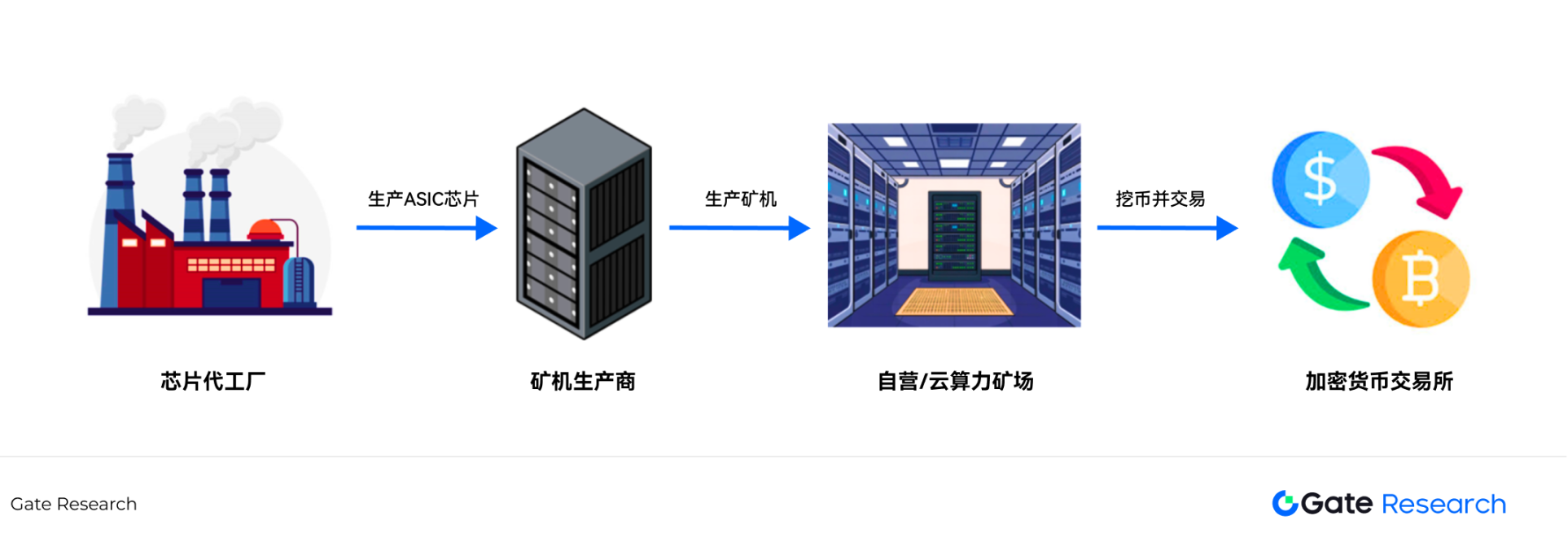

The main ecology of Bitcoin mining includes mining machines, self-operated mining farms, and cloud computing mining farms. Mining machine companies include Bitmain, Canaan Technology (NASDAQ: CAN), BitMicro, and Ebang International (NASDAQ: EBON). The main factories of several companies are all located in mainland China. Among them, Bitmain occupies a major share of the mining machine market (its market share exceeded 70% in the 2018 prospectus).

Self-operated mining companies include Marathon Digital (NASDAQ: MARA), Riot Platform (NASDAQ: RIOT), Cleanspark (NASDAQ:CLSK) and many other companies. The headquarters of self-operated mining companies listed on NASDAQ are all located in the United States, but their mining farms are distributed in many countries such as the United States, the United Arab Emirates, and Paraguay. Marathon currently has the world's largest mining farm, with a total computing power of more than 54EH/s, accounting for about 6% of the current total network computing power.

The main companies in cloud computing mining farms include Ant Pool, Bitdeer (NASDAQ: BTDR), BitFufu (NASDAQ: BFBF), Ecos and other companies. Unlike self-operated mining farms, cloud computing power mining farms transfer part of the risk of Bitcoin price fluctuations to customers by selling the computing power required for mining to individual or institutional customers in packages. The platform itself focuses on the site selection, construction and daily operation of the mining farm. Bitdeer has some self-operated mining farms and some cloud computing power mining farm businesses. BitFufu only has cloud computing power business.

Affected by Trump's tariff policy, the stock prices of Bitcoin mining-related companies have fallen. Their declines have exceeded the Nasdaq 100 Index. Through Yahoo's yfinance database, the author captured the closing prices of 8 Bitcoin mining-related companies in the past month, as well as the NASDAQ 100 Index as a reference standard. When Trump announced the tariff policy on April 2, the stock prices of Bitcoin mining-related companies all fell sharply. After Trump announced on April 9 that the tariff policy would be postponed for 90 days, the stock prices of Bitcoin mining-related companies rebounded significantly.

After the data is standardized, since the tariff policy was issued on April 2, mining machines have been the sector with the most obvious decline in the Bitcoin mining industry, with Canaan Technology falling by more than 17% and Ebang International falling by more than 11%. The second largest sector is the self-operated mining farm sector, with Core Scientific leading the decline, with a drop of more than 10% in the past month; Marathon's drop is only 0.8%, the lowest in the sector. Finally, cloud computing power mining farms are less affected by this, with BitFufu only falling by 5.9%. The NASDAQ100 index, which serves as a reference standard, fell 2.2%.

Table 1: Performance of Bitcoin mining companies and the NASDAQ 100 Index (NDX) in the past month

After Trump announced the tariff policy, Bitcoin mining-related companies all fell to varying degrees, but as mentioned above, the stock price performance of each sub-sector also showed a certain degree of differentiation. The core reason is that each link in the Bitcoin mining supply chain is subject to different levels of tariffs.

Figure 1: Bitcoin mining core supply chain

From the perspective of stock price performance, the decline of mining machine manufacturers in the past month is the most obvious. The core reason is that mining machine manufacturing has suffered from tariff policies on both the supply side and the demand side. The upstream of mining machine production is TSMC, Samsung, SMIC and other foundries. The mining machine company first completes the IC design of the ASIC chip independently, and then delivers the drawings to the foundry for tape-out. After the tape-out is successful, the foundry will mass-produce the ASIC chip, and the mining machine company will get the chip and package it into a mining machine.

TSMC occupies 64.9% of the market share in the field of chip foundry [1]. The Trump administration requires TSMC to build a factory in the United States, otherwise it will impose more than 100% tariffs on it [2]. Foundries such as SMIC, Hua Hong Semiconductor, and Samsung are also under pressure from the high tariffs of the United States. Foundries have only two choices: paying tariffs or reducing orders from the United States. Either way, the profits of the foundries will decline. This part of the pressure may be transferred to downstream mining machine manufacturers, forcing manufacturers to pay higher prices to increase the gross profit margin of foundry orders.

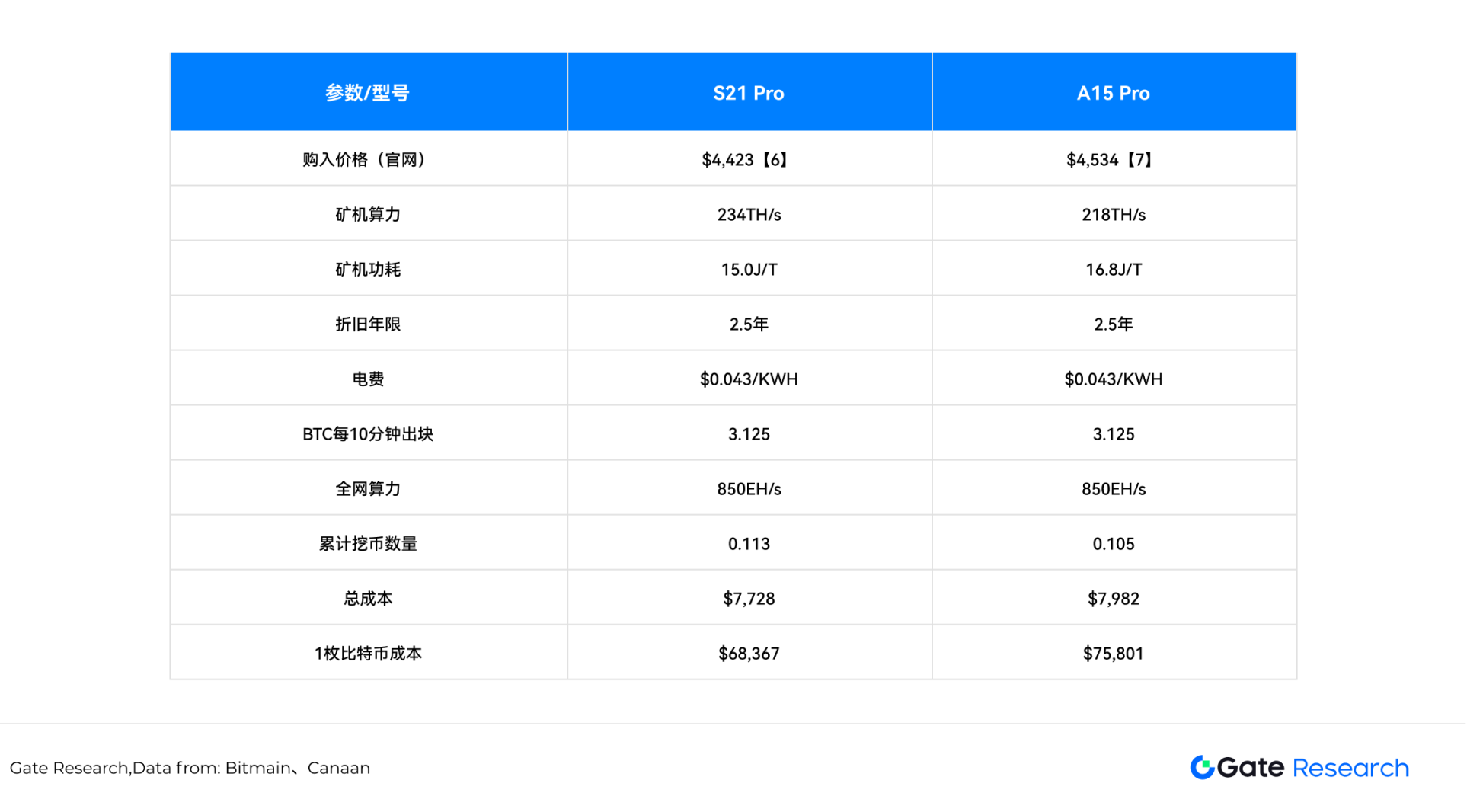

From the demand side, since Bitmain, Canaan Technology, MicroBT and other companies are all registered in China, American mining farms such as Marathon, Riot, and Cleanspark have to bear high tariffs and pay higher costs when purchasing mining machines. Therefore, in the short term, the orders for mining machines will shrink significantly. Take Bitmain's main model Ant S21 Pro and Canaan Technology's main model Avalon A15 Pro as examples. Before the tariff policy is implemented, without considering operating costs, assuming that the electricity price cost is $0.043/KWH (Cleanspark's electricity price cost in 2024) [3], the total network computing power is 850EH/s [4], and the depreciation period of the mining machine is 30 months [5]. At present, the cost of mining one bitcoin for S21 Pro is $68,367, and the cost of mining one bitcoin for A15 Pro is $75,801.

Table 2: Parameters of mainstream mining machines in Bitcoin mining

Note 1: The main calculation formula is as follows:

Cumulative number of coins mined = mining machine computing power × 60 × 24 × 365 × depreciation period × block reward / 10 / total network computing power / 1000,000

Total cost = mining machine price + Mining machine computing power × mining machine power consumption × electricity cost × 24 × 365 / 1,000 (excluding personnel and site rental costs)

Mining cost = total cost / cumulative number of coins mined

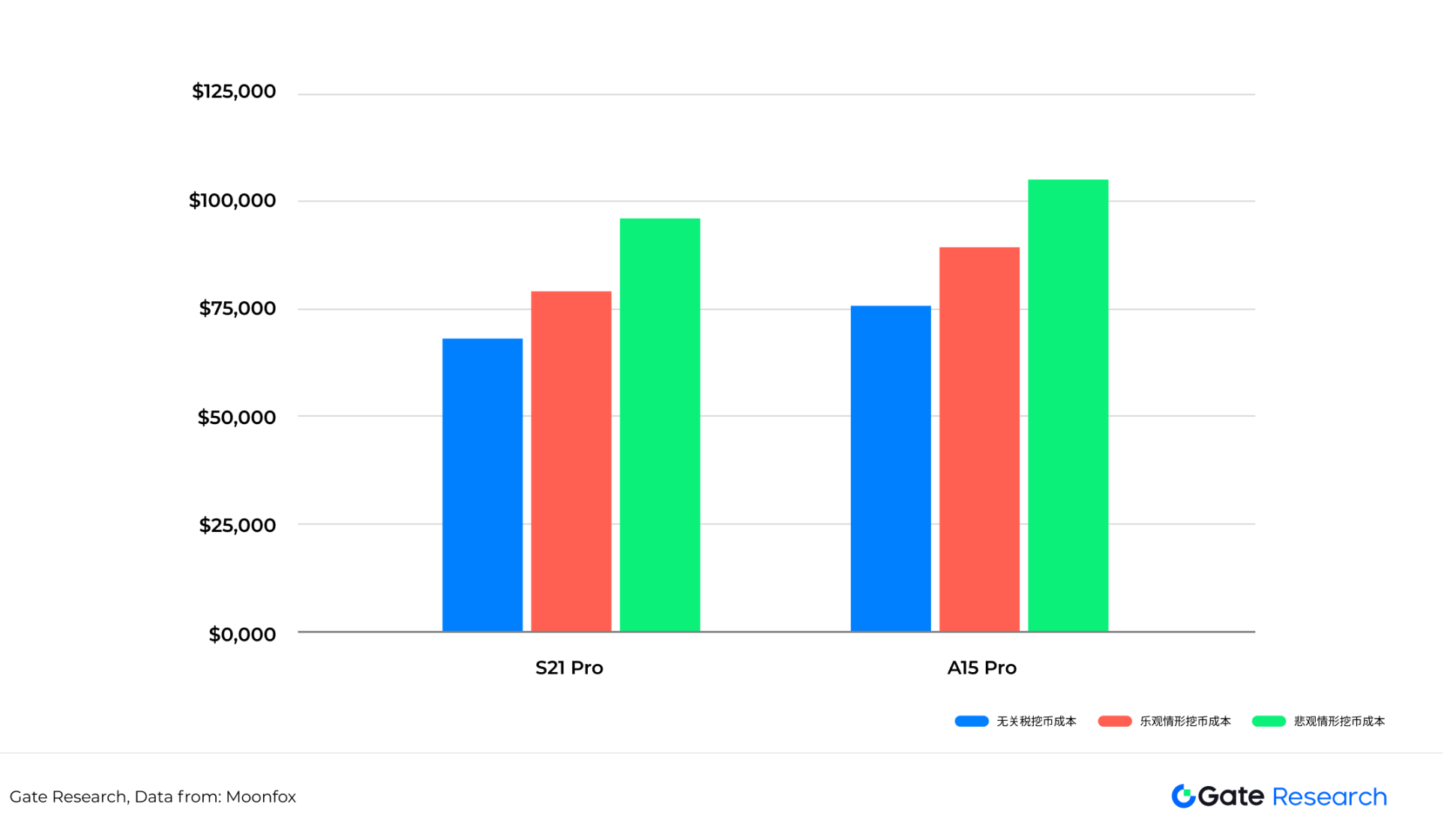

Once the tariff policy is implemented, in the optimistic scenario, the price of exported mining machines will increase by 30% on the original basis, then the cost of mining 1 Bitcoin for S21 Pro will be $80,105, and the cost of mining 1 Bitcoin for A15 Pro will be $88,717. In the pessimistic scenario, the price of exported mining machines will increase by 70% on the original basis, then the cost of mining 1 Bitcoin for S21 Pro will be $95,756, and the cost of mining 1 Bitcoin for A15 Pro will be $105,938.

Table 3: Mining costs of mining machines under different tariff scenarios

The above prices have not yet taken into account the complex operating costs of the mines, which include site rental costs and personnel costs. If these costs are included, the mining costs will rise further. A substantial increase in tariffs will make the mines bear higher mining costs, and the weakening of demand will also have a significant impact on upstream mining machine manufacturers.

From a long-term perspective, mining machine manufacturers may give priority to considering tariff-friendly regions for capacity layout, and through global capacity allocation strategies, effectively avoid potential tariff policy risks and achieve supply chain cost optimization.

Compared with mining machine manufacturers being squeezed by both supply and demand, self-operated mining farms are mainly affected by the supply side, and the business process of selling Bitcoin to cryptocurrency exchanges is less affected by tariff policies. The price of Bitcoin is affected by tariff policies, and funds hate uncertain policies, so short-term funds choose to flow out, and Bitcoin has fallen significantly. However, self-operated mining farms represented by Marathon will choose a hoarding strategy when cash flow is sufficient, rather than selling Bitcoin on exchanges immediately after it is mined. Similar to MicroStrategy's debt-buying strategy, Marathon has issued convertible bonds many times to directly purchase Bitcoin. Therefore, large mining farms are relatively less affected by the decline in Bitcoin prices. 【8】【9】【10】【11】

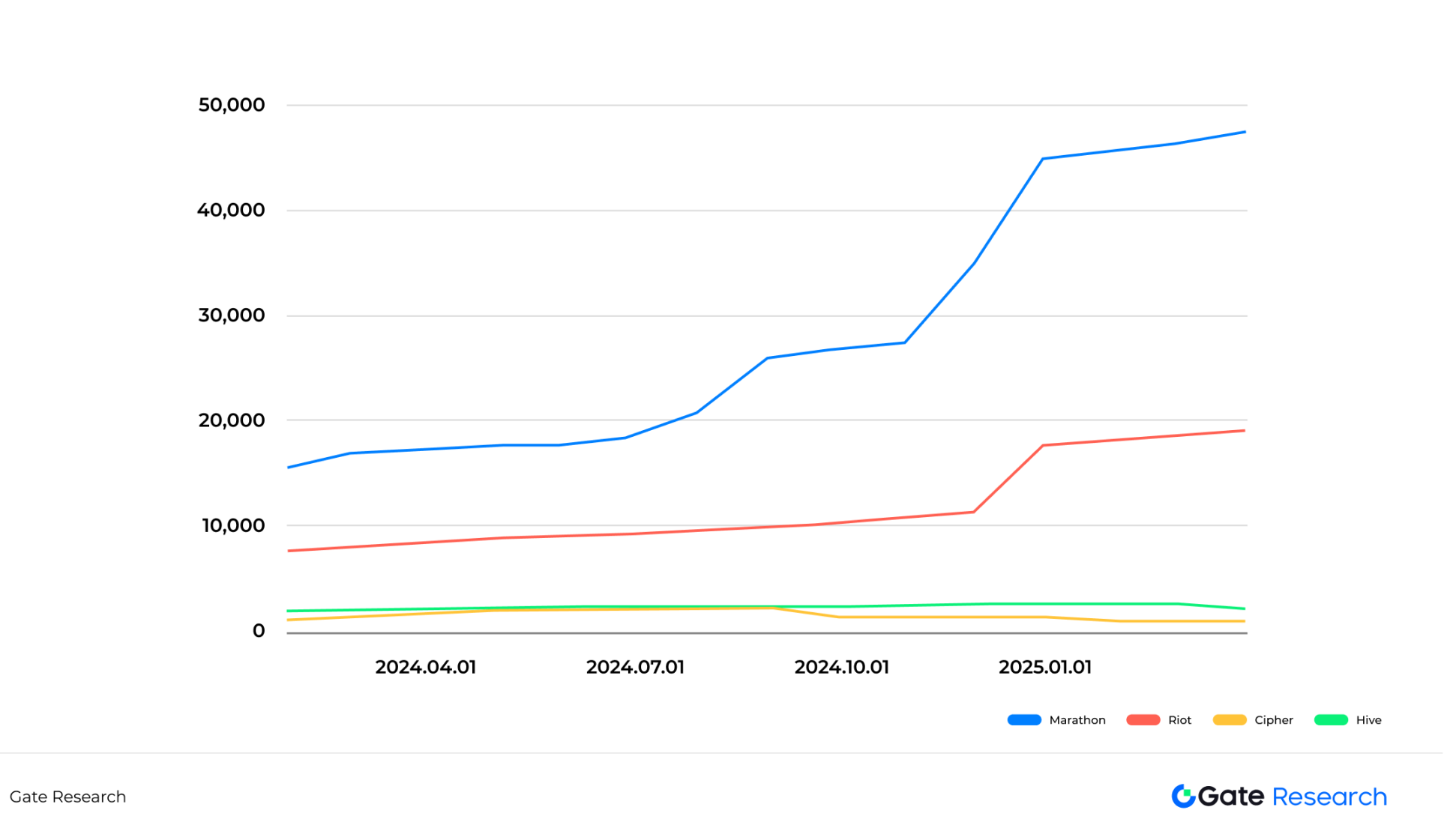

For small mining farms with tight cash flow, the decline in Bitcoin prices has a particularly significant impact on their stock prices. Due to limited funds, these mining farms are usually unable to hold the mined Bitcoins for a long time and can only sell them immediately after mining to maintain operating funds. During market downturns, this "mine and sell" strategy may exacerbate market selling pressure and further affect Bitcoin price trends. As shown in the figure below, Cipher and Hive held 1,034 and 2,201 Bitcoins in March 2025, down 40% and 3% year-on-year respectively; while Marathon and Riot held 47,531 and 19,223 Bitcoins in March 2025, up 173% and 126% year-on-year respectively.

Table 4: Changes in the number of coins held by self-operated mining companies (January 2024 to March 2025)

In the past month, the share prices of small and medium-sized self-operated mining farms Cipher and Hive Digital have risen and fallen by -7.1% and -5.5% respectively since the announcement of the tariff policy. The decline in share prices is significantly greater than that of large mining farms such as Marthon that insist on hoarding coins.

However, in the long run, the depreciation cycle of mining equipment is usually 2.5 to 3 years, which means that self-operated mines need to continue capital expenditures (CAPEX) to purchase new mining machines to replace old equipment. Although the statistical calibers adopted by various mining companies when disclosing computing power data are different (such as average monthly computing power, power-on computing power, and computing power at the end of the month), it is difficult to directly compare the computing power indicators of different companies horizontally. From January 2024 to March 2025, the computing power data disclosed by mainstream listed mining companies showed that their computing power growth rate generally exceeded 70%. The core driver of the continued growth of computing power lies in "relative competitiveness": in the context of the continuous increase in the computing power of the entire network, if the computing power of the mine itself does not increase accordingly, the number of bitcoins it can mine will continue to decline. Bitcoin mining is a dynamic game. The expansion of computing power is like sailing against the current. If you don't advance, you will retreat.

Against this background, if the tariff policy on mining machines is officially implemented, the cost increase pressure of upstream mining machine manufacturers will inevitably be transmitted to downstream mining farms, further pushing up the marginal production cost of the industry and posing a challenge to the profitability of medium-sized mining farms.

Cloud computing power mining farms are essentially a leasing model, with mining machine manufacturers as the upstream and individual and institutional customers as the downstream. Cloud computing power mining farms do not hold or sell coins, but package and sell 30-day, 60-day, and 90-day computing power to customers, who will choose to hoard or sell coins based on their own judgment. Therefore, cloud computing power mining farms mainly earn service fees paid by customers, and do not directly bear the profits or losses brought about by the rise and fall of Bitcoin.

The core competitiveness of cloud computing power mining farms lies in reducing rental, electricity and labor costs through site optimization, while maintaining a high degree of flexibility in computing power deployment to cope with market fluctuations - in a bull market, mining machines and sites need to be quickly expanded to meet customer needs, and in a bear market, operations need to be streamlined and redundant computing power needs to be converted to self-mining. This dynamic balance ability directly determines the company's market competitiveness.

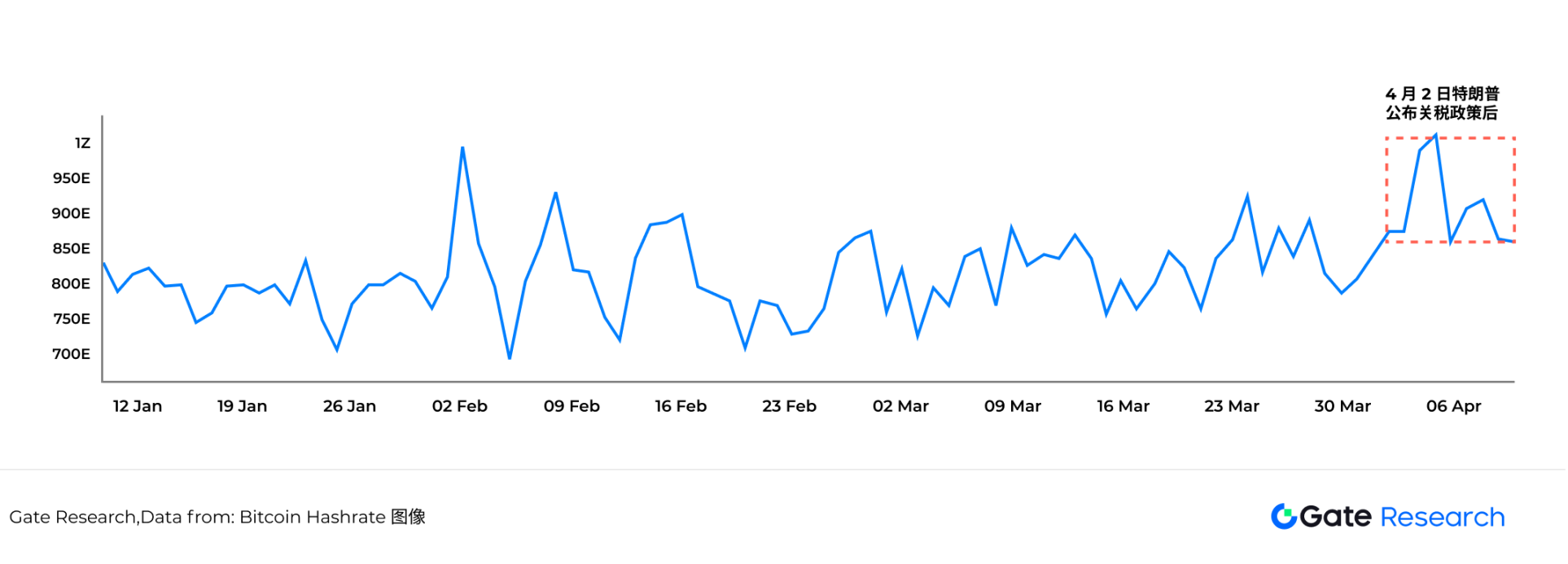

The income of cloud computing power companies is mainly driven by the computing power of the entire network. When the computing power of the entire network increases, it proves that most miners are still optimistic about the future price of Bitcoin, or more customers choose to buy cloud computing power; when the computing power of the entire network decreases, it means that miners are not optimistic about the trend of Bitcoin prices, and the portion of cloud computing power in the computing power of the entire network will also decrease. The data in the figure below shows that after Trump announced the tariff policy on April 2, the average daily computing power of Bitcoin in the entire network even hit a record high on April 5, breaking through 1 ZH/s for the first time. 【12】

Figure 2: Changes in Bitcoin Network Computing Power (January 2025 to April 2025)

From the cost perspective, although the price of mining machines is under upward pressure due to the transmission of tariff policies, the leasing business model of cloud computing power mining farms naturally has a risk buffer mechanism - its essence is to pass on the purchase cost of mining machines to customers through computing power service fees, and some customers directly share the hardware investment through mining machine hosting agreements, making the erosion of platform profits by mining machine premiums significantly weaker than the traditional mining model. This cost-shifting and cost-sharing feature makes cloud computing mining farms a field that is less affected by the Trump administration's tariff policy.

The United States recently imposed tariffs on Bitcoin mining equipment imported from China and other countries, resulting in a significant increase in the operating costs of American miners. This provides greater potential opportunities for non-US companies to enter the Bitcoin mining industry, because they can purchase Chinese-made mining machines from other countries at a lower cost, thereby gaining cost advantages. Although US mining farms can circumvent some of the impact of tariffs by setting up operating bases overseas, it is undeniable that these tariff policies have increased the operating costs and policy risks of domestic US mining farms.

According to the above deduction, the daily output of Bitcoin is 450, and the miners who mine Bitcoin will be more dispersed, and the voice of US mining companies such as Marathon, Riot, and Cleanspark may decline. Since large mining companies such as Marathon have adopted a hoarding strategy in the past, and companies in other countries that are potential entrants into the mining industry are still unclear about their attitude towards holding Bitcoin, they may choose a "mine, withdraw and sell" strategy (withdraw Bitcoin immediately after mining and sell it on the exchange). From this perspective, the high tariff policy is generally negative for Bitcoin prices. The departure of some mining farms from the United States also violates Trump's original intention of ensuring that all remaining Bitcoins are "Made in the USA".

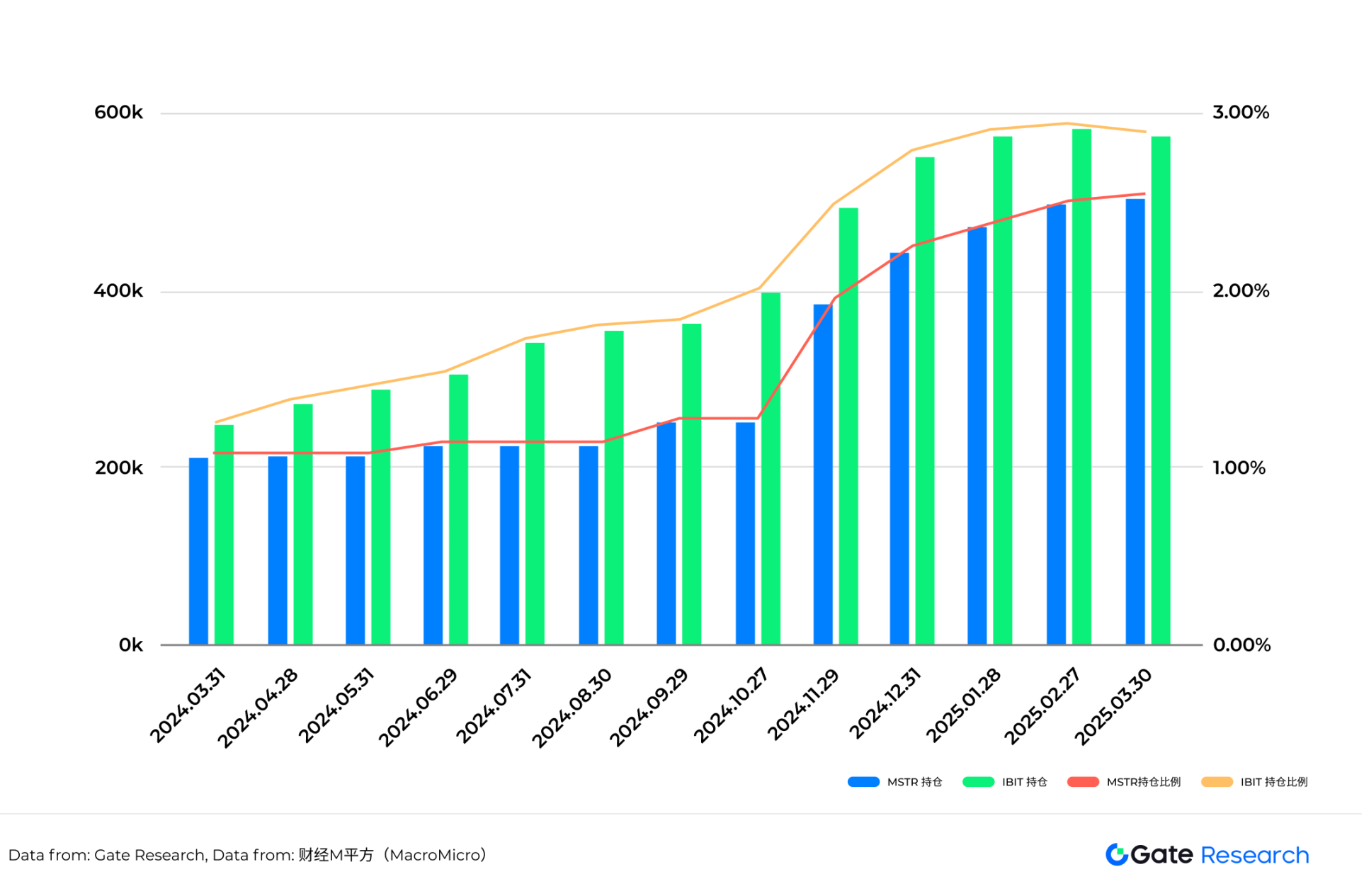

But in the long run, the core logic of Bitcoin has undergone a fundamental change in 2024. Bitcoin spot ETF funds represented by BlackRock IBIT and US stock hoarding companies represented by MicroStrategy still have the pricing power of Bitcoin. As of April 2025, IBIT holds 570,983 Bitcoins [13] and MicroStrategy holds 528,185 Bitcoins [14]. The proportion of Bitcoin held by both companies in the total circulation of Bitcoin continues to increase [15], and the purchasing power of both companies is sufficient to absorb the number of newly produced Bitcoins every day.

Table 5: Bitcoin holdings and proportions of MicroStrategy and IBIT

The Trump administration's promotion of the "reciprocal tariff" policy has posed a dual challenge to the upstream cost and geopolitical layout of the Bitcoin mining industry. Mining machine manufacturers are under the heaviest pressure due to the limited foundry chain and reduced demand. Self-operated mines are facing the double squeeze of cost increase and capital expenditure growth, while cloud computing mines rely on the "risk transfer" mechanism to have a relatively buffering capacity. Overall, the expansion of North American mining may be limited, and global computing power will be further dispersed to low-tariff regions such as Southeast Asia and the Middle East. The voice of American mining companies in the Bitcoin ecosystem may decline in stages.

Mining companies often have huge investments, long cycles, and weak risk resistance; the Bitcoin network itself cannot actively adjust these risks. Its mechanism is "openness, fairness, and competition" rather than "defense, response, and regulation." This has formed a structural contradiction: the world's most decentralized asset, and the industrial chain behind it, is one of the areas most vulnerable to centralized policy intervention. Therefore, mining participants must re-recognize the importance of policy. Bitcoin prices are no longer the only indicator. Policy trends, geo-security, energy scheduling, and manufacturing stability are the real keys to the survival of the mining industry.

In the short term, the rising mining costs and the "mining, withdrawing and selling" behavior of some miners may have a marginal negative impact on the price of Bitcoin; but in the medium and long term, institutional forces represented by BlackRock IBIT and MicroStrategy have become the dominant force in the market, and their continued buying power is expected to hedge supply pressure and stabilize the market structure. The Bitcoin mining industry is in a critical period of policy reshaping and structural transfer. Global investors need to pay close attention to the rebalancing of the industrial chain brought about by policy evolution and computing power migration.

SHIB's surges past 411M txs while linking with K9 Finance amid token volatility.

Alex

AlexSenators demand SEC rigorously vet crypto ETFs over transparency, manipulation concerns.

Miyuki

MiyukiCrypto upstart 5thScape woos XRP investors with 1,000% presale gains amid VR/AR pivot.

Alex

AlexMemecoin presale mania births overnight millionaires, fueling Solana's renaissance and polarizing debates.

Miyuki

MiyukiIMF demands crypto capital gains taxes in exchange for Pakistan bailout funding.

Weiliang

WeiliangBakkt stock jumps as leadership transition aims to capitalize on custody firm's turnaround.

Alex

AlexAvalanche memecoin Sender's implosion amid suspicious fund movements reignites exit scam fears.

Alex

AlexBlackRock's $100M tokenized Ethereum fund paves institutional DeFi path amid regulatory vetting.

Miyuki

MiyukiGenesis Global, a bankrupt crypto lender, agrees to a $21 million penalty tied to Gemini Earn, settling SEC charges of securities law violations.

Weiliang

WeiliangThe UK's FCA aims to recover $8 million for supervising stablecoins and crypto, part of a broader regulatory agenda.

Alex

Alex