Thoughts on Ethereum governance after the EIP-3074 incident

EIP-3074, Vitalik Buterin, Thoughts on Ethereum governance after the EIP-3074 incident Golden Finance, What role does Vitalik play in Ethereum governance?

JinseFinance

JinseFinance

Author: Flashbots Source: Flashbots Research Translation: Shan Ouba, Golden Finance

Wallets are the gateway to Web3 and an important portal for users to send and receive messages, manage funds, and interact with blockchain applications. As an important part of blockchain infrastructure, wallets have a significant impact on users' Web3 experience.

The wallet ecosystem is diverse, and providers offer a variety of products and services through different mechanisms. As wallet providers strive to achieve sustainability and diversification, their operating models are also evolving, creating new dynamics between users, applications, and the underlying blockchain infrastructure.

Our report aims to shed light on the current state of wallets on Ethereum based on research conducted by orderflow.art.

However, identifying wallets through on-chain transaction tracking faces several challenges:

Incomplete identification due to unknown routers or signing addresses.

It is difficult to identify multiple wallet addresses associated with centralized exchanges.

Some wallets lack router addresses, making identification difficult for users.

Despite these limitations, this report provides a comprehensive overview of the Ethereum wallet landscape, current trends, and future prospects.

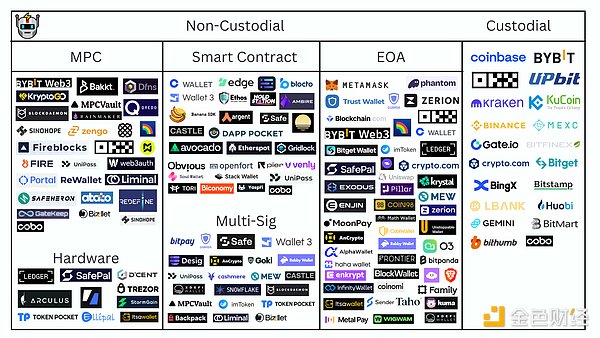

The report begins with a background section covering two key areas: wallet classification and order flow lifecycle. In the wallet classification, we classify Web3 wallets into custodial and non-custodial types and provide a detailed look at various forms of non-custodial wallets. The order flow lifecycle section outlines the journey of a transaction, identifying the key players from order flow originator to block builder.

Next, we explore current trends, focusing on recent developments affecting order flow originators (OFOs). We examine the impact of the increasing concentration of the block building market, which has increased competition for order flow. This section covers three key concepts: Payment for Order Flow (PFOF), Order Flow Auctions (OFA), and Private Order Flow (POF). In addition, we introduce Account Abstraction (AA), with a particular focus on ERC-4337, a major development that is reshaping the wallet landscape.

Finally, in Future Trends, we explore developments that aim to enhance user experience and address regulatory challenges in the wallet space. We examine pre-confirmations (pre-confs), a mechanism designed to increase transaction confirmation speed. We also analyze two Ethereum Improvement Proposals (EIPs) that aim to enhance account abstraction capabilities. In addition, we discuss Trusted Execution Environments (TEEs) and their role in improving the security and privacy of Web3 wallets. We consider how TEEs can be a potential compliance solution for the crypto industry, especially as the regulatory focus shifts from decentralization to control issues.

Wallets are the primary interface for users to interact with blockchain applications. While users often maintain multiple wallets (e.g., multiple MetaMask accounts), the process of migrating private keys to a new wallet provider is often cumbersome. This lack of user-friendly portability creates a “sticky” effect that often ties users to their existing wallet providers.

Increasing competition for order flow makes it even more important for wallet providers to acquire and retain users. This competitive landscape has led to an interesting development: decentralized finance (DeFi) applications such as Uniswap, 1inch, and Curve Finance are now creating their own wallets. This strategic move gives these DeFi platforms greater control over their users’ order flow, potentially capturing more value and providing a more integrated user experience.

This trend highlights the evolving relationship between users, wallets, and DeFi applications in the blockchain ecosystem. It highlights how the battle for order flow is reshaping the wallet landscape and influencing the strategies of major players in the DeFi space.

Web3 wallets are generally divided into custodial (controlled by a third party) and non-custodial (controlled by the user). Control refers to who holds the private key of the wallet.

Hosted wallets: Custodial wallets are mainly provided by cryptocurrency exchanges and Telegram robots. They save users' private keys and provide users with a better user experience. However, users do not have full control over their funds, and these third parties may be able to access the user's funds without the user's permission.

Non-custodial wallets: Users hold the private keys and have full control over non-custodial wallets. If the private keys are lost, the user will lose access to the wallet and funds. Hot wallets have private keys stored on an internet-connected device that interacts with the application. Cold wallets store private keys on dedicated, isolated hardware devices that do not interact with the application. Non-custodial "hot" wallets are connected to the internet and are typically accessed through a browser extension, mobile app, or desktop application. "Cold" wallets have no online access and assets are stored on a physical device.

There are different types of non-custodial wallets that use different technologies to improve user experience and security.

Multi-party computation (MPC) wallets use cryptography to encrypt, segment, and distribute private keys to multiple devices. These devices or parties must evaluate the computation without revealing their private keys or data. Multi-party computation protocols used in the context of MPC wallets typically have the following properties: Threshold security: Ensures that a predefined number of parties must cooperate to sign a transaction. Key fragmentation: The ability to split a private key into multiple shares. Distributed key generation: Generate keys in a distributed manner so that no single party knows the complete private key. The benefits of MPC wallets are: Security: Since no single person controls the private key, an attacker needs to attack multiple parties, increasing the security of the wallet.

Recoverability: By storing cryptographic key fragments in multiple places, authorized parties can recover accounts if keys are lost.

Accessibility: Because private key fragments are securely distributed among multiple parties, assets can be held online. Transactions can be performed more efficiently than hot wallets without compromising the security of keys.

Externally Owned Accounts (EOA) are managed by unique private keys controlled by users to interact with smart contracts on the chain.

EOA uses private Elliptic Curve Digital Signature Algorithm (ECDSA) keys to sign and verify digital transactions. Users can send and receive transactions, interact with smart contracts, and approve messages through EOA.

To create an EOA, the wallet UI generates a private key and a seed phrase. Since there is only one private key and seed phrase, if the user loses both, they will not be able to access their wallet.

Smart contract wallets, or smart wallets, leverage account abstraction and the programmability of smart contracts to improve the user experience. Smart contract wallets are not controlled by private keys, but by contract code. Account abstraction protocols like ERC-4337 can help smart contract wallets bypass the requirement for EOA wallets to initiate transactions. Smart contract wallets can be programmed to implement the following features:

Two-factor authentication

Account freezing

Flexible recovery

Transaction batching

Transfer and spending limits

Session keys

Gas sponsorship and non-native token Gas payment

Multi-signature wallets

Compared to EOA, smart contract wallets have lower gas overhead, which is mainly due to the execution of contract code and the publication of events. Smart contracts are inherently more complex and powerful than EOA, so only audited and battle-tested smart contract wallets are trustworthy.

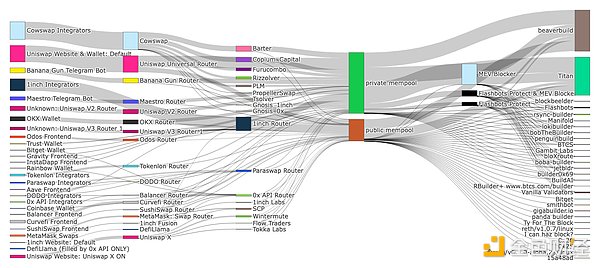

Orderflow.art illustrates the order flow status and identifies the known on-chain participants in the transaction lifecycle.

The lifecycle of a transaction starts with the on-chain frontend on the left side of the order flow Sankey diagram and ends with the block builder on the right side.

The key on-chain participants in the transaction life cycle are:

The Order Flow Originator (OFO) is the first on-chain application to interact with the wallet. OFO includes:

Wallet: The wallet is continually adding more features to improve the user experience, such as direct swaps.

Note: Figures 3, 4, and 5 only include known routers and underestimate the wallet's native swap transactions.

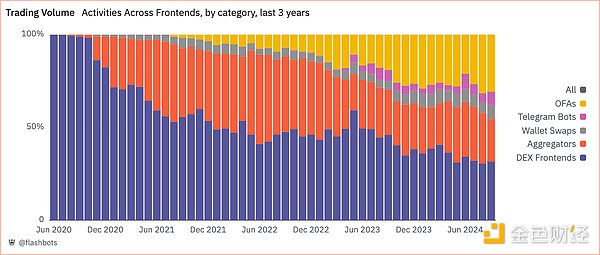

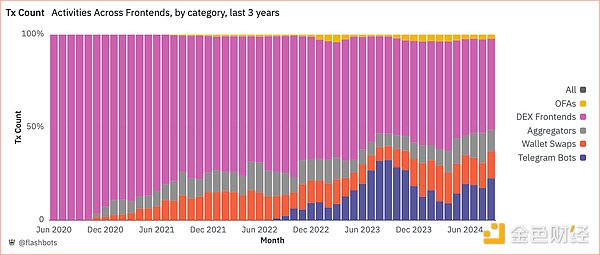

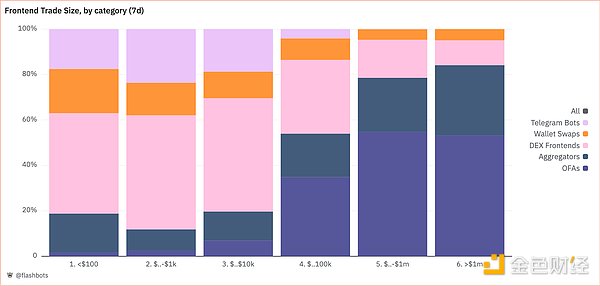

Frontends: Applications such as Uniswap have their own wallets and interfaces for users to create trades. DEX frontends are losing dominance in both transaction volume and market share by number of trades (Figures 3 and 4).

Telegram Bots: Banana Gun, Maestro, and Unibot have accounted for a large portion of retail transactions over the past year (Figure 4). Transaction sizes are typically less than $10,000 (Figure 5).

Aggregators: Aggregators are applications such as DefiLlama, Matcha, 0x API, and 1inch API that connect to multiple DEXs to unify decentralized liquidity. Trade count market share has remained relatively stable since 2023, while volume has declined slightly (Figures 3 and 4).

Order Flow Auctions: OFAs include solver batch auctions (e.g., CoWSwap), RFQ systems (e.g., Uniswap X), and execution auctions (e.g., MEV-Blocker). OFAs have been gaining volume market share at the expense of DEX frontends (Figure 3) and are generally used for larger trades (Figure 5).

Large trades or trades involving illiquid pairs are often routed to order flow auctions (OFAs) and aggregators to minimize slippage. These providers source liquidity from multiple decentralized exchanges (DEXs), off-chain sources, and proprietary inventories.

Market Makers: Trading entities that execute trades using off-chain liquidity and their own inventory. They provide liquidity to request-for-quote (RFQ) platforms like Hashflow and Uniswap X.

Solutions: Third-party entities that determine the best routing and pricing for trade executions. Solutions are used in OFAs like CoWSwap, and some provide direct user trade submissions through their own front-end interfaces.

CEX-DEX Seekers: These seekers leverage off-chain liquidity from centralized exchanges (CEXs) to capture on-chain arbitrage opportunities. They can leverage OFAs with private memory pools like MEV Share and MEV-Blocker.

Ethereum orders are submitted to public or private memory pools:

Public memory pool: transactions are visible to everyone, and searchers and OFAs can pick them up for packaging. All block builders can access these transactions for inclusion in blocks.

Private memory pool: transactions are only visible to selected parties, including specific searchers, OFAs, and builders.

Builders schedule and include transactions in blocks. If the transaction is included in the winning builder's block, the order's lifecycle is complete. If not included in the winning block, the transaction will remain in the memory pool until it is included in a future block or discarded.

The Ethereum landscape is currently showing several major trends that are reshaping the industry. The two major trends in Ethereum that affect order flow originators are 1) the centralization of the block builder market, and 2) the use of ERC-4337 to achieve account abstraction.

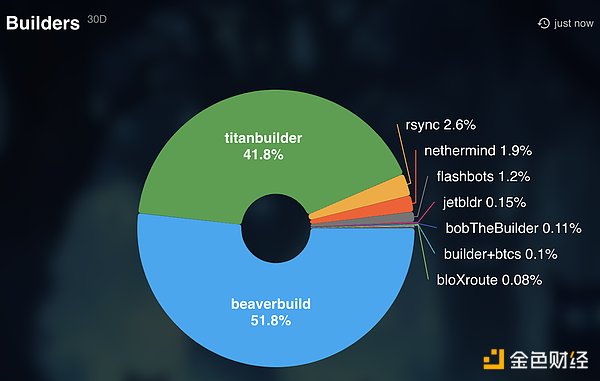

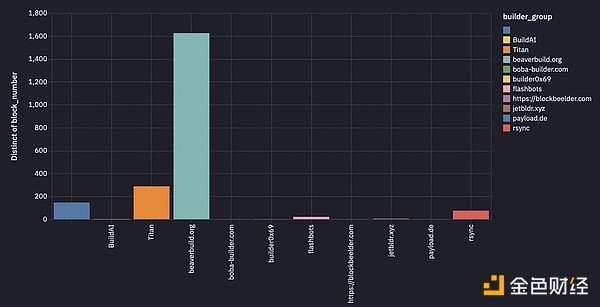

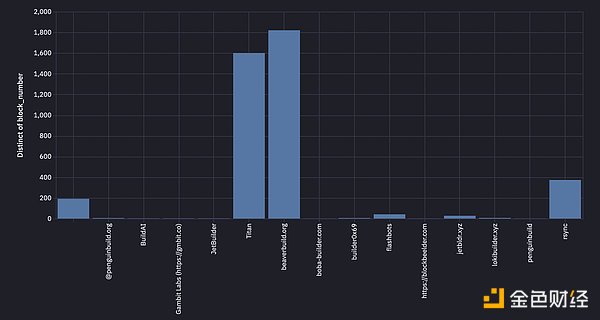

The Ethereum builder market is becoming increasingly concentrated, with two builders accounting for more than 90% of the block market.

This concentration has led to new dynamics in order flow:

Payment for Order Flow (PFOF)

Order Flow Auctions (OFA)

Private Order Flow

These mechanisms are changing the way trades are processed and prioritized, providing benefits such as MEV protection and improved price discovery, but also raising concerns about market fairness and decentralization

Payment for Order Flow (PFOF) is a traditional finance concept that originally market makers paid brokers for OTC order flow. Market makers viewed retail order flow as ignorant and harmless, and trading was highly profitable. As automated trading systems (ATS) expand, market makers use PFOF to attract retail order flow to their ATS.

Retail traders can benefit from PFOF in three ways:

A portion of the PFOF is used to cover retail traders’ execution costs.

Market makers will provide tighter quotes, enabling retail traders to execute trades at better prices

Market makers will be able to provide greater liquidity for odd lot orders.

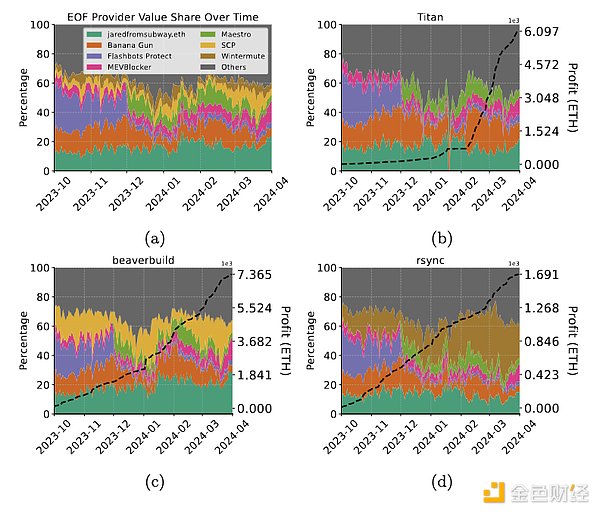

In Ethereum, PFOF has become an exclusive order flow (“EOF”) relationship between order flow originators (“OFOs”) and builders. EOFs bypass the public memory pool and account for up to 35% of the market share. Exclusive order flow enables builders to build blocks of higher value than competitors, who can only source transactions from the public memory pool or the Order Flow Auction (“OFA”). Since EOF requires execution guarantees, builders will multiplex OFO’s bundles to guarantee timely inclusion.

There are several reasons why order flow initiators leverage EOF relationships:

Block inclusion guarantees. By working with top builders, OFO increases the probability that its transactions will be included in the next built block.

User MEV protection. OFO can nearly eliminate the MEV of its transactions.

Priority gas fee rebates. OFO can get rebates for priority gas fees paid by users. Builders value high-quality trades, such as grabbing orders from Telegram bots, and are willing to pay more for this order flow.

Currently known EOF relationships:

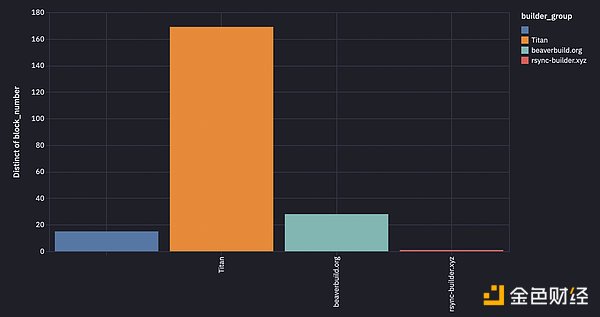

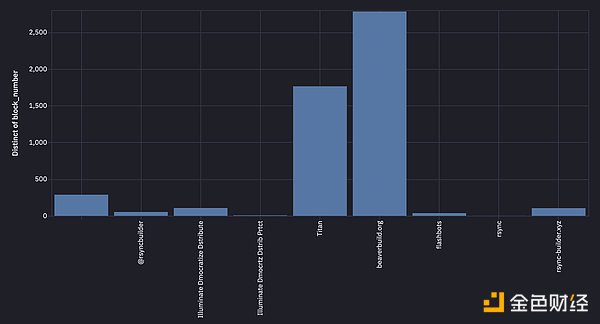

Banana Gun and Titan Builder

Master and Beaver

* EOF is approximated by order flow not seen by Flashbots or memory pool.

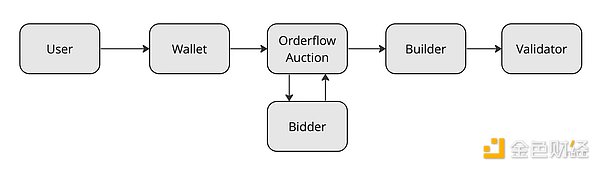

The Order Flow Auction (OFA) was created to protect user trades from negative MEV strategies such as front-running and mezzanine attacks. OFA provides many benefits to users, including:

Reduced transaction costs. OFA bundles transactions, thereby reducing gas fees and reducing execution errors.

MEV refunds. OFA can auction MEV buyback opportunities and return a portion of captured MEV to users.

Improved price discovery. Third-party solutions compete for the best execution price.

Enhanced liquidity. Third-party solutions can aggregate liquidity from a number of sources including DEXs, CEXs, and private inventories.

OFA aggregates swaps from multiple users and auctions them to third-party bidders for execution. OFA acts as an auctioneer and selects the winning bid based on predefined criteria. The winning bid is submitted to the block builders on-chain in a bundle to reach consensus.

OFAs come in multiple types:

Request for Quote (RFQ): RFQs leverage a system of pre-selected bidders, funds, and market makers, using on-chain and private inventories to submit bids. RFQs provide better liquidity than public automated market makers (AMMs) because RFQ market makers have access to other liquidity sources such as CEXs and cross-chain AMMs. Examples: UniswapX, Bebop, 1inch Fusion, Hashflow, 0xAPI

Frequent Batch Auctions: Frequent Batch Auctions enable third-party solutions to optimize price and liquidity while protecting transactions from MEV. Trades are bundled together, saving gas and increasing execution rates. Examples: CoWSwap, DFlow

Transaction Execution Auctions: Third-party bidders (particularly Seekers) extract MEV and compete for the highest user refund. This OFA is typically integrated with wallets directly via RPC. Examples: MEV-Blocker, Merkle

Blockspace Aggregator Auctions: Blockspace Aggregator Auctions return value to the original user via builder priority gas rebates. Builders compete to include transaction packages to increase the value of their blocks and will refund a portion of the priority gas paid for the transaction package. Example: Flashbots MEV Share

Private Order Flow (POF) is an order flow from vertically integrated order flow originators (wallets, applications, solvers, seekers) and builders. This flow is typically not multiplexed and sent to a single builder.

Top builders Beaver Build and Rsync integrate with proprietary trading firms SCP and Wintermute and benefit from internal CEX-DEX order flow. Integrated search builders have an advantage over regular builders because their searcher profits can be redistributed to builders, increasing their likelihood of submitting a winning block bid. Integrated search builders also benefit from latency savings when sending transactions from searchers to builders. This latency savings can be extended to block builder auctions.

(a) https://arxiv.org/pdf/2407.13931. EOF of Titan (b), Beaverbuild (c), and Rsync builder (d). Note that only Rsync can see Wintermute private order flow, and only Beaverbuild can see SCP private order flow.

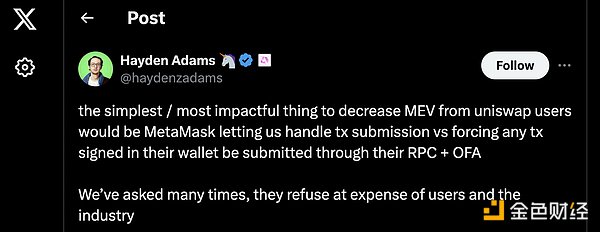

OFAs such as Flashbots Protect and MEV-Blocker already offer RPCs for users to integrate into their wallets. These products are primarily for individual wallet users to opt-in and integrate directly into applications.

In addition, wallets have begun capturing the value of their order flow.

Metamask Smart Traders - Metamask Smart Traders perform the same functions as OFA, providing MEV protection, gas refunds, and reversion protection. This service is automatically integrated into Metamask's wallet for users to choose from. Seekers and solvers pay to access Smart Trader order flow.

Trust Wallet MEV Protection - Trust Wallet MEV protection is provided to users by default, but does not include gas refunds and reversion protection.

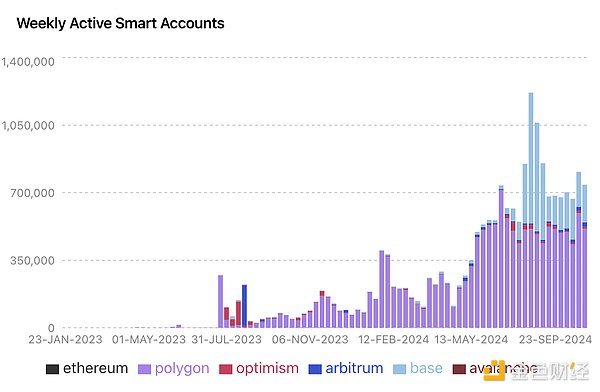

The implementation of account abstraction, particularly through ERC-4337, is revolutionizing how users interact with blockchain networks through the introduction of smart contract wallets and new entities such as Bundlers and Paymasters. These developments not only enhance the user experience, but also create new opportunities and challenges in terms of transaction processing and fee structures.

The main goal of account abstraction is to remove the need for all users to have an EOA and allow users to use smart contract wallets as their primary account. Account abstraction achieves this by decoupling account management and transaction execution from the EOA. Account abstraction uses new entities: 1) Bundlers, which are used to initiate transactions; and 2) Paymasters, which are used to determine gas payment policies.

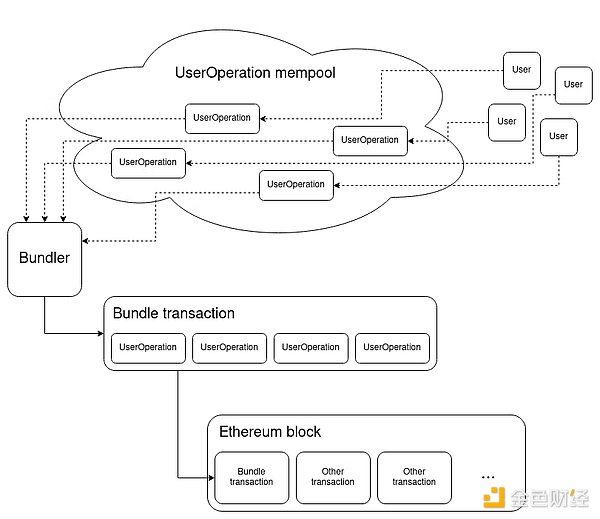

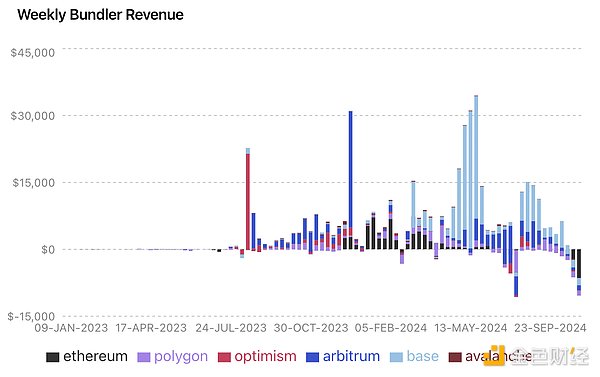

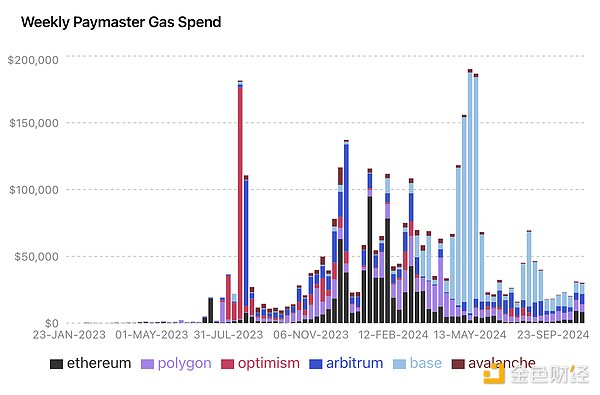

ERC-4337 introduces two new participants - Bundler and Paymaster:

Bundler - Bundler combines multiple user operations into one transaction, similar to a block generator, and submits the transaction to the entry point contract for execution. More importantly, Bundler owns EOA, allowing them to initiate transactions, eliminating the need for users to have EOA wallets. Current bundlers include Skandha, Alchemy, Rundler, Voltaire, Alto, Stackup, and Infinitism.

Paymaster - Paymaster is the smart contract that handles the gas payment policy of a wallet. Paymaster determines which currency (stablecoin or other ERC-20 token) can be used for gas payments and allows applications to pay gas fees for their users.

Under ERC-4337, Bundlers are in a similar position to today’s block builders and can execute exclusive order flow trades using smart contract wallets. Exclusive order flow is more important to Bundlers because they compete for the highest priority fees, and losing Bundlers pay the gas cost of recovering the UserOperation.

Since the UserOperation mempool is public, UserOperations are vulnerable to MEV from front-running and mezzanine attacks. Bundlers can capture a portion of MEV because they sort and batch UserOperations into one bundle transaction. Seekers can run Bundlers to extract MEV from the public UserOperation mempool. Bundlers and builders can integrate to gain additional order flow.

The cryptocurrency and blockchain space is on the cusp of a major transformation, driven by technological innovation and regulatory developments. Key trends shaping the future include:

Pre-confirmations to increase transaction speed.

EIP-7702 and EIP-7212 for account abstraction and smart wallet improvements to enhance user experience and transaction signing standards.

Integration of Trusted Execution Environments (TEEs) for enhanced security.

Regulatory discussions, particularly around stablecoins and securities, are driving the industry to adapt within new legal frameworks.

These trends are poised to redefine how users interact with blockchain networks, how developers build applications, and how the ecosystem navigates regulatory challenges, as the focus shifts from broad decentralization to nuanced discussions of control and enforcement.

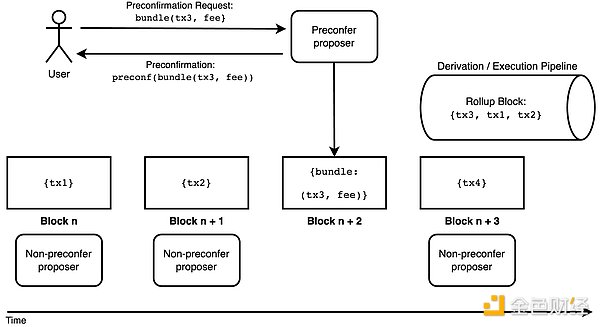

Preconfirmations ("preconfs") are a research proposal that would allow users to receive confirmation of transactions before they are confirmed by consensus. Preconfirmations aim to improve the user experience by eliminating high network congestion on Ethereum, layer 2 rollups, and validation through faster confirmations. First proposed by Justin Drake, preconfirmation-based proposals allow L1 proposers to provide economic guarantees that transactions will be included in L2 user transactions.

Ethereum block proposers ("pre-negotiators") or delegates sign a commitment to users that their transactions will be included and executed faster than the expected L1 consensus.

The field of pre-confirmation is still in its early stages, and several different approaches have been proposed. The following approaches are likely to have the greatest impact on order flow originators:

XGA-style preconfirmations: XGA-style preconfirmations guarantee that (non-positional) bundles are included in the bottom of the block. Filler transactions (transactions that do not need to be executed immediately or have lower MEV) can be included in the bottom bundle. This allows builders to focus on valuable top-of-block MEV transactions and simplifies gas pricing for filler transactions.

Primev’s MEV-Commit: MEV-commit is a P2P network where Ethereum transactions are committed to execution, and providers are rewarded or slashed. Order flow originators (“bidders”) specify their trade execution intentions to providers.

Espresso’s BFT preconfirmations: BFT preconfirmations are backed by the safety and liveness guarantees of the BFT consensus algorithm. BFT preconfirmations are supported by a subset of L1 validators, rather than a single validator as with preconfirmation-based.

Preconfirmations will result in a better execution experience as order flow initiators can guarantee trade execution at a higher fee.

For XGA-style preconfirmations, incorporating non-latency sensitive transactions (i.e. "governance", "stakes", "authorizations", "claims") at the bottom of the block can reduce the gas consumed by these transactions and reduce the number of transaction reversals due to insufficient gas.

There are two account abstraction EIPs that can fully unleash the potential of smart contract wallets and become game changers for the wallet ecosystem.

EIP-7702 introduces the following features to EOA:

Batching: Users can perform multiple operations in one atomic transaction.

Sponsorship: A separate account X or application operator can pay for transactions for account Y. Account X can receive ERC-20 tokens for this service.

Privilege downgrade: Users sign subkeys that provide weaker, specific permissions. For example, only interacting with specific applications, only transacting with certain ERC-20 tokens, and transfer restrictions.

EIP-7702 is designed to be backward and forward compatible with ERC-4337, allowing EOA to leverage existing ERC-4337 infrastructure. EOA can also temporarily convert itself into a smart contract wallet to incorporate ERC-4337 bundles.

Benefits of EIP-7702 include:

Reduced security risks: EIP-7702 also eliminates the central point of trust when assigning smart contract code to EOA for transactions. There is no possibility of unauthorized transactions with EIP-7702 because the contract code is deleted after the transaction is executed.

Easy dApp adoption: Applications using ERC-4337 can easily integrate with EIP-7702 without changing their code. EOA can call smart contracts without authorization.

EIP-7702 is still a new proposal and there are some issues that developers need to consider:

Revocation: EIP-7702 does not have clear details about revoking contract code when any malicious code is detected.

Chain-agnostic signatures: EIP-7702 uses fixed signatures that can be reused in other chains, but lacks flexibility if the user wants a different implementation.

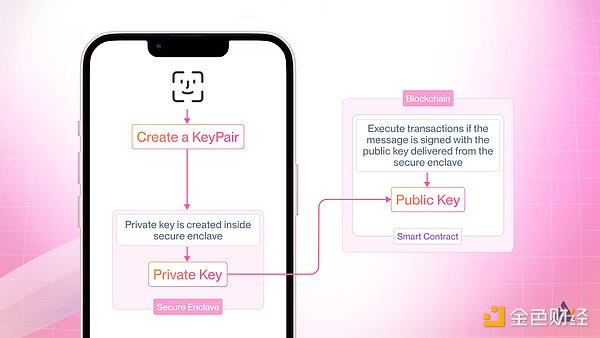

EIP-7212 or RIP-7212 uses the "secp256r1" elliptic curve standard to create signature verification contracts. The standard has been adopted by the largest Web2 companies for user authentication and can be integrated into ERC-4337 smart contract wallets.

“secp256r1” is currently used in the following authentication applications:

Apple’s Secure Enclave: Apple’s Secure Enclave is a Trusted Execution Environment (TEE) hardware that creates and stores keys. The Secure Enclave can encrypt or decrypt data, sign arbitrary messages, and can only be accessed via biometrics.

WebAuthn: Web Authentication is a web standard for authentication used by most Web2 browsers (Chrome, Firefox, Edge, and Safari). WebAuthn uses domain-specific public key cryptography for user authentication, eliminating passwords, providing faster recovery, and reducing security risks.

Android Keystore: Android Keystore is a secure system credential store. Applications can create private and public keys and store them in the Keystore. The Keystore is encrypted based on the user's own phone passcode and can be accessed via a password or biometrics.

Keystore: Keystores are FIDO credentials that allow users to access their accounts without a password using biometrics or a PIN. Users can access a website or app by unlocking their mobile device, without a password.

RIP-7212 is a rolled-up version of EIP-7212 that teams at Kakarot, Polygon, Optimism, zkSync, Scroll, and Arbitrum have committed to implementing. Polygon offers RIP-7212 on its testnet, and Coinbase's recently launched Smart Wallet includes password authentication.

The smart contract wallet creates a password or public and private key pair.

The private key is stored in the TEE on your mobile device.

When the smart contract wallet creates a transaction for approval, the user authenticates using biometrics or a mobile PIN to unlock the private key.

The mobile device then "signs" the transaction using the private key and sends the completed transaction back to the smart contract wallet.

The signature is verified on-chain via the RIP-7212 smart contract.

While EIP-7702 is still in the proposal stage, RIP-7212 is being actively integrated into L2 Rollup and implemented into smart contract wallets. The Passkey Wallet provides powerful capabilities to ERC-4337 smart wallets by eliminating the need for passwords and seed phrases and bringing security to the hardware level. Projects currently adopting Passkey include:

Coinbase Smart Wallet: Coinbase's Smart Wallet utilizes keys for user authentication and sponsoring gas transactions. Smart Wallet supports 8 networks (Base, Ethereum, Optimism, Arbitrum, Polygon, Avalanche, BNB, Zora) and provides a wallet SDK for dApps integration.

Clave: Clave leverages mobile TEE and keys to provide social recovery, account naming services, biometric login, and sponsored gas fees on zkSync.

Banana SDK: Banana's SDK leverages WebAuthn to provide zero-knowledge 2FA, biometrics, and recovery accounts with nominees.

Turnkey: Turnkey is a Wallet-as-a-Service (WaaS) provider that stores private keys in TEEs.

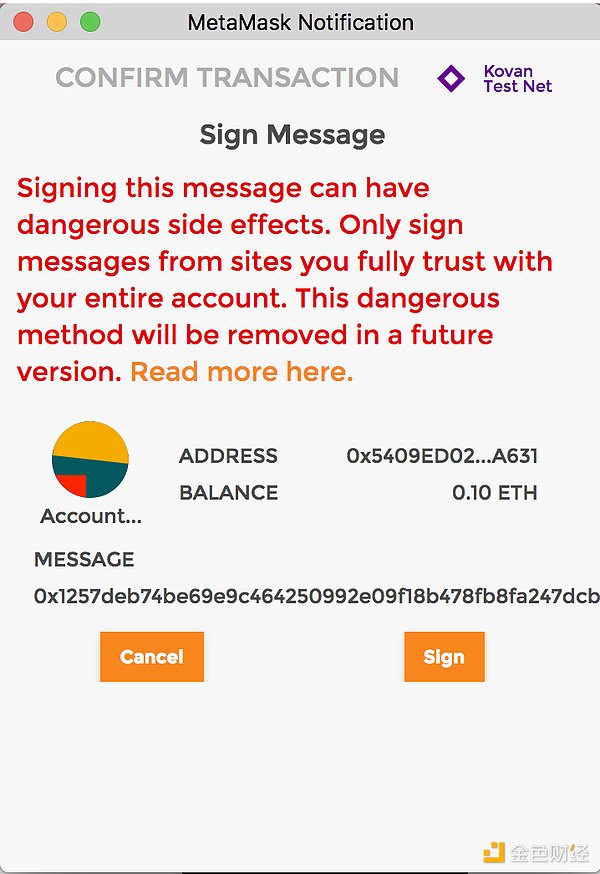

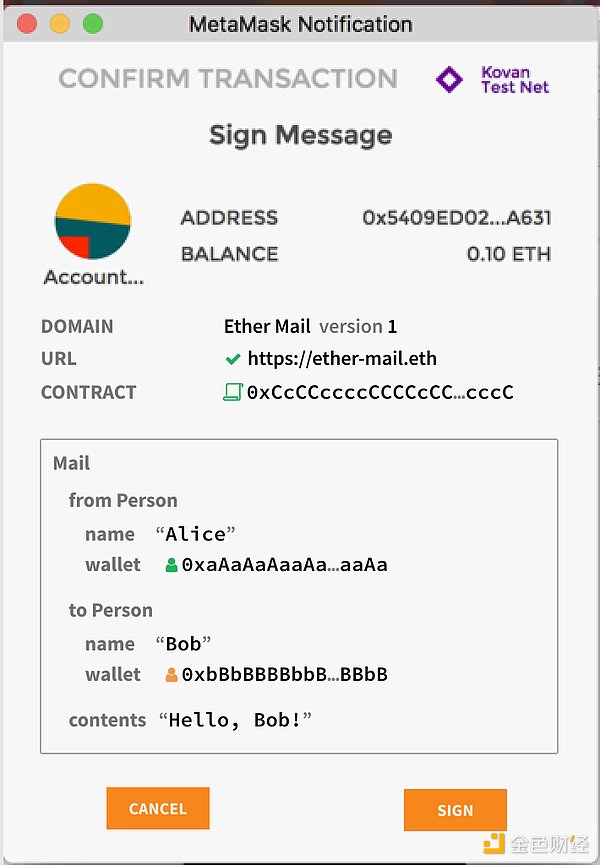

EIP-712 is a typed message signature standard that aims to allow off-chain message signatures to be used for on-chain signatures, providing a better user experience. Unlike reading byte strings, EIP-712 allows signatures to be displayed in a readable format without losing system security properties. Off-chain signatures save gas and reduce the number of on-chain transactions.

dApps developers leverage a JSON data structure signed by users.

Domain delimiters prevent signatures from being used on multiple dApps and allow for multiple different signature use cases within a given dApp.

Wallet and front-end operators can parse dApp data structures and convert the data into user-readable messages.

One of the key capabilities unlocked by EIP-712 is that it allows dApps to control transaction flow for users, not wallets. Applications like Uniswap can minimize users’ MEV because swaps bypass OFA and other MEV value extractors.

In addition to the readability of wallet transactions, EIP-712 also allows third parties to pay gas fees for user votes, thereby improving the usability of governance. Voters can use the signature function of EIP-712 to create signed delegation or voting transactions for free.

In addition to wallet readability, EIP-712 can also be used to improve user experience in other areas.

Governance. Users can delegate voting to others and have third parties pay gas fees for them through the signing function of EIP-712.

Clear signatures. A hardware wallet or separate device can display messages from a dApp, ensuring that users can be sure that no malware or malicious applications are sending them the message.

Replay attack prevention. Data to prevent replay attacks can be included in the structured data of EIP-712.

MEV minimization. EIP-712 allows users to sign transactions while enabling the front end to send order flow without broadcasting it to the network, thereby minimizing users' exposure to malicious MEV.

Trusted Execution Environment (TEE) is a secure area based on a hardware microprocessor where sensitive computations and operations can run completely and privately. TEEs support isolation and remote attestation, and can run virtual machines such as EVM and CosmWasm without cryptographic overhead such as multi-party computation (MPC) or zkSNARK.

For web3 wallets, mobile TEEs such as Apple's Secure Enclave and Google's Titan M2 can better protect the private keys of smart contract wallets than standard hardware wallets. Users can create and store private keys within the TEE and sign transactions with these keys. The keys remain on the device and can only be accessed by the device owner through biometric authentication or device PIN.

TEE is currently used in a variety of wallet solutions:

MPC: Fireblocks uses Intel SGX TEE to isolate encrypted data, MPC and ZKP cryptographic algorithms, and the execution portion of its software from its internal systems and external third parties. Fireblocks stores MPC keys, API credentials, and its policy engine in a secure area to prevent unauthorized access by hackers, malicious employees, and internal conspirators.

Smart Contract Wallets: As described in the previous section RIP-7212, smart wallets utilize mobile TEE to store keys. Smart contract wallets that currently use TEE include Coinbase Smart Wallet, Banana SDK, Turnkey, Clave, and Weeve.

TEE is expected to be a major change in blockchain.

Flashbots SUAVE will use TEE to create a secure and private MEV ecosystem.

Smart contract wallets will use mobile TEE and account abstraction to improve user onboarding experience and attract new user groups.

Large enterprises have adopted TEE to solve their own privacy and security needs. Visa created the LucidiTEE blockchain to improve multi-party computation and storage of private data.

TEE is a potential regulatory compliance solution that can enhance the control, data privacy and operational security of blockchain.

One of the main challenges facing wallet providers is educating users and regulators about self-custody and on-chain accounts. However, as the web3 ecosystem matures, key stakeholders have come to recognize several key points:

Wallets do not hold, manage, or custody user assets; they merely provide an interface to access those assets.

Blockchain addresses exist independently of wallets and are not created or managed by wallets.

Users can freely switch between different wallet providers because their assets and accounts exist on-chain and are not associated with any specific wallet service.

This growing understanding is critical to clarifying the role of wallets in the cryptocurrency ecosystem and distinguishing them from traditional financial service providers.

Stablecoins remain one of the most important crypto assets as they enable seamless and frictionless transfer of value across borders and economies. They allow users to transfer value between volatile assets to stable denominations for future use. However, stablecoins have become top of the crypto agenda for many regulators, primarily due to concerns about:

Control and monitor global fiat currency flows.

Their impact on currency strength and monetary policy.

The need for oversight of their issuance and support.

As a result, stablecoins have become top of the crypto agenda for many regulators, sparking debate about their role in the broader financial ecosystem.

In the United States, stablecoins have received widespread regulatory attention due to Facebook's (now Meta) Libra project. The tech giant proposed a privately managed stablecoin that could theoretically become a major digital currency, raising concerns about its impact on central banks' control over monetary policy.

Since the closure of the Libra project in 2022, the main goal of U.S. regulatory stablecoin policy has been to ensure that stablecoins are properly collateralized and supervised. This shift has prompted stablecoin issuers to adopt practices similar to those of regulated financial institutions, which have robust custody agreements, established banking relationships, and comprehensive monitoring programs. While various regulators have introduced piecemeal regulations, the U.S. Congress is working to develop a more comprehensive regulatory framework for stablecoins.

In the European Union, the Markets in Crypto Assets Authority (MiCA) is gradually coming into effect, which contains key stablecoin provisions. As of this writing, only Circle's USDC and euro stablecoins have been successfully registered in the EU.

In-wallet token swaps have become a popular feature for many cryptocurrency wallets, improving the usability of on-chain applications and enabling users to bridge and interact across chains.

However, this feature has attracted the attention of regulators, especially securities regulators, who have sought to apply traditional financial services regulations to wallets that offer swap functionality. Most notably, the SEC has taken legal action against certain wallet providers, alleging that the swap functionality of these wallets is actually operating as an unregistered broker-dealer.

In April 2024, the SEC dismissed allegations that Coinbase Wallet acted as a broker. Self-hosted wallets with swap functionality generally do not meet the criteria for broker classification. The SEC's argument is based on their allegations that some of the assets offered by these wallets are unregistered securities.

In April 2024, Consensys proactively sued the SEC over its authority to regulate MetaMask as a securities broker-dealer and issuer, and was granted an expedited review by the judge in the case. The expedited court proceeding could result in a ruling by the end of the year.

Despite initiating that lawsuit and losing the Coinbase v SEC case, the SEC filed a Wells Notice against Consensys in late June 2024. The SEC charged Consensys with acting as an unregistered broker-dealer in crypto asset securities through MetaMask Swaps and its crypto staking program, MetaMask Staking.

While wallets will continue to be a focal point in the illicit fundraising and self-custody debate, much of the regulatory conversation going forward will focus on the issue of decentralization. Over the past few years, the crypto industry has used the concept of decentralization to explain to regulators why traditional financial securities regulations should not apply to crypto services. This argument specifically discusses the issue of control and responsible parties.

Traditional financial rules and guidance regulate intermediaries to provide consumer protection and accountability. However, a key challenge arises: how can these goals be achieved when the services in question are not intermediaries in nature and do not custody assets or perform operations for users?

Decentralization, both as a concept and a design goal, helps explain why traditional financial services regulations are difficult to apply to cryptocurrencies. However, we are now entering a new phase in the regulatory discussion, where regulators are seeking to define decentralization and apply it to a variety of services, from wallets to decentralized exchanges (DEXs) and beyond. Regulators now see an opportunity to classify many crypto services as non-decentralized or "nominally decentralized." This classification stems from two main factors:

For many services, the burden of meeting the standards of true decentralization is often technically infeasible.

These decentralization standards may not align with the actual goals of regulation. This shift in regulatory approach could have a significant impact on how crypto services are classified and regulated in the future.

That’s why the next phase of regulatory discussions will shift to the concept of control. Key questions include: Can wallets control the execution of user actions? Can DEXs control how actions are executed or filled? The crypto industry as a whole has made significant progress in developing new operating models that go beyond the concept of decentralized services and into discussions about control, data, and privacy.

At the forefront of these advances is the practicality of Trusted Execution Environments (TEEs). We are moving toward a market structure where operational control resides in hardware and software rather than in the hands of service providers. In this model, service providers have no direct control over ongoing operations and no visibility into user orders. With this approach, the crypto industry is pioneering new ways for financial services and communication applications to operate.

Finally, as we move from discussions about decentralization to more nuanced conversations about control, the concepts of execution, finality, and settlement will become increasingly important. The industry needs to collectively define:

Who is responsible for execution

When an action is considered settled on-chain

Who is responsible for resolution

EIP-3074, Vitalik Buterin, Thoughts on Ethereum governance after the EIP-3074 incident Golden Finance, What role does Vitalik play in Ethereum governance?

JinseFinance

JinseFinanceAdd a new transaction type that adds a contract_code field and a signature and converts the signing account to a smart contract wallet during that transaction, with the goal of providing similar functionality to EIP-3074.

JinseFinance

JinseFinanceEIP-3074 aims to enhance Ethereum wallet usability by making EOAs more programmable, allowing for batch transactions and third-party fee sponsorship. While supported by some, security concerns persist, emphasizing the need for clear pathways to address vulnerabilities.

Edmund

EdmundEIP-3074, Ethereum 2.0, Bankless: Why is EIP-3074 important? Golden Finance, Ethereum's latest hot improvement proposal may change the way you trade.

JinseFinance

JinseFinanceEthereum core developers have agreed to include EIP-3074 in the upcoming hard fork upgrade Prague/Electra (expected in Q4 2024/early 2025).

JinseFinance

JinseFinanceEIP-3074 was approved to go live in the next Ethereum hard fork (Prague). This EIP will forever change the way users interact on the EVM chain, making the wallet user experience simpler, cheaper, and more powerful.

JinseFinance

JinseFinanceOne sentence description: EIP-3074 gives EOA wallet smart contract functions, changing the way users interact on the EVM chain

JinseFinance

JinseFinanceThe Ethereum Dencun upgrade will enable Ethereum transactions to be submitted as blobs, potentially reducing the cost of publishing data on the blockchain.

JinseFinance

JinseFinance JinseFinance

JinseFinanceParticipants of the accelerator program will get funding, mentorship and market exposure through the platform DeFi.org.

Cointelegraph

Cointelegraph