Author: Duo Nine, crypto KOL; Compiler: 0xjs@Golden Finance

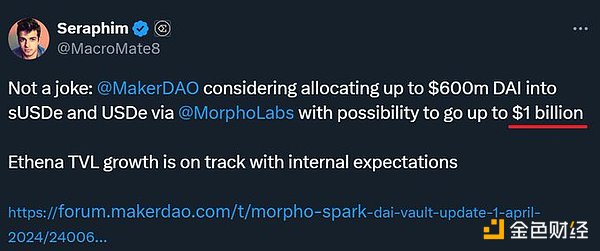

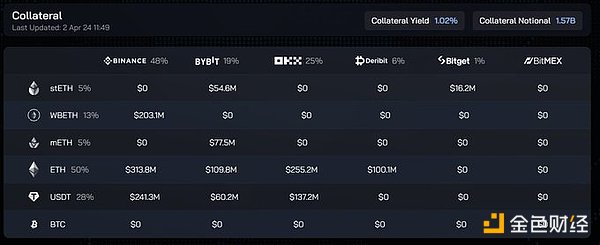

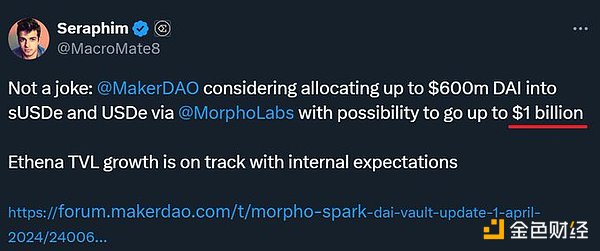

MakerDAO recently proposed to allocate $600 million of DAI to USDe and sUSDe. How to understand MakerDAO's move? Crypto KOL Duo Nine published an article to interpret it.

1. Issuing $100 million of DAI to enter USDe to gain benefits is one thing, but issuing billions of dollars means being hurt.

Why does MakerDAO plan to risk minting $1 billion in DAI to get Ethena's benefits? When USDe inevitably falls below $1, can DAI be decoupled? Is MakerDAO's move a bold move or something else?

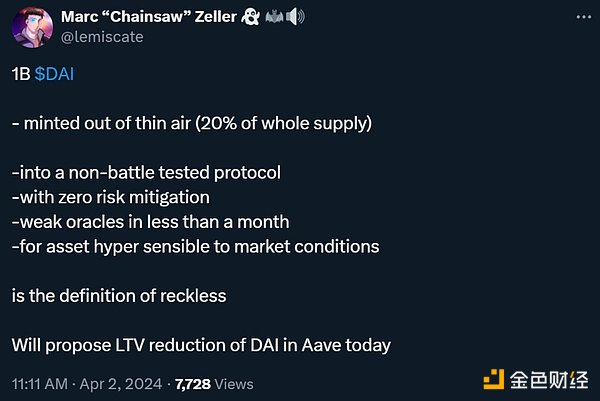

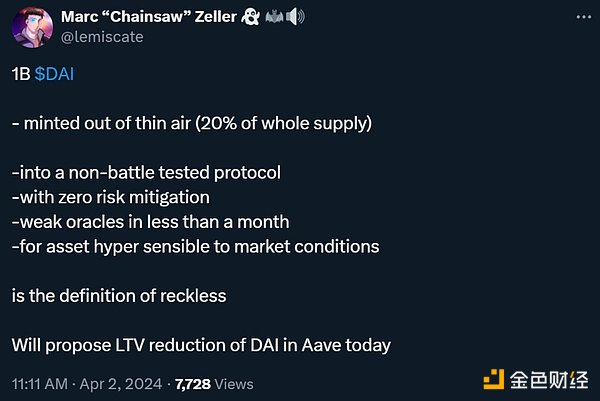

2. This article is inspired by Marc Zeller, the founder of AAVEChan. He sounded the alarm.

Long story short: he is right. MakerDAO's actions were reckless and fueled by greed. But if you look closely at the risks of DAI, you will find a new picture.

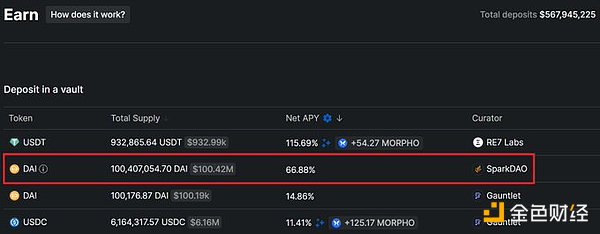

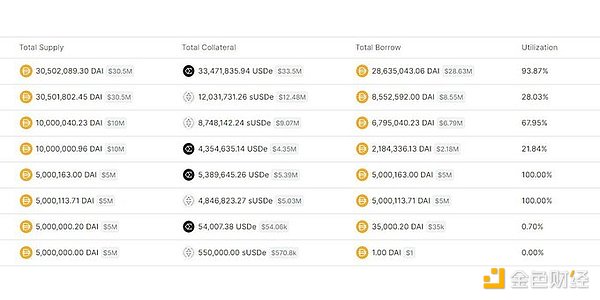

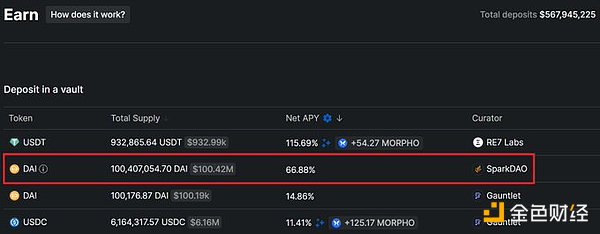

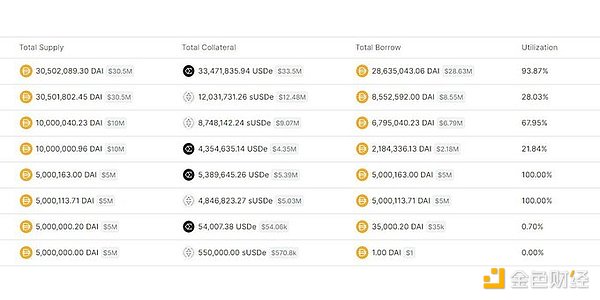

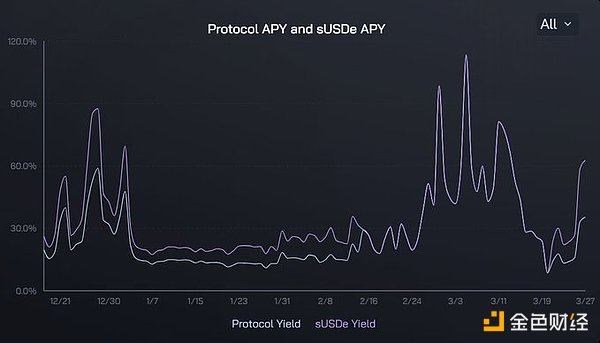

3. MakerDAO is now printing cash, of course at your expense. They issued 100 million DAI, which can only be obtained by borrowing with USDe/sUSDe collateral. Users pay huge costs, while Maker makes huge profits, with an annualized rate of 66% for $100 million!

What happened?

4. MakerDAO is taking advantage of users' greed in chasing higher APY on USDe. They don't care, they will use billions of dollars to fuel this greed. Maker makes huge profits and USDe's market value soars. Win-win. But there's a catch! There's always a catch.

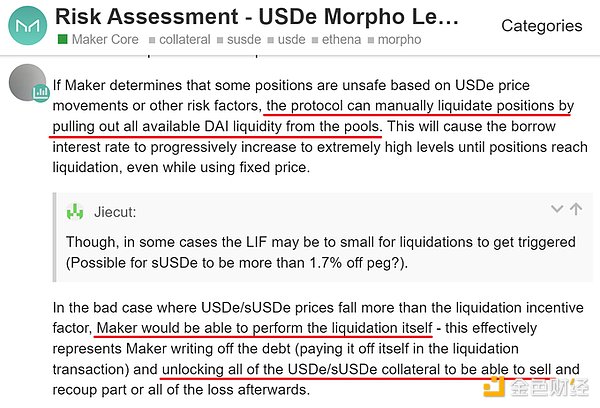

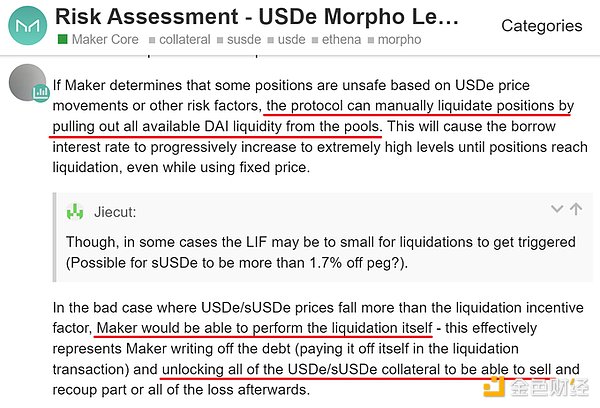

5. Even if Maker's vault reaches billions of dollars, they will liquidate you before they get hurt! This means, they will be the first to sell USDe and get their funds back when USDe decouples. Users are liquidated and Maker keeps the profits. Not bad, right? How about USDe/Ethena?

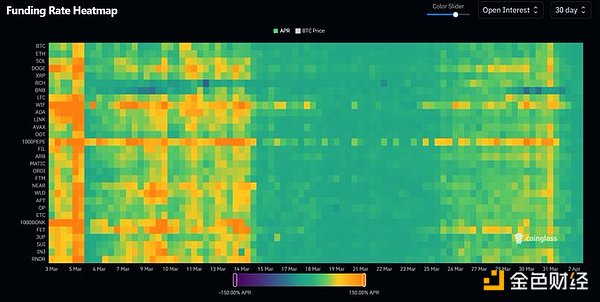

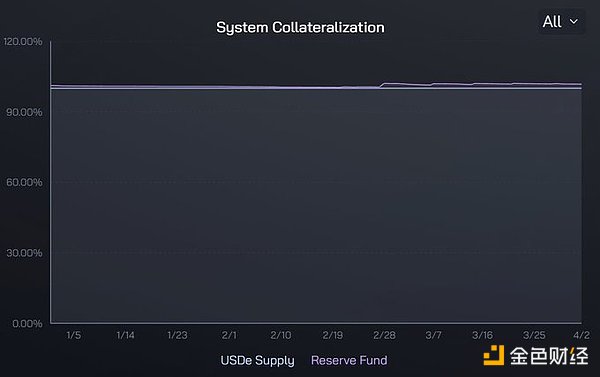

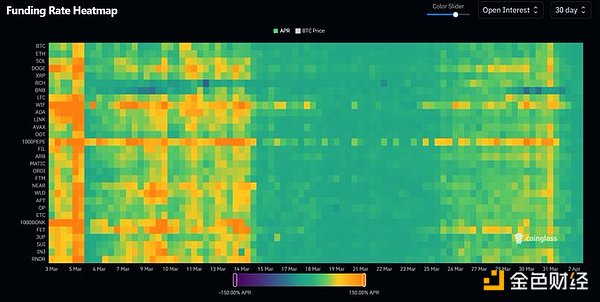

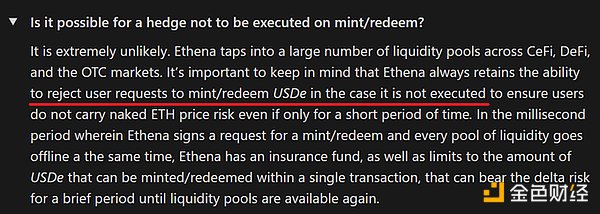

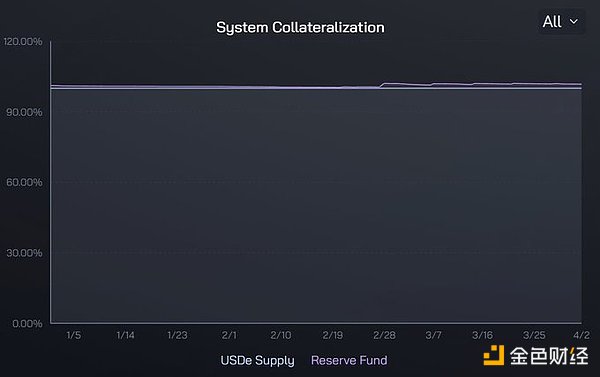

6. USDe decoupling is only a matter of time. The bigger this bubble gets, the more certain I am that it will happen. Imagine this: USDe's market cap is about $10 billion, and Maker is responsible for $2 billion of it. These are conservative numbers (see reason #12). What happens next? 7. Markets turn bearish, funding rates are negative. USDe’s peg to the dollar requires them to be positive! Ethena needs billions of dollars in shorts to keep USDe stable and maintain its $10 billion market cap. Risks increase. Fast. Suddenly, MakerDAO decides to unwind its $2 billion exposure. What’s next?

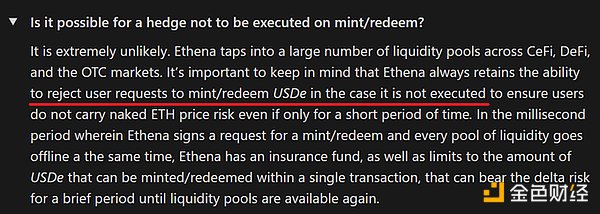

8. USDe is facing selling pressure and its market value is shrinking. People realize that the exit door can only accommodate so many people. USDe, which is pegged to the US dollar, fluctuated under negative financing rates and then fell below $1. Panic and liquidation began.

9. The first victims? Users who borrowed DAI using USDe and sUSDe on Morpho. They will be liquidated soon. As USDe's peg to the dollar fell, Maker took out the funds first. A total of $2 billion. DAI is safe, and Maker will keep the lending profits until then. What about the users?

10. They receive a liquidation message and their balance is zero. What happens to USDe? Since 50% of the backing is real assets, there is a hard limit on how much its peg can fall. Think ETH, stETH, and BTC (to be added later). But this is also a problem!

11. When the market value of USDe begins to plummet, for example, from $10 billion to $5 billion, Ethena must close its positions and redeem collateral (such as ETH or BTC). If there are any bottlenecks in the redemption process, the exchange rate of USDe pegged to the US dollar will also be affected. But Maker doesn't care about all this. Why?

12. They made money, withdrew first, and DAI was on the peg. Now multiply MakerDAO by 10 times. Do you think only Maker and DAI will do this? No, everyone will do it! They will all plug into Ethena and charge you. After all, this is a cryptocurrency casino. Why does Ethena want this?

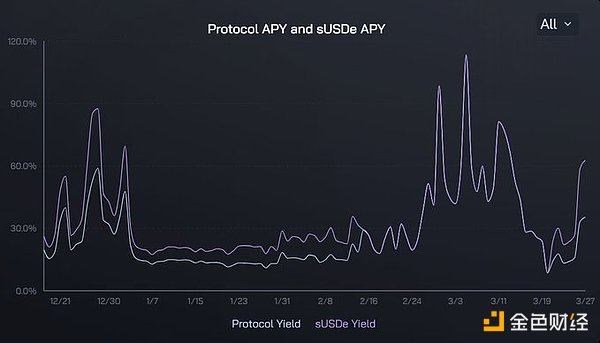

13. In a bull market, they will work with anyone who is willing to throw money at them. This is how USDe's market value grows. Imagine an annualized return of 20%, 40% or 60% on $10 billion! Even if it works for one month, the net profit is hundreds of millions! When will it end?

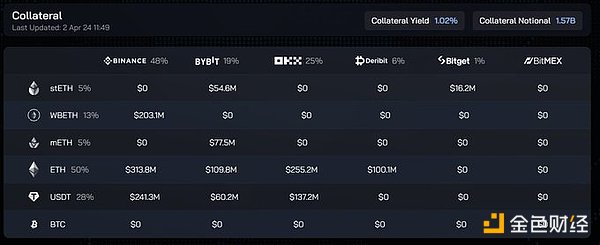

14. When the bear market comes. Today, Ethena effectively breeds all crypto traders who go long in a bull market and pay for the privilege. The yield is real and comes primarily from the pockets of retail investors who want 100x returns on the futures market. What exactly is Ethena?

15. This is by far the most sophisticated and smartest crypto protocol that can take advantage of the greed in this market. They are basically breeding greed. They know the risks and make them explicit, and it's worth it. In this sense, I respect the Ethena team. That’s hard to do.

But I’m not sure I can say the same for MakerDAO. They’re just leveraging Ethena, exploiting it, increasing its risk. All risk is borne by Ethena and its users. Maker takes almost no risk in this regard. Ethena is welcome to them because the incentives are aligned right now. But 2x!

16. Ethena getting too big could pose systemic risk to everyone. This is true. No joke. USDe is untested by bear markets, and it’s risky when billions of dollars are involved. I urge all of Ethena’s big players like Hayes to show some restraint and play for the long term.

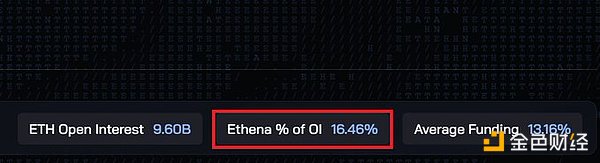

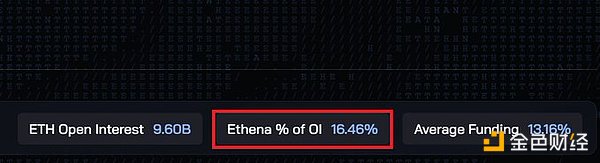

17. If Ethena's ETH and BTC holdings reach more than 25%, it would be huge! This means that Ethena will account for 1/4 of all BTC and ETH futures transactions - on the short side! ETH's interest rate is already 16%. If things get big and bad, this could become systemic.

18. My advice? Get out when things get too big. Get out when this bull market is nearing its end. We don't know what will break first, but the list of what could break is pretty long. I won't go there to find the answer. I'll watch the show while eating popcorn from my Bitcoin bag. You?

19. Don't forget that Ethena and many yield protocols have lock-up times. 7 days, 14 days, 21 days.

When you wait for the lock-up time to end, the smart money will leave.

WenJun

WenJun