While most of the current use of stablecoins stems from cryptocurrency transactions, blockchain and stablecoins have the potential to transform traditional complex and heavyweight financial systems, such as securities markets and payment systems.

Recently, there has been a growing momentum for the adoption of stablecoins in payment systems, which occurs primarily in two directions:

1) the integration of stablecoin functionality centered on card networks;

2) efforts to bypass card networks and issuing banks entirely.

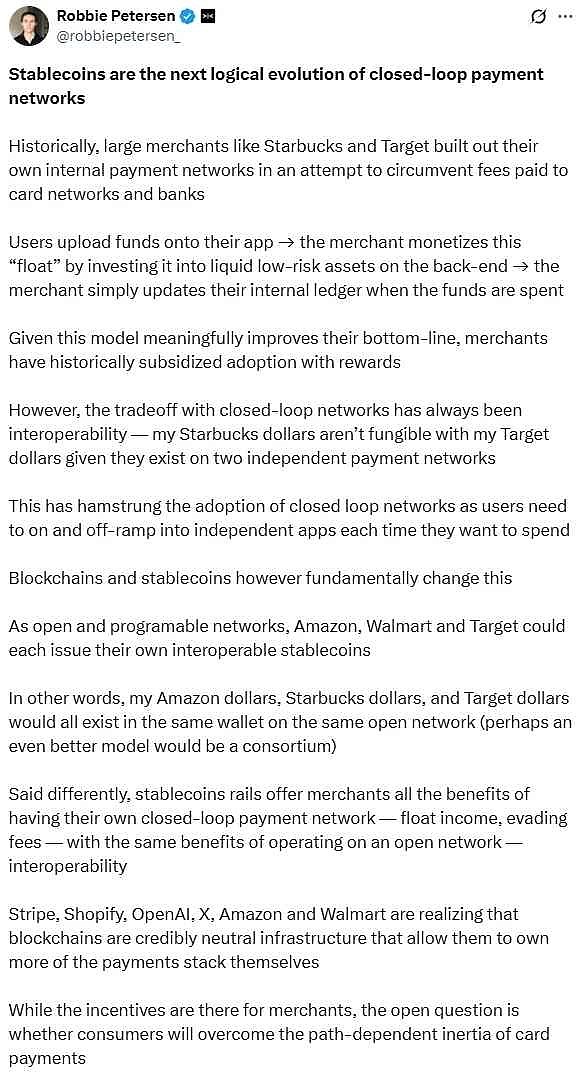

As the stablecoin industry grows, it is expected that more companies that already have a large user and merchant base will build their own payment systems. This could pose a threat to banks and credit card networks.

Potential of Stablecoins

1.1 The use of stablecoins is still mainly in exchanges

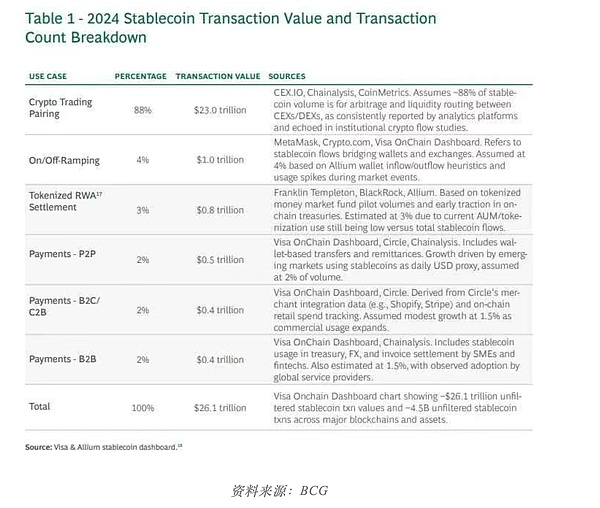

Not only in the United States, but also around the world, people are very interested in stablecoins. All parties are actively discussing the innovative potential of stablecoins in areas such as remittances, payments, risk-weighted assets (RWA) and interbank settlement. However, according to a report by the Boston Consulting Group (BCG), cryptocurrency transactions will account for 88% of stablecoin transactions in 2024. This reflects the limitations of the current application of stablecoins, indicating that they are still far from the practical applications we expect.

1.2 Stablecoins can fundamentally change the financial system

Although the advancement of financial technology has significantly improved the user-friendliness of the financial system, the back-end systems that handle actual transactions are still inefficient and outdated. In this regard, blockchain and stablecoins may even revolutionize the back-end of the financial system. This is not just a supplement to the existing infrastructure, but also a technology that can completely replace the existing infrastructure, just like the historical transformation of the financial system.

1.2.1 Securities Market

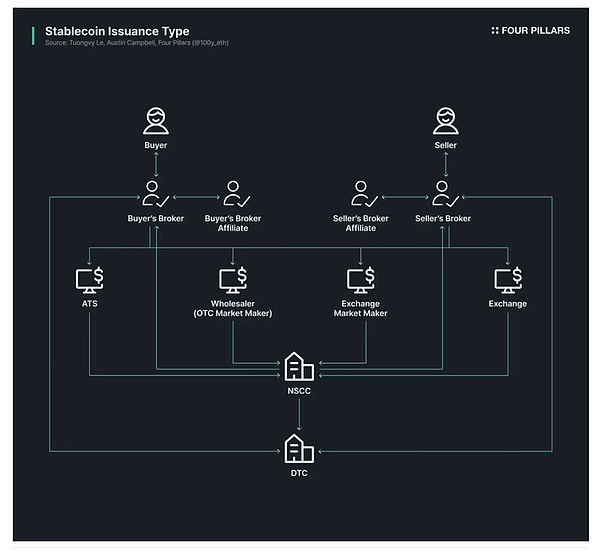

The reason why the back-end of the securities market is so complicated stems from the "paper crisis" of the US securities market in the 1960s and 1970s and the policy responses taken to solve this crisis. At that time, securities trading relied entirely on paper documents. As trading volume surged, the system was paralyzed for a time. In response to this problem, the US Congress introduced the Securities Investor Protection Act (SIPA) and its amendments, established a centralized clearing and settlement structure, and introduced an indirect securities holding system.

The system initially digitized securities ownership and improved settlement efficiency. However, it also made numerous intermediaries such as brokers, clearing agencies, and custodians indispensable, which brought structural complexity and cost issues. Today's securities market is ultimately the product of policy compromises and gradual improvements to overcome technological limitations. In the absence of more advanced technologies like blockchain, the system has persisted for decades.

1.2.2 Cross-border remittances

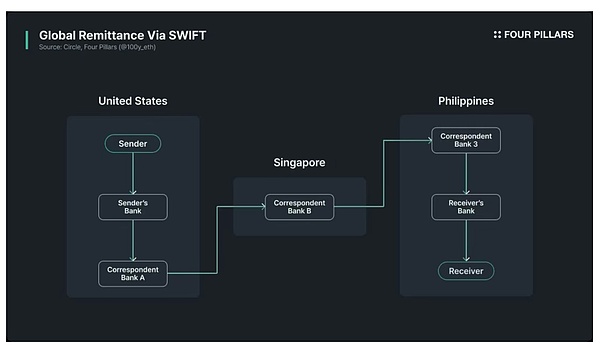

SWIFT is the most widely used cross-border remittance system. It is a global information transmission network established by 239 banks in Brussels in 1973. It was created to replace the slow and error-prone telex-based international interbank communication system. At that time, each bank used its own communication standard, resulting in low compatibility, slow speed and security issues. To address these issues, SWIFT was created to provide a common language and a secure network.

However, SWIFT itself only transmits messages. The actual movement of funds is carried out through accounts at correspondent banks or central banks, and settlements between accounts are handled separately. This involves multiple intermediary banks, each of which adds delays due to fees, KYC/AML checks, currency conversions, time zone differences, holidays, etc. This results in high costs and low transparency. If blockchain and stablecoins had existed at the time, messaging and fund transfers could have been handled on a unified platform, creating a more efficient infrastructure for cross-border payments.

Can Stablecoins Change the Payment Market?

While various potential use cases such as securities markets and cross-border remittances have been discussed as systems that stablecoins can innovate, the next most anticipated use case after exchange trading is payment systems. In fact, in the field of payment, not only are there Web3 companies, but major Web2 companies such as Visa, Mastercard, Stripe and PayPal are also actively exploring new business opportunities.

To determine whether stablecoins can truly change the existing payment system, we must first study how the existing payment system works, where inefficiencies arise, and whether stablecoins can solve these problems.

2.1 How the existing payment system works

2.1.1 How the payment system works

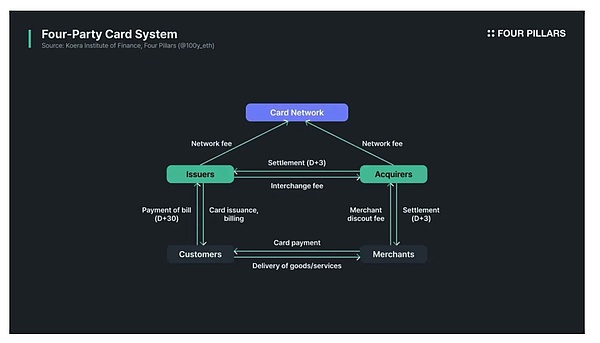

When a customer pays a merchant, the process is as follows:

Authorization:

The customer tries to pay with a card.

The POS terminal or online payment gateway sends an authorization request containing payment information to the acquirer.

The acquirer forwards this request to the card network (e.g. VisaNet, Mastercard Banknet).

The card network passes the request to the issuing bank.

Confirmation:

The issuing bank verifies the card validity, account balance, credit limit, and whether the transaction is suspicious.

Once the verification is complete, the approval or rejection response is sent to the recovery agency through the card network.

If approved, the corresponding amount will be temporarily retained in the customer's account.

If rejected, the merchant will receive a response with the reason for the rejection.

Capture:

In industries such as gas stations, hotels, and online shopping, the final amount is confirmed after the initial authorization.

Thus, the point in time when the merchant sends a fetch request is the point in time when the transaction is effectively completed and the request is sent to the acquirer.

Batching:

The transactions authorized throughout the day are grouped into a batch and sent to the acquirer all at once after the close of business.

Clearing & Interchange:

The acquirer sends the batch data to the card networks.

The card networks route each transaction to the relevant issuing bank, calculating an interchange fee in the process.

Transfer:

The funds are transferred from the issuing bank's settlement account to the acquiring bank's settlement account.

The card networks aggregate daily transactions and generate settlement files to reconcile both parties, but the actual movement of funds is carried out through the interbank payment network.

Remittance:

The acquirer deposits the payment amount with the merchant after deducting relevant fees.

The merchant is sent the funds via ACH or wire transfer.

Review:

Finally, the merchant checks whether the funds received match its own records and reviews whether there are any discrepancies, omissions or duplicate charges.

2.2 What is a problem? What is not a problem?

The biggest problems often pointed out about the traditional credit card system are high fees and slow settlement times. Are these drawbacks inevitable, or are they solvable?

2.2.1 Payment Fees

Let’s first look at credit card payment fees. From a merchant’s perspective, there are three main fees incurred during a credit card transaction:

Interchange fee: the largest portion, charged by the issuing bank.

Scheme fee: the fee charged by the card network for processing the transaction.

Acquirer markup fee: the fee charged by the acquiring bank.

Can blockchain and stablecoins reduce these fees?

The first potential area of savings is global transactions. When merchants and cardholders are located in different countries, settlements must go through SWIFT. If this process is replaced with blockchain or stablecoins, costs can be significantly reduced.

The second area is bypassing the card networks and issuing banks to reduce fees. What is the essence of a card network? It is a communication network that connects the bank where customers hold funds and the bank where merchants receive funds. If stablecoin payments are fully adopted, customers can pay merchants' Web3 accounts directly from their self-hosted stablecoin wallets through the blockchain network.

2.2.2 Settlement time

Next, let's examine settlement time. In bank card payments, transaction authorization occurs almost instantly. In this regard, public blockchain networks are likely to be far less scalable than centralized card networks. However, in traditional card payments, clearing typically takes an extra 1 to 2 days and settlement an extra 1 to 5 days.

There are many reasons why settlement takes time. Some can be resolved, while others cannot:

Clearing time: Card payments typically batch all daily transactions and settle once a day. Systems based entirely on blockchain or stablecoins do not need to follow this one-day clearing cycle.

Disputes, suspicious transactions, cancellations, refunds: Even with stablecoin payments, these issues cannot be resolved. Since such situations are inevitable in the payment process, delayed settlement is still necessary.

Cross-border payments: When trading across borders, funds must be settled via SWIFT, which causes further delays. Blockchain can clearly provide a solution in this regard.

Stablecoin-based payment systems

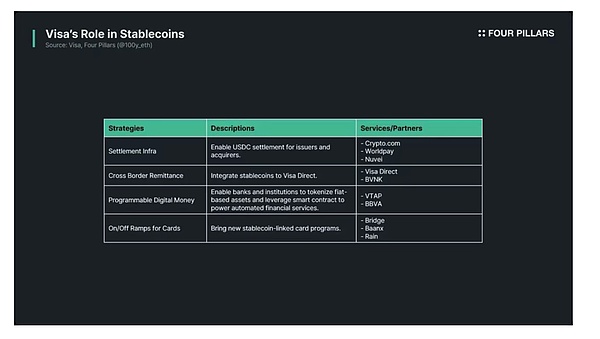

Recently, we have seen many financial institutions and companies begin to adopt stablecoin-based payment systems. This huge shift is achieved through two strategies. The first strategy is led by card networks such as Visa and Mastercard. The second strategy attempts to bypass the card networks and issuing banks completely.

3.1 Card network-centric stablecoin payments

Visa and Mastercard are actively exploring ways to integrate stablecoin functionality into their infrastructure.

Crypto debit cards:

These cards allow customers to pay with stablecoins stored in their Web3 wallets or exchange accounts. In this case, the customer's stablecoins are either converted into fiat currency by the issuing bank and processed through the existing payment system; or the stablecoins are directly received by the card network through the funding account and then processed according to the same process as traditional bank card payments.

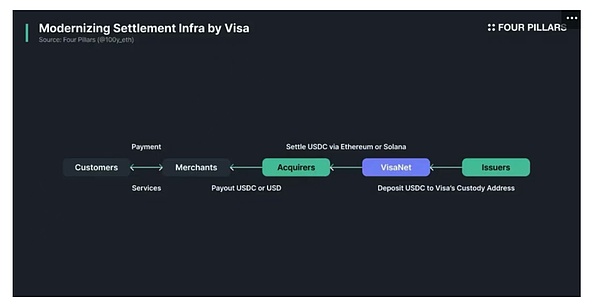

Stablecoin Settlement:

As mentioned above, the card network can accept stablecoins through the treasury account or use stablecoins to settle with the acquirer.

In essence, card network-centric stablecoin payments simply add stablecoin payment and settlement support to the traditional system. The participants and infrastructure remain unchanged. Therefore, this system does not have a significant advantage in terms of cost or time. However, for customers and companies that natively use stablecoins, the system can reduce transaction friction by skipping the on/off ramp process. In addition, cross-border transactions will gain obvious benefits if the entire payment process is settled in stablecoins.

3.2 Initiatives to bypass credit card networks and issuing banks

At the same time, there are also some payment service providers that bypass card networks such as Visa and Mastercard and use stablecoins to process payments. For example, PayPal's PYUSD payment and Shopify x Coinbase x Stripe's USDC payment plan.

3.2.1 PYUSD Payments

PayPal users can use their PYUSD balances to make payments within the PayPal app. These PYUSD holdings are not stored in the user's own wallet, but in the account of Paxos, the issuer of PYUSD. When PYUSD is paid, PYUSD does not actually move on the chain. Instead, the ownership of PYUSD is transferred from the customer to the merchant within the PayPal backend. If the merchant wants to settle in fiat currency, PayPal will convert PYUSD into US dollars at a ratio of 1:1 and settle the funds to the merchant through bank networks such as ACH.

If the customer's PYUSD balance is insufficient, it can be topped up through a bank account or bank card, which may incur fees. Similarly, if the merchant requires settlement in fiat currency, additional fees and time may be incurred through the bank network. However, if the entire payment cycle is carried out using PYUSD, there is no need to go through a bank card network or issuing bank, which can significantly save time and costs.

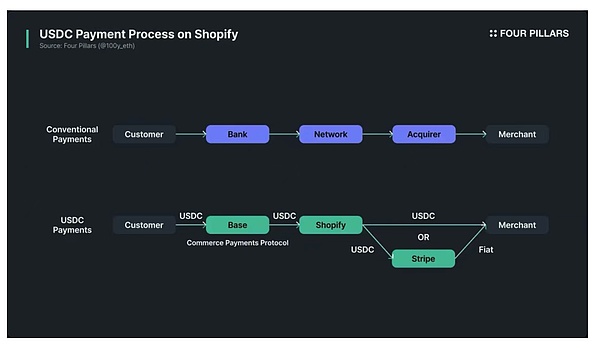

3.2.2 Shopify x Coinbase x Stripe Payment

Although PayPal uses stablecoins and does not directly involve the payment process of the blockchain network, USDC payment on Shopify has gone a step further.

In June 2025, Shopify announced a partnership with Coinbase and Stripe to integrate USDC payment functionality into Shopify Payments. Customers can choose USDC as a payment method in Shopify stores and connect a crypto wallet holding USDC on the Base network to make payments.

Here, the smart contract "Business Payment Protocol" on the Base network uses the traditional "authorize now, capture later" process to pre-authorize payments, and the actual funds transfer takes place later. Shopify and Coinbase aggregate USDC transaction data within a day and clear it on the Base network.

For settlement, Shopify's default method is to convert USDC into the merchant's local currency and deposit it into the merchant's bank account through a bank payment network such as ACH or SEPA. This conversion is handled by Stripe's infrastructure. Merchants can also choose to settle directly in USDC to get funds faster.

Final Thoughts

The most common question about stablecoin-based payment systems is: "Since blockchain transactions are inherently irreversible, how are cancellations or chargebacks handled?" While it may be possible to eventually have a payment system that is completely peer-to-peer between customers and merchants, issues such as fraud detection, chargebacks, and refunds will always exist, so intermediaries in the payment process will still be necessary. Therefore, the role of card networks and issuing banks that traditionally perform these functions will not disappear completely.

However, in the PayPal and Shopify stablecoin payment cases discussed above, intermediaries such as PayPal and Stripe acted as payment service providers (PSPs), handling issues such as fraud detection, cancellations, and chargebacks. In the case of PYUSD, transactions are not processed on-chain but on PayPal's backend, which provides room for dispute resolution. In the case of Shopify, the Commerce Payments Protocol smart contract on the Base network introduces a buffer time instead of approving payments immediately, which provides room for dispute resolution. In addition, USDC issuer Circle released the Refund Protocol for non-custodial dispute resolution in stablecoin payments.

Stablecoin-based payments are the inevitable future. Just as issuance is important, distribution is equally important. As Dragonfly ...

JinseFinance

JinseFinance

JinseFinance

JinseFinance Huang Bo

Huang Bo Beincrypto

Beincrypto Bitcoinist

Bitcoinist Coinlive

Coinlive  Bitcoinist

Bitcoinist Beincrypto

Beincrypto Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph