Introduction

In previous reports, we traced Bitcoin’s journey from two pizzas to a million iPhones and charted its evolution from a speculative asset to a macro-relevant reserve alternative. In parallel, we explored how digital assets are no longer fringe assets, but increasingly important in redefining capital formation, liquidity, and trust in the 21st century.

As of July 2025, stablecoins are no longer just payment instruments, they are levers of geopolitical influence, monetary strategy, and financial infrastructure. This investor-focused report lays out the evolving US-centric strategy to position dollar-backed stablecoins as a digital extension of the dollar system. Against the backdrop of politically favorable governments, accelerating regulation, and global fragmentation, we explore how stablecoins are being weaponized to reassert the dollar’s dominance, attract capital to US Treasuries, and reshape cross-border financial rails. Investors should view stablecoins not just as payment instruments, but as programmable sovereign capital flows backed by the credibility of U.S. policy, global demand for liquidity, and scalable currency interoperability.

Source: Stablecoin Insider

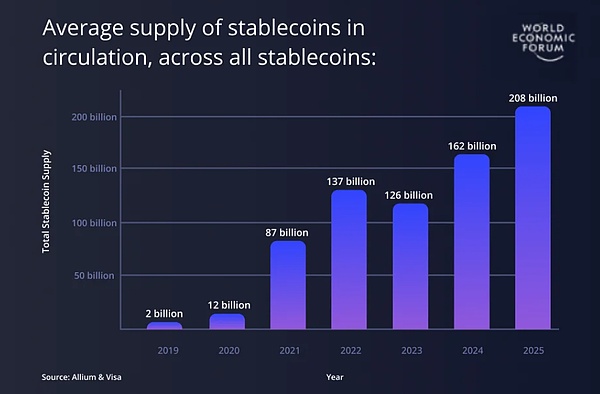

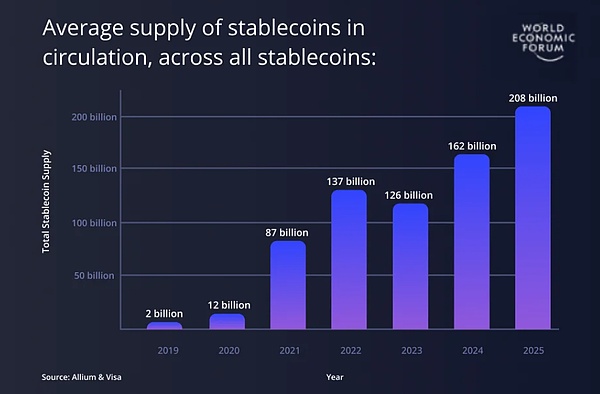

In 2019, stablecoins were just a small side bet in the digital asset space, with a total supply of only $2 billion. Fast forward to today, and that number is expected to exceed $260 billion, driven by a surge in interest from global banks, leading fintech platforms, and Web3 builders who are changing how money moves around the world. What's driving this rapid growth? Simply put, traditional payment systems are too slow, costly, and fragmented to keep up with today's global economy.

InformationSource:Allium & Visa

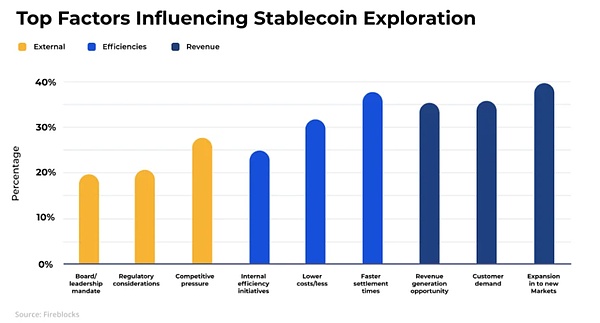

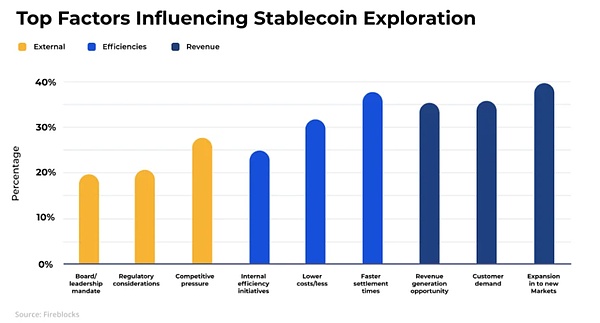

The traditional financial system is often slow, expensive and outdated – which is why stablecoins are rapidly gaining attention around the world. Today, banks, businesses and fintech companies are increasingly looking to stablecoins as a faster and more reliable way to transfer value and tap into new sources of revenue.

What's driving this momentum? Faster settlement times, significantly reduced transaction costs, increasing regulatory clarity in regions such as the EU and Asia, and growing customer demand for modern, real-time payments. Stablecoins are rapidly evolving from an experiment to a strategic necessity.

Source: Fireblocks

The Basic Logic of Stablecoins: The Beginning of Platform Finance

Stablecoins are no longer just programmable currencies. They are becoming the connective tissue of a decentralized global financial system, serving as interoperable value conduits between banks, fintechs, DeFi protocols, and national economies. Think of them as the TCP/IP of finance: invisible to most users, but critical to how transactions move in an increasingly digital economy.

Their programmability enables a new paradigm for financial settlement: 24/7 availability, cross-platform composability, and instant finality. Whether embedded in enterprise financial systems, powering Web3 applications, or facilitating retail payments, stablecoins offer an alternative to traditional rails like SWIFT or ACH. Importantly, this transformation is not happening in isolation, and is closely tied to evolving regulation and geopolitics.

Just as broadband internet transformed retail and media through ubiquitous programmable infrastructure, stablecoins are doing the same for payments, banking, and capital markets. The most profound changes often start at the protocol layer, and stablecoins are where it’s at — invisible, but indispensable.

USE CASESAND PATH TO MONETIZATION

The real driver behind the explosive growth of stablecoins is not hype, but application.

For businesses, stablecoins are quickly becoming a tool for global treasury optimization. Companies can pay international contractors, manage foreign exchange risk, and settle cross-border invoices—all without touching the correspondent banking system. In Latin America, Africa, and parts of Asia, freelancers now often request to be paid in USDC or USDT to protect themselves from local currency fluctuations.

On the consumer side, stablecoins are breaking into everyday finance. PayPal, VisaNet, and Stripe have all integrated stablecoin rails. This means users can now hold digital dollars in their wallets and use them like fiat currency — bridging the user experience of Web2 with the trustless backend of Web3. Stripe’s acquisition of stablecoin issuer Bridge in 2024 was a turning point, signaling that the largest fintech platforms now view stablecoins not as competitors but as infrastructure.

Even banks are paying attention. In Asia and the Middle East, banks are experimenting with stablecoins for cross-border interbank settlements and programmable foreign exchange flows. What was once a fringe crypto product is now reshaping mainstream financial plumbing.

In addition, we see adoption accelerating in B2B and payroll. As of Q2 2025, over 280 enterprise platforms support stablecoin settlements. From agriculture to digital media, companies across the supply chain are using stablecoins for faster, cheaper, and programmable payments. When paired with tokenized invoices and smart contracts, stablecoins can unlock real-time working capital management.

Source: Reuters

US policy adjustment: from rejecting CBDC to accelerating stablecoin

The US government has made a strategic adjustment. Instead of pursuing central bank digital currency, it has doubled down on regulated privately issued stablecoins as a digital pillar for the expansion of the US dollar.

In July 2025, Capitol Hill’s “Crypto Week” witnessed the advancement of three key bills that will define the United States’ future attitude towards digital assets. At the same time, the Trump administration has also begun to embrace the crypto space - banning CBDC (Central Bank Digital Currency) while supporting an innovation-friendly framework to empower private stablecoin issuers.

This shift is not only economic, but also ideological. The United States positions stablecoins as a free-market alternative to state-owned digital currencies. This approach also reflects an understanding that the global financial architecture is shifting from centralized to decentralized, and the United States intends to lead this evolution through private sector-led innovation, backed by regulatory clarity.

Why did the United States chooseto support stablecoins?

Consolidating Tech and Financial Dominance:

For four decades, the United States has led the global value chain through technological and financial dominance. Stablecoins are the fusion layer of the two.

Rebuilding Treasury Demand:

Foreign holdings of U.S. Treasuries have fallen sharply. Stablecoin issuers such as Tether and Circle are stepping in, holding over $120B in Treasuries — making them an invisible liquidity anchor for the U.S. debt market. While this number sounds like a drop in the bucket compared to the current $37T in debt, demand will grow as the number of user cases increases.

ARK Invest estimates that if stablecoin market cap reaches $2T by 2028, reserve mandates could drive up to $1.6T in US debt demand. That’s a larger pool of buyers than Japan.

Digital Dollarization Strategy:

In a world where China is launching a digital yuan and Europe is piloting a digital euro; the US is using private stablecoins as an answer. These tokens enable dollars to travel abroad without relying on a Fed account or correspondent bank.

Legislative Framework: The Three Pillars Strategy of the United States

GENIUS Act – Legalization of Stablecoins

Allow banks, licensed non-banks, and regulated state-chartered entities to issue stablecoins

Require 1:1 reserve support and high-quality liquid assets (such as Treasury bonds, FDIC insured cash)

Prohibit interest-bearing stablecoins and algorithmic models

Monthly disclosure and annual third-party audits

CLARITY Act – Token Lifecycle Governance

Classify tokens based on their lifecycle: pre-launch = securities, post-decentralization = commodities

Assign SEC oversight during fundraising and transfer to CFTC (Commodity Futures Trading Commission) after the project is decentralized

Includes safe harbors for DeFi interfaces and launch exemptions for small token issuance

This modular framework provides token projects with a gradual path to compliance.

Anti-CBDC Acts – Private Sector Digital Dollars

Explicitly prohibit the Fed from issuing a retail digital dollar

Reflects an ideological and commercial preference for private railroads over state-run solutions

Together, these laws build a coherent regulatory stack that positions stablecoins over CBDCs as the future of U.S. digital currency

Global resistance: division and the struggle for sovereignty

2. China and Hong Kong – Strategic Reshaping

While mainland China continues to ban crypto, Shanghai is now exploring stablecoins pegged to the yuan, with giants like JD.com and Ant Group lobbying to offer offshore yuan tokens under Hong Kong’s upcoming licensing regime (effective August 1, 2025). Hong Kong has received more than 40 applications (including from Ant, JD, Standard Chartered and Circle), but will grant fewer than 10 licenses under strict capital, reserve and anti-money laundering rules.

Risks:

These yuan stablecoins face central bank regulation and are subject to changes in the People’s Bank of China’s policies and capital control restrictions. Under the Hong Kong regime, offshore issuers must also deal with uncertainty over license approval.

3. Japan - Cautious Innovation

Japan's revised Payment Services Act (mid-2023, updated in early 2025) restricts the issuance of stablecoins to banks, trust companies and licensed payment providers. Issuers must hold fully backed reserves (domestic trust holdings), of which ~50% is allowed in short-term government bonds.

Risks:

In a low-interest rate environment, this stringent requirement limits potential yields and raises the bar for reserve management, ultimately squeezing issuers' profitability.

Risk Considerations

1. Bank and Reserve Risk

Stablecoins like USDC keep real money in banks to back their tokens. But in March 2023, when Silicon Valley Bank collapsed, USDC's $3.3 billion in funds were in trouble. This caused USDC to temporarily lose the value of $1, falling to $0.87. If the bank fails, people may lose trust and the stablecoin may depreciate.

2. Smart Contract Risk

Many stablecoins use smart contracts to run. But these programs can have bugs or be hacked. In the past, projects such as Euler and Curve have lost millions of dollars due to code problems or spoofing attacks. If the technology is not strong enough, even well-known stablecoins can be exposed.

3. Reserve and Liquidity Risk

If the stablecoin does not hold enough safe and liquid assets (such as U.S. Treasury bills or cash), it may not be able to repay users when people try to redeem their coins. In Europe, new rules such as MiCA require stablecoins to show their reserves in real time to help prevent this. Failure to comply can result in large fines — up to €15 million or 3% of a company’s revenue.

4. Loss of peg and market panic

Sometimes, even the largest stablecoins can briefly lose their $1 value (called a “depeg”). This can happen during times of stress or bad news. When this happens, investors may rush to sell weaker stablecoins and move to safer ones. This can cause sharp market moves and undermine confidence.

Stablecoins as the Dollar’sDigital Avatar

The United States has chosen its own path in the digital currency race—not central bank tokens, but privately issued, dollar-backed stablecoins operating under a clear federal framework.

For investors, this marks a generational shift. Stablecoins are no longer a crypto product—they are now becoming the operating system for digital finance. The race is no longer just about digital tokens, but about maintaining control over the global economic settlement layer.

In the coming quarters, expect institutional capital to flow into stablecoin infrastructure, strengthening the alignment between traditional finance and Web3, and blurring the lines between sovereign currencies and protocol-native liquidity. In the future, stablecoins may no longer be a product, but more like a lifestyle.

Joy

Joy