HashKey: A panoramic view of the PayFi track - full of challenges and huge potential

The prospects are broad, but the challenges are numerous; this is the true portrayal of PayFi at the moment.

JinseFinance

JinseFinance

TL;DR

1. The stablecoin market continues to grow, and crypto payments will not completely replace the traditional legal currency system

2. The real significance of PayFi is to promote the application and innovation of crypto assets in real scenarios in the real world

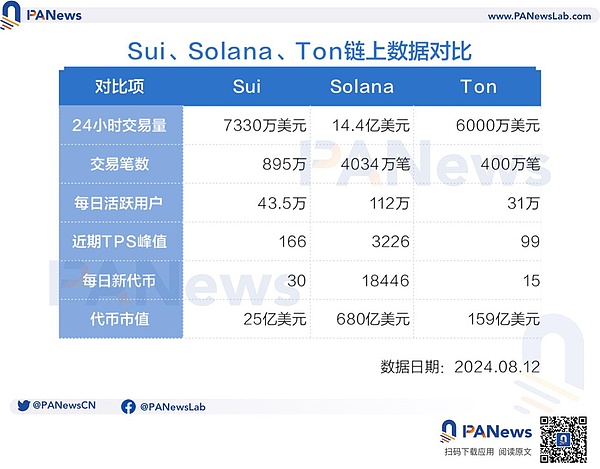

3. Solana is not necessarily the only option for PayFi or the crypto payment track. Ton Network and Sui are likely to catch up with their respective advantages

4. The PayFi track has huge room for imagination in the future. As a composite innovative application of multiple tracks, its potential market value may exceed 10 billion US dollars

In recent years, the crypto payment track has been constantly iterating and developing, from the initial prejudice that crypto payments were considered to be gray market trading tools to the acquisition of the stablecoin platform Bridge by the traditional financial technology platform Stripe, and the entry of orthodox industry giants such as Paypal and Visa. Combined with the new concept of PayFi that has recently emerged, it has attracted widespread attention.

ArkStream In order to better understand the prospects of this track, we briefly sorted out the encrypted payment track and focused on how PayFi iterates the encrypted payment track, so as to gradually explore its future development direction.

Crypto Payment Track

Since its birth in 2008, Bitcoin has experienced a gradual transition from small-scale transactions of technology enthusiasts to commercial applications widely accepted by global merchants, and then to regulatory intervention and compliance development. It has now formed a diversified and platform-based payment ecosystem. Today, with the maturity of technology and the expansion of application scenarios, encrypted payments are gradually being integrated into the traditional financial system, providing users with more efficient, low-cost, highly transparent and decentralized payment solutions, heralding a new round of changes in the field of financial technology.

Behind this innovation, stablecoins, as a bridge between cryptocurrencies and legal tender, provide a foundation for the widespread application of crypto payments through stable value storage and efficient on-chain circulation. By studying the situation of the stablecoin market, we can well interpret the entire market.

Overview of the Stablecoin Market

https://visaonchainanalytics.com/

https://defillama.com/stablecoins

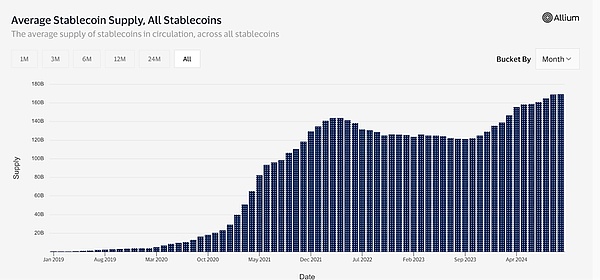

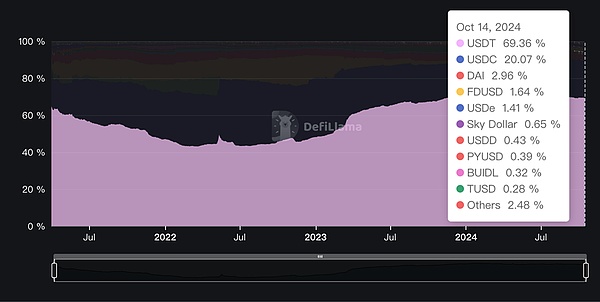

There is no doubt that the popularity of encrypted payments is directly linked to the stablecoin market. These two charts (total supply of stablecoins and their respective market share) reflect that the supply of stablecoins has experienced long-term growth worldwide. USDT and USDC, as the two giants of stablecoins, occupy 90% of the total market, and USDT is the well-deserved leader (70% share) and shows a stable and slow upward trend.

At the same time, we investigated the distribution of USDT and USDC on the chain. USDT was issued on 13 chains in total.

Among them, the issuance on Torn is the largest, accounting for more than 50%, followed by Ethereum and Solana. The top four on-chain issuances account for nearly 99% of the total issuance. On the contrary, the distribution of USDC is more concentrated, with issuance on Ethereum accounting for nearly 92% of the total issuance, followed by Solana, Torn and Polygon.

It is not difficult to conclude that ETH and Solana are still the mainstream stablecoin application scenarios. The continued growth of the stablecoin track combined with the entry of many leaders in the traditional payment industry is enough to prove that the encrypted payment track has initially possessed an operating system of "payment scale", and it also directly proves that the market recognizes the application scenarios of stablecoin payments.

In order to better understand the operating mechanism of encrypted payment, we will analyze the four-layer architecture of the encrypted payment solution, which ensures the security, scalability and user experience of encrypted payment.

Crypto Payment Solutions

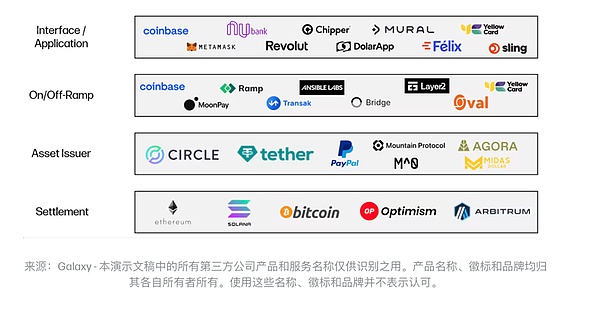

In the cryptocurrency payment solution, we can see through the flow chart that there are a total of four layers of architecture:

https://www.galaxy.com/insights/perspectives/the-future-of-payments/

- Settlement layer: The underlying infrastructure of the blockchain, the public chain, many Layer 1s and general Layer 2s such as Optimism and Arbitrum, they are slightly different in speed, scalability, privacy and security, and in essence they are selling block space.

- Asset issuance layer:Responsible for creating, maintaining and redeeming stablecoins, aiming to maintain a stable value against a fiat currency or a basket of anchored assets. Issuers make profits by investing in assets with stable returns such as government bonds. Unlike intermediaries in traditional payments, asset issuers do not charge fees for each transaction using their stablecoins. Once a stablecoin is issued on the chain, it can be self-custodied and transferred without paying any additional fees to the asset issuer.

- Deposit and withdrawal layer:Deposit and withdrawal providers serve as the connection between blockchain and fiat currency, and as a technical bridge between stablecoins on the blockchain and the fiat system and bank accounts. This type of platform is mainly divided into two categories: B2C and C2C.

- Interface/application:The platform provides a software interface to customer service, supports payment of cryptocurrencies, and uses the traffic-driven fees generated by front-end transaction volume as a business model.

Current Status of Crypto Payment Track

- Traditional payment giants enter the crypto market

With the year-on-year expansion of the crypto market and the passage of ETFs, traditional payment giants and crypto-native payment projects are actively developing and expanding related businesses. As early as 2023, Visa has expanded the settlement function of USDC to Solana, providing a more efficient solution for cross-border payments and real-time settlements.

Combined with the four-layer architecture of crypto payments we introduced earlier, Visa builds its crypto payment ecosystem through multi-level cooperation:

1. At the asset issuance layer, Visa cooperates with Circle to use USDC as a stable currency for settlement to ensure stable and compliant payments.

2. In the gold layer, Visa supports users to transfer funds between fiat currency and cryptocurrency through cooperation with Crypto.com;

3. At the application layer, Visa provides acquirers such as Worldpay and Nuvei with the option of USDC settlement, ensuring that merchants can flexibly handle encrypted payments.

4. At the settlement layer, Visa chose Solana as the blockchain infrastructure, using its high parallel processing capabilities, stable and predictable transaction fees, and fast block confirmation time to achieve more efficient on-chain settlement.

Through this integration, Visa is no longer dependent solely on the traditional bank settlement system. This integration means that users can use USDC for settlement directly through the blockchain network, eliminating intermediaries, shortening settlement time, and reducing costs. This move not only shows how encrypted payments can bring innovation to the traditional payment system, but also provides new ideas for the future global payment network.

Paypal also chose Solana as its new public chain for PYUSD payment this year, and actively promoted blockchain-based payment methods. Paypal's vice president has repeatedly emphasized Solana's performance in high throughput and low latency, making it an ideal infrastructure for crypto payments. Although these traditional payment giants are not as good as Web3 native payment players in blockchain technology and understanding of the Crypto industry, they have quickly entered the crypto payment market with their huge user base and traditional industry resources to compete for market share.

- Native Crypto Projects

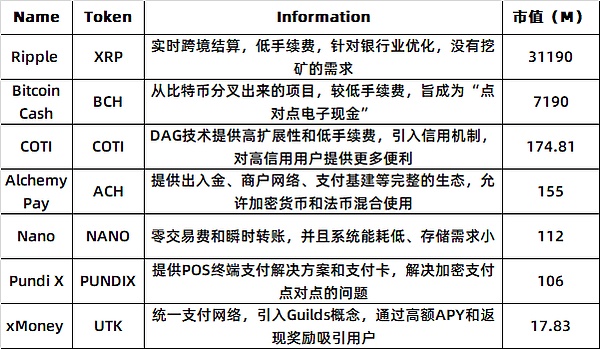

Compared to these traditional giants, native crypto payment projects drive business development in a more innovative way. Here we have counted the projects belonging to crypto payment in Binance Exchange

- Ripple for B2B cross-border transactions

Ripple has raised nearly $300 million in total so far, and its investors include well-known venture capital institutions such as a16z, Pantera, Polychain, and IDE. Currently, there are nearly 6 million active accounts, and its partner institutions exceed 300 in 50 different countries.

XRP is the native token of Ripple Network. As a Layer 1 public chain, Ripple focuses on the B2B market and is committed to building a CBDC ecosystem through a decentralized payment settlement and asset exchange platform in cooperation with banks around the world.

Ripple uses the RPCA consensus algorithm, and its RippleNet is built on the XRP Ledger, providing a variety of solutions including xCurrent, xVia and xRapid, aiming to improve the efficiency and liquidity of cross-border fund transfers. Through these technologies, Ripple cooperates with traditional financial institutions such as Bank of America and Credit Suisse. Compared with the traditional SWIFT system, Ripple has significant advantages in transaction speed and cost, completing transactions in seconds at a cost of less than 1% of the traditional cross-border payment cost.

According to statistics, the number of XRP payment user transactions is about 150,000 per day, with an average daily activity of more than 10,000. Its development has not been smooth sailing. It has experienced a years-long SEC lawsuit accusing it of issuing securities in an unregistered manner. It was not until recently that the SEC withdrew its lawsuit against Ripple.

- Alchemy Pay for crypto payments

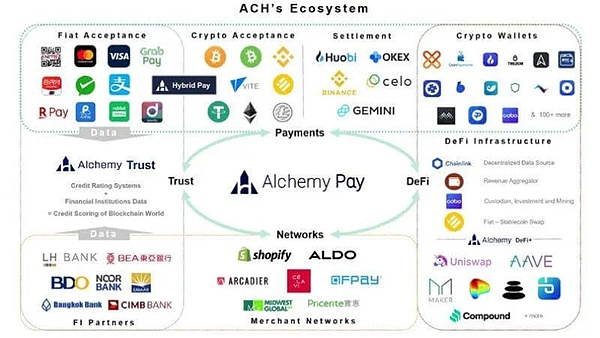

Alchemy Pay has received a total of US$10 million in financing from investment institutions such as DWF and CGV. Recently, its virtual card and Samsung Pay have attracted public attention again.

Alchemy Pay has built a hybrid payment architecture that combines on-chain and off-chain by integrating underlying payment protocols such as Lightning Network, State Channel, and Raiden Network. The on-chain is responsible for ledger management and data storage, while the off-chain handles computationally intensive tasks such as inspection and reconciliation. This architecture supports Alchemy Pay to provide customized solutions including deposit and withdrawal payment services, NFT quick purchase, crypto credit cards, and crypto payments.

https://alexablockchain.com/alchemy-pay-to-transform-crypto-payment-with-its-new-product/

According to the ACH ecosystem map compiled by a third party, Alchemy Pay's ecosystem has opened up four major sectors: payment, merchant network, DeFi, and trusted assets. Its partners include industry leaders such as Binance, Shopify, Visa, and QFPay, highlighting its extensive layout in the entire payment chain.

The biggest difference from XRP is that Alchemy Pay's token ACH is not a medium for crypto transactions, but provides users with cash back rewards through each payment, providing a consumption reward mechanism similar to traditional credit cards, enabling actual payment scenarios, and improving user loyalty.

ArkStream believes that whether it is the traditional industry giants relying on their deep industry resources and global business network to enter the crypto market, or the crypto-native payment projects relying on their decentralized architecture and token economic model, these two types of players are promoting the development of the industry in different ways. Traditional giants have strong market influence and compliance advantages, while crypto-native projects have unique advantages in technological innovation and rapid iteration. Recently, we have also witnessed Stripe completing the largest acquisition in the history of crypto by acquiring Bridge. We look forward to the two strong forces to fully utilize the traditional industry's ability in resource integration and scale operation, combined with the innovative mechanism of crypto, to promote the entire payment industry towards digitalization, cost reduction and efficiency improvement.

- Pain points of the crypto payment track

1. Unstable transaction costs: The original intention of crypto payment is to reduce the middlemen and transaction costs in the traditional payment link, but in actual operation, its fees are not cheaper than traditional payment. The network often sees a surge in transaction fees during peak trading periods, especially the congestion problem of major public chains is more significant. In contrast, the rates of traditional payment tools such as credit cards or third-party payment platforms are more stable, and many daily transaction fees are borne by merchants (similar to the free shipping theory), which is less perceived by users and easier to accept.

2. Limited processing power: Although the decentralization and consensus mechanism of blockchain ensure the transparency and security of the system, it also greatly limits the processing power of the network. Since blockchain requires global nodes to reach a consensus, the transaction speed is limited by the block capacity and block time. Although Layer 2 expansion solutions (such as the Lightning Network), more efficient cross-chain communication and sharding technology may bring new breakthroughs, even Solana, which has been proven to have the best performance, still cannot compare with traditional payment giants such as Visa in terms of its highest TPS. For high-frequency small-amount payment scenarios, the current encrypted payment network still has obvious bottlenecks

3. Lack of application scenarios: Although encrypted payment can be realized in the most basic daily consumption, transfer, cross-border payment, etc. in reality. However, in the mature financial market environment, common business scenarios such as lending, insurance, leasing, crowdfunding, asset management and other derivative application scenarios still rely on the traditional financial system, and the share of encrypted payment is completely blank

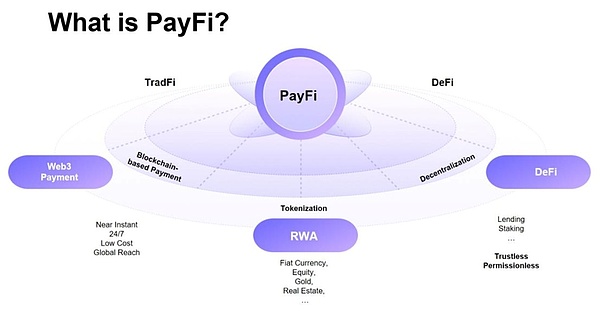

ArkStream The fundamental reason is that the iteration of existing encryption technologies and the application of products often give priority to the interests of existing users in the encryption field, ignoring the broader market demand. Whether it is Alchemy or Visa, the focus on blockchain is still on deposits and withdrawals, encrypted debit cards, encrypted peer-to-peer payments, etc. In order to further realize Mass Adoption, ArkStream believes that project parties need to pay attention to the needs of users outside the encrypted ecosystem, especially the needs to unlock more application scenarios, and create a full payment ecosystem belonging to encryption. Lily Liu, Chairman of the Solana Foundation, noticed this market gap and proposed the concept of "PayFi" at the Hong Kong Web3 Carnival in April 2024 to meet these challenges and promote the widespread use of encrypted payments. PayFi: A New Chapter in Web3 Payments Introduction to PayFi First of all, what is PayFi? PayFi is not an independent concept, but an innovative application that integrates Web3 payments, DeFi, and RWA.

1. RWA tokenizes assets and puts them on the chain, making the value transfer 1:1 on the blockchain seamless, and uses smart contracts to build transaction and settlement processes;

2. DeFi focuses on the on-chain economy and innovation of traditional financial products around decentralization. Whether it is automatic market makers, flash loans, liquidity mining, etc., its mainstream purpose is trading;

3. Web3 Payment focuses on using cryptocurrency as a payment medium, such as cross-border remittances, encrypted payment cards, etc. to improve the efficiency of traditional finance.

PayFi is not equal to RWA, Web3 Payment or DeFi. ArkStream believes that its real significance lies in promoting the application of digital assets in real scenarios in the real world. To be more precise, it expands the innovative application scenarios of DeFi to reality on the road that RWA and Web3 Payment have already paved.

https://www.feixiaohao.com/news/12951184.html

PayFi’s two core concepts:

- Tokenization of real-world assets: When the transaction payment scenarios are essentially real life, the premise for realizing PayFi is to move traditional payment scenarios to the chain through tokenization. By tokenizing stable and low-risk assets, DeFi is used to achieve transparency, high liquidity, multiple gameplay, and high returns on capital. At the same time, RWA provides a wider range of asset categories and a stable source of anchored income. - Releasing the time value of funds: Another important concept of PayFi is to realize the time value of funds at the lowest cost but in the most efficient way through smart contracts and the centralized characteristics of blockchain. For example: users can manage and invest funds without intermediaries, such as on-chain flash credit markets, installment payment systems, and automated investment strategies. More application scenarios all aim to reduce opportunity costs so that funds can quickly enter the market for reinvestment or other purposes.

Here we use a basic mathematical model to quantify the value created by PayFi, focusing on the opportunity cost loss caused by the return on funds:

P is the amount of the prepayment, r is the interest rate, and assuming that traditional cross-border payments take 3 days and encrypted payments take 3 minutes, we can calculate the opportunity costs in the two cases

Opportunity cost (traditional payment) = P × r × 3

Opportunity cost (encrypted payment) = P × r × (3/1440)

The gap between the two is about the interest rate difference of 3 days. From our simple reasoning, we can conclude that the opportunity cost gap between the two will become larger and larger as the prepayment increases and the interest rate rises. Therefore, this efficiency improvement is particularly significant in high-frequency, large-value transactions, and interest rate hike environments.

PayFi's public chain choice

So far, many crypto payment projects have come to Solana for layout. At present, Solana has become the main platform for PYUSD, with a market share of 64%, far exceeding Ethereum's 36%. EUROC, EURC and other MiCA-compliant stablecoins will also land on the Solana ecosystem.

So why do both traditional financial and native crypto projects tend to develop on Solana? We have analyzed this and summarized the following key factors: high-performance public chains, capital liquidity and talent liquidity.

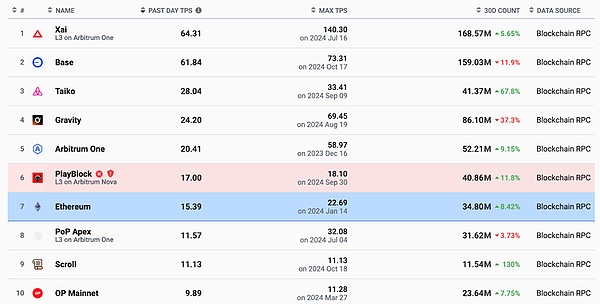

-High-performance public chains: Solana's high performance is its core competitiveness, and its recorded TPS ranks among the best in public chains so far. The consensus mechanism and low gas fee adopted by Solana make its performance significantly better than most L2 solutions

- Capital liquidity: Solana's ecosystem has obtained $61 billion in pledged capital, and the investment of top venture capital funds such as a16z and Polychain Capital has further enhanced Solana's market confidence and competitiveness

- Rich application group: Many C-end application scenarios, whether it is Sanctum debit card, Helium's Sim card or Solana's official mobile phone, far exceed the application construction of other public chains

Most of the Layer 2 projects such as Optimism, zkSync, Lighting Network or public chains including Polygon, the unlaunched Monad, Aptos, etc., all claim to have stronger and better TPS and scalability. However, according to the website data, most of the highest TPS records of L1 and L2 cannot even reach a fraction of Solana.

https://l2beat.com/scaling/activity

Although Solana has experienced several major security interruptions since the launch of the mainnet in 2020, ArkStream believes that it is difficult for a chain to fundamentally replace Solana in the short term. Here we believe that Sui and TON, as two emerging public chains, are gradually showing their unique advantages and providing more options for the development of future encrypted payments

Sui: Parallel processing + innovative ecology

As a new generation of public chain, Sui adopts DAG architecture and parallel processing. Unlike Solana's high-frequency trading and DeFi expertise, Sui focuses more on solving network bottlenecks in large-scale user interactions. This also explains why Gamefi and more complex contracts may benefit from Sui's parallel computing capabilities and scalability.

Although Sui has not yet attracted large-scale capital like Solana, and its peak TPS in records is less than half of Solana. But the development team behind it has rich experience in payment and decentralized application development, and may attract more innovative projects to develop on its ecosystem in the future. For PayFi, Sui's parallel processing capabilities may highlight its advantages in applications with intensive user interactions.

TON: Community + Payment Bridge

TON originated from Telegram's platform optimized for large-scale community communications and small-amount multi-payments. Unlike Sui and Solana's technical paths, TON focuses on low latency and high scalability. Its sharding architecture can support a large number of small payment transactions and has been integrated into Telegram's user ecosystem.

TON's greatest potential lies in its huge user base, backed by 900 million monthly active users and integrated mini app functions. As a bridge connecting Web2 + Web3, TON provides a huge ready-made market for payment projects such as PayFi through social payment and micropayment fields.

https://www.techflowpost.com/article/detail_19707.html

Although Solana has taken a leading position in the current crypto payment market, including PayFi, with its proven high performance, rich DeFi ecosystem and capital advantages. However, as technology continues to upgrade, the future of crypto payments may be the coexistence of multiple chains. Sui's parallel processing capabilities and innovative application scenarios, and TON's wide application in social payments are expected to become the key forces to break the existing crypto payment landscape.

As for whether PayFi's project parties will choose Sui or TON, it may ultimately depend on factors such as the project's product demand, market positioning, and GTM strategy, but the richness of multiple chains and application scenarios in the future will undoubtedly provide more opportunities for PayFi projects.

Business model and landing application

The concept of PayFi was first proposed in April 2024, and the number of related projects is relatively small. We divide the projects in PayFi that we have seen so far into two tracks. The two application scenarios are: cross-border trade and credit finance.

Huma Finance

Product Introduction: Huma Finance is the current focus of the PayFi track. Its main business is PayFi applications for C-end and small and medium-sized enterprises. The newly acquired Arf mainly solves the liquidity of prepaid capital in current cross-border payments.

Arf's vision is to solve the liquidity and timeliness problems of prepaid capital in current cross-border payments. Through the Arf platform, the trust issues between buyers and sellers are solved, and there is no need to prepay banks or letters of credit, which are required for traditional cross-border transactions. Arf builds an on-chain liquidity network by providing peer-to-peer services, providing on-chain stablecoins to enterprises in advance while eliminating the need for prepayments. When using Arf's services, enterprises only need to pay the relevant fees and repay Arf within the agreed time.

https://x.com/arf_one

At the same time, Huma Finance's main business mainly revolves around the concept of "Buy Now, Pay Never" claimed by Lily Liu. Its core concept is that customers can choose to use their accounts receivable that are about to expire as collateral. Huma tokenizes these accounts receivable through its agreement. Customers borrow from the loan pool, and the enforced part will be implemented by smart contracts on the chain. Its extensible space includes: trade financing, small and micro enterprise credit, international tuition payment, etc.

Technical architecture: Huma Finance's PayFi Stack includes six layers: transaction layer, currency layer, custody layer, financing layer, compliance layer and application layer, covering all levels from transaction processing to asset management, financing and compliance. This full-stack design ensures that the entire process from loan application, asset evaluation, capital provision to final payment can be completed in the same ecosystem. PayFi greatly simplifies the complex lending and payment process through automation, decentralization and multi-level technical integration, improves efficiency and reduces costs.

Data analysis: As of now, there is a total loan amount of US$1 billion, and there is no record of default. As the leader in the PayFi track, Huma Finance has raised US$38 million.

PayFi's future development market

After introducing PayFi-related projects, we also thought about the areas of its application scenarios. ArkStream believes that PayFi undoubtedly has the potential for global mass adoption, and its early application scenarios are not necessarily limited to developed countries (the United States, Singapore, Europe, etc.). We believe that emerging markets also have broad prospects.

-Market strategy in developed countries: In developed countries, PayFi can use its ability to integrate DeFi innovations to supplement existing digital payment systems. Due to the clearer regulatory framework and policy support in developed countries, (such as USDC, PYUSD, EUROC) have been widely used in these countries. Finding a suitable entry point, for example, working with retailers, e-commerce, and cross-border financial platforms to build low-cost and more capital-efficient encrypted payment channels may accelerate the opening of the PayFi market

-Opportunities in emerging markets: At the same time, PayFi is in areas lacking traditional financial services. By providing products such as encrypted micro loans and flash loans. The decentralization and cross-border convenience of the encrypted payment system can provide financial services to these "unbanked people". For example, in Africa, Southeast Asia and Latin America, or in some countries with high inflation fiat currencies such as Nigeria and Argentina. Because emerging markets lack complex traditional financial infrastructure, providing stable PayFi products may achieve scale faster than in developed countries.

Therefore, ArkStream concludes that PayFi should combine multiple market development strategies and develop on two tracks: in developed countries, focus on iterating and establishing partnerships to assist existing application scenarios. In developing countries, promote the application of crypto payments and PayFi and the penetration of cross-border remittance markets.

Development Prospects

Although the concept of PayFi was proposed not long ago, its landing application projects are relatively scarce. However, ArkStream believes that PayFi has a potential future development direction in the current environment. We see that both the development of crypto payment projects and the external economic environment are of great benefit to PayFi.

The global high interest rate environment caused by the US interest rate hike in the past few years has led to a lot of attention for bond products, and many users in the crypto market have also transferred their money into the tokenized bond market. Users value its stable underlying assets and relatively high liquidity.

According to RWA.XYZ data, the size of the tokenized US bond market has risen from US$770 million at the beginning of 2024 to US$1.916 billion today (as of August 1, 2024), an increase of 248%.

https://app.rwa.xyz/

As the United States announced a rate cut, the yield on U.S. Treasury bonds continued to decline. Investors' dependence on U.S. Treasury bonds weakened, and this part of the funds needed to find the next scenario to take over. Investors turned to look for other assets with sustainable value and stable sources of income.

PayFi, combined with the rise of the RWA model, just filled this demand. At present, the locked position of the RWA track is as high as 6 billion US dollars, and it continues to rise. The essence of RWA is to move real-world assets (such as bonds, accounts receivable, supply chain financial assets, etc.) to the chain through tokenization, providing investors with diversified choices, while achieving higher liquidity of assets.

Here we provide three potential RWA targets:

1. MakerDAO RWA provides traditional assets such as real estate and accounts receivable, combined with the DAI stablecoin issued by MakerDAO, to effectively connect the capital demand under the chain with the liquidity on the chain. It is also the RWA protocol ranked first in TVL;

2. Tether Gold provides traditional tokens pegged to gold, allowing investors to invest in gold through cryptocurrency without directly holding physical gold;

3. Ondo Finance provides risk-graded treasury bonds, corporate bonds, etc. of real financial assets on the chain. Funds can be invested according to risk preferences. Against the background of declining treasury bond interest rates, RWA products such as corporate loans provided by Ondo may be more in line with investors' preferences.

Conclusion

At present, the number of projects related to the PayFi track is extremely limited, and most of them are still in the early stages of development. Therefore, we pay more attention to the innovation of PayFi project solutions.

From the perspective of business model, PayFi combines multiple tracks such as encrypted payment (such as Ripple, Stellar), DeFi lending (such as AAVE, Compound), and RWA (such as MakerDAO RWA, Ondo Finance). Projects in these fields have successfully verified the feasibility of their business models and proved their market demand and growth potential. By horizontally referencing the market value of these tracks, PayFi, as a composite innovative business model, may have greater room for development. Considering that the market value of leading projects in the fields of crypto payment, credit financing and RWA has reached billions to tens of billions of dollars, we have reason to speculate that with the unlocking and superposition of multiple scenarios such as cross-border payment, supply chain finance, and corporate financing, the overall market value of the PayFi track may even break through this ceiling.

From the product dimension, the development of the PayFi project in the future should focus on segmented payment scenarios and optimize the efficiency and experience in these areas. There is no doubt that PayFi is one of the few remaining blue ocean markets, but there is still a lack of a large number of application projects in this track. We call on more developers to use existing crypto payment technology, pay attention to the global market, and innovate in combination with actual needs in real life.

For example, at the venue of Token2049 this year, we noticed that TADA Taxi’s cooperation with Ton Network reduced the commission rate of taxi software through crypto payment and profit sharing, making it stand out among similar taxi platforms. At the same time, we also noticed that Ether.Fi is carrying out the encrypted payment card business. Its Cash business not only has the functions of traditional encrypted payment application scenarios, that is, depositing encrypted assets for consumption. At the same time, it allows users to use the income from liquid pledges to repay their consumption expenses.

This kind of breakthrough in real-life scenarios is exactly where PayFi has great potential for reference worldwide. Project parties should not only focus on finding the next high-yield "reservoir" for on-chain funds, but should pay more attention to how to let users in traditional industries experience the convenience of PayFi, and further increase the penetration rate of the encrypted market from the altruistic perspective of price, products, etc.

It is conceivable that many new financial products that are difficult to achieve in the traditional financial system will emerge in the future, such as:

- Second-level lending: By pledging crypto assets through the PayFi platform, users can obtain loans that are more advantageous than traditional financial channels;

- Advance consumption and investment: Without the need for debt, users can consume or invest in advance before the future income cycle arrives;

- High-yield liquidity funds: By using pledge and liquidity pledge, users can retain the liquidity of funds while enjoying a high yield of more than 10%;

- Early payment of interest on locked-in financial products: Users can use interest as working capital before the financial product expires.

These innovative products all utilize the core concept of "time is money". By maximizing the value of time, we clearly realize that PayFi is not a castle in the air, nor is it just a "carnival for insiders". Whether from the perspective of practicality or innovation, PayFi is gradually opening up the path to the integration of encryption and traditional finance. As a long-term investor, ArkStream sees the potential of PayFi and even foresees a bankless future.

The innovations in these application scenarios combine the needs of DeFi and real-world applications, further verifying the huge potential of PayFi in unleashing capital efficiency. ArkStream believes that the long-term application prospects of PayFi are limitless.

The prospects are broad, but the challenges are numerous; this is the true portrayal of PayFi at the moment.

JinseFinance

JinseFinanceBitcoin is a decentralized transfer system and does not implement decentralized payment settlement. However, if Bitcoin transfers can trigger the execution of a smart contract in another decentralized system, such settlement may be possible.

JinseFinance

JinseFinanceWhat kind of infrastructure do we need to support real-world payment scenarios? What is the value and significance of PayFi?

JinseFinance

JinseFinanceRWA, PayFi, will PayFi be the next narrative of RWA? Golden Finance, will unsecured credit lending protocols work in the DeFi world?

JinseFinance

JinseFinanceThis article introduces the following: 1) Why has PayFi become a new topic? 2) Analysis of Huma's underlying business logic of Lending+RWA+PayFi. 3) What is the subsequent expansion space of the PayFi track?

JinseFinance

JinseFinanceWeb3 payment covers a wide range of business scenarios and categories, including stablecoins, wallets, asset custody, etc. Traditional financial institutions and Web3 entrepreneurs have combined blockchain technology and cryptocurrency to build numerous Web3 payment projects and use cases.

JinseFinance

JinseFinanceWith the development of high-performance blockchain technology, the true value of PayFi will expand and scale rapidly.

JinseFinance

JinseFinanceThis article will focus on the introduction of the “PayFi” concept and related projects to help readers keep up with Solana’s latest narrative.

JinseFinance

JinseFinance试想一下未来金融该如何运行,我会引入数字货币和区块链技术能够带来的优势:24/7 全天候可用、即时结算、无须许可公平准入、全球流动性、资产可组合性,以及公开透明。

JinseFinance

JinseFinanceThe Korean cryptocurrency market is active, with a high user ratio, large transaction volume, rapid development of the Web3 ecosystem, and significant government support and education promotion.

JinseFinance

JinseFinance