Public Opinion Collection and Research left;">The Treasury Department will launch a 60-day public comment period within 30 days of the GENIUS Act taking effect to identify innovative methods, technologies, or strategies that regulated financial institutions are currently using or may adopt to detect and circumvent illegal activities involving digital assets, including money laundering. These methods may involve application program interfaces (APIs), artificial intelligence (AI), digital identity verification, and blockchain monitoring technologies.

The adoption of APIs, AI, and blockchain monitoring technologies will drive regulators to transition from traditional manual review to automated supervision, and improve the efficiency of anti-money laundering review and supervision.

After the above public comment period ends, the Treasury Department will conduct a study based on the public comments. The Financial Crimes Enforcement Network (FinCEN) will evaluate the innovative approaches mentioned in the public comments and compare them with existing approaches to determine their progress in terms of regulatory effectiveness, costs, privacy risks, operational efficiency, and cybersecurity impact. After the evaluation, FinCEN will develop specific requirements for regulated financial institutions to adopt innovative approaches to detect illegal activities involving digital assets, operating specifications for payment stablecoin issuers to identify and report illegal activities involving their payment stablecoins, and operating specifications for payment stablecoin issuers to monitor blockchain transaction systems and practices.

The Treasury Department needs to incorporate the national counterterrorism and illicit financing strategy required by the Countering America’s Adversaries Through Sanctions Act into the regulation of illegal activities involving digital assets, paying attention to the use of digital assets in money laundering and sanctions evasion and the high-risk behavior in foreign jurisdictions that uses digital assets to obtain legal currency to facilitate illegal activities.

The Ministry of Finance will submit reports to Congress on a regular basis to report on the research results and progress of technical implementation of innovative detection technologies, and put forward legislative recommendations.

2 Compliance challenges faced by different types of projects

The GENIUS Act has a wide range of impacts, but the severity of compliance challenges faced by different types of Web3 projects varies significantly. The following analyzes the specific challenges faced by various types of projects in order of severity.

2.1 Direct Impact: Stablecoin Issuers

Mainstream stablecoin issuersAs the core regulatory objects of the GENIUS Act, they face the most stringent compliance requirements and the highest implementation costs. These projects must obtain federal or state licenses within 120 days, establish a 100% reserve support system, implement monthly public disclosures, and have the technical capabilities to freeze assets in real time. For large issuers with a market value of more than $50 billion, they are also required to accept annual audits and enhanced reporting requirements. Compliance costs are expected to be an initial investment of $8 million to $20 million, and ongoing operating costs of $3 million to $10 million per year.

Algorithmic and decentralized stablecoin projectsAlthough they may not be directly subject to traditional reserve requirements, they face uncertainty in regulatory classification. These projects need to reassess their governance structure, technical architecture, and compliance strategy to determine whether existing models need to be adjusted to adapt to regulatory requirements. In particular, stablecoin mechanisms involving yield generation may be classified as securities and face SEC supervision.

2.2 Severe Impact: DeFi Core Protocol

DeFi lending protocolFacing fundamental adjustments to the business model, in particular, the ban on yield-based stablecoins will force these protocols to redesign their product architecture. The protocol needs to remove or reconstruct strategies based on yield-based stablecoins, adjust the interest rate model, and ensure that all integrated stablecoins come from compliant issuers. Such projects will also need to implement enhanced transaction monitoring and reporting mechanisms to comply with AML requirements.

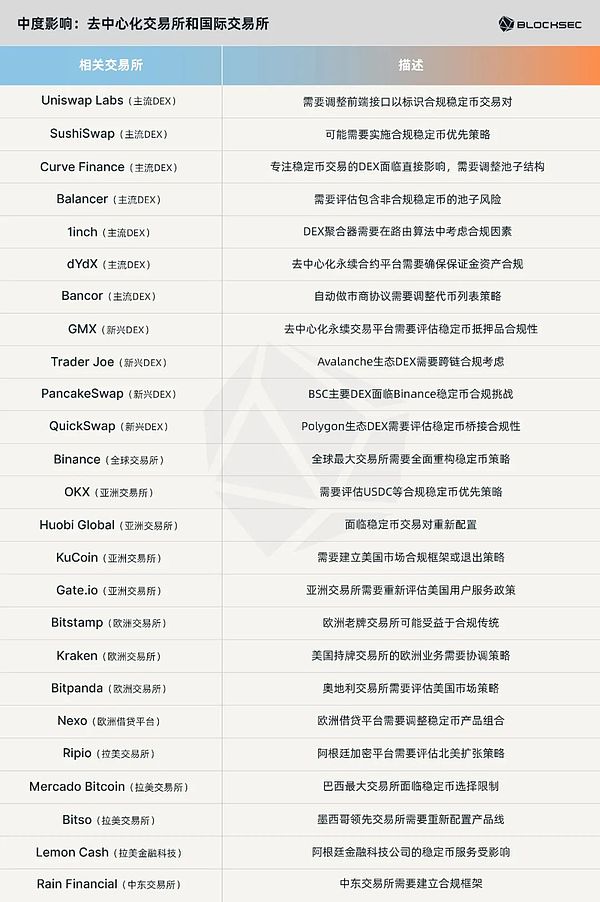

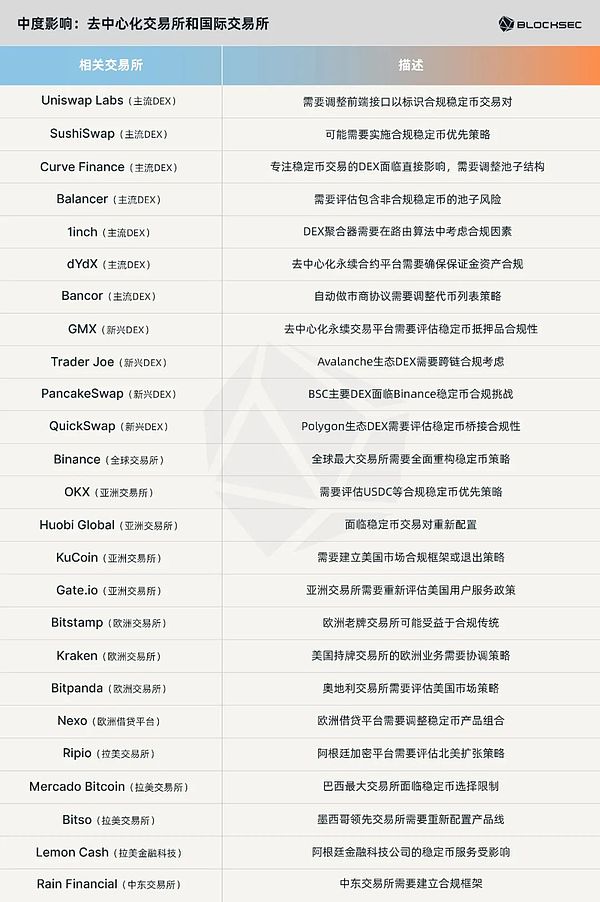

DeFi yield protocolsare most directly impacted, as their core business model - providing yield on stablecoins - may be classified as securities issuance. These protocols will need to completely redesign their product portfolios, remove strategies based on non-compliant stablecoins, or seek new models that operate within the regulatory framework. 2.3 Moderate Impact: Decentralized Exchanges and International Exchanges Decentralized Exchanges (DEX) benefit relatively from the asymmetry of regulation, as GENIUS is mainly aimed at issuers rather than trading platforms. However, these platforms still need to adjust their front-end interfaces to identify compliant stablecoins, and may need to implement a compliant stablecoin priority strategy and consider compliance factors in the routing algorithm. DEXs that focus on stablecoin trading, such as Curve, face more direct impacts and need to reconfigure their liquidity pool structure.

International exchangesface a binary choice: either establish a comprehensive U.S. compliance framework or exit the U.S. market. These platforms need to reconfigure stablecoin trading pairs, prioritize the promotion of compliant stablecoins, and may need to limit services to U.S. users. The cost and complexity of compliance will drive these platforms to reassess their global market strategies. 2.4 Moderate Impact: Wallet Service Providers

Custody Wallet Providers

2.4 Moderate Impact: Wallet Service Providers

Custody Wallet Providers

Facing similar regulatory requirements as money transmitters, these companies are required to implement fund segregation measures and enhanced consumer protection. These companies must separate customer funds from operational assets, establish user protection mechanisms in the event of the issuer's bankruptcy, and may need to obtain corresponding financial services licenses. Self-custodial wallet providersremain relatively independent, but need to implement stablecoin compliance status display functions in the user interface, provide user education, and may need to make strategic decisions on the treatment of compliant and non-compliant stablecoins. This type of impact is mainly reflected in product function adjustments rather than regulatory compliance requirements.

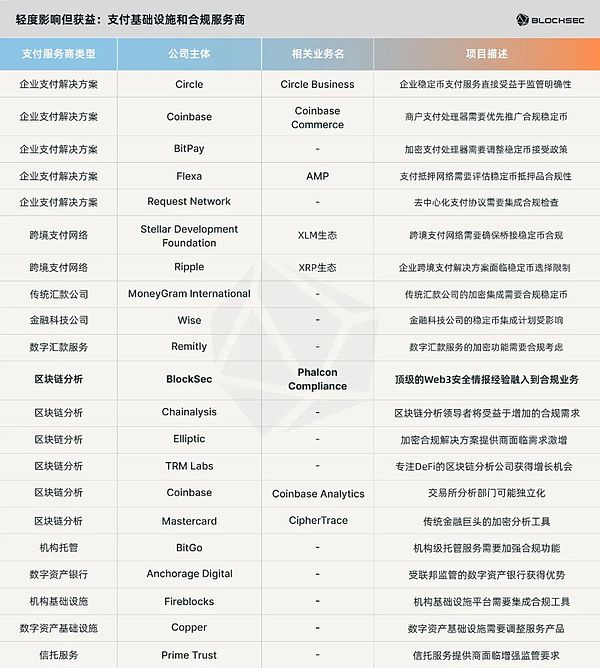

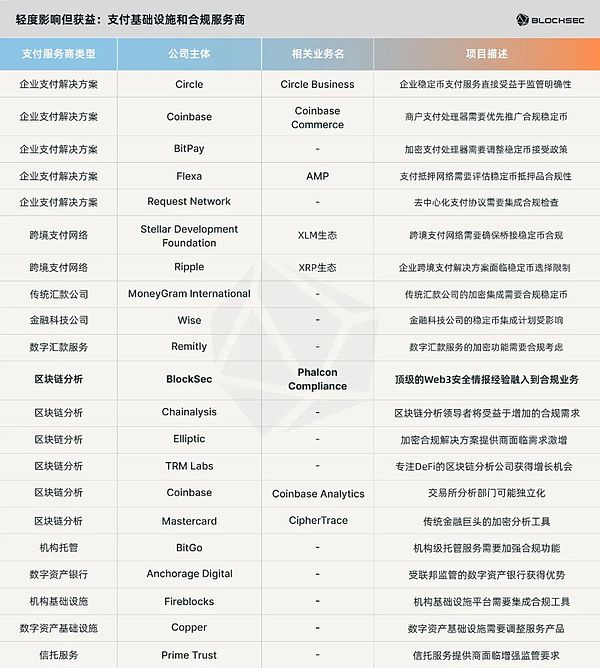

2.5 Slightly affected but benefiting from the bill: payment infrastructure and compliance service providers

Payment infrastructure providersare actually beneficiaries of the GENIUS Act, as regulatory clarity will promote cooperation from traditional financial institutions and adoption by the corporate market. These companies need to adjust their products to prioritize support for compliant stablecoins, but overall will benefit from increased market confidence and an expanded customer base.

Compliance infrastructure service providersface huge market opportunities, as the entire Web3 industry's demand for blockchain analysis, transaction monitoring, hosting services, and compliance consulting will increase dramatically. These companies need to quickly expand their service capabilities to meet market demand.

2.6 Common characteristics of compliance challenges

Through the analysis of the above types of Web3 projects, we summarize several common compliance challenges brought about by the GENIUS Act:

2.6.1 Technical architecture adjustment requirements

Almost all Web3 projects involving stablecoins in the U.S. market need to adjust their technical architecture. Stablecoin issuers need to establish real-time transaction monitoring systems and asset freezing capabilities; DeFi protocols need to redesign smart contracts to distinguish between compliant and non-compliant stablecoins; DEX platforms need to integrate compliance status displays in the front-end interface; wallet providers need to implement user education and risk warning functions. The complexity and cost of these technical adjustments vary depending on the type of project, but all require a lot of development resources.

2.6.2 Pressure to establish regulatory relationships

For most Web3 projects, establishing and maintaining regulatory relationships is a new challenge. Directly regulated entities(such as stablecoin issuers and custodial wallet providers) need to establish direct contact with the OCC, state regulators, and FinCEN;indirectly affected entities(such as DeFi protocols and DEX) need to establish a regulatory compliance framework through legal counsel;international projectsneed to evaluate whether to establish a U.S. subsidiary or seek regulatory exemptions. The establishment of a regulatory relationship requires not only a lot of legal and compliance involvement, but also long-term maintenance investment.

2.6.3 Requirements for reconstruction of operating model

The GENIUS Act will be a good opportunity to encourage more Web3 projects to rethink their basic operating models. Yield-based stablecoin projectsneed to completely reconstruct their value propositions;decentralized projectsneed to find a balance between maintaining decentralized characteristics and meeting compliance requirements;cross-chain projectsneed to deal with the complexity of compliance in multiple jurisdictions;algorithm-driven projectsneed to introduce more manual supervision and intervention mechanisms. This reconstruction of the operating model may require the project party to rethink the core competitiveness and market positioning of the project.

3 BlockSec's compliance solution

The GUNIUS Act provides a clear regulatory framework for the issuance of stablecoins in the United States. Clearer compliance requirements will help reduce industry risks, attract more users to participate, and bring new development opportunities to the industry. More and more institutions no longer regard regulation as an obstacle, but actively embrace compliance, and continuously improve their compliance capabilities by implementing KYC, identifying and recording suspicious behaviors related to money laundering and terrorist financing, tracking sanctioned entities, conducting due diligence on large transactions, promptly reporting suspected illegal and irregular transactions, and taking measures to prevent, freeze or reject related transactions.

However, the anonymity of blockchain and the complexity of on-chain interactions (especially cross-chain transactions) have brought huge challenges to institutions in terms of risk assessment, teamwork and compliance review. To this end, BlockSec has established in-depth cooperation with Grandway Law Firm to provide comprehensive compliance support to institutions through the combination of technology and law.

3.1 Phalcon Compliance APP: Easily identify and manage compliance risks

In response to the growing global compliance needs, BlockSec launched the Phalcon Compliance APP to provide VASPs with efficient tools that comply with Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) regulatory standards, helping institutions to accurately identify and manage risks associated with addresses/funds.

3.1.1 Accurately identify illegal activities ?

Risk exposure tracking: Through a massive database covering 400 million+address tags and updated in real time, it can accurately locate high-risk entities (such as sanctions lists), support unlimitedjump transaction tracking, and quickly identify suspicious addresses that intersect with high-risk entities.

Transaction behavior analysis: Real-time monitoring of on-chain transactions, combined with an AI-based intelligent behavior analysis engine, parallel processing of 500+ transactions per second, comprehensive analysis of behavioral characteristics, and accurate identification of suspicious activities such as money laundering and fund splitting.

3.1.2 Preset + custom risk engine ?

Preset risk engine: built-in risk engine that complies with FATF standards, covering major risk types such as entity risk, interaction risk, high-frequency transfer, large-value transfer, transit address, etc., to help institutions easily meet international compliance requirements.

Customized risk engine: At the same time, institutions can customize risk rules according to their jurisdiction and business type to meet personalized compliance needs.

3.1.3 Continuous screening and risk alerts ?

Users can choose to screen address risks regularly, or trigger global screening with one click to grasp the address risk status in real time. Once a risk hazard is found or the address risk level changes, the system will promptly push alerts through 7 notification channels such as Telegram, email, Lark, etc. to help institutions quickly learn about relevant risks. 3.1.4 Address and Customer Management ? Users can view the risk level and historical alarm records of the address to understand the overall risk situation of the address. The system also supports associating multiple addresses to one entity to achieve comprehensive risk analysis of customers, so as to have a more comprehensive understanding of the risk characteristics of customers and take more effective risk management measures.

The system has a built-in fund tracing investigation tool MetaSleuth

3.1.5 Efficient team collaboration ?

The system supports functions such as task delegation, adding comments, and setting blacklists. Different roles can collaborate efficiently through the system and handle risk alerts in a timely manner. In addition, BlockSec also introduced Grandway as an external consultant to provide legal support and consulting advice on specific compliance issues.

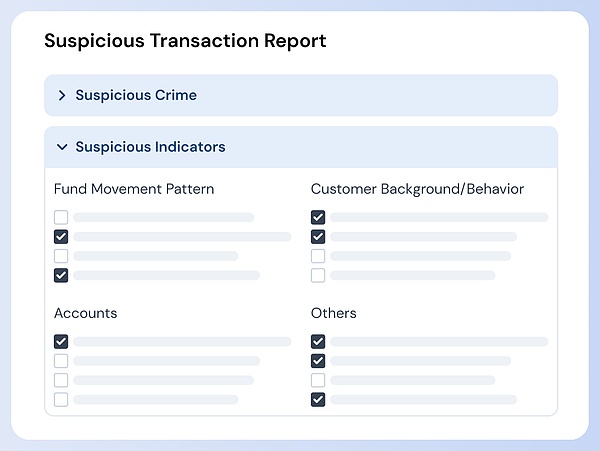

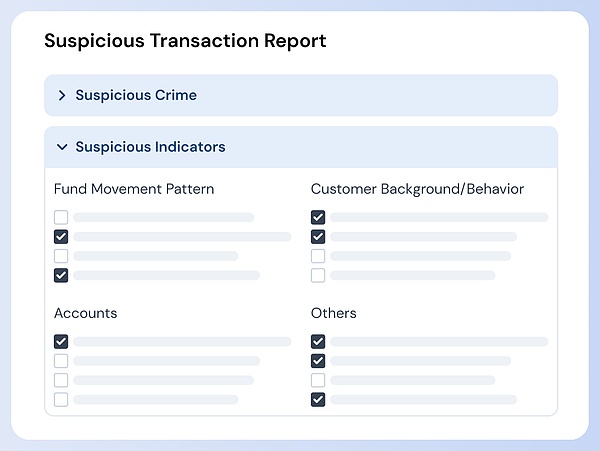

3.1.6 One-click export of STR/SAR reports

Users can select the United States, Hong Kong, Singapore and other countries or regions according to their own needs, and export the corresponding STR/SARreports with one click. Through in-depth cooperation with Grandway, BlockSec ensures that the compliance and standardization of the reports meet the regulatory requirements of the corresponding countries or regions, allowing institutions to respond more calmly in a complex regulatory environment.

Faced with complex supervision and upgrading of black industries, Phalcon Compliance APP provides VASP with a full-process compliance solution from real-time monitoring to report generation, builds a dynamic risk control barrier, accurately prevents money laundering, terrorist financing and other risks, and enables efficient implementation of regulatory compliance.

3.2 Experience Now

The launch of Compliance APP marks the upgrade of BlockSec Phalcon from an attack monitoring and automatic blocking platform to a platform covering two core modules: security threat defense (Security APP) and compliance risk management (Compliance APP), providing users with a one-stop solution of "integrated offense and defense, worry-free supervision".

The platform now supports 30+ mainstream blockchain networks including Ethereum, BSC, Solana, Base, Tron, Arbitrum, Avalanche, Optimism, Manta, Merlin, Mantle, Sei, Bitlayer, Core, BoB, Story, Sonic, Gnosis, Berachain, etc.

Aaron

Aaron