By Anthony Pompliano, Translated by Shaw Jinse Finance

To Investors.

The financial markets are about to go wild. I know a lot of people predicting the next recession is imminent, but they're dead wrong.

I'm not sure whether they're drawing conclusions based on bad data, drawing bad conclusions based on good data, or both. It doesn't really matter how they came to their wrong conclusions.

They're dead wrong.

Take the U.S. stock market, for example. Adam Kobeissi writes:

"The stock market is on fire. Since 1975, the S&P 500 has risen 30% or more over a five-month period only six times. 2025 is one of those times. According to Carson Research, in each of those instances, the S&P 500 has risen in both the following six and 12 months. In fact, in those instances, the S&P 500 has risen an average of 18.1% over the following 12 months."

These numbers are insane. Want to bet against history? Go ahead. But I prefer to think of financial markets as science. Things in motion tend to stay in motion. Inertia is a powerful force.

But this is where things get interesting. If the stock market rises 30% in five months, someone's bound to get richer, right? Who owns those stocks? Adam Kobeissi went on to explain: "The latest data shows that in the second quarter of 2025 alone, the net worth of American households increased by $7.1 trillion. In other words, for three consecutive months, American households increased their net worth by an average of $79 billion per day... As a result, the rich are getting richer. Currently, the bottom 50% of American households own only 2.5% of the total wealth in the United States. In fact, the richest 1% of households now own $40 trillion more than the total wealth of the bottom 50% of households." In short, the stock market has delivered historic returns over the past five months. It's made the rich even richer, while the bottom 50% of Americans have been left to watch.

It's not the rich's fault; it's a financial education problem. In fact, I believe we face a national crisis if we don't find a way to educate every student about personal finance and investing.

In the future, asset owners will be winners, and savers will be losers. You may not like this statement, but that doesn't mean it's not true.

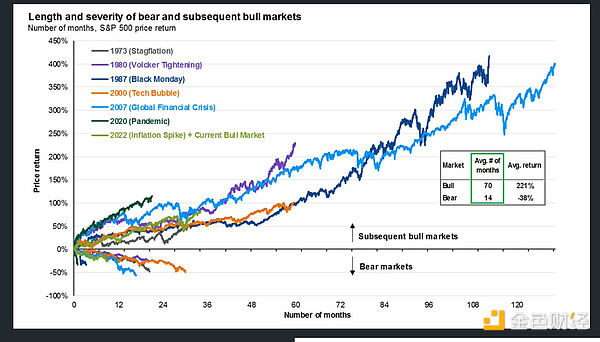

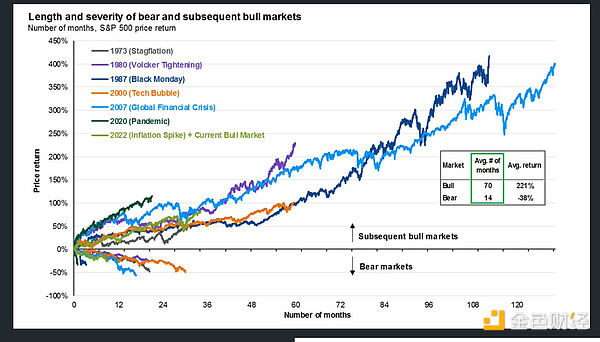

This bull market is far from over, either. Mike Zaccardi writes, "On average, a bull market lasts 70 months. We are about to enter the 35th month of this one."

That goes against the narrative a bit, doesn't it? I know your pessimistic neighbor won't tell you this data. But the data is the data, and almost all of it suggests we're in a bull market with plenty of room left in it. Let's turn our attention to this week's Federal Reserve meeting, which should culminate in a rate cut. Yes, they're cutting rates even with the stock market at record highs and government inflation readings over 2.5%. We've never seen anything like it. Charlie Bilello of Creative Planning points out that the last time the Fed cut rates when inflation was over 2.9% was in October 2008, "in the midst of the worst recession/bear market since the Great Depression." I draw two key conclusions from the Fed's unprecedented move. First, the Fed is acting because of the labor market. Artificial intelligence has been a significant deflationary force in the US economy. Businesses are finding ways to achieve higher productivity and profitability with fewer employees. Second, the Fed has been slow to act for months. I believe the Fed should cut interest rates by 50-75 basis points to return them to their desired level, but history shows that the Fed tends to avoid making bold decisions. Let's start with a "fair" comparison. Polymarket is giving only an 8% probability of a 50 basis point rate cut, which is very low compared to the 90% probability of a 25 basis point rate cut this week.

But whether the rate cut is 25, 50 or 75 basis points is not important. "The Fed last cut rates in December 2024, so there will be nine months between cuts," wrote Ryan Detrick of the Carson Group. "A gap of 5-12 months between cuts is generally bullish for the S&P 500. A year later, if 10 out of 11 times there are above-average returns, that should comfort bulls." The Fed will push asset prices from stocks to gold to Bitcoin to higher levels. They have no choice. They must fix the labor market or face deeper trouble. Never mind that government data is misleading the Fed into thinking inflation is much higher than it actually is. Never mind that the Fed has become a politicized institution that seems to be contradicting the current administration's economic plans. And never mind that the Fed is one moment saying it's "data dependent" and the next moment changing its tune.

Central banks are in a bind. They have to cut rates. With asset prices near all-time highs, we can only expect new, cheap money flooding the market to push prices higher and higher in the weeks and months ahead.

Get your wellies ready. Liquidity is coming. Investors are going to be very happy.

Weatherly

Weatherly