Author: Luke, Mars Finance

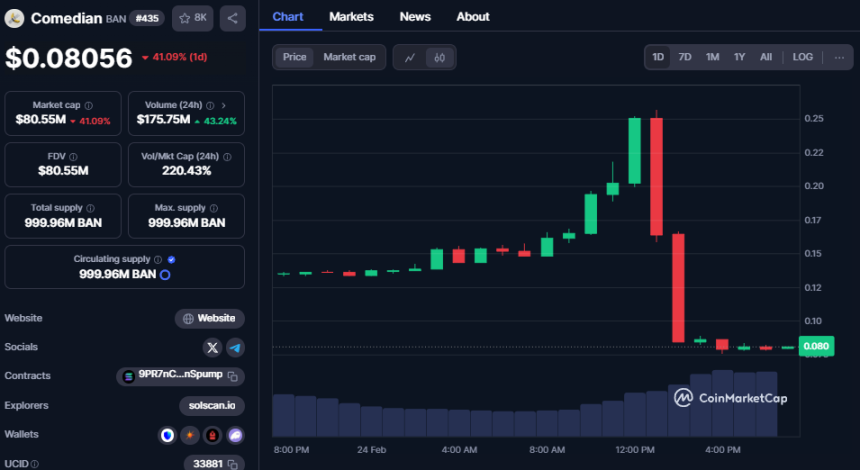

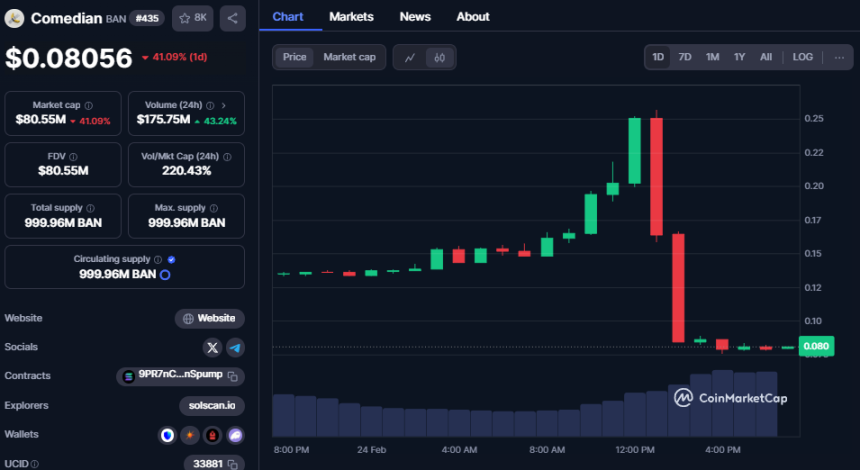

Today, the price of $BAN experienced a dramatic crash, plummeting by more than 38% in just a few hours. This wave of plunge not only shocked investors, but also revealed the deep-seated manipulation behind the market. From the carefully planned trading path of the banker to the sudden change in exchange policy, the plunge of $BAN is undoubtedly a typical market manipulation event. This article will deeply analyze the reasons behind the collapse of $BAN and explore how the banker exploits loopholes in the market mechanism to accurately double-harvest through the contract market.

High concentration of chips: the innate gene of the game of controlling the market

According to the monitoring of the on-chain data platform GMGN and analyst @Web3Tinkle, the chips of $BAN show the characteristics of extreme centralization. The dealer currently holds about 75% of the circulation. This centralized control structure makes the dealer almost absolutely dominant in the market. By investing only 2 million US dollars, the dealer can push the market value of $BAN from 20 million US dollars to 200 million US dollars. The leverage effect is so strong that it is jaw-dropping. Such a market layout means that the dealer has enough ability to control the market trend without investing a lot of money.

Looking back at the historical operations of the project party, the market's heat in November last year made $BAN the focus of attention. During this period, the project party successfully cleaned up the chips, and the proportion of retail investors' holdings was extremely low. This operation laid the groundwork for subsequent market manipulation. The dealer controlled almost all the circulating chips, and the influence of retail investors was greatly weakened, which laid hidden dangers for subsequent price fluctuations.

Funding rate changes: the death trap of the contract market

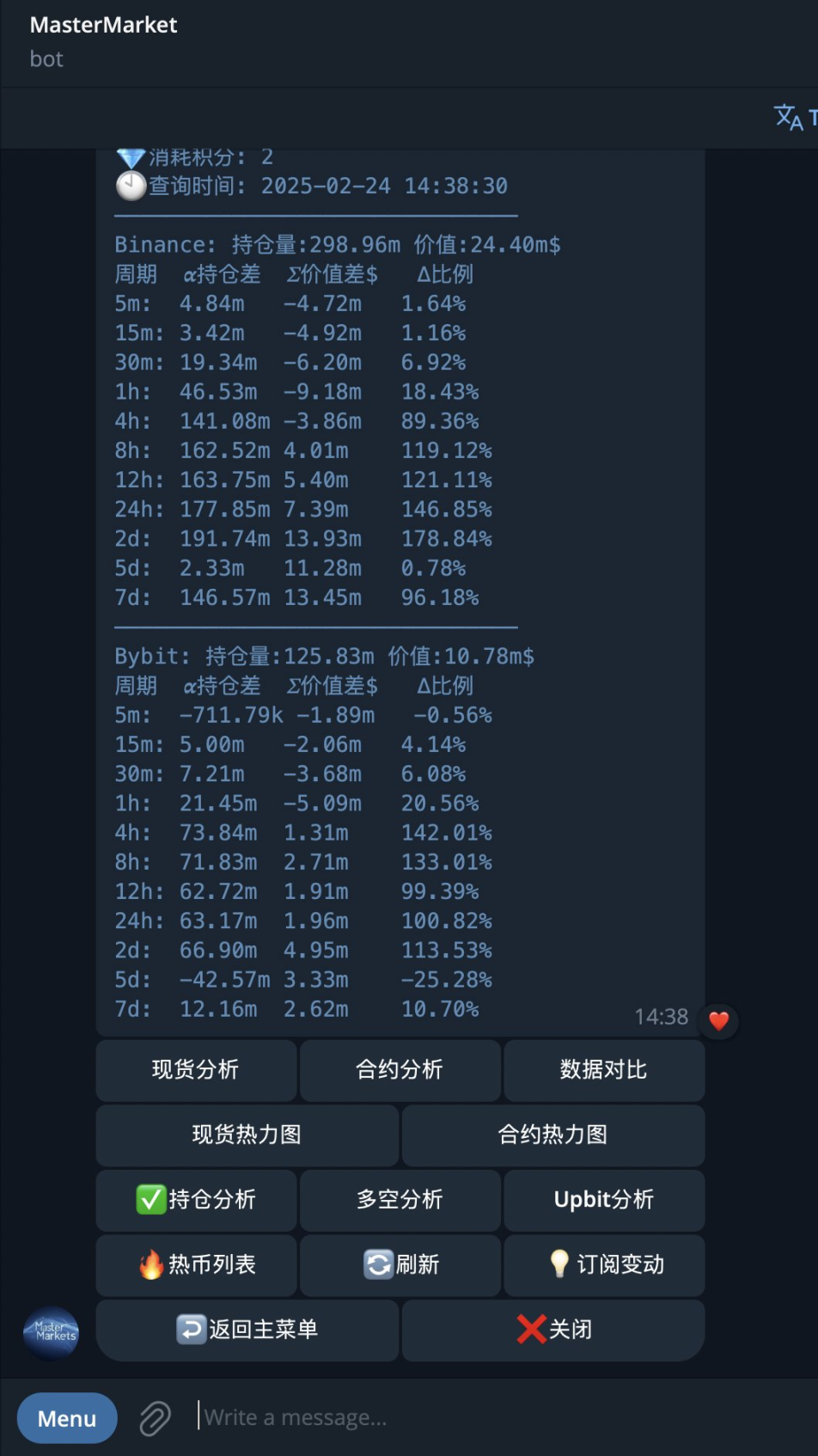

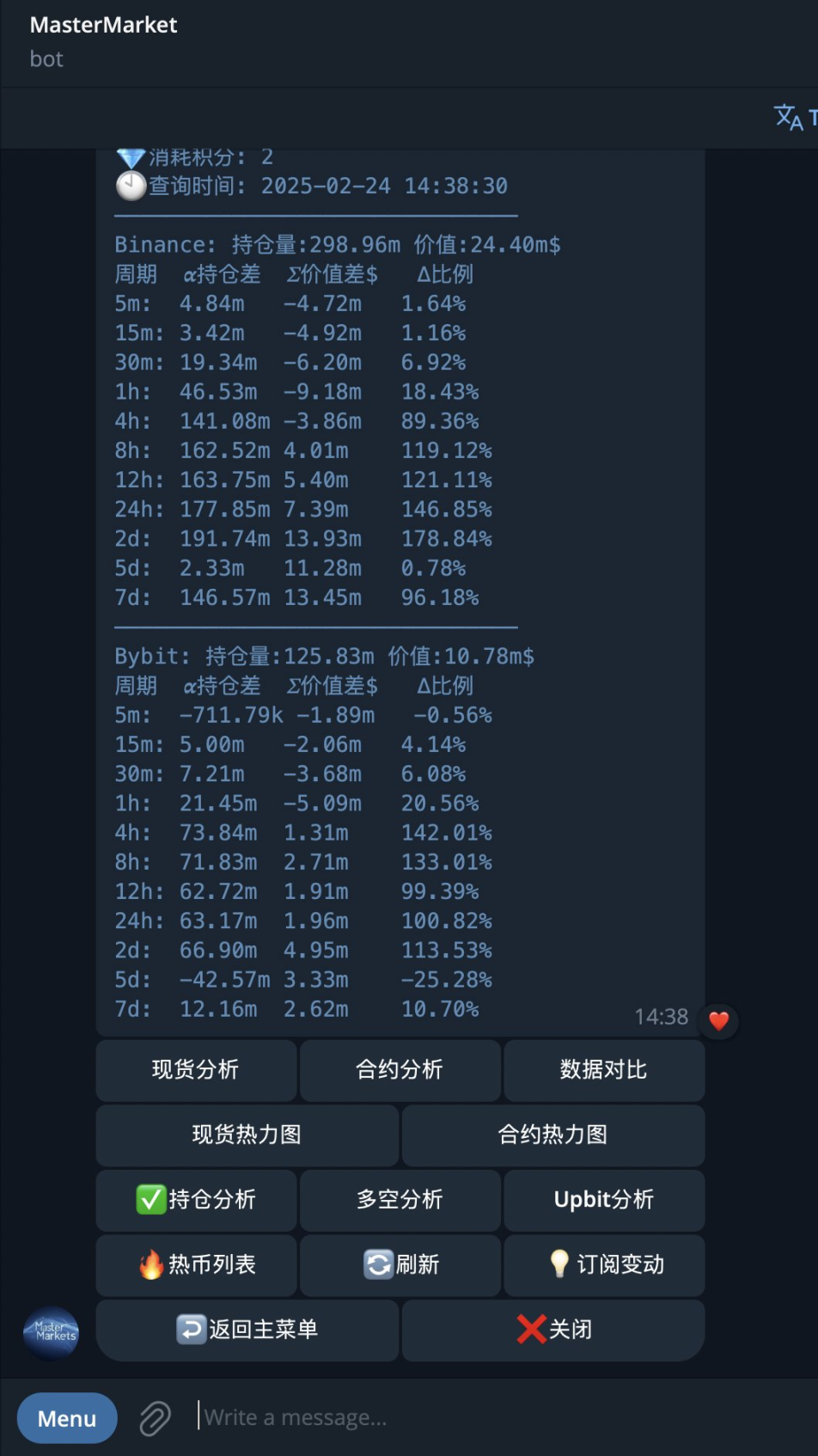

On the eve of the $BAN plunge, the funding rates of Binance and Bybit platforms experienced unprecedented abnormal fluctuations. This change is not accidental, it reveals that the market is facing huge manipulation risks. Binance's funding rate once reached -2% every 4 hours, which means that the daily cost of short positions is as high as 12%. The situation on the Bybit platform is even more extreme, with a funding rate of -4% every 2 hours, which is equivalent to a surge in the daily holding cost of short positions to 48%.

There are several danger signals hidden behind these extreme data. First, the market's short positions increased sharply, but prices rose in the opposite direction, causing a huge cognitive divergence between long and short positions. Short positions increased, but market prices did not fall, but continued to rise, forming a serious dislocation of market signals. Secondly, Binance adjusted the fund settlement cycle, shortening it from 4 hours to 2 hours. This change means that the holding cost of short positions has almost doubled, further exacerbating the pressure on short positions. Finally, the extreme negative fee rate attracted a large number of retail longs to enter the market. They entered the market with the mentality of "eating interest", forming an irrational FOMO sentiment, which undoubtedly provided the dealer with an opportunity to harvest.

The whole path of dealer operation: a textbook of double killing and harvesting

$BAN's plunge was not an accidental market fluctuation, but the result of the dealer's careful layout. From the perspective of the dealer's operation path, the entire operation process can be divided into several stages, which reflects how the dealer completes the double harvest through market manipulation.

In the first stage, the market maker pushed up the price through the extremely small funds in the spot market, pushing the price of $BAN from 0.14 USDT to 0.2 USDT, creating an illusion of a technical breakthrough. This process of pulling the price successfully attracted a large number of short positions, and also triggered arbitrage behavior by long positions. The market's holdings soared rapidly, accumulating huge market energy for the subsequent operations of the market maker.

Entering the second stage, the market maker suddenly put great pressure on the shorts by adjusting the funding rate settlement cycle. This adjustment of the Binance platform doubled the holding cost of the shorts, which quickly hit the confidence of the shorts. At the same time, the bulls mistakenly believed that this move represented a favorable policy and began to accelerate their entry into the market, which undoubtedly intensified the buying sentiment in the market.

In the final harvesting stage, the dealer sold most of the controlled chips through the spot market, which directly led to the collapse of market prices. At the same time, in the contract market, the dealer closed the long orders on the one hand, and started to open short orders on the other hand. The two-way operation successfully captured the market's explosion energy. In this process, the dealer also took advantage of the difference in funding rates between different platforms to conduct arbitrage operations, and provided hedging protection for its own funds through the high negative rate of the Bybit platform.

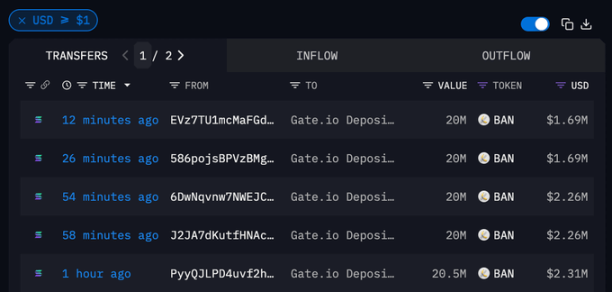

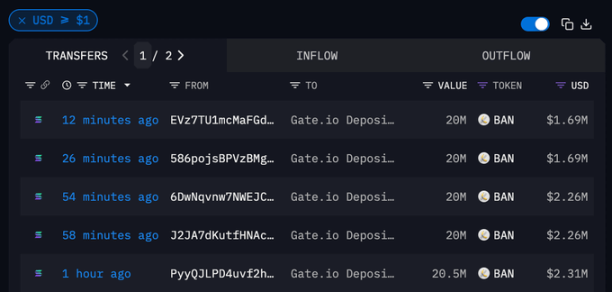

Iron Evidence on the Chain: The Deep Logic of the "Suicidal" Selling by Large Investors

After the plunge, on-chain data showed that five addresses belonging to the same entity recharged 10.21 million $BAN to Gate.io, worth about 3.15 million US dollars. This operation undoubtedly reveals the deep intentions of the dealer. These addresses withdrew coins at a price of 0.133 USDT two days ago, but now they are selling at a loss at a price of 0.1016 USDT, showing the "suicidal" selling behavior of these whales. This operation not only highlights the dealer's flexibility under price control, but also exposes the traces of manipulation behind it.

It is worth noting that these recharge funds are likely to come from the internal accounts of the exchange, which may be to create a false market liquidity through arbitrage operations and further mislead retail investors' investment decisions. At the same time, this behavior of "cutting meat" by large investors has exacerbated the panic in the market, making retail investors more pessimistic about the market outlook, and causing more investors to sell their assets.

Market Revelation: Structural Risks in the Crypto Market

From the $BAN crash, we can get some profound market revelations. First of all, the survival rules of the controlled currencies have quietly changed, and the market value and chip concentration often exceed the impact of fundamentals. If investors still hold the mentality of value investment, they may get lost in these controlled currencies. On the contrary, the thinking of game may be more suitable for these markets, and investors need to have more acute market insight.

Secondly, the double-edged sword effect of the derivatives market cannot be ignored. Mechanisms such as funding rates should be used to balance the long and short forces in the market, but under the clever manipulation of the banker, these mechanisms have become their tools to harvest retail investors. For retail investors, understanding the rules of the derivatives market and operating prudently is the best strategy to deal with this market manipulation.

Finally, the rule adjustments of the exchange have also exacerbated market volatility. The sudden adjustment of the exchange's funding rate and the opacity of the rules have made market sentiment more unstable. In the absence of effective supervision, the operations of exchanges and bankers may have a great impact on the market. Therefore, when participating, investors should pay close attention to the policy changes of the exchange in addition to paying attention to the market fundamentals.

Investor warning: When a currency shows the triple signals of "high concentration of chips, extreme derivatives fees, and abnormal exchange rules", the market has actually entered the countdown for the banker's harvest. The plunge of $BAN this time once again confirms this point: in the crypto market lacking effective supervision, the controllers have the dual privileges of "creating rules" and "breaking rules", and retail investors must always be vigilant.

Joy

Joy