Author: Kazu Umemoto, David C Source: Bankless Translation: Shan Ouba, Golden Finance

The upcoming HyperEVM is attracting a new wave of DeFi participants who hope to get a piece of Hyperliquid's success.

Hyperliquid's HyperEVM extension is coming, and the heat of the ecosystem is rapidly heating up amid various speculations about its release.

Hyperliquid's perpetual contract DEX (decentralized exchange) has quickly risen to become one of the preferred platforms for perpetual contract traders since its launch in 2022. Currently, the DEX has an average daily trading volume of 4.4 billion US dollars and continues to set new historical highs, accounting for half of the trading volume of the entire on-chain perpetual contract DEX.

For a blockchain with only a single application online, this is an astonishing level of activity…Hyperliquid supporters see the potential for HyperEVM expansion: a large number of applications will flock to this ecosystem and drive huge growth in on-chain activity. These applications will not only be attracted by Hyperliquid's huge transaction volume, but also benefit from its unique underlying technology:

Projects that expand to the HyperLiquid ecosystem will benefit from the chain's consensus mechanism, HyperBFT. HyperBFT can handle more than 100,000 transactions per second and has extremely low gas fees.

In addition, HyperLiquid uses a unique mechanism to achieve permissionless token listing while ensuring deep liquidity. Every 31 hours, Hyperliquid conducts a Dutch auction where projects can bid within their acceptable price range to get their tokens online. This model reduces the risk of "running away" because token deployers need to pay a higher upfront cost.

With that in mind, let’s take a look at the projects that have announced they will be launching in the HyperEVM ecosystem.

HyperLend

HyperLend is a lending platform native to the HyperLiquid ecosystem that offers three different types of lending pools: core pools, independent pools, and peer-to-peer pools.

Unlike traditional lending platforms, HyperLend allows users to use their HyperLiquidity Provider (HLP) as collateral. This not only provides additional utility to the HLP token, but also allows holders to earn additional income on HyperLiquid’s perpetual contract platform.

Kinetiq

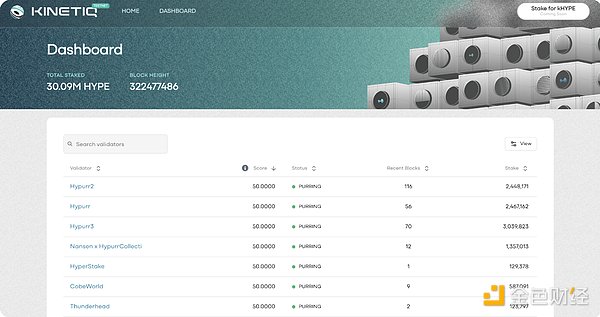

Kinetiq is a liquidity staking protocol where users can deposit HYPE tokens and receive its liquid staking version kHYPE. Kinetiq will then distribute the HYPE deposited by users to validators.

However, Kinetiq does not simply distribute HYPE equally to all validators, but instead uses a scoring system. This ensures that validators are always online and functioning properly. If certain validators fail to meet Kinetiq's standards, they will lose their delegated HYPE, which will be redistributed to other more reliable validators.

Silhouette

The upcoming Silhouette is a decentralized trading environment that provides private trade execution on Hyperliquid while still being tightly integrated with the on-chain liquidity engine. By leveraging cutting-edge privacy technologies such as Fully Homomorphic Encryption (FHE) and Secure Multi-Party Computation (sMPC), Silhouette ensures that transaction details remain confidential while being processed on-chain.

Unlike traditional DEXs and current Hyperliquids, where orders are publicly visible before execution, Silhouette uses a hidden matching engine that prevents frontrunning, MEV attacks, and information leaks. This allows traders to protect their trading strategies, especially for users who trade large amounts on exchanges. As a result, Silhouette is not a replacement for transparent DEXs, but rather an alternative execution venue that allows traders to protect their order flow from prying eyes of market observers while maintaining competitive pricing and high liquidity.

Felix

Felix is a stablecoin protocol built on the Liquity v2 code, issuing an over-collateralized stablecoin feUSD. With the launch of HyperEVM, users can use Hyperliquid assets (such as HYPE or PURR), as well as BTC, ETH, SOL as collateral to mint feUSD and use it in the entire on-chain DeFi ecosystem. Felix maintains the peg of feUSD to $1 through a redemption mechanism, allowing users to directly redeem feUSD with $1 worth of collateral. If feUSD falls below $1, arbitrageurs can redeem it for collateral, reducing the circulating supply and restoring price stability. In addition, Felix provides Stability Pool Vaults, where users can deposit feUSD to earn yield and profit from liquidation events. When a borrower's position is liquidated, the feUSD in the Stability Pool is destroyed to repay the debt, and the depositor receives a portion of the liquidated collateral.

This mechanism not only keeps the system stable, but also brings rewards to users who provide funds. Overall, Felix provides an efficient, decentralized, collateral-backed stablecoin, bringing DeFi basic financial tools to the Hyperliquid ecosystem.

HyperEVM is just the beginning

While the four projects introduced above give us some idea of the direction of the development of the Hyperliquid ecosystem, they are just part of the wave of dApps carried by HyperEVM.

The huge transaction volume on the chain - billions of dollars per day - not only proves the strength of Hyperliquid's user base, but also demonstrates its huge appeal to developers. With a high-performance consensus mechanism, built-in liquidity pipeline, and a pragmatic token launch model, HyperEVM is building Hyperliquid into a complete ecosystem, far beyond its current scale. If new applications can take full advantage of Hyperliquid's underlying architecture, this upcoming upgrade may not only strengthen a single platform - it may even reshape the entire on-chain transaction and DeFi future.

Aaron

Aaron

Aaron

Aaron Clement

Clement Jasper

Jasper Catherine

Catherine Clement

Clement Snake

Snake Alex

Alex Kikyo

Kikyo Davin

Davin Jasper

Jasper