Author: William M. Peaster, Bankless; Translator: Wuzhu, Golden Finance

Two years ago, Bored Apes was on top of the world.

Yuga Labs, the creator of BAYC, was riding high after announcing the launch of the Otherside gaming metaverse and acquiring CrypoPunks and Meebits from Larva Labs.

The momentum sparked a frenzy, with collectors flocking to Bored Apes like never before, driving the set’s reserve price to an all-time high of 128 ETH.

Since then, however, things have only seemed to go downhill. Last week, BAYC floor price dropped to 10 ETH, the lowest price in nearly 3 years and down -92% from the ATH in April 2022.

Why is it down?

Some of the contributing factors here are beyond Yuga’s control, like selling pressure building on Blur or more collectors jumping ship to hotter ecosystems like Bitcoin Ordinals or Solana memecoins.

Other factors, though, are Yuga’s fault. In their heyday, they expanded their offerings to 25 different series like a sprawling umbrella that was confusing and turned off more than a few holders. Their recent acquisitions of PROOF and Moonbirds have confused many, leading to complaints that Yuga lacks a cohesive grand vision.

Additionally, the much-anticipated Otherside metaverse is still early in development, and while initial playtests look promising, smaller teams like Nifty Island have moved further and faster toward similar goals.

Another point worth briefly mentioning here is the social dimension of value.

The value of NFTs comes not only from their utility and interchangeability, but also from their social dimension, and today the social value of Bored Apes is at its lowest point in some time. They no longer have the aura they once had, their primary value is currently transactional value, and some holders have moved on to more memetic projects.

So what is Yuga Labs to do? Can they bounce back and return Bored Apes to its former glory?

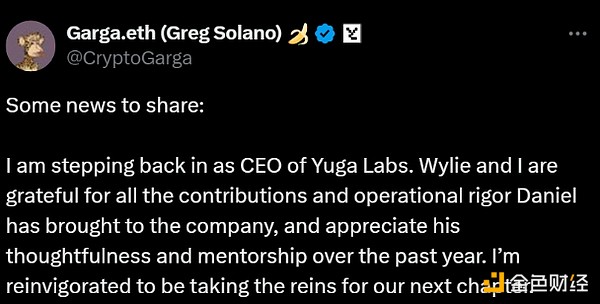

It is certainly possible, and there have been some encouraging signs recently. First and foremost, Yuga co-founder Greg "Garga" Solano recently returned to lead the company.

It’s the right move after a lackluster tenure under former Activision executive Daniel Alegre as CEO, and if anyone can help Bored Apes recapture some of their early magic, it’s Garga. He said in his comeback announcement:

“We want to free up as much as possible the Yuga BAYC team to execute on its vision. More focused, more agile. So it can… create space for the magical and crazy things we used to do.”

This renewed emphasis on focus and streamlining has been reflected in other areas as well. For example, last week Yuga sold its HV-MTL and Legends of the Mara (LoTM) games to Faraway, suggesting it is cutting back on major projects such as Bored Apes and Otherside.

These moves are exactly what anyone backing Bored Apes would like to see, but there is still a lot of work to be done, so should we be bullish on BAYC in three years?

In the short term, things could get worse before they get better.With ETH NFTs in an awkward position and things being shinier in the crypto economy right now, I could see Bored Apes’ floor price dropping below 10 ETH, although I doubt that would last long.

In the long term, the outlook looks much better. Yuga has leaned into a partnership with Magic Eden, which is currently the most active NFT marketplace and could pay dividends in the future. The launch of ApeChain L2 later this year and Otherside in the coming years could also be major catalysts for BAYC.

Additionally, Yuga still has a lot of work to do in terms of brand, community, and resources to work with. In other words, they are certainly not standing in front of a blank canvas with few options.

So while it’s impossible to say whether Bored Apes will reclaim its previous ATH floor price of 128 ETH, their future prospects do remain promising and I could foresee the floor price breaking 40 ETH again by the end of 2024.

Long story short? Bored Apes is falling, but not out, and I think there are more bullish factors than bearish factors at the moment. Let's see if Yuga can hold on to the end and achieve a comeback!

JinseFinance

JinseFinance

JinseFinance

JinseFinance Alex

Alex decrypt

decrypt Bitcoinist

Bitcoinist dailyhodl

dailyhodl Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph