Author: Jack Inabinet, Senior Analyst at Bankless; Translation: @Jinse Finance xz

Digital Asset Treasurys (DATs) have become one of the explosive phenomena of this crypto cycle.

These publicly traded companies have made crypto asset accumulation a core strategy, investing billions of dollars in their chosen digital assets—from Bitcoin and Ethereum to Hyperliquid tokens and even Tether Gold! According to CoinGecko's "2025 Digital Asset Treasury Report," there were 142 such companies as of October.

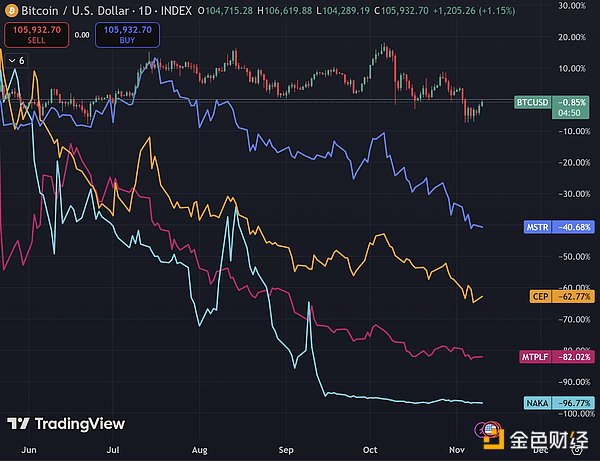

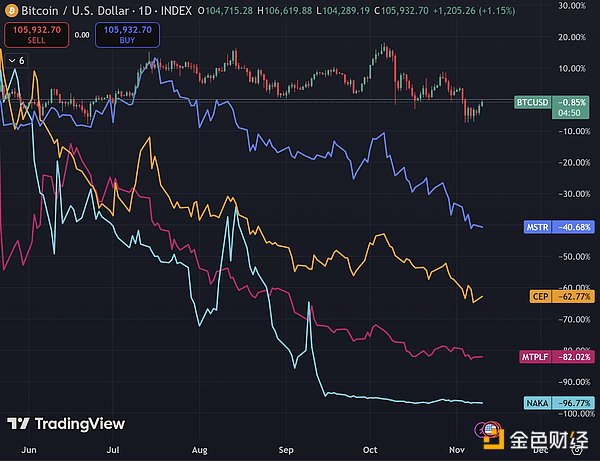

While DATs were riding high earlier this year, with their numbers growing exponentially (new entrants using more than a dozen cryptocurrencies to chase the replication effect of soaring stock prices), most of these stocks have become marginalized, especially dragged down by the overall weakness of the crypto market. This article will delve into the root causes of the continued poor performance of DATs and the potential risks these publicly traded companies may pose if the market shifts. 1. DAT Growth Slowing? It's no secret that the crypto market will perform poorly in 2025. Despite a flood of seemingly positive headlines at the beginning of the year, as I pointed out last week, the total market capitalization of cryptocurrencies (TOTAL) is still lagging behind the stock market benchmark (S&P 500). Major cryptocurrencies like Bitcoin and Ethereum are trading at roughly the same price level as at the beginning of the year, while many leading altcoins have experienced indiscriminate crashes—former hot coins (including ATOM, ENA, PENGU, and WIF) have all fallen by more than 50% this year. However, while crypto tokens experienced a continuous sell-off throughout the year, the DAT chart showed a one-sided upward trend, both in terms of the total number of companies and the value of their crypto asset holdings. For a considerable period in mid-2025, for underperforming listed companies, switching to the DAT model seemed like a natural choice: the stock price often surged immediately after the announcement of the transformation, generating several times the return for company insiders overnight. Correspondingly, the selected cryptocurrencies gained a new source of price-insensitive demand from DAT—these DATs would accumulate as many tokens as possible. While this positive-sum relationship incentivized a large number of companies to adopt DAT strategies in 2025, the frenzy is cooling. The stock prices of new DAT projects are now predictably plummeting within days of launch, some even falling below their pre-transformation prices… For example, Nakamoto (a Bitcoin treasury company, ticker symbol NAKA), founded by Bitcoin Magazine CEO David Bailey, has been hitting new all-time lows just six months after becoming a DAT. The stock is currently down 81% from its pre-transformation price and approximately 99% from its all-time high (reached ten days after the DAT announcement). A more recent example is Forward Industries (a Solana treasury company, launched in early September, directly backed by the blockchain's largest institutional investors, including Multicoin Capital, Galaxy Digital, and Jump Crypto). After its stock price fell 75% from its historical high (reached seven days after the DAT announcement), it is now 33% lower than its pre-transformation price. The disillusionment of the DAT dream is evident in various asset data; the scarcity premium once exclusive to blue-chip stocks like Strategy (MSTR) seems to be disappearing along with the subsequent homogenization of DAT companies.

2、DATRisk

DAT stock can be compared to a call option on the cryptocurrency it holds: the token price must be above a certain threshold by a specific future date, otherwise the stock will lose value—because the reserve assets must be liquidated to pay off debts.

The new DAT project has so far been unaffected by the general downturn in the liquid crypto market. However, the continued stagnation of cryptocurrency prices has begun to trouble the valuation of this inherently time-sensitive industry. DAT amplifies potential shareholder returns through borrowing. This strategy makes sense when the token outperforms the US dollar, but if the opposite happens, leverage can quickly threaten shareholder returns. Technically, DAT cannot be "liquidated" because its leverage is generated by issuing periodic debt (which does not need to be repaid before maturity). However, this does not mean that DAT cannot sell its crypto reserves. Peter Thiel-backed ETHZilla sold $40 million of its Ethereum reserves last month to buy back shares from investors. Similarly, Swan-backed Sequans sold 970 BTC last week to prepay debt, marking the first instance of a BTC-based DAT liquidating its reserves.

Furthermore, although many current DAT management teams have stated they have no intention of selling their crypto reserves, as a publicly traded company with shareholder interests, DAT could be forced to liquidate its treasury assets in a hostile takeover.

The crypto-native space is no stranger to similar "risk-free value" treasury raids: acquiring a majority stake in a troubled DeFi protocol with the intention of liquidating its treasury assets to obtain a value higher than the protocol itself.

If these hundred or so DAT tokens you've never heard of trade at a deep discount to their net asset value (NAV) due to existing shareholders' disappointment with earnings, other investors may seize the opportunity—this time hoping to profit quickly by liquidating the treasury, which could further drag down the price of the underlying token.

Miyuki

Miyuki