Author: David C, Bankless; Translator: Baishui, Golden Finance

Friend.tech’s much-anticipated token launch and product revamp both hit a rough patch when it debuted last week.

The community faced issues with a flawed token airdrop process, non-functional new features, and a multi-step claims process that required people to interact with new features of the protocol. As a result, its token fell to a low of $0.93, a far cry from its pre-listing price of $10. The token then rebounded to a local high of $3.14 amid a rally that claimed the controversial launch was part of Racer’s master plan.

The token is currently trading at around $1.66, with a market cap of just over $155 million. On Crypto Twitter, the debate over whether FRIEND is still undervalued continues to rage, with heated debates on both sides.

While many factors, such as the market cap of the token relative to the level of hype generated by the project, suggest huge upside, usage data tells a different story. Let's look at a different perspective next!

Friend.Tech is Undervalued

First, let's look at the bull case.

FRIEND's growth is based on its close connection to Base, fair launch, low market cap, strong leadership, and application utility.

FRIEND = Base:Arguably the project that launched Base last year, FRIEND can be seen as the most "Base" of the tokens - a comprehensive representation of the success of the Base chain. It is the native token of the hottest application and a social token for a social/consumer chain. Currently, Base claims that they will not launch tokens that may leave room for FRIEND's status to grow.

Fair Launch, Low Market Cap:FRIEND has an extremely low market cap (~$155 million), and the project is backed by one of the industry's most prominent venture capital firms, Paradigm, and currently has no reserved supply for its investors.

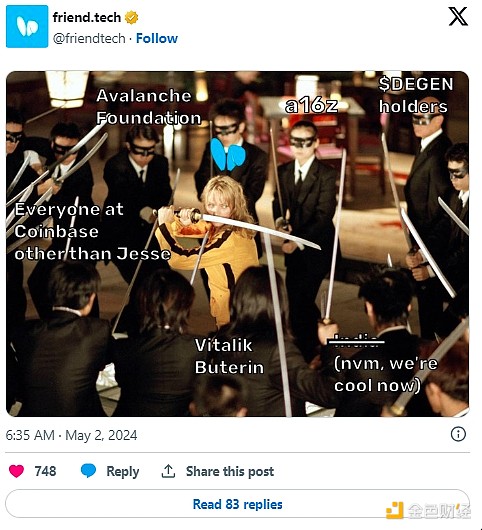

Racer = Personality Role:Most projects that perform well tend to have strong personalities that coordinate as leaders of the community. Racer, the founder of Friends.tech, personified this role as a polarizing online persona that has both loyal supporters and outspoken critics.

Required for groups:Keys for groups, new group chat feature for V2, priced in FRIEND, giving the token a functionality rather than a throwaway use case like “vote in governance”.

Together, these factors demonstrate FRIEND’s unique position in the Base ecosystem and provide a strong case for the token.

Friend.Tech is overvalued

On the other hand, data indicates a decline in activity on the platform — evident in a drop in tokens, group creation, and stagnant liquidity.

Falling token trading volume:Since launch, FRIEND trading volume (a prerequisite for price action as volume indicates ample liquidity required for price to rise) has trended significantly downward, currently around $1.5 million compared to around $6.5 million on day one.

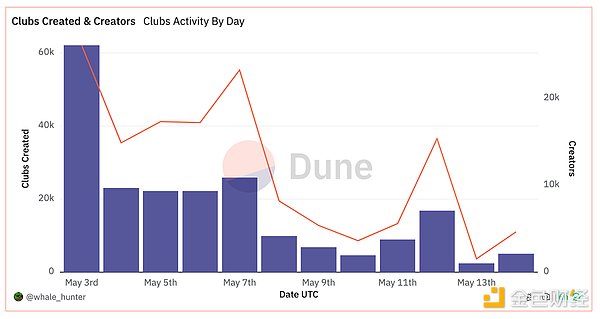

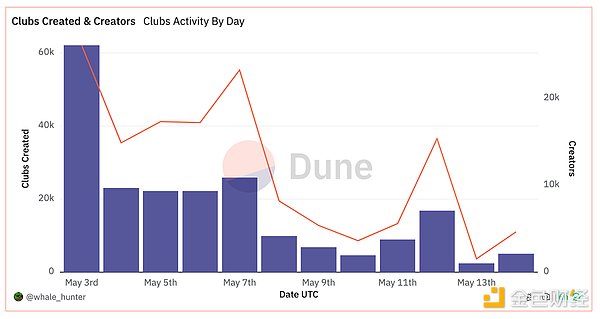

Groups Created Decline:V2’s new group chat feature, “Group Creation,” has stalled. While this could be a sign of groups maturing and people settling into their favorite groups, it also comes with new feature releases, potentially indicating lower demand for this new format.

FRIEND Liquidity Stagnation:As mentioned before, liquidity is critical to token growth and price action. Despite considerable incentives to provide liquidity to FRIEND on FTSE’s native DEX Bunnyswap, liquidity for the token appears to have plateaued, which could signal a ceiling to price action, at least for now.

These dots indicate declining user activity, decreasing trading volume, and stagnant liquidity, suggesting that despite FRIEND’s nasty initial rally, its valuation could be overvalued.

Building a Narrative

While it is certain that FRIEND is undervalued, quantitative factors suggest that the token is overvalued.

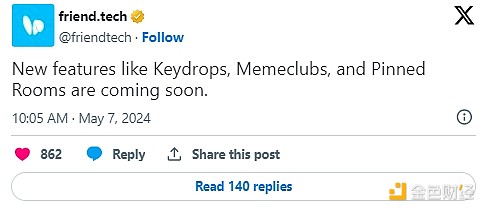

While friend.tech continues to roll out features such as sharing fees with councillors, fixed groups, and new relationship curves, these features have not increased activity. Ahead of the V2 launch, Racer previewed upgrades such as Money Clubs for managing shared vaults, minting on-chain collectibles, and a more dynamic chatroom with reactions, tagging, notifications, fixed messages, raffles, and referral programs.

While a roadmap has not yet been released or confirmed, Meme clubs and keydrops have been confirmed, with the former likely to be a significant bullish catalyst for Friends.tech if it is allowed to launch its own Memecoin on Bunnyswap.

All in all, the debate over the value of Friend.tech continues. While FRIEND's position on Base, low market cap, high-profile founders, and increased use cases for joining groups all appear to be reasons for price growth, there are still issues with declining activity, a decreasing number of tokens, and stagnant liquidity.

As Friend.tech rolls out new features and continues to grow, its true value may become clearer. At the moment, the market is still divided on whether FRIEND is a hidden gem or a risky bet. In this case, it's best to find a group on the app that you like to chat with and use that.

Kikyo

Kikyo