Author: Arjun Chand, Bankless; Compiler: Deng Tong, Golden Finance

Your friend knows almost nothing about cryptocurrency, but he is already a rich man. Why? Because they bought a token that had a dog wearing a hat on it.

The hat is worn all the time, so the price keeps rising. Get it — this meme is about to go mainstream in Las Vegas, thanks to the community raising $650,000 to light it up.

Memecoin is very popular now.

Historically, memecoins have been one of the best performing assets. Let's take a quick trip down memory lane and look at some of the brightest stars in the meme coin galaxy:

Dogecoin (DOGE) – Musk’s favorite meme coin that once graced SNL and is now part of meme coin history, with a market capitalization of $20 billion.

Shiba Inu (SHIB) —— Shiba Inu is to Dogecoin what alt-L1 transactions are to Ethereum; The beta game of Footsteps is currently only one place behind DOGE, with a market value of more than 10 billion US dollars. At its peak, it even reached a staggering $40 billion, a return of 8,000 times compared to the beginning of 2021.

Pepe (PEPE) - Recently, we have examples like PEPE that are showing early signs that we may finally be emerging from a bear market. PEPE reached a market capitalization of $1 billion within a month of its launch and currently maintains a market capitalization of $3 billion.

Bonk (BONK) — The memecoin was one of the major catalysts in reviving the Solana ecosystem, going from $30 million in just over a month Market capitalization soared to $1.5 billion (a rapid 50x increase) and, after a slight decline, remains at an outstanding $2.5 trillion.

Dogwifhat (WIF) – This meme coin has become an iconic Wall Street bull run that shows no signs of stopping. With a market capitalization of $2.25 billion, WIF is the leader among the Solana meme coins.

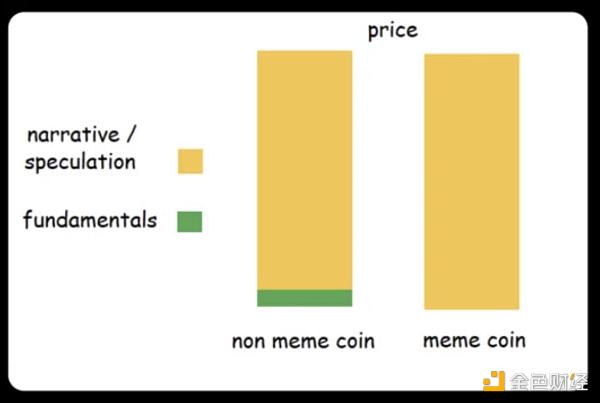

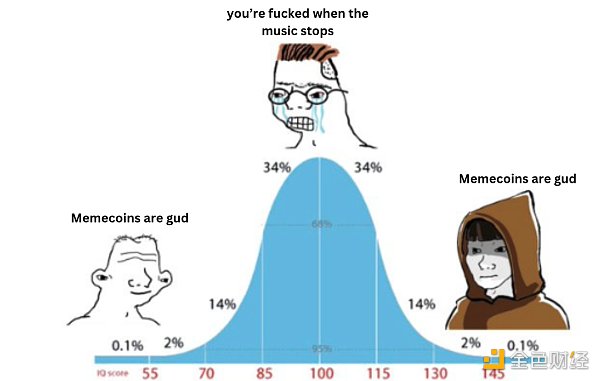

But let’s be honest, meme coins are a gamble. There's no foolproof strategy for investing in them—it's either a moonshot in Valhalla, or you could see your entire net worth disappear.

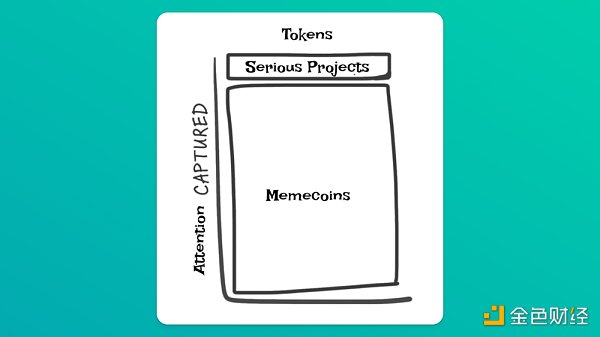

The jury is still out on whether meme coins are good or bad. But one thing is for sure: Meme coins have become the lifeblood of the bull market. They attract people to the chain, promote cross-chain activity, and provide a golden lottery ticket to invest in cryptocurrencies.

The following points are a guide to evaluating memecoins so you don’t get caught up in the hype. These tips can help you set the criteria for defining what makes memecoins an attractive investment opportunity. Let’s take a closer look!

1. Build a Trusted Network

Don’t get your alpha from your favorite Twitter influencers.

Timing is everything in cryptocurrencies, especially memecoins. Arriving early can mean the difference between a 5x gain and a 100x gain. To be early, you must understand the "alpha chain" and how information spreads.

If you’re taking your cues from a Twitter influencer with a large following, you’re probably already late to the party. This doesn't always mean disaster, but it may mean that the insiders who got in first are ready to "shed their baggage," leaving you with no choice but to become a "community member."

However, because it is impossible to constantly follow the cryptocurrency market and be the first to seize every opportunity. This is where the friends you make in a bear market come in – these are people you can trust and who share similar interests as you.

With your team, you can cover more ground, pool insights, and validate each other's hunches. That way, if a majority of your team thinks the memecoin looks promising, it's likely to have broader appeal, increasing your odds of making the right decision.

It's like having a group of friends who can help you discover the next big thing - if you all buy into the meme, it has potential. But if you try to figure it out on your own, sometimes you might fall short.

2. Make full use of data tools

In order to make wise investment choices, you need the latest and most accurate information.

Tools like Dexscreener and Blockchain Explorer are your best friends for collecting necessary data points.

For example, For meme coins, token distribution is a key metric. It tells you whether the memecoin has real community support or is just a handful of insiders trying to make a quick buck by pumping and selling.

Here’s how to view memecoin token distribution:

Discover Whales—Use a blockchain explorer to enter the contract address of the token. Navigate to the Holders section to see how tokens are distributed among holders. A good sign is that no one whale is hogging all the coins.

Healthy spread and growing token holders - A well-spread token supply usually means more stable and widespread Community. If you notice a different group of holders slowly but surely accumulating more coins, it could mean they believe in the future of the coin.

Fair Launch – Focus on the initial distribution of tokens after they are launched. A fair initial distribution model, rather than disproportionate allocations to development teams or early investors, could be a positive sign.

3. Track project communications

For any cryptocurrency project, whether it is a meme coin or a project that caters to demand, having a solid online presence is important The essential.

If you like a project's meme potential, make sure they've demonstrated some traction in communicating their area of focus.

This means a A beautiful website, an engaging X feed and an active Telegram group are all non-negotiable. They're the backbone of communication, community, and branding—the very things that can make or break a project's viral reputation.

This website serves as the official billboard for the project. This is where meme coins come into their own.

Telegram channels are direct lines to the community where you can see active community members and memes.

And Twitter? That's a loudspeaker. It broadcasts the memecoin story to the world.

Meme coins that gain a foothold on these platforms, combining humor and community engagement, are more likely to attract attention and become hugely successful.

4. Know your limits in on-chain casinos

Please remember the golden rule: only bet Note the losses you can accept.

Memecoins are fun and can be a quick get rich scheme, but they are unpredictable and you can lose everything easily.

The high volatility of meme coins means the risk of loss is significant , so don’t gamble with your savings, but maybe it’s okay to gamble with your lunch money on some days.

Some investors use leverage strategies to balance ultra-safe bets (e.g. BTC, ETH, SOL) with the high risk of memecoins. This way, you can enjoy the thrill of memecoins while maintaining a solid financial foundation, unaffected by memecoin fluctuations.

In addition, Think of memecoin as an on-chain PvP battle - the fool theory often prevails. Always ask yourself: "Would anyone else be willing to buy this coin at a higher price than what I paid?" If you're not sure, it might be time to take profits and avoid regrets later.

In addition, Think of memecoin as an on-chain PvP battle - the fool theory often prevails. Always ask yourself: "Would anyone else be willing to buy this coin at a higher price than what I paid?" If you're not sure, it might be time to take profits and avoid regrets later.

Are we riding a memecoin superbike? Who knows, but one thing is for sure: Meme coins are not going away. They're fun and have the best potential for the funniest results.

While we are in a bull market, enjoy the memecoin playground, but don’t risk it all just to get rich overnight. Time is of the essence in the market, so make sure you don't ruin yourself with memecoins or leverage or both.

Invest wisely, be patient, and we will all succeed!

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive JinseFinance

JinseFinance Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph