Author: TokenBrice, Source: DefiLlama 24

Velodrome model, inspired by veCRV, implements the three key players of DEX — Superior alignment between liquidity providers (LPs), token holders, and projects that require liquidity. However, most players in the DeFi space still don’t understand the reasons behind it: but once you read this article, you are no longer one of them.

Today, we discuss Velodrome/Aerodrome, a real success story in the DeFi space. This article will compare the two models and explain how Velodrome improves on the veCRV template and how the subtle differences make a huge difference.

First, let me make something clear: to understand what follows, everyone needs to realize that DEX has two core components:

1. What it provides Liquidity structure (such as x*y=k, stableswap, CL, stableswap-NG, curve V2, etc.)

2. Incentive model, for DEX, this is synonymous with its tokenomics.

This article focuses on the latter, the core of Velodrome’s innovation. This article assumes you have a basic understanding of Curve’s veCRV token economics.

A/ veCRV / veVELO Fee collection and distribution

Fee collection and redistribution are the lifeblood of decentralized exchanges. Simple is usually a good thing here, as the leader in the DEX spaceUniswap is still running an extremely simple yet extremely efficient model where 100% of the funds collected go to liquidity providers.

With the launch of the CRV token in August 2020, Curve explored an alternative path in which 50% of thefees charged on a given trading pair flowed to liquidity providers , the remaining 50% goes to the “DAO”(management fees), i.e. veCRV holders. Curve introduces the concept of "Liquidity Meter" in which holders of locked tokens (veCRV) can direct CRV emissions to be received by liquidity providers, creating a New motivational strategies.

Velodrome, launched two years later at the end of May 2022, explores another way of forking, inspired by a previous project that iterated on the Curve model: Solidly . HereLPs do not receive fees charged on the trading pairs on which they provide liquidity and are incentivized entirely through emissions.

The core difference between veCRV and veVELO is how they handle fees charged at the DEX/DAO level, the amount of fees we charge and their distribution model Differences were observed.

Let’s dive into the nuances of this topic: they are the key to understanding the pros and cons of each mode.

A.1/ Number of fee allocations: VELO = 2 x Curve

Curve and Velodrome follow the same basic logic: every week, a certain number of CRV/VELO Tokens are issued and distributed to liquidity providers. Each pool has a meter associated with it,veCRV/veVELO holders can vote, andweekly budget allocation follows the ratio of "meter votes": if a meter receives the total veCRV /veVELO votes, then 1% of all issuance generated that week will be directed to that currency pair.

These issuances are essentially the primary cost of a DEX: the price paid to attract and retain liquidity. What matters then is the other side of the ledger – Revenue: in our case, the fees collected.

On Curve, revenue comes from a "management fee" on each pool, usually set at 50%. This means that thefees charged on a given pool are split equally between LP and DAO/veCRV holders.

Curve income overview: light blue is management fees, yellow is fees paid to LPs, Dark blue is revenue from the crvUSD stablecoin - Source: curvemonitor.com

Curve income overview: light blue is management fees, yellow is fees paid to LPs, Dark blue is revenue from the crvUSD stablecoin - Source: curvemonitor.com

On Velodrome, it's simple: liquidity providers don't get the fees they charge on the trading pairs they supply in the pool; They are incentivized solely through $VELO emissions, meaningDAO/veVELO holders receive 100% of the fees generated on the DEX.

While this core difference has had a huge impact, the next difference is even more meaningful when it comes to how these fees are allocated to veCRV/veVELO holders.

A.2/ Cost Allocation Model: A Fairer, More Efficient Approach

Curve employs a model that can be described as a cost-levelling system: The fees veCRV holders receive depend solely on the amount ofveCRVthey hold. Stripping away too many technical details, these fees are charged in the various tokens involved in the pool (e.g. USDC/USDT/DAI for3pool) and are harvested and exchanged for3pool on a weekly basis LPtokens, which are then available for claim byveCRV holders—as you can see, this means some kind of infrastructure is required to operate,the cost of which increases with Curve DEX Increased by the number of upper pools.

Velodrome, on the other hand, offers a superior model in all dimensions as it enables betterDEX/LP/Tokens without requiring any infrastructure HolderConsistency. Let's see how it's done.

Put simply, Velodrome connects metered voting campaigns to fee allocations. Here, the amount of veVELO a holder owns matters, but even more important is which pool they voted for, as voters will only receive the fees charged on the trading pair they voted for. They charge per-pool fees (i.e. voters of the ETH/USDC pool receive ETH and USDC) which means the required infrastructure is easier to manage.

Velodrome ties fee distribution to metered voting activity: veVELO holders only receive fees charged on the pool they voted for, paid out once a week in the currency pair of the original pool. This better aligns veVELO holders with the best interests of Velodrome as a DEX compared to Curve.

This simple shift creates an interesting voting flywheel. High-volume trading pairs charge large fees, meaning there is a high incentive for voters. This results in many votes > directing reasonable issuance to the pair > attracting more liquidity providers > taking on more trading volume. until a balance point is reached. This means that a large number of currency pairs can be self-sustaining without requiring bribes or seeking whale voters, which is not the case on Curve.

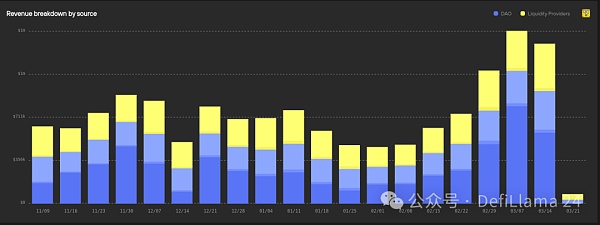

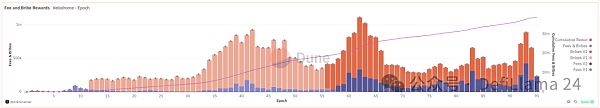

Velodrome Revenue Overview - Source: 0xkhmer Dashboard

Velodrome Revenue Overview - Source: 0xkhmer Dashboard

Aerodrome Revenue Overview - Source: 0xkhmer Dashboard

Aerodrome Revenue Overview - Source: 0xkhmer Dashboard

A.3/ Practical Meaning< br>

Now, let us illustrate by considering the case of a veCRV/veVELO voter who decides to vote for a trading pair with the smallest trading volume (this is a common case) .

On Curve:

1. A significant veCRV holder votes for a pool that handles a small volume compared to its TVL, either To collect a bribe, either because he wants to support the coins involved in the pool.

2. His voting activity is harmful to Curve as a DEX because he directs issuance to unnecessary places.

3. He receives the same amount of 3CRV as a more Curve-inclined voter, who has an equal amount of veCRV packets, trying to direct incentives toward votes that maximize transaction volume.

Now on Velodrome:

1. A significant veVELO holder votes for a pool that handles a small volume compared to its TVL, or Either to collect a bribe or because he wants to support the tokens involved in the pool.

2. His voting activity is harmful to Velodrome as a DEX because he directs issuance to unnecessary places.

3. The amount of fees he receives is very small because the pool he votes for handles very small transaction volumes.

The same is true for voting for a DEX interested high volume pool:

• On Curve, this DEX-aligned voter will receive to the same amount of 3CRV as any voter holding the same token.

• On Velodrome, this DEX-aligned voter will be well rewarded as he will be the majority voter on a high volume pair: this is what maximizes fee earning ideal situation.

In both respects, a bribe is paid to voters and may result in votes being directed to pools that are not optimal in terms of handling transaction volume. On Curve, however, there is no penalty for doing so. On Velodrome,the bribers of these pools competewith high volume pools that offer attractive APRs, with or without bribes.

Look at it from another perspective: on Curve, the cost of a bribe only depends on the value of the CRV issued. On Velodrome, the base price a project has to pay is determined by thetotal bribe + fees charged by other pools. This means that high volume pools drive up the cost of bribery, providing another incentive within the flywheel.

Understanding the above means understanding the core differences between Curve and Velodrome models. However, for a complete understanding, many more elements must be considered. Let us discussLP boost now.

B/ LP Boost and its impact on the ecosystem

LP boost, simply put, is a function unique to Curve. Many protocols that adopt veCRV tokenomics, such as Balancer and its veBAL, also use this feature. It enables veCRV holders to earn more CRV rewards based on multiple factors, including their veCRV holdings and the size of their various LPs. Therefore, with appropriate veCRV ownership, LPs can receive an "LP Boost" of up to 2.5x the base issuance rate.

B.1/ LP boost explanation

In order to obtain the maximum boost, up to 2.5 times, the following must be done:

1. Hold as much veCRV as possible.

2. Hold LP positions in as many pools as possible.

3. Have proportional/balanced TVL across these different pools.

Simply put, LP boost is a tough game from the start. It is not intended to benefit individual veCRV holders relative to their LPs, but rather to attract new protocols. With protocols like Convex, they are able to consistently achieve 1+2+3 all the time. Convex’s growth is not a success story; it’s by design (Curve’s design). Without Convex, another similar protocol would own most of the veCRV supply. We observe similar patterns in other protocols employing LP boost:Balancer has Aura. Convex and Aura control over 50% of the veCRV/veBAL supply.

Velodrome and Aerodrome completely avoid the possibility of new protocols gobbling up supply by not having any boosting mechanisms. As we can see with Curve,Convex came along and took most of the supply; now, all LPs are getting boostand no one is benefiting from any disproportionate amount of CRV. The system has converged to the point where everyone gets about the same effective boost. In Velodrome/Aerodrome, there is no Boost, as the future result will be that the LP gets the same effective boost. Another fact is thatsince Convex owns the majority of locked CRV, they control the future governance of CRV.

B.2/ Consequences of LP Boost

The existence of LP-boost requires a Convex-like layer on top of DEX; This is inevitable. At this pointsome may be thinking: “So you have a protocol that eats up most of your issuances and locks them up forever; what’s the problem?”

The answer is simple:It's just a design inefficiency, because these meta-layers provide functionality that can be provided at the base level (by the DEX itself) in a simpler way, and at no cost.

Curve requires Convex and the Bribery Market: Votium, Warden and Hidden Hands. But automatic compounding/voting proxy managers are also needed: Airforce Union, Concentrator, etc. You'll end up seeing dozens of protocols charging some fees here and there to offer what Velodrome is able to package natively. This makes the user experience more complexand users must understand these protocols and their subtleties to get the most out of Curve.

Remember when we discussed fee allocation we mentioned that Curve requires more intensive infrastructure to operate? Well,imagine the chaos on the backend of veCRV+LP boost. There's a reason why Curve and Balancer took so long to launch on the new L2and often only had partial features (like no LP boost, surprise surprise).

Seamless scaling—beyond what Curve has to offer:

On Velodrome, the bribery market is built-in: projects can< Posting their bribes directly on the Velodrome frontend, voters can view available bribes and vote in the same place.

Velodrome Relays

They start with Quality of Experience/Gas Savings upgrades, such as "Automatic Max Lock< ", saving the hassle of manual operations for those lockers who wish to maintain a maximum lock to maximize the volume of their meter votes, to broader featureslike Relay,a veVELO position management system.

This is a tool for projects that use Velodrome to grow liquidity on their trading pairs. It enables them to set up their own voting and bribery strategies and have them implemented automatically: no more weekly submissions of transactions. Relay has an additional benefit, as the currently available strategy is a veVELO-maxi strategy, which compounds all collected fees and bribes into VELO and relocks them to maximize voting power: it creates a sizable VELO pool, directly Tied to fees allocated by the exchange. Nearly 1/5 of veVELO is already there.

As Relay functionality matures, more strategies will become available to its users, including some that compound all earned fees and bribes into veVELO. Or a strategy to automatically claim ETH or USDC. This is very convenient for veVELO holders who don’t particularly want to support a project.

veNFT: Tokenization of Positions

Velodrome also includes other clever innovations, such as the still undervalued veNFT: on Curve, veCRV is not available transferred, making their management painful. Velodrome achieves the same consistency but allows transferability:veVELO positions are represented by veNFT and can be transferred. There is no way to exchange a given veNFT for VELO native currency other than waiting for the lock to expire. However, it simplifies the management of such a position by allowing transfers. Additionally, there is an OTC market for veVELO veNFT where holders can sell their positions at a discount compared to the value of VELO’s native currency.

A deep understanding of the nature of the game

Exchanges like Curve or Velodrome are a special type of product in the DeFi landscape. In regular business terms, they can be described asB2B2C: business to business to consumer. They areB2Bin that their first clients are other projects - various protocols looking for liquidity. If they succeed in serving this market,the projects they bootstrap into their DEXs will do B2C’s work for themas their liquidity pools provide opportunities for their respective token holders.

In this regard, I feel like Curve has completely failed. With its pyramid structure of solutions nested within each other,Curve is particularly unfriendly to project access. Do they want a bribe? Okay, Decided to choose between veCRV or vlCVX Bribery on Bribe.crv, Votium, Warden or StakeDAO. Do they want to manage their own CRV? OK, justchoose between veCRV, aCRV, cvxCRV, sdCRV, vlCVX, uCRV and more. While this variety of options may be exciting for Curve enthusiasts, in my opinionit becomes a burden on the B2B side.

In contrast, the Velodrome experience is seamless: everything happens in one place, every option is clear, and there’s no need to fiddle with half a dozen Comparisons between obscure and sometimes misleading choices. Coupled with the previously discussed features of the veCRV game, specifically the LP boost, it makes the Curve ecosystem particularly unfriendly to new entrants:Who would want to enter a place where three years after the start the interests are still skewed towards the first entrants? What about competition?

Additionally, Velodrome's BD efforts are significant; the team works extensively to help new projects onboard, and has designed several plans to make the experience for new entrants as simple and compelling as possible, all boiled down to the "Tour de OP” umbrella, including bribery matching programs, locked rewards, and voting enhancements.

Summary

As you may have seen, Velodrome and Aerodrome have attracted a lot of attention recently due to the rally of their tokens: I think it's deserved. Velodrome implements centralized liquidity The launch of Slipstream will increase the transaction volume processed per unit of TVL, unlocking the next growth stage of the flywheel. Aerodrome, Velodrome’s offshoot on the Base network, has seen phenomenal growth since its launch six months ago, further proving the viability of this model.

In the long term, the Velodrome team began to call Velo "MetaDEX", implying that Velodrome is becoming not just Optimism, but the basic liquidity center of the entire Superchain: all Chain built on the OP stack.

Time will tell, but Velodrome has had great success with Optimism,so properly managing cross-chain DEX will be a game changer. This is especially true considering Curve and Balancer failed there - not because they didn't try, but because their complex infrastructure and LP boost made cross-chain deployment painful (like AuraFinance distributing AURA on a chain with no liquidity ).

PS: I'm talking about the DEX part of the product suite here, which is the full range of products for Velodrome, but not for Curve, which now has crvUSD and Llamalend. Still, even including crvUSD, Aerodrome now collects and distributes more fees than Curve, all on one chain compared to Curve’s 13. Although Curve-DEX has been underperforming for some time, the team has repeatedly proven its ability to innovate and bounce back. crvUSD has surpassed Curve-DEX in revenue, who knows what Llamalend can achieve.

The game continues: let’s wait and see.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance CryptoSlate

CryptoSlate Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph