Author: Will Owens, Research Analyst, Galaxy Digital; Translation: @jinsecaijingxz

The term "cryptocurrency" originally meant "hidden" or "secret" currency, but for most of its development, privacy protection was not truly prioritized by the industry—until recently.

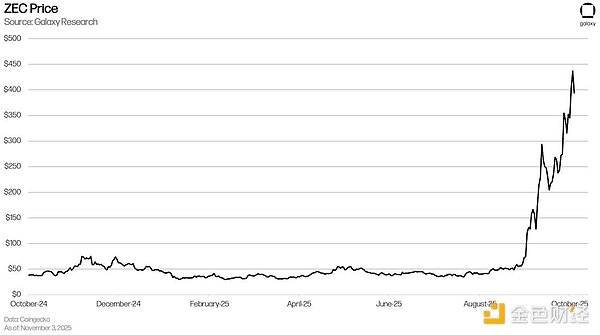

In the past few weeks, the privacy narrative has resurfaced in the market spotlight. The established privacy coin Zcash (ZEC) has surged 700% since September, and the crypto space seems to have seen a sudden influx of privacy experts. Some prominent Bitcoin figures have questioned whether this surge is "manipulated," warning buyers that they may become "exit liquidity" (meaning latecomers are forced to buy when early players sell off). Economist Lyn Alden specifically warned investors to be wary of "pump-and-dump traps," while investor Naval Ravikant immediately countered with the core argument: "Transparent cryptocurrencies cannot survive under government regulatory crackdowns."

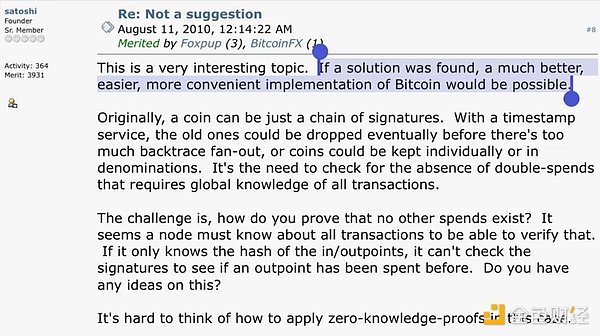

It's worth remembering that Satoshi Nakamoto, the anonymous founder of Bitcoin, acknowledged the network's privacy limitations in his 2008 white paper. While CoinJoin implementations like Samourai and Wasabi were once prevalent on the Bitcoin network, they are facing increasing regulatory pressure. Samourai has effectively ceased operations since its founder's arrest, and Wasabi terminated its CoinJoin function and began blocking US users in June 2024 due to regulatory pressure. PayJoin, a simple tool that can bypass Satoshi Nakamoto's "multi-input ownership heuristic," is gaining popularity, but this solution still requires user interaction. As mentioned above, Satoshi Nakamoto actually revealed a deeper problem arising from Bitcoin's transparency—the multi-input ownership heuristic assumes that all inputs to the same transaction belong to the same owner, allowing blockchain analysts to more accurately track fund flows and cluster addresses. Zcash, born from a Bitcoin fork, directly addresses the fundamental privacy limitations pointed out by Satoshi Nakamoto by implementing transaction shielding through zero-knowledge proofs.

Key points of this article:

After years of silence, ZEC has surged approximately eightfold in the past month, far outperforming the broader market, forcing the industry to re-examine the value of privacy features.

This discussion recreates the framework of the early Bitcoin debate regarding privacy versus regulatory realities.

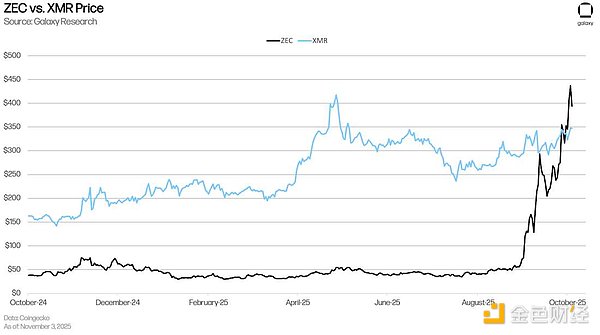

Zcash's market capitalization has surpassed Monero's.

Zcash's user experience has significantly improved (see Zashi Wallet).

Zcash's user experience has significantly improved (see Zashi Wallet).

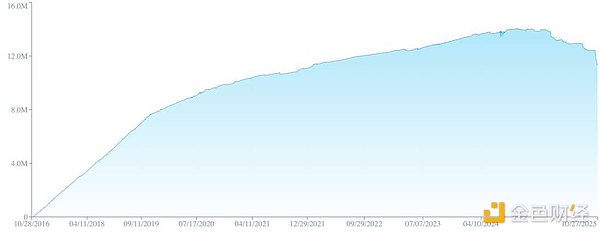

Cross-chain intent architecture reduces operational friction (e.g., the NEAR intent protocol). The anonymity set continues to expand—for the first time, over 30% of the ZEC supply has been deposited into the shielded liquidity pool. However, compared to Bitcoin, Zcash's full node coverage remains weak. 1. Development History and Network Upgrades Zcash's origins can be traced back to academic research in 2013—when cryptographers at Johns Hopkins University developed the Zerocoin protocol. As researchers continuously improved upon the original scheme's high computational cost and low efficiency, the design gradually evolved into Zerocash, and ultimately into Zcash. In 2016, cyberpunk pioneer Zooko Wilcox and his Electric Coin Company created Zcash, aiming to make it a privacy-enhanced fork of Bitcoin. Its goal was clear: to retain Bitcoin's monetary essence while fixing its most criticized design flaw (which Satoshi Nakamoto himself has acknowledged)—the lack of transaction privacy. Unlike Bitcoin, where all on-chain transactions are publicly visible, Zcash uses zero-knowledge proof technology, zk-SNARKs (Zero-Knowledge Concise Non-Interactive Arguments), allowing users to verify transaction validity while hiding the sender, receiver, and amount. Although Monero came earlier and implemented privacy protection through ring signatures, stealth addresses, and bulletproof protocols, Zcash is still the first mainstream blockchain to integrate zk-SNARKs at the protocol layer. Zcash uses an on-chain funding model, allocating a portion of block rewards to community-led initiatives rather than specific organizations. Under the current ZIP 1016 framework, 8% of the block reward goes into the Zcash Community Fund (ZCG), and 12% flows into a holder-controlled fund managed by holder vote. Neither the Electric Coin Company (ECC) nor the Zcash Foundation receives an automatic allocation, but they can apply for funding through the aforementioned mechanism. Zcash has undergone several network upgrades (NU): Sapling (2018): Achieved a significant leap in efficiency by shielding transactions; Heartwood (2020): Introduced shielded coin base outputs, allowing miners to privately receive block rewards; Canopy (2020): With the launch of the first halving, a four-year development fund jointly managed by ECC, the Zcash Foundation, and the community fund replaced the original founder rewards (part of which was originally intended for early investors); NU5/Orchard (2022): Enabled Halo 2 recursive proofs to replace complex trusted settings, introduced a unified address for transparent and shielded recipients, and established the Orchard shielded fund pool; NU6 (2024): Achieves decentralized treasury management through an in-protocol treasury, improving the transparency of development fund custody and distribution. Currently, the protocol is preparing for the NU7 upgrade. Throughout most of ZEC's lifespan, its market performance has been consistently weak, not only underperforming BTC but also being overshadowed by Monero (XMR) for a long time. Monero provides basic anonymity to all users through default mandatory privacy protection, but its mechanism relies on a ring signature scheme with a small set of decoys—each real transaction is mixed with a finite set of anonymities consisting of 15 decoy inputs, which has been shown to have partial deanonymization potential. Regulatory agencies often subject Monero to stricter scrutiny (due to its default mandatory privacy features); for example, in 2020, the IRS Criminal Investigation Department commissioned Chainalysis and Integra FEC to study Monero transaction tracking technology. In contrast, Zcash implements an optional privacy mode through zk-SNARKs, which can fully encrypt transaction data and generate a larger anonymity set when using masked addresses. While this dual-mode design may reduce privacy strength due to user errors (such as misusing transparent addresses), under proper operation, Zcash's cryptographic guarantees provide mathematically more rigorous privacy protection. Its privacy layer also possesses quantum-resistant properties, a feature not yet implemented in Monero's current ring signature scheme (the development team has acknowledged this deficiency and plans to address it through upgrades such as FCMP++). Today, the price movement of ZEC alone is reshaping a completely new industry narrative.

2、Technical Architecture

Zcash inherits Bitcoin's monetary design: a fixed total supply of 21 million ZEC, using Proof-of-Work consensus, and undergoing a halving approximately every four years. Its Equihash algorithm is more resistant to ASIC centralization than Bitcoin's SHA-256, with a block generation time of approximately 75 seconds (about 8 times faster than Bitcoin's 10-minute block time). Zcash's halving cycle also maintains a roughly four-year period, with the next halving expected in November 2028, at which point the block reward will decrease to 0.78125 ZEC.

The Zcash network currently maintains approximately 100-120 full nodes, a slight increase from the low of approximately 60 at the beginning of this year, but still limited in scale compared to Bitcoin (approximately 24,000 nodes) or Monero (approximately 4,000 nodes).

The Zcash network currently maintains approximately 100-120 full nodes, a slight increase from the low of approximately 60 at the beginning of the year, but still limited in scale compared to Bitcoin (approximately 24,000 nodes) or Monero (approximately 4,000 nodes).

3What isNEAR Intents?

NEAR Intents (Intent Protocol) is a new cross-chain coordination layer built on top of the NEAR protocol, allowing users to declare intents (such as "pay X amount of ETH to address y") to replace the cumbersome process of manually managing cross-chain bridges, exchange operations, and wallet interactions.

Its underlying implementation is achieved by intent executors (autonomous on-chain agents), which automate the realization of user intents through operations such as liquidity routing, cross-chain exchange, and settlement.

For Zcash, integrating intent functionality means that users can now transfer assets between the transparent network and Zcash shielded liquidity pools without exposing each step on-chain.

In practice, traders or institutions can transfer funds from visible blockchains (such as Ethereum) to Zcash to rebuild privacy. After completing a transaction in the shielded pool, they can also return to the original chain as needed, ensuring that there is no direct connection between the two addresses. The integration of the NEAR intent protocol with the Zashi wallet (the official ECC wallet, the most widely used Zcash wallet) eliminates the technical friction for users performing cross-chain and shielded operations. Zcash natively supports viewing keys, allowing selective disclosure of shielded transaction details for auditing or compliance purposes. These features together make Zcash's privacy protection both convenient for personal use and meets the needs of institutions. 4. Why Now? Zcash's nearly 700% surge seems to reflect a deeper cultural shift in the crypto space. As highlighted in a16z's "2025 Crypto Industry Status Report," search interest in privacy-related keywords on Google has surged in recent months. Many Bitcoin critics lament its "institutionalization" trend, accusing Bitcoin of being "dominated by ETFs" and subject to centralized custody. However, Bitcoin itself remains completely transparent, and ETFs haven't changed this characteristic; they've only added intermediaries. In contrast, Zcash supporters position it as a "crypto Bitcoin," viewing it as a return to cypherpunk ideals—a claim that resonates with the increasing prevalence of on-chain surveillance (including analytics firms like Chainalysis and social media spies like ZachXBT and Lookonchain). The rise of Zcash has reignited the age-old philosophical debate between "privacy is a right" and "transparency is a regulatory necessity," a dilemma the project has long sought to resolve. As its privacy technology stack finally reaches consumer-grade usability, Zcash is gaining more attention. The Zashi wallet, launched in March 2024, eliminated the operational complexity of the shielding function, and the proportion of shielded assets is also trending upwards. As more ZEC goes into shielding, the anonymity set expands, and Zcash's privacy will continue to strengthen. Perhaps the most telling sign of Zcash's "strong comeback" comes from Hyperliquid—a few weeks ago, the decentralized exchange launched ZEC perpetual contracts, allowing traders to establish leveraged positions in this privacy coin. This move indicates a surge in market demand for exposure to this token, which has been dormant for several years. The launch of perpetual contracts has increased ZEC market liquidity (approximately $115 million in open interest as of October 30th), while also exacerbating spot price volatility. From a technical perspective, Zcash's fundamentals haven't drastically changed, but the market's perception of its technology has shifted. This recent surge stems from continued support from top crypto opinion leaders and a renewed awareness of the necessity for privacy in permissionless currencies. Regardless of whether ZEC's price strength can be sustained, this rotation of funds has successfully forced the market to reassess the value of privacy (other privacy tokens such as RAIL, ARRR, and UMBRA also saw strong buying). This surge has brought Zcash back into the market spotlight after years of marginalization. Whether speculative momentum can translate into sustained network growth remains to be seen, but the renewed emphasis on privacy reveals a deeper truth: in an increasingly transparent financial system, transaction privacy is once again being recognized as a valuable feature.

Miyuki

Miyuki

Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Brian

Brian Anais

Anais Alex

Alex Miyuki

Miyuki