Author: Vincent, GodRealmX

As we all know, DeFi is the cornerstone of Web3, and the capacity changes of the entire DeFi system symbolize the changes in the popularity of the entire Crypto industry. From the DeFi summer that began at the end of 2020 to the 519 black swan in 2021, the TVL of the entire DeFi ecosystem fell from US$123 billion to US$75 billion, but after a brief market adjustment, the TVL of the DeFi ecosystem rebounded rapidly and reached a peak of around US$180 billion.

After the Luna and FTX explosions in 2022, the entire DeFi system experienced a downturn for a year and a half, and then in 2024, the DeFi system ushered in a revival again. From the perspective of looking for a sword in a boat, the current scale of DeFi is far from reaching its true upper limit. It is a good choice to find the underestimated Alpha in the DeFi track.

In the current Web3 environment where PoS is popular, LST (Liquid Staking Token) has long become an indispensable asset type. If an ecosystem wants to develop, in addition to building the necessary DeFi infrastructure, the most important thing to consider is how to do a good job of LST liquidity, so the operation of LST is particularly important.

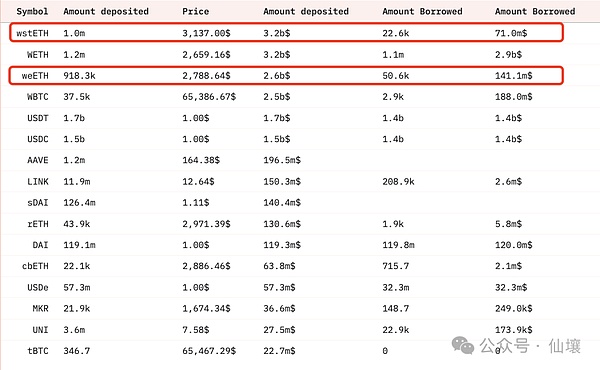

Because DeFi has excellent composability, the liquidity of LST will be related to the economic security of the entire ecosystem. For example, in major DeFi protocols such as AAVE, the scale of lending with LST as collateral is very large. If LRT based on LST (Token obtained by staking LST) is included, then this amount will double.

In addition, since multi-ecological operability and multiple assets can better ensure ecological stability in the current environment, LST-related operations will also involve issues of interaction with the external ecology. In contrast, although there are differences in some technical implementations among various LSTs, from a business perspective, everyone's model is similar. Wouldn't it be great if there could be a safer LST Issuer to provide technical support so that each company can develop business scenarios with peace of mind?

For this reason, were-examined LST related projects,andfinallyfoundthatBifrost ,whichweresearchedbeforeisstilla good choice.CoincideswiththelaunchToken economicmodel2.0,sowewillre-examineBifrost’soverallmechanismdesignanddataperformancetoday.

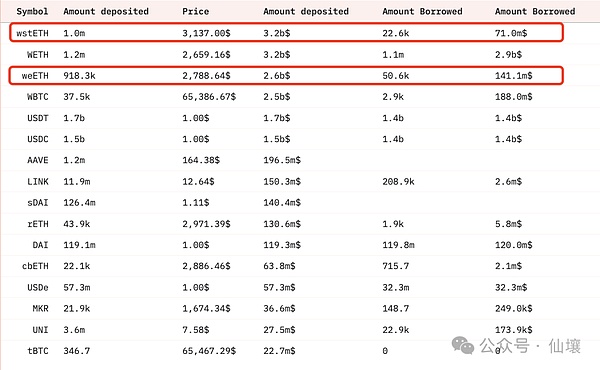

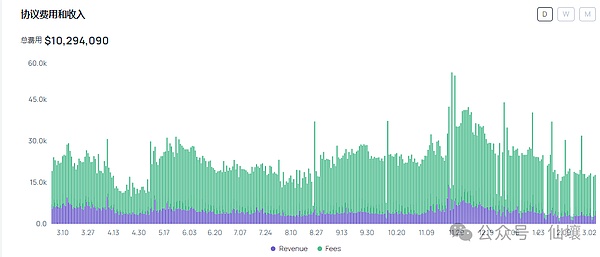

Source: https://dune.com/KARTOD/AAVE-Mega-Dashboard

From here we can see that LST and LRT assets account for a large proportion of AAVE's business volume, especially from the deposit data, which accounts for the majority

LST cannot be ignored

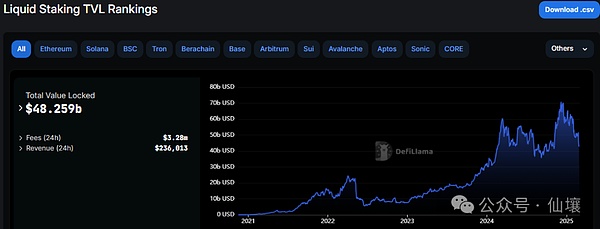

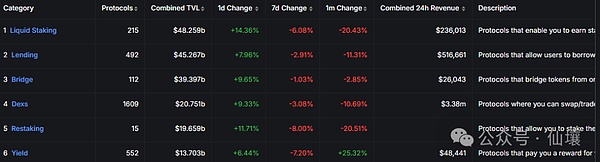

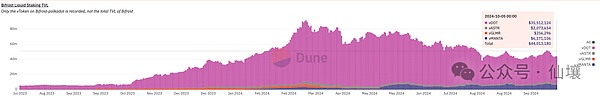

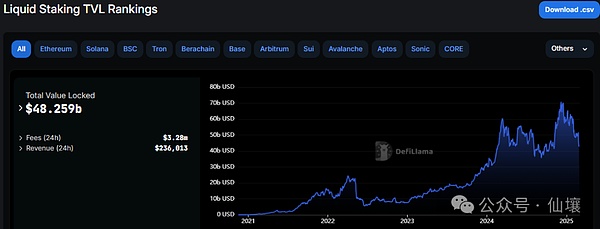

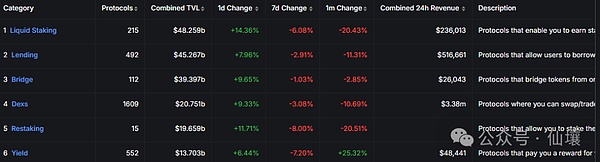

In terms of the existing market size, LST is currently thelargestassetcategoryin theDeFiecosystem. Since the merger with Ethereum, its scale has been soaring, and it once exceeded 60 billion US dollars in March 2024. Although it has now fallen back, it still maintains a volume of 48 billion US dollars. Looking at the entire Web3 application track, almost no other track can reach this level in terms of funding scale.

Source: https://defillama.com/protocols/Liquid%20Staking

If the Restaking track is included, the scale will be much larger.

There are many LST-related projects, and almost every public chain has its own native LST.

However, as we mentioned at the beginning, Web3 is not an isolated ecosystem, but a whole that is interconnected with each other through interoperability. The overlap of assets between multiple ecosystems theoretically strengthens the economic robustness of each ecosystem, but it also inevitably brings about structural fragility that affects the entire system.

This problem is even more unavoidable for LST. Therefore, a good LST issuance facility must be able to provide an efficient and secure interoperability solution. At the same time, this also involves a problem of operational complexity:

Under normal circumstances, users want to operate on different chains, even if they want to interact with versions of the same protocol on different chains, complex steps are required. You need to understand the differences between each chain, what the Gas Token is, and add the corresponding Gas Token to your wallet.

What's more, for a specific application, once it involves multi-chain deployment, it is bound to involve the problem of liquidity fragmentation. We have had an in-depth discussion in the 2023 article "The Future of Cross-Chain Bridges: Full Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline". In short, the core issue of LST at present is:

How can we safely aggregate the resources and ecosystems on each chain so that users don't have to perceive the existence of the "chain"? For example, if I have 1 wstETH, can I use it wherever I want, and hide the links such as automatic exchange and payment of Gas on different chains? I want to use a certain DAPP. Can I use it on any chain without transferring assets? At the same time, project owners no longer need to choose a chain, and no longer need to repeatedly deploy on multiple chains. Instead, they can deploy on the most suitable chain, and then people on different chains can interact?

Bifrost has proposed a relatively complete solution to the above problems. Although we have briefly talked about its architecture and characteristics before, after a year of silent construction, Bifrost's strategic layout and technical solutions have been greatly updated. Let us take a look at Bifrost's latest model together.

Bifrost Overview

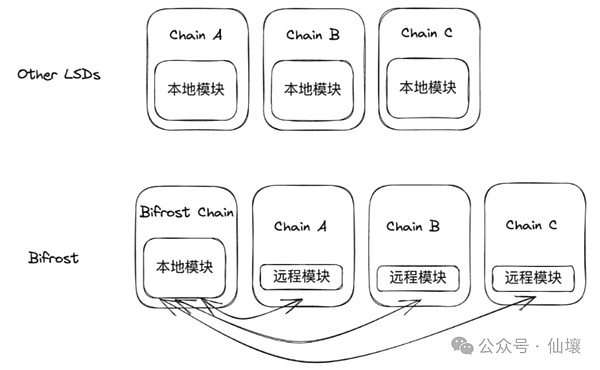

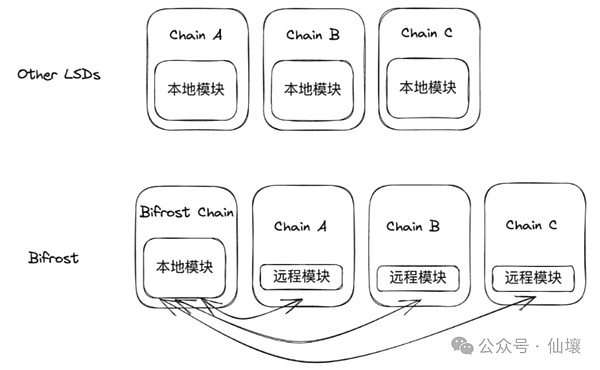

In fact, Bifrost is not a new project.Itis a parallel chain of Polkadot, specifically forLST.It positions itself as the full-chainLSTinfrastructure.Some people also callBifrost’s model “chain abstraction”.Bifrost’s liquidity pledge module is only deployed on the Bifrost chain, and the corresponding LST asset - vToken’s liquidity is also all on the Bifrost chain, but other chains can interact with the liquidity pledge module and liquidity pool on the Bifrost chain through remote calls.

In this way:

Users can mint vTokens on other chains;

Users can redeem vTokens on other chains;

Users can redeem vTokens on other chains, but what is touched behind is the liquidity of the Bifrost chain;

Users can provide liquidity for the vToken/Token pool on the Bifrost Parachain on other chains and obtain LP Tokens;

Users can destroy LP Tokens on other chains to redeem liquidity.

For these operations, users are completely unaware of the cross-chain transfer process behind them, and everything is done as if it were done locally. Bifrost deploys a remote module (remote modular) on other chains to receive user requests, pass them across chains to the liquidity pledge module of the Bifrost chain, and then return the results across chains to the remote module. Users only need to initiate requests from the remote module on other chains, and the subsequent process will be triggered and completed by Relayers. As shown in the figure below:

Overall, Bifrost is a full-chain liquidity pledge protocol with the characteristics of "chain abstraction". However, some details other than cross-chain technology need to be supplemented here so that we can better understand Bifrost.

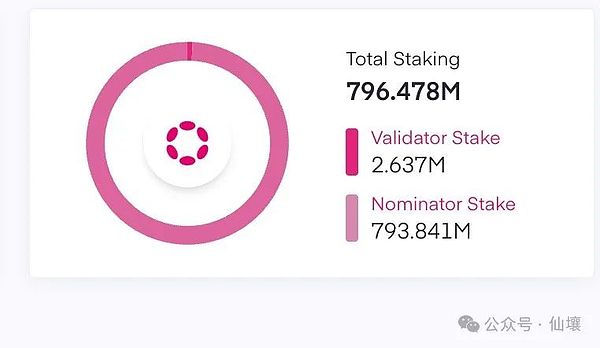

Economic Security

Bifrost itself has deployed a parachain on Polkadot, so it has a unique advantage in security. We know that Polkadot is divided into relay chains and parachains, and all parachains share the security of the Polkadot relay chain. Currently, the number of DOTs staked on Polkadot exceeds 3 billion US dollars, and security is fully economically guaranteed. Compared with other chain abstraction solutions, Bifrost itself does not need too much investment in security, and can focus on the development of business logic.

Advantages of Sovereign Chains

Finally, Polkadot XCM itself, combined with Bifrost's business, can well implement the "chain abstraction" function. Users can complete various vToken operations on any chain ecosystem that is connected to Bifrost without switching to other ecosystems.

Moreover, the most important thing is that Bifrost can set LST as the Gas Token. This provides the underlying guarantee for chain abstraction;

At the same time, for other ecosystems, to access different LSTs, especially LSTs from different ecosystems, it is no longer necessary to connect to a large number of RPCs, but only to connect to the Bifrost standard RPC;

In terms of business expansion, various functions can be expanded by upgrading the chain itself, such as introducing LRT, RWA, etc. At present, Bifrost has begun to introduce LRT, so due to its own characteristics, the introduction of RWA is not a big problem;

Although Bifrost is a parallel chain, Polkadot's architecture allows parallel chains to have their own tokens, their own governance models, and can introduce various applications;

Secondly, Bifrost is also a sovereign chain for LST. It does not need to deploy its own contracts and liquidity on each chain like the traditional multi-chain deployment of LST (avoiding the problem of conventional LST liquidity fragmentation). The sovereign chain itself also allows Bifrost's functional expansion to be more free, especially the Substrate architecture itself is excellent in composability and scalability. Bifrost based on this architecture can achieve functions that other LST issuers cannot achieve. For example:

Of course, in the world of Web3, in addition to the quality of the product itself, the most important thing is whether a positive feedback mechanism can be formed between the project's token and the project's business. This has to be said about Bifrost's Token Model 2.0, which will be launched this year.

Token Economics 2.0

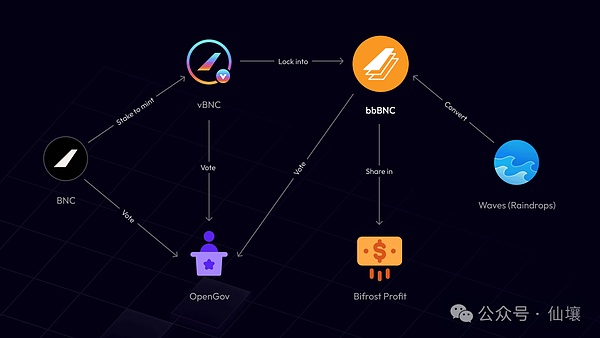

The original Bifrost token BNC, its scenarios are mainly focused on governance, which is also a common problem of Polkadot's parachain ecosystem-related tokens. Nowadays, it is difficult for pure governance tokens to have a clear room for growth. Even old governance tokens such as UNI are considering joining the dividend strategy, so the launch of a new BNC token economy is imminent.

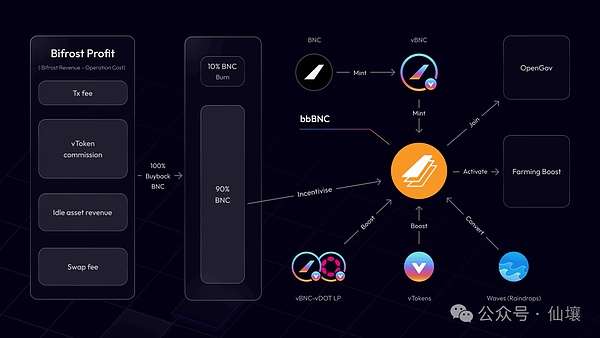

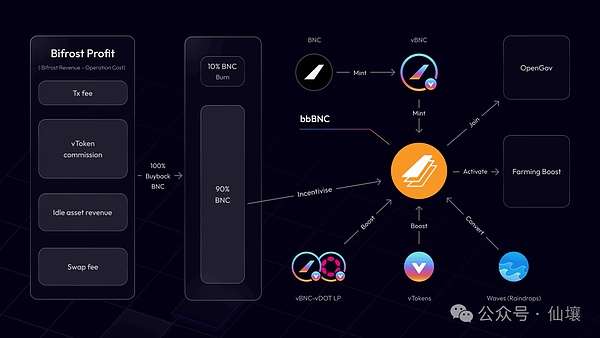

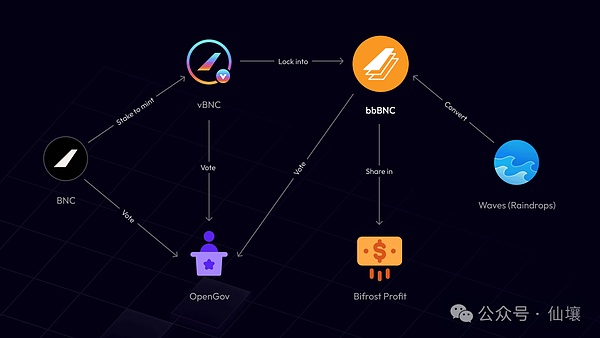

Currently, all Bifrost protocol revenue goes directly to the treasury, and it directly expands its business on the business side, but does not share interests with BNC token holders. The economic model of Bifrost 2.0 plans to use 100% of the protocol profits for BNC repurchases, 90% for bbBNC holders, and the remaining 10% will be destroyed.

This new system built around token buybacks must be familiar to everyone. The advantage of this system is that once it is properly operated, it can form a virtuous flywheel effect: buybacks are often accompanied by destruction or locking, which are two ways to reduce the circulation of tokens.

Back to Bifrost, its core token for dividends is bbBNC, and the preceding bb is the abbreviation of "buy back". According to the official blog, users can obtain vBNC (i.e., Bifrost's own token LST) by staking BNC for liquidity, and then lock vBNC to obtain bbBNC. The amount of bbBNC a user obtains depends on the amount of vBNC locked and the length of the lock-up period. This is a very classic Curve veToken model;

At the same time, because Bifrost has previously conducted Raindrops points activities, these points can also be exchanged for bbBNC after bbBNC goes online. Of course, this part of bbBNC is paid by the treasury and will not be minted directly.

The method of obtaining bbBNC is not troublesome, but it should be noted that like other veTokens, bbBNC cannot be transferred and can be exchanged for vBNC at any time, but if it is exchanged before the expiration date, there will be a penalty mechanism of different proportions.

In addition to receiving protocol dividends, there are other benefits to holding bbBNC. In summary, they include:

Profit distribution: bbBNC holders will share protocol profits. The distribution ratio depends on the amount of bbBNC held and the length of the lock-up period. The larger the holding amount and the longer the lock-up period, the higher the profit distribution share.

Staking rewards: bbBNC obtained by locking vBNC integrates the rewards of liquid staked BNC.

Governance rights: bbBNC inherits the governance rights of BNC, allowing holders to participate in the governance of the Bifrost protocol.

Farming Boost: bbBNC holders can get extra rewards when participating in vToken farming.

So, if we put the flywheel effect of the above token repurchase into the new token economy of Bifrost, we can use the following figure to represent it:

The higher the value captured by BNC, the higher the market value of Bifrost, which in turn drives more application scenarios of LST. More application scenarios will promote the improvement of vTokens' comprehensive yield (staking yield + vToken re-staking yield), thereby generating more vToken minting. More vToken minting means more protocol revenue, which will increase the income of bbBNC holders, further capture more value for BNC, and form a positive growth flywheel. So, if we look at some more realistic data, what will be the actual benefits that the new token economy can bring to bbBNC? At present, the total BNC supply is 80m, the circulation volume is 44m+, the circulation market value is 8m, and the FDV is around 15m. According to the data of Bifrost Dapp, there are about 9.8m BNCs that have participated in staking. According to the current exchange rate of 0.88, there are about 5m vBNCs in circulation.

Now, we know the current situation of vBNC holders. Assuming that 100% of these people choose to exchange vBNC pledge for bbBNC, then, what we need to know now is Bifrost's income.

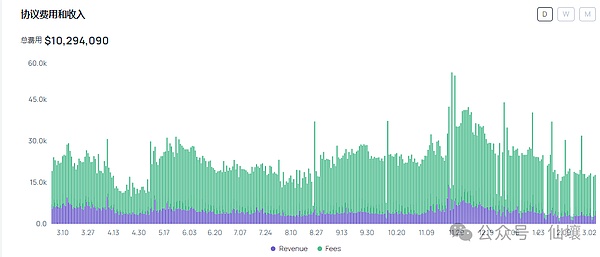

According to the official display, Bifrost's income sources are divided intothe following parts:

vToken Commission: The protocol earns commissions from staking rewards through its liquidity staking service

System Staking: This is generated by staking assets in the Bifrost system account.

Transaction fee: As an independent application chain, gas fee is also an important source of income

vToken exchange fee: Bifrost has established liquidity pools for vTokens. Users need to pay fees when using these pools to exchange vTokens. Most of these exchange fees belong to liquidity providers (LPs), and part of them will be shared with bbBNC holders.

Extended application income: Bifrost will also launch various extended application services centered on liquidity staking, including LST leveraged staking (Loop Stake). Users who use these services will create income for the Bifrost protocol, thereby providing returns to bbBNC holders.

bbBNC early redemption penalty: If bbBNC is redeemed before expiration, a certain reduction will be incurred, which will be allocated to the protocol income.

The most important thing here is the vToken commission and the vToken exchange fee. Needless to say, the vToken commission is the foundation of existence, but we also know that the transaction fee income of LST-related pools cannot be underestimated, because compared with directly redeeming the native token, exiting LST through transactions is often more cost-effective. Therefore, the income calculation for Bifrost should also be based on these two points.

Of course, at present, because the overall Polkadot ecosystem is in a trough, even the largest DOT LST protocol, there is not much LST swap on Bifrost. Since most of the income will be given to LP, in fact, according to the current data, its income is not much. It is only in the future, when the positive flywheel is running, the proportion of the corresponding swap income will increase. So this time we only calculate the income according to the LST commission.

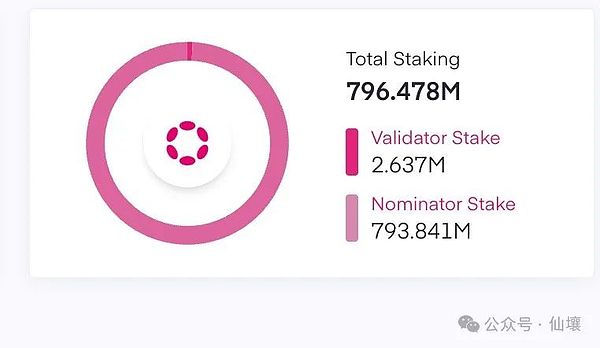

According to the Bifrost vToken commission rules, Bifrost will get 10% of the staking income.

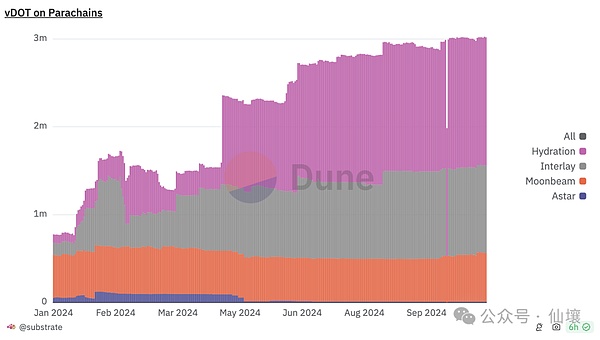

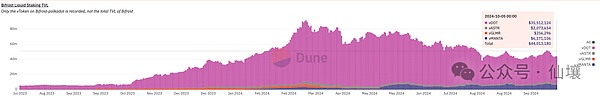

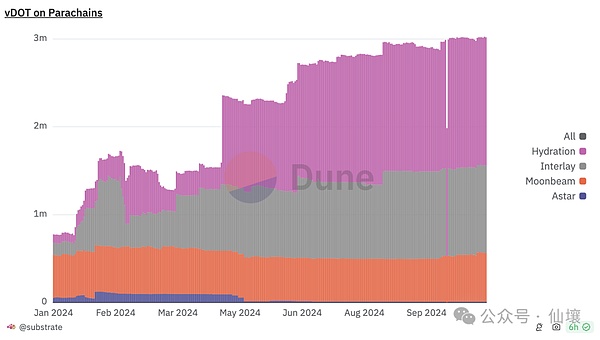

From the above picture, we can see that the main staking business of Bifrost is DOT. Especially at the end of 2023, when Polkadot welcomed the first batch of DOT unlocking slots, Bifrost, with its excellent service and low fees, as well as the technical support of SLP+SLPx+vToken, became the first in the Polkadot LST protocol, occupying more than 60% of the DOT LST market.

In March 2024, vDOT once reached a peak TVL of 80m. Today, vDOT TVL still exceeds 35m.

Followed closely are vMANTA and vASTR, whose combined TVL exceeds 6m. If calculated based on the 90-day average staking base apy of the three, and assuming that the current TVL of each vToken remains unchanged, the returns are:

vDOT: 12.02%, the total staking income for one year is about 4.97m, and the 10% commission is $497,000;

vMANTA: 20.10%, the total staking income for one year is 0.61m, 10% commission is $61,000;

vASTR: 10.47%, the total staking income for one year is 0.38m, 10% commission is $38,000;

So in terms of staking income alone, assuming that all data are consistent with the current ones, Bifrost can make a profit of 719,068 per year. According to Bifrost's official revenue data, including other income such as system staking, the profit in 2024 is about 1.69 million US dollars:

As mentioned earlier, there are currently about 5m vBNC, and according to the current market price, the total value is about 1.1m. In other words, if these 5m vBNCs all obtain bbBNC according to the maximum lock-up time, then apy is about 70% (of course, we need to make it clear that protocol revenue is not equal to protocol profit, which needs to deduct project operating costs).

Therefore, if the flywheel of Bifrost Token Economy 2.0 can turn, so that the revenue data and staking data can grow in both directions, then this rate of return can be maintained at a good level. Moreover, there is another point that cannot be ignored, which is the use of vToken itself. In addition to earning fees on Bifrost, vToken itself is a full-chain asset that can be used on any chain. Combined with various DeFi, its income will be even higher.

In addition, Bifrost, Hyperbridge and Snowbridge jointly launched a liquidity incentive proposal for the Polkadot ecosystem, planning to allocate about 800,000 DOTs from the Polkadot treasury to incentivize Arbitrum, Base, BNB Chain and DOT/ETH and vDOT/ETH liquidity providers on Ethereum. The plan can attract more liquidity for Bifrost to enhance the user experience within its ecosystem.

In general, Bifrost's architecture combined with the new Token Economy 2.0 is still a very noteworthy project in the Liquid Staking track, especially since it has been deeply involved in the Polkadot ecosystem. The vDOT it has issued is already the DOT LST with the highest TVL (US$35 million). However, compared with the huge DOT market value (US$6.7 billion), its growth potential cannot be ignored. Because it has the characteristics of chain abstraction, it naturally has the ability to span multiple ecosystems. LST is the basic business of each ecosystem. The superposition of various favorable buffs makes people look forward to its performance.

Anais

Anais