Written by: 0xxz@金财经

Famous Wall Street investor Catherine Wood and her subsidiary ARK Investment have released the "Big Ideas" report at the beginning of each year since 2017, which has always attracted market attention.

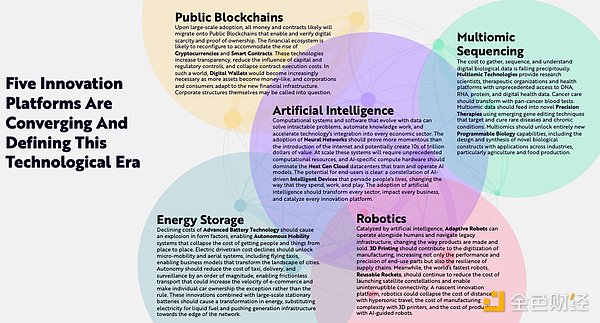

With Big Ideas in 2023, ARK believes that five major categories of technologies define our era: public chains, AI, energy storage, robotics, multi-omics sequencing.

The "Big Ideas 2024" report is 163 pages long and has 15 parts. In addition to the overview Technological Convergence, 4 of the other 14 parts involve cryptocurrency and Web3, namely: AI, Bitcoin Configuration, and Bitcoin in 2023 coins, smart contracts.

Because the "Big Ideas 2024" report was released during China's 2024 New Year, the content of the report, especially the encryption-related content, has not been fully translated and introduced to the Simplified Chinese network. Golden Finance has compiled this part of the content to reward readers.

In order to take care of the reading experience, we put the three parts of Bitcoin configuration, Bitcoin in 2023, and smart contracts at the front, and the AI part at the end.

Bitcoin Allocation

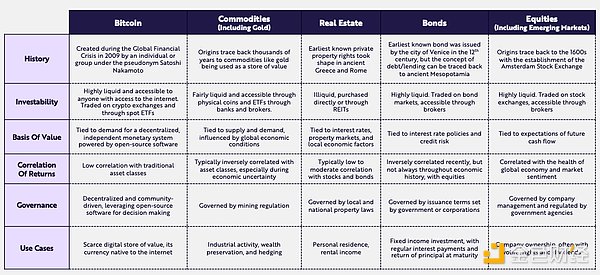

Digital assets, such as Bitcoin, are a new asset class

According to ARK research, Bitcoin has emerged as an independent asset class worthy of strategic allocation in institutional investment portfolios.

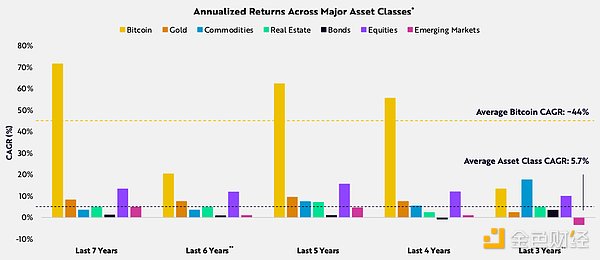

Bitcoin outperforms all major assets over longer time frames

Over the past seven years, Bitcoin's annualized returns have averaged about 44%, while other major assets have averaged only 5.7%.

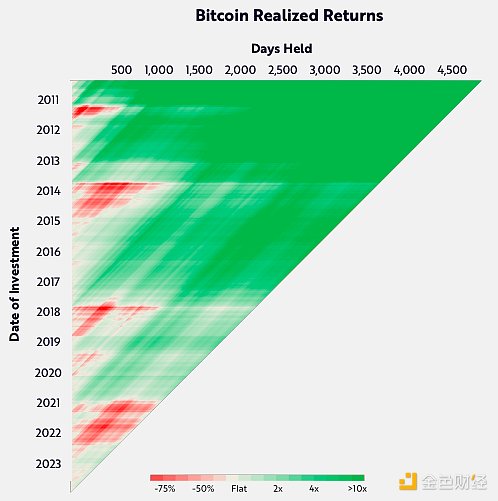

Overall, investors who hold Bitcoin for the long term benefit over time

'Time, timing': Bitcoin's volatility could obscure its long-term returns. While significant appreciation or depreciation may occur in the short term, a long-term investment horizon has always been key to investing in Bitcoin. Rather than obsessing over “when,” a better question would be “how long?” Historically, investors who bought Bitcoin whenever and held it for at least 5 years have profited.

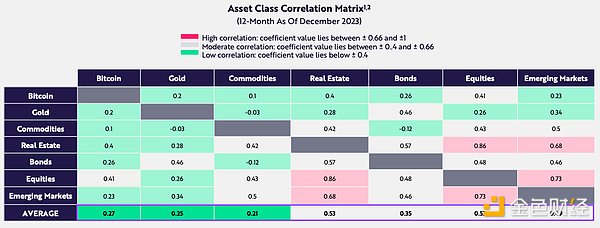

Bitcoin has a low correlation with traditional assets

Historically, Bitcoin’s price movements have Other asset classes are less strongly correlated. Over the past five years, Bitcoin returns have averaged only a 0.27 correlation with traditional asset classes.

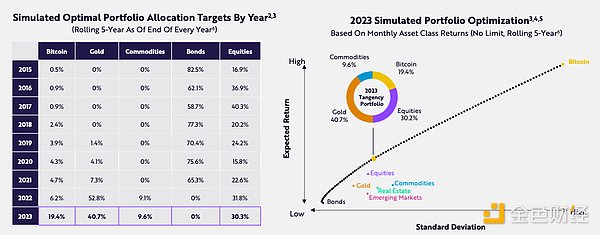

Bitcoin can play an important role in maximizing risk-adjusted returns

ARK's research focuses on volatility in traditional asset classes performance and return profile, and suggests that a portfolio seeking to maximize risk-adjusted returns should allocate 19.4% of funds to Bitcoin in 2023.

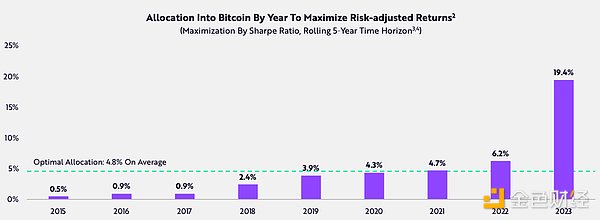

On a 5-year rolling basis, allocating to Bitcoin has maximized risk-adjusted returns over the past 9 years

According to us In 2015, the optimal allocation to maximize risk-adjusted returns was 0.5% over a 5-year time horizon. Since then, on the same basis, the average allocation to Bitcoin has been 4.8%, reaching 19.4% in 2023 alone.

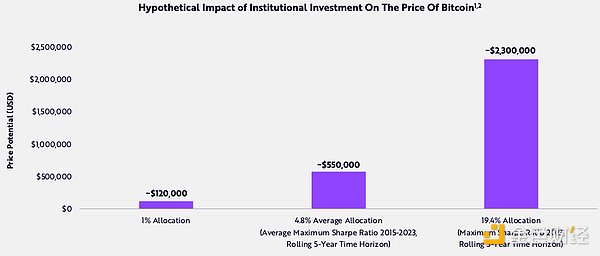

What impact will the optimal allocation of Bitcoin have?

Allocation of Bitcoin from the $250 trillion global investable asset base will have a significant impact on price.

1% allocation will bring the Bitcoin price to $120,000; 4.8 % allocation will bring the price of Bitcoin to $550,000; an allocation of 19.4% will bring the price of Bitcoin to $2.3 million.

Bitcoin in 2023

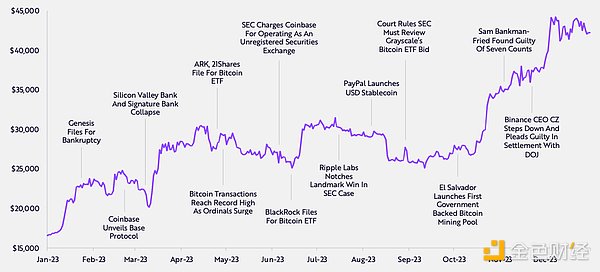

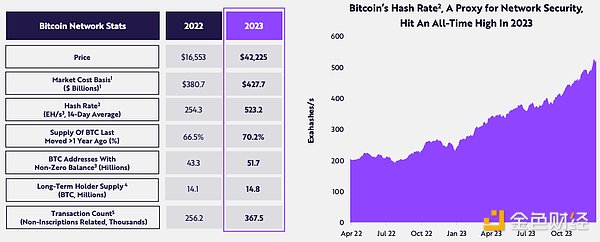

Bitcoin price surged 155% in 2023, market value increased To US$827 billion

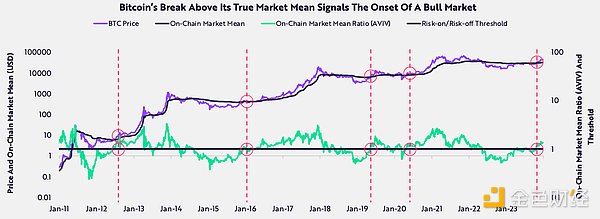

Bitcoin price breaks through its on-chain market average for the first time in nearly 4 years

Chain The Upper Market Mean is an original indicator from ARK that serves as a reliable dividing point between risk-averse and risk-on Bitcoin markets. Historically, when Bitcoin price breaks above the market mean, it usually marks the early stages of a bull market.

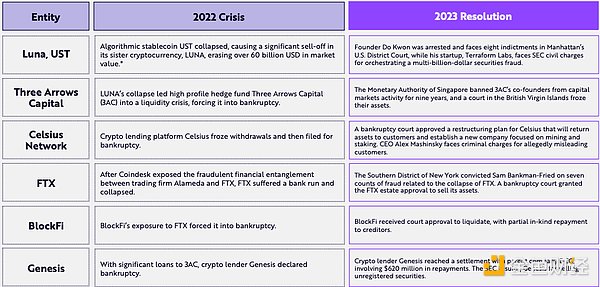

2023 provides important answers to the crypto crisis of 2022

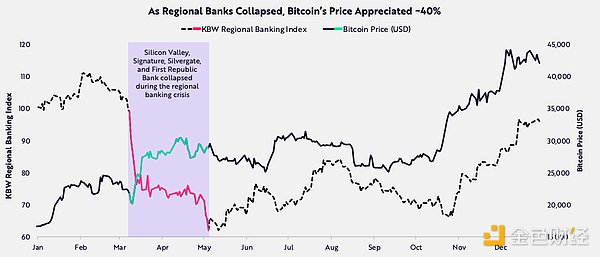

< strong>Bitcoin becomes safe haven during massive U.S. district bank collapse

In early 2023, during the historic U.S. district bank collapse, the price of Bitcoin rose by more than 40%, highlighting its Role as a counterparty risk hedging tool

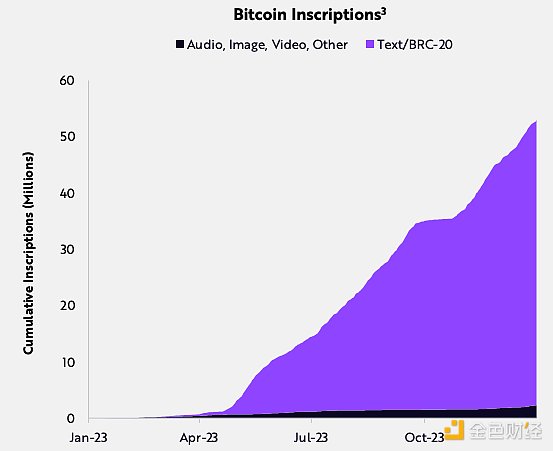

The surge in the number of inscriptions shows that the Bitcoin network has other functions besides transaction settlement

< p>Bitcoin Inscription, launched in January 2023, introduces a unique numbering system that assigns each "satoshi" (the smallest unit of Bitcoin) a number based on its position in the blockchain. Each satoshi is identifiable and immutable, allowing users to burn data, images or text on it. Unlike other blockchains that require smart contracts for NFTs, Bitcoin Inscription sits underneath the Bitcoin blockchain.

The impact of inscriptions on transaction size and block space has sparked debate. We believe that Inscription is a product of the free market and represents healthy innovation on Bitcoin.

Bitcoin’s fundamentals have survived the crisis in 2022 without any problems and will continue to develop steadily in 2023

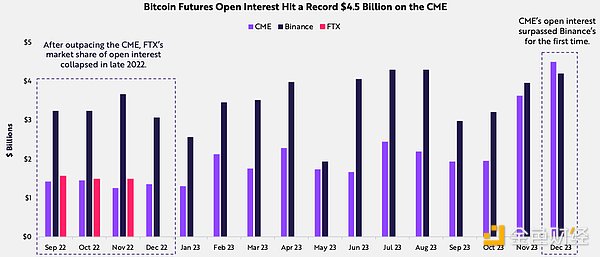

The U.S. Commodity Futures Exchange CME surpassed Binance and became the world’s largest Bitcoin futures exchange

With the thunderstorms in the crypto market in 2022 Bitcoin’s market dynamics shifted more towards the United States following the increased demand for more regulated and secure infrastructure.

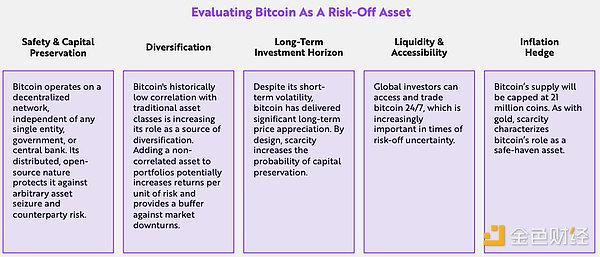

Bitcoin is evolving into a reliable safe-haven asset

As macroeconomic uncertainty rises As trust in traditional “safe-haven assets” increases, Bitcoin becomes a viable alternative.

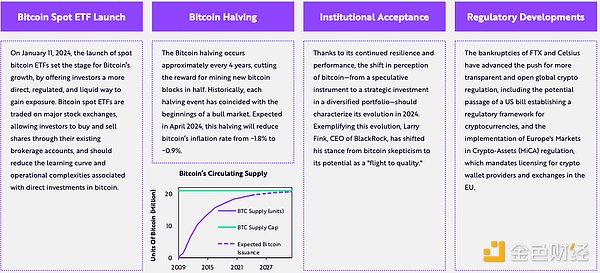

Bitcoin will face major catalysts in 2024:

Bitcoin spot ETF issuance, Bitcoin halving, institutional acceptance, regulatory progress

Smart Contract

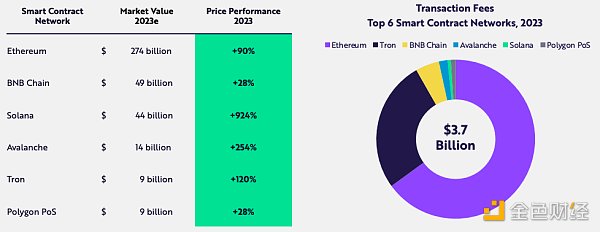

Smart contracts deployed on public chains provide a global, automated, and auditable alternative to rent-seeking intermediaries and traditional financial infrastructure.

After the "crypto market crisis" of 2022, a number of digital asset solutions have gained market favor, including stablecoins, tokenized treasury bonds, and scaling technologies.

According to ARK research, as the value of on-chain financial assets increases, the market value related to decentralized applications is likely to grow at an annual rate of 32%, increasing from $775 billion in 2023 $5.2 trillion by 2030.

Smart contracts are the foundation of the Internet financial system

As a new thing, smart contracts are promoting a new Internet-native financial system. Led by Ethereum, the largest smart contract blockchain, multiple networks are supporting on-chain activity and competing for market share.

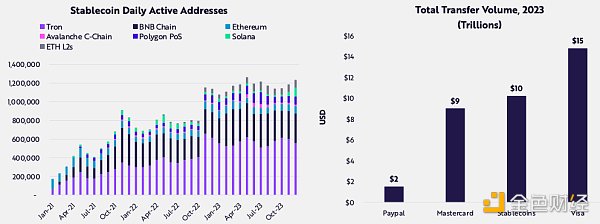

Stablecoins highlight the value of smart contracts Claim

Stablecoins highlight the value of smart contracts Claim

Given hyperinflation in emerging markets and increasing global instability, demand for stablecoins that provide digital access to the U.S. dollar has soared. Over the past three years, the number of daily active stablecoin addresses globally has grown at an annual rate of 93%, from 171,000 to 1.2 million. In 2023, stablecoin transfer volume will surpass Mastercard.

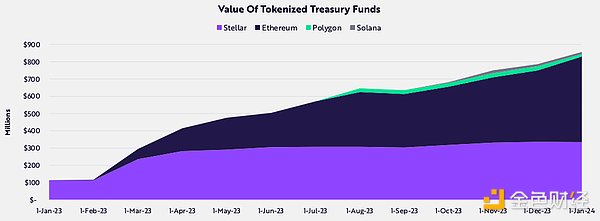

Traditional financial assets are becoming Moving on-chain

Traditional financial assets are becoming Moving on-chain

Tokenization enables finance professionals to track, trade and stake funds on public chains more easily than in traditional financial markets. Tokenized Treasury funding surged more than 7x in 2023, reaching $850 million. Early funds launched on the Stellar blockchain, but Ethereum became the largest market for tokenized Treasuries in 2023.

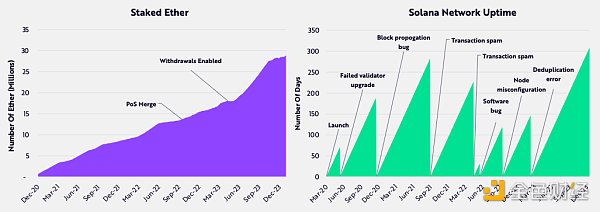

Development Staff optimizes protocol during bear market

In the face of the crypto market crisis of 2022 and its aftermath, core developers advance the technology roadmap and strengthen the protocol to support the next bull market. Ethereum successfully migrated to the PoS consensus mechanism, and Solana set a new record for continuous running time.

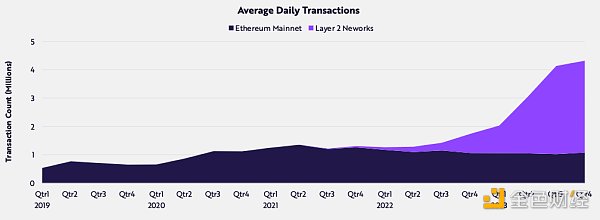

The L2 network has expanded the Ethereum ecosystem Transactions in the system

The L2 network has expanded the Ethereum ecosystem Transactions in the system

Since the beginning of 2021, more than 20 L2 networks have been launched, allowing Ethereum to scale average daily transaction volume 4x with lower fees. Despite early success, most L2 networks are centrally controlled. The proliferation of L2 complicates the user and developer experience.

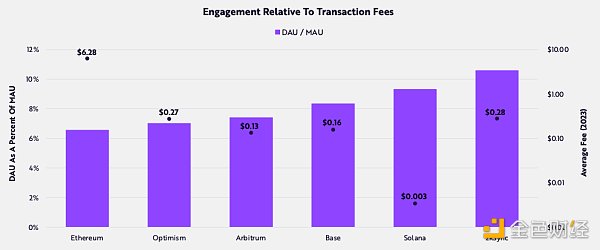

Lower costs are moving up the chain Participation

Lower costs are moving up the chain Participation

On-chain participation (measured as the ratio of daily active addresses (DAU) to monthly active addresses (MAU)) has increased as transaction costs have fallen.

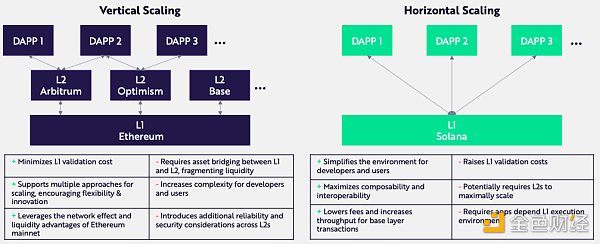

A monomer chain like Solana is Vertical scaling offers an alternative

A monomer chain like Solana is Vertical scaling offers an alternative

Smart contract network design comes with trade-offs. The Ethereum ecosystem makes it more complex as it scales by prioritizing underlying decentralization. Solana maintains a simple architecture and gains traction for users and application developers by prioritizing single-layer scalability.

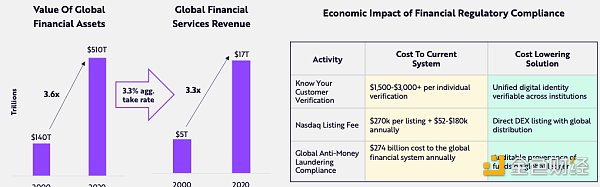

Smart contracts can significantly reduce the cost of financial services

Smart contracts can significantly reduce the cost of financial services

Due to factors such as global economic growth, increased financialization, and equity multiple expansion, the value of global financial assets has expanded from US$140 trillion in 2000 to US$510 trillion in 2020. The operating costs of the global financial system have also increased in tandem with the increase in the value of financial assets. The $20 trillion financial services industry, with total annual revenue, has a rate of 3.3% relative to the value of all financial assets. Smart contracts can significantly reduce financial burdens.

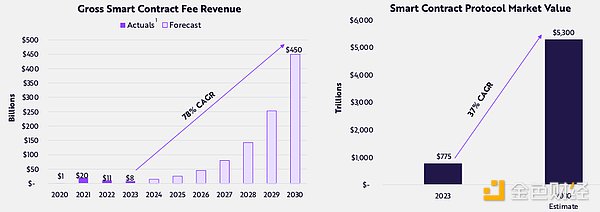

By 2030, smart contract networks may Generating $450 Billion in Fees

By 2030, smart contract networks may Generating $450 Billion in Fees

Smart contracts can facilitate the creation, ownership and management of on-chain assets at a fraction of the cost of traditional finance. If financial assets are moved to blockchain infrastructure like the Internet, and the rates for decentralized financial services are one-third that of traditional financial services, smart contracts could generate more than $450 billion in annual fees by 2030, creating The market value exceeds US$5 trillion, growing at compound annual growth rates of 78% and 32% respectively.

< /p>

< /p>

AI

Performs superhuman performance in various tests Horizontal AI models, such as GPT-4, should lead to an unprecedented explosion of productivity. ChatGPT’s “iPhone moment” caught enterprises off guard, and they are now scrambling to harness the potential of AI.

Thanks to rapidly falling costs and the emergence of open source models, AI can deliver on the promise of far more than improving efficiency. If knowledge worker productivity can quadruple by 2030, as we believe it will, real GDP growth could accelerate and break records over the next five to ten years.

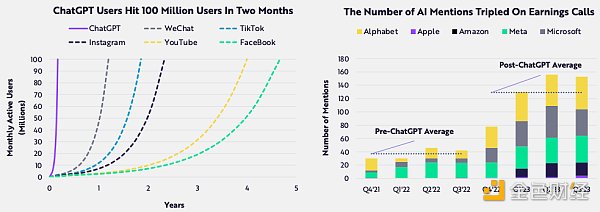

ChatGPT satisfies consumers and amazes businesses

Since Google invented the Transformer architecture in 2017, after years of progress, ChatGPT has catalyzed the public’s understanding of the Transformer architecture. Understanding generative AI. No longer just a tool for developers, ChatGPT's simple chat interface enables speakers of any language to harness the power of large language models (LLMs). In 2023, businesses are scrambling to understand and deploy generative AI.

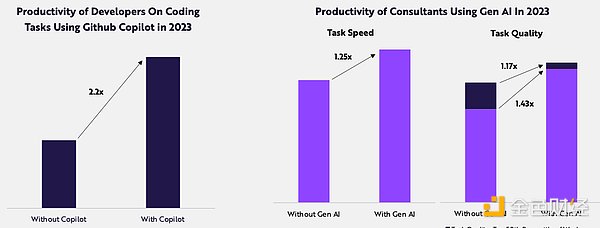

AI has significantly improved productivity

AI has significantly improved productivity

strong>

Coding assistants like GitHub Copilot and Replit AI are early success stories, improving software developer productivity and job satisfaction. AI assistants are improving the performance of knowledge workers, and interestingly, they are more beneficial to poor performers than high performers.

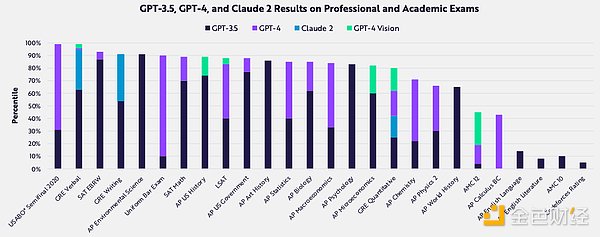

The underlying model is improving across domains

With larger training data sets and more parameters, GPT-4 significantly outperforms GPT-3.5. Increasingly, underlying models are becoming “multimodal”—supporting text, images, audio, and video—and are not only more dynamic and user-friendly, but also more performant.

Wen Sheng Graphical models are reshaping graphic design

Eight years after researchers at the University of Toronto first introduced the modern Vincentian graphic model, the output of graphic models is now comparable to the work of professional graphic designers. A human designer can spend hundreds of dollars creating an image, such as a herd of elephants crossing a green field, in a few hours. The Vincent diagram model can generate the same image in seconds and for pennies. Professional applications such as Adobe Photoshop and consumer applications such as Lensa and ChatGPT integrate image models into their products and services.

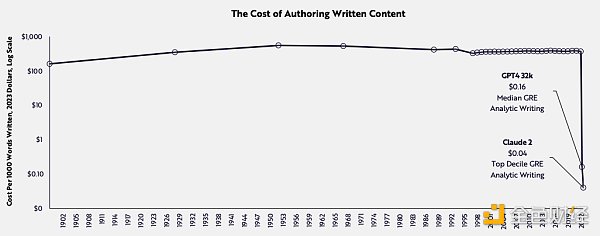

The cost of creating written content has plummeted< /strong>

The cost of creating written content has plummeted< /strong>

Over the past century, the cost of creating written content has remained relatively stable in terms of real value. Over the past two years, as the quality of LLM writing has improved, costs have plummeted.

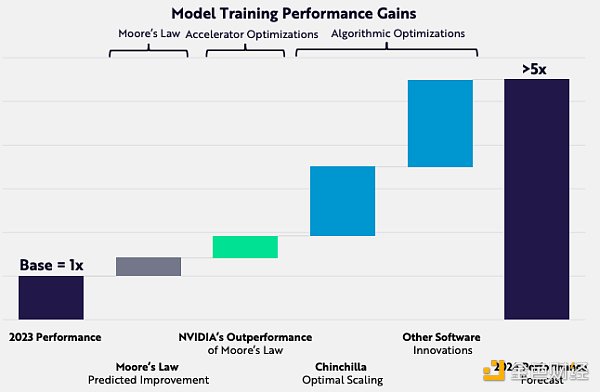

AI training performance is improving rapidly

AI training performance is improving rapidly

strong>

AI researchers are innovating across training and inference, hardware and model design to improve performance and reduce costs.

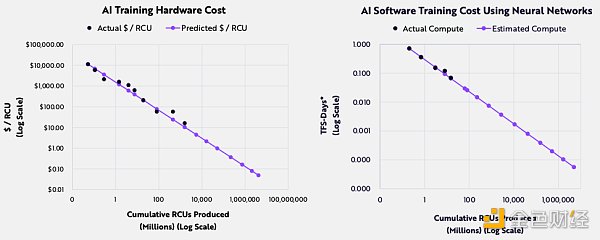

Training costs continue to drop by 75% annually< /strong>

Training costs continue to drop by 75% annually< /strong>

According to Wright's law, improvements in accelerated computing hardware should reduce the production cost of AI relative computing units (RCU) by 53% per year, while improvements in algorithm models can further reduce training costs by 47%. In other words, the convergence of hardware and software could drive AI training costs down by 75% annually through 2030.

As production use cases emerge, AI The focus is shifting to inference cost

As production use cases emerge, AI The focus is shifting to inference cost

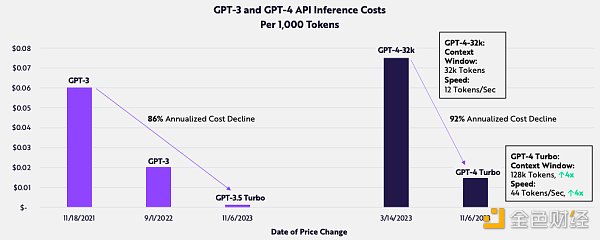

After initially focusing on LLM training cost optimization, researchers are now making inference cost a priority. Based on enterprise-scale use cases, inference costs appear to be declining at an annual rate of approximately 86%, even faster than training costs. Today, the inference costs associated with GPT-4 Turbo are lower than those associated with GPT-3 a year ago.

The open source community is competing with private models< /strong>

The open source community is competing with private models< /strong>

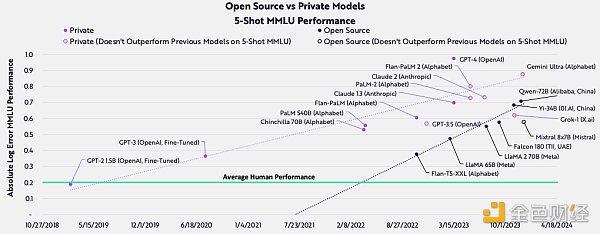

Challenging OpenAI and Google’s closed-source model, the open source community and its corporate giant Meta are democratizing access to generative AI. All in all, open source models are improving faster than closed source models, and some recent models from China have helped.

Improvement of language model performance requires meticulous technology

Improvement of language model performance requires meticulous technology

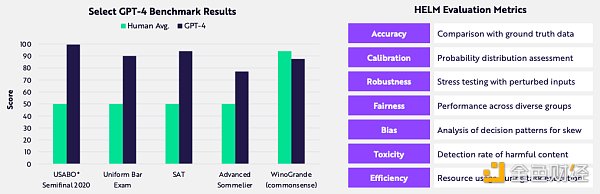

GPT-4 significantly outperforms the average human on standardized educational tests ranging from the SAT to the Advanced Winemaker Exam. However, it lags behind human levels in common sense reasoning, as measured by WinnoGrande. Stanford's framework, Holistic Evaluation of Language Models (HELM), is one of the most comprehensive and continuously updated evaluation methods, having tested more than 80 models, evaluated against a combination of 73 scenarios and 65 metrics.

The language model will run out of data, limiting Its performance?

The language model will run out of data, limiting Its performance?

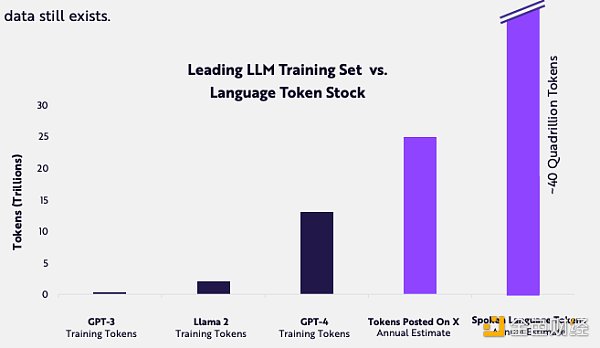

Computing power and high-quality training data appear to be major contributors to model performance. As models get larger and require more training data, will insufficient data cause model performance to stagnate? Epoch AI estimates that high-quality language/data sources, such as books and scientific papers, may be exhausted by 2024, although there is still a large amount of untapped visual data.

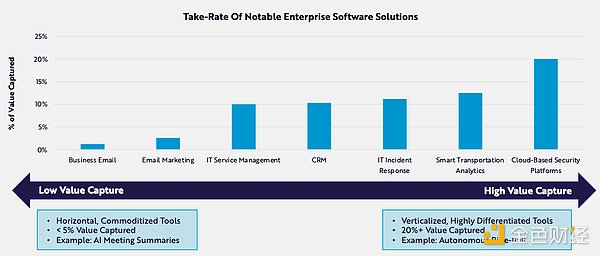

Customized artificial intelligence products should have more Large Pricing Power

Customized artificial intelligence products should have more Large Pricing Power

As open source alternatives emerge and costs fall, software vendors that tailor AI to end-use applications should be able to more easily achieve profitability.

Brian

Brian

Brian

Brian Beincrypto

Beincrypto Coindesk

Coindesk Catherine

Catherine Finbold

Finbold Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx Ftftx

Ftftx Cointelegraph

Cointelegraph