In October 2023, Andrei Grachev, DWF Russia's managing partner, posted a photo of a Lamborghini luxury car on social media with the caption "DWF Lambo". Such a high-profile display of wealth quickly attracted the attention of the crypto industry - Why can the head of this seemingly small crypto institution afford a Lamborghini supercar?

Andrei Grachev, 36, was the head of the Russian branch of the cryptocurrency exchange Huobi. According to the information, he is the co-founder of DWF Labs, but he is based in Switzerland.

DWF Labs' role in the crypto market is a market maker (MM), a middleman company that buys and sells assets at the same time, and is usually indifferent to the rise or fall of asset prices. The role of market makers is to increase market liquidity and make it easier for participants to buy and sell assets. They make profits by pocketing the difference between the buying and selling prices. In traditional finance, market makers must maintain price neutrality according to the rules of the exchanges they apply.

On Binance's trading platform, DWF Labs is labeled as "VIP 9", which means that the company has a monthly trading volume of at least $4 billion, and at this level, Binance usually provides trading fee discounts and enjoys private account manager services.

According to a person familiar with Binance's operations, Binance does not require market makers to sign any specific agreements governing their transactions, which means that, to a large extent, Binance allows market makers to trade as they wish. However, a Binance spokesman said that all users on the platform must abide by general terms of use that prohibit market manipulation.

However, according to a proposal document sent to potential clients in 2022, DWF Labs did not adopt a price-neutral rule, but instead proposed to use its active trading positions to push up token prices and create so-called "artificial trading volume" on exchanges including Binance to attract other traders. In a report prepared for a token project client that year, DWF even wrote directly that the agency had successfully generated artificial trading volume equivalent to two-thirds of the token, and was working to create a "believable trading pattern" that could bring "bullish sentiment" to project tokens if it cooperated with DWF Labs.

YGG incident brings DWF market manipulation to the surface

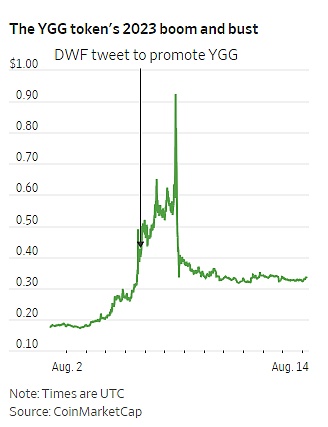

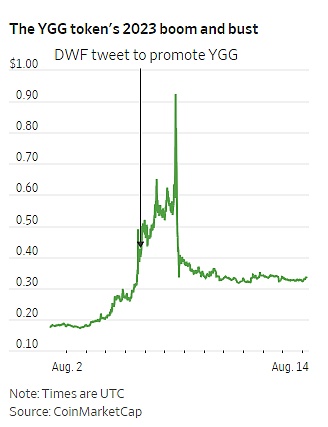

In August 2023, Binance announced the listing of high-leverage derivatives contracts related to the YGG token, which is the native token issued by the blockchain game guild Yield Guild Games and a company invested by DWF Labs, which had previously agreed to sell $10 million worth of tokens to DWF Labs, accounting for about a quarter of its market value at the time.

Andrei Grachev had touted YGG on social media, claiming that the listing would bring "sustainability and strength" to the token, but just after the YGG derivative contract was launched on Binance, its price plummeted (as shown in the figure above).

The cryptocurrency industry noticed the volatility, and two other market-making firms privately expressed concerns about DWF Labs to Binance. One of the market makers complained about DWF Labs' transactions to Binance's department that handles VIP customers, which reported the matter to Binance's market monitoring team, which soon began an investigation into DWF Labs in September 2023.

Investigation and dismissal

According to Binance insiders, its investigators found that DWF Labs was suspected of manipulating the price of YGG and at least six other tokens, and conducted more than $300 million in wash sales in 2023, and the final conclusion was that these actions violated Binance's terms of use.

Not only that, investigators are said to have found similar wash sales on the Binance exchange, especially among VIP customers on which Binance's business relies. Last year, top trading customers (traders with monthly trading volume exceeding US$100 million) accounted for two-thirds of Binance's total trading volume. Therefore, investigators recommended closing hundreds of customers who violated the terms of use by the first half of 2023.

In the case of DWF Labs, the investigation found that after Andrei Grachev tweeted to promote YGG, DWF sold nearly 5 million tokens in two batches when the price of YGG was close to the market peak, causing the token price to plummet and collapse, while YGG co-founder Gabby Dizon claimed that she was unaware of Binance's findings.

In late September 2023, the Binance market investigation team submitted a report that DWF Labs was suspected of market manipulation and recommended that Binance remove DWF Labs, but things seemed to have changed again.

In the following days, the head of Binance's VIP customer department and its employees questioned the findings and complained to the company's leadership. As a result, Binance executives said that the market investigation team did not have enough evidence to show that DWF Labs was involved in market manipulation, and the wash sales it found might be accidental so-called self-trading, which might not constitute manipulation. Binance also believed that the head of the market investigation team worked too closely with the competitor who initially filed the complaint against DWF Labs on the case. A week later, Binance claimed to have fired several investigators involved in the matter in order to save costs.

Responses from all parties

There is no doubt that Binance plays a pivotal role in the current global digital currency economy. Currently, Binance has listed about 400 cryptocurrencies on the platform and provides derivatives that allow users to bet on price direction. The number of Binance users is as high as 190 million. Industry data shows that the value of spot and derivative transactions processed in March exceeded 4 trillion US dollars.

According to the Wall Street Journal, a former Binance insider said that Binance seemed to be "sheltering" DWF Labs' market manipulation. Due to the huge transaction volume of DWF Labs, Binance not only did not stop DWF Labs as recommended by the market research team, but fired the staff investigating the market maker. The purpose of doing so is likely to earn high transaction fees from large customers.

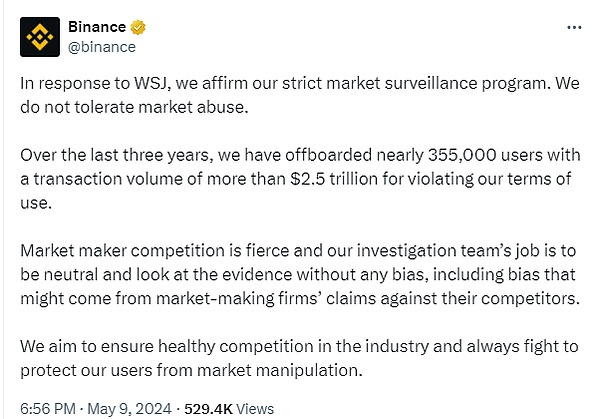

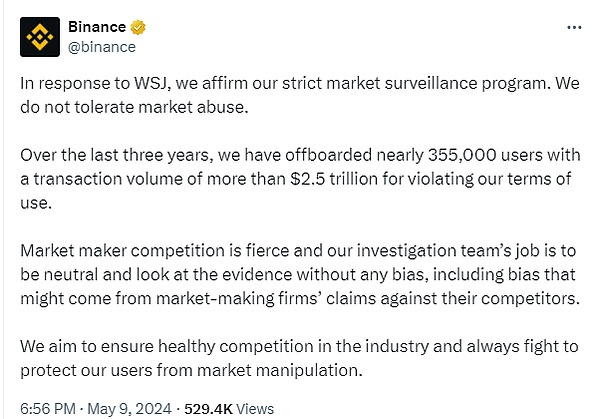

In response, a Binance spokesperson said that he disagreed with any claim that it allowed market manipulation, and that Binance was also prioritizing improving compliance functions. The spokesperson said: "We have a strong monitoring framework that can identify market abuse and take action. Binance will not favor any individual user for the safety of the platform, no matter how large the scale is."

At the same time, the spokesperson also pointed out that Binance will not easily make the decision to remove users, and there must be sufficient evidence to prove that they have violated the terms of use. Under no circumstances will Binance trade for profit or manipulate the market, adding that its operations are "under strict scrutiny." The spokesperson disclosed data that Binance has closed nearly 355,000 user accounts for violations in the past three years, involving transactions of more than $2.5 trillion.

Just after the Wall Street Journal revealed that DWF Labs had wash trading and potential market manipulation issues on the Binance trading platform, Binance responded on the social media platform on the evening of May 9 and wrote:

“Binance strongly refutes any claim that its market monitoring program allows market manipulation on the platform. Binance has a strong market supervision framework to identify market abuse and take action. Any user who violates the terms of use will be cleared, and market abuse will not be tolerated. In the past three years, the number of users who have been cleared for violating the terms of use has been close to 355,000, with a trading volume of more than US$2.5 trillion. Binance has 1.9 100 million users. They can rest assured that Binance prioritizes the security of the platform and will not favor any individual, no matter how large. In other words, none of these decisions are made lightly. Binance will use a variety of tools to conduct an in-depth investigation and will only remove users if there is sufficient evidence that they have violated our Terms of Use. In addition, Inca Digital recently conducted an independent investigation into Binance's market monitoring practices, verifying the effectiveness of the methods and finding the smallest traces of abnormal trading activity. "

DWF Labs, as a party to this incident, also responded on social media and wrote:

"DWF Labs would like to clarify that many of the allegations reported in the media recently are unfounded and distort the facts. DWF Labs operates in accordance with the highest standards of integrity, transparency and ethics and remains committed to supporting more than 700 partners."

Subsequently, Binance co-founder and chief customer service officer He Yi interpreted Binance's response, emphasizing that Binance has been doing MM (market maker) market monitoring, and it is very strict, but it is not aimed at any fund. There is competition among market makers and the means are very shady. He hinted that some market makers engage in PR behavior, but Binance should not be involved. Binance will ensure its own fairness and will not participate, but will also report truthfully to the monitor and other regulatory authorities. He Yi also added: "Everyone is influenced by their own culture, background and prejudice. I am very grateful to WSJ for its persistent long-term investment in Binance, which has helped us increase a lot of exposure and save a lot of budget. But I found an interesting phenomenon that some mainstream media articles are beginning to output emotions and prejudices, and are no longer based on facts. For example, the complaints (views) of former employees can become articles; and Binance helps law enforcement agencies to actively investigate and report the arrest of Zkasino, the main culprit (facts) is not worth reporting." From He Yi's response, this incident seems to be caused by a struggle between market makers. It is very likely that competitors have released some negative news in the media for public relations purposes to attack market makers such as DWF Labs.

On the day when the Wall Street Journal published the article, Binance announced the launch of a new round of new coin mining projects. At least for now, Binance has not been greatly affected by this incident.

JinseFinance

JinseFinance