Written by: ChandlerZ, Foresight News

On March 24, according to Binance’s official announcement, its internal audit team received a report on March 23, 2025, accusing an employee of using insider information to conduct front-running transactions for improper gains. Binance launched a full internal investigation.

At the time of the alleged incident, this person was working within the Binance wallet team, which had no business relationship or cooperation with the project in question. However, he is suspected of abusing his previous position information for personal gain. Before joining the wallet team a month ago, the employee worked in a business development position at BNB Chain. Thus, using the information obtained in his previous position and his familiarity with the on-chain project, he knew that the project was TGE, and used multiple linked wallet addresses to purchase a large number of project tokens before the project publicly released the token announcement.

After the announcement, the employee quickly sold some of the tokens he held, making a considerable profit, while the remaining tokens retained a considerable amount of unrealized gains. According to non-public information obtained from his previous position, this behavior constituted front-running and was a clear violation of company policy.

The preliminary investigation has been concluded, the person involved has been suspended and will face legal prosecution. In addition, Binance has completed the verification and deduplication of the report and distributed the $100,000 reward equally to the reporter.

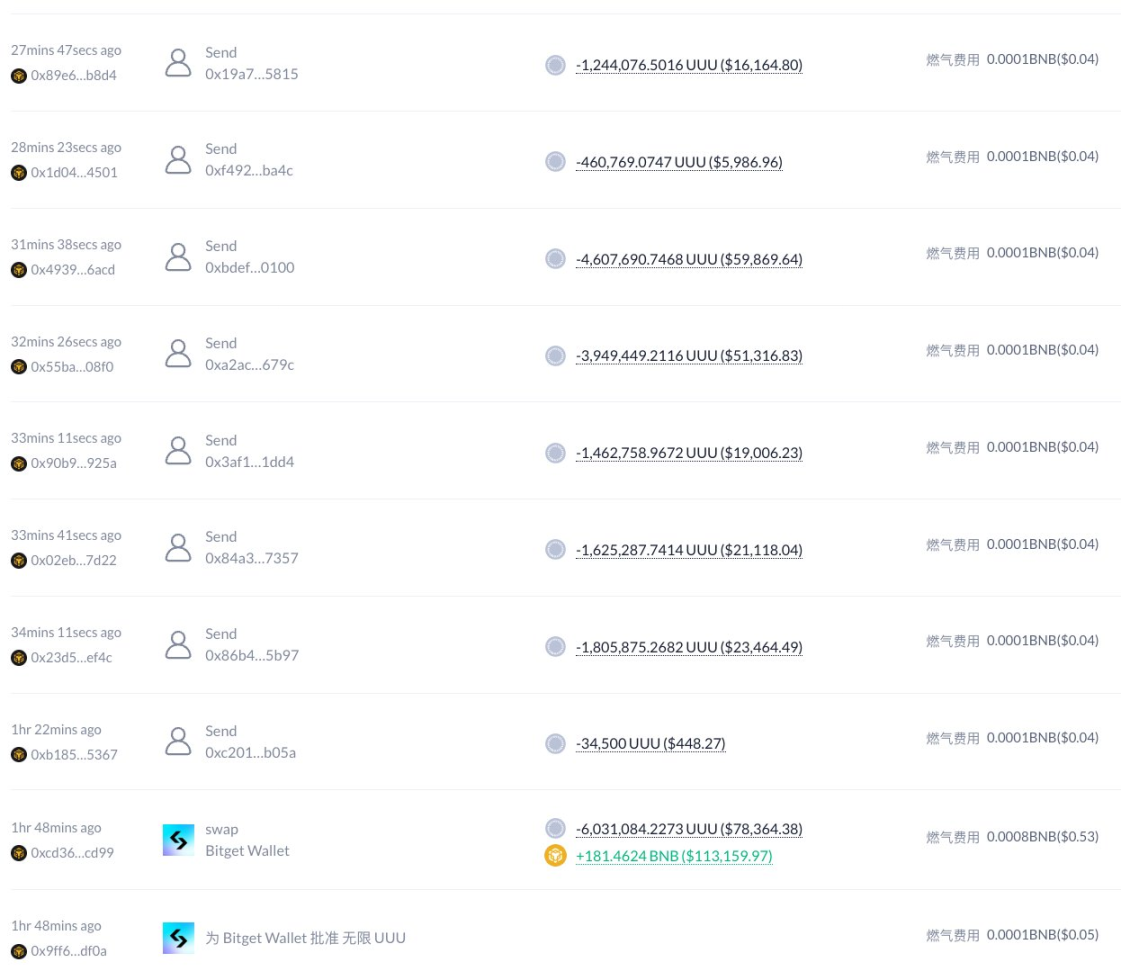

The on-chain evidence caught the "rat's tail"

According to the exposure of X user @土澳大狮兄 BroLeon, Binance employee Freddie Ng was accused of suspected illegal insider trading and participated in the UUU token arbitrage of $110,000. After he made the on-chain information public, he asked Binance to give a reasonable explanation for the matter.

BroLeon said, "The insider trading of UUU tokens has been confirmed! I have just verified the report, and the whole process of stealing has been exposed on the chain. I wonder what will happen to Freddie Ng, the BD and growth employee of Binance Wallet who was caught in the insider trading this time."

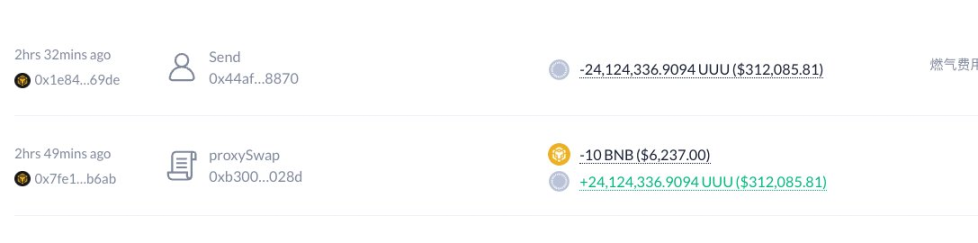

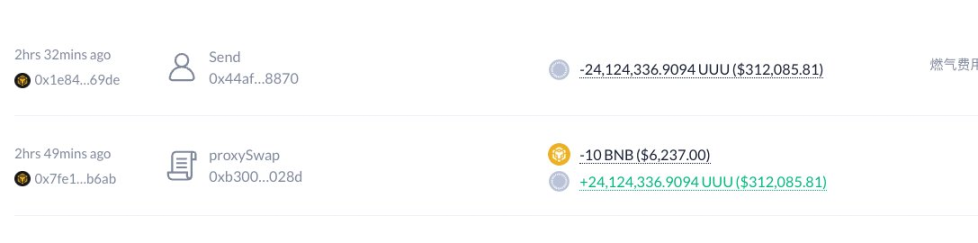

According to the entire process of the crime, the Binance employee named Freddie Ng must have known in advance that the UUU token was going to be pumped up, and used his own small address starting with 0xEDb0 to spend 10 BNB to buy 24.1 million tokens at an average price of US$0.00026, worth US$312,000, and transferred all of them to the wallet starting with 0x44a.

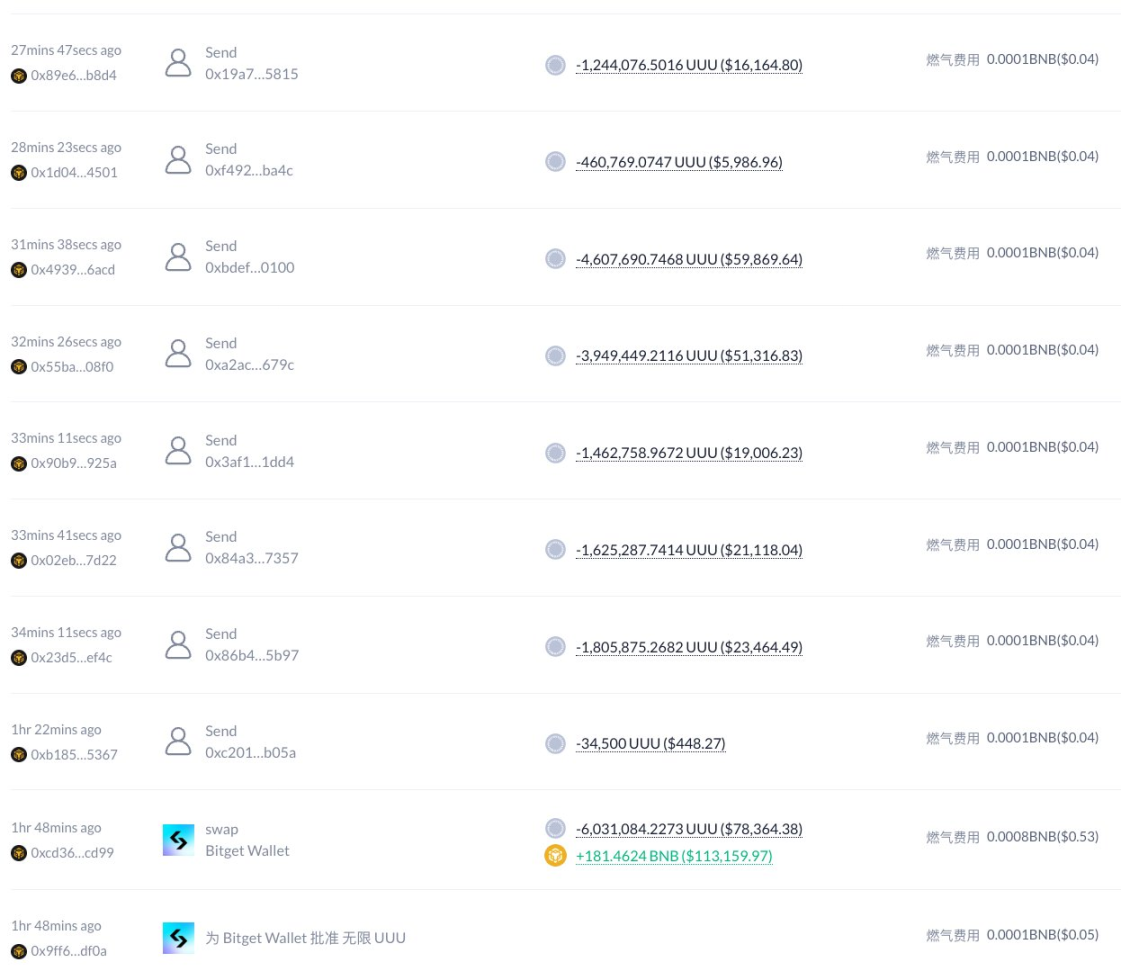

Afterwards, Freddie sold 6.02 million UUUs at an average price of $0.0188 through the Bitget wallet, earning $113,600, and distributed the remaining UUU tokens to 8 different addresses, with each address receiving tens of thousands of dollars.

BroLeon said, "This guy made a mistake. The wallet he used to buy the insider trading was the money transferred from his real-name wallet freddieng.bnb (starting with 0x77C) 121 days ago."

On March 23, BNB Chain trading platform uDex officially launched the official token UUU on four.meme. uDEX is one of the members of BNBChain MVB Season 8. It provides users with on-chain information and allows users to trade directly from social networks. Currently, the market value of the token is 8.22 million US dollars.

Industry problems are difficult to cure

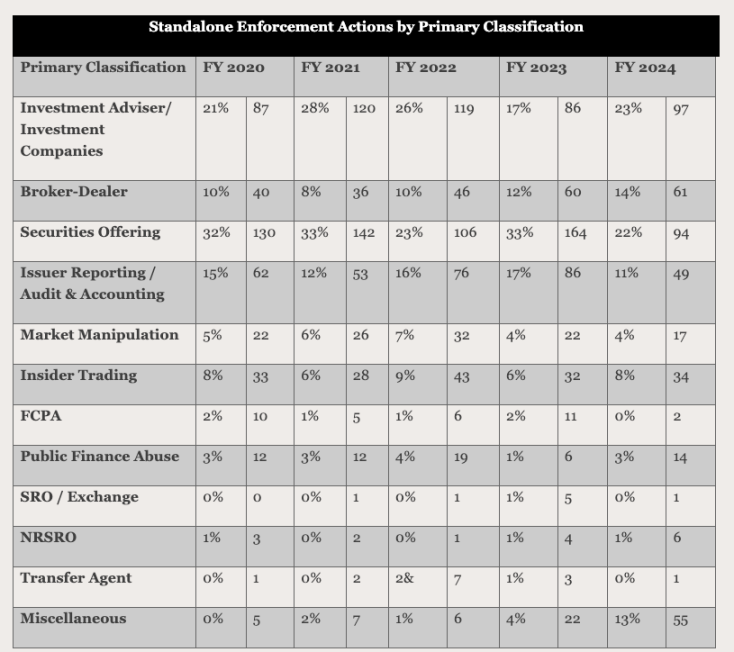

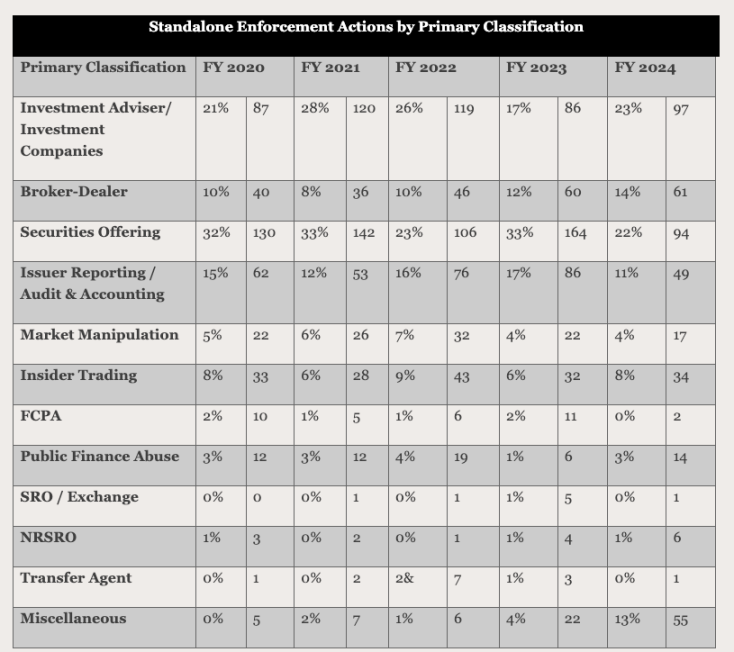

Insider trading is not a problem unique to the cryptocurrency market. Taking the historical data of the U.S. Securities and Exchange Commission (SEC) as an example, insider trading-related enforcement cases account for an average of 8-9% of the total annual enforcement, a proportion that already exists in traditional financial markets.

This is not the first time that Binance has faced insider trading doubts, but few employees have been investigated before. Since 2018, the cryptocurrency industry has continued to have systematic doubts about internal transactions on trading platforms. Many exchanges have been accused of similar mouse warehouse problems at different times, which has become an industry problem.

The transparency and decentralization of the cryptocurrency market have not completely eliminated the risk of insider trading. On the contrary, due to the lack of unified supervision and imperfect internal controls, trading platforms can easily become a hotbed for such behavior. Although major exchanges have strengthened the construction of compliance and risk control systems, the anonymity, technical complexity and global operation model of cryptocurrencies still make traditional regulatory measures face considerable challenges in implementation.

Industry giants such as Binance often show a strong deterrent effect when faced with the problem of insider trading abuse, but similar incidents often occur due to the lack of effective prevention and monitoring measures. Externally, Binance's swift investigation results and actions this time show its determination to rectify the situation, but whether the problem of insider trading can be completely eliminated still requires the industry to strengthen compliance management and transparency from the source.

Alex

Alex