Author: TechFlow

In the cryptocurrency world, understanding macroeconomic data is a must for investors.

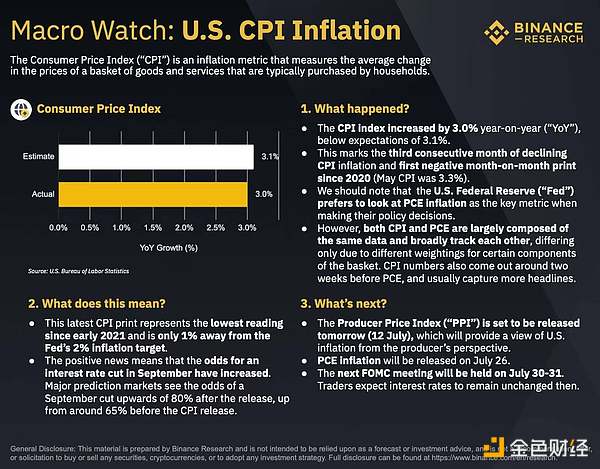

Binance Research has just released an interpretation of the recently announced CPI index, analyzing the definition, impact and future development of the CPI index through a picture.

TechFlow compiled the original picture.

Macro Observation: U.S. Consumer Price Index (CPI) Inflation

The Consumer Price Index (CPI) is an inflation indicator that measures the average change in the price of a basket of goods and services that households typically purchase.

1. What happened?

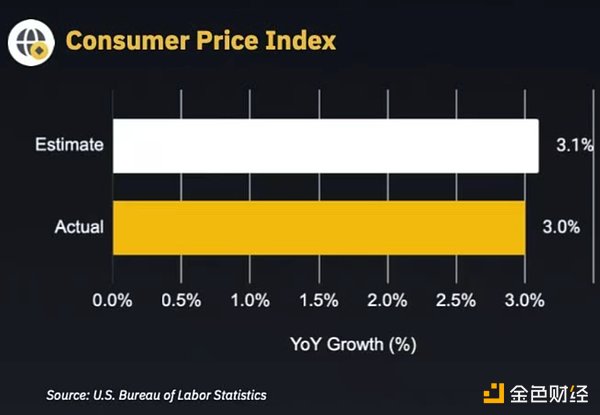

The CPI index increased by 3.0% year-on-year, lower than the expected 3.1%.

This is the third consecutive month of decline in CPI inflation and the first negative monthly growth since 2020 (CPI was 3.3% in May).

It should be noted that the U.S. Federal Reserve ("Fed") prefers to refer to personal consumption expenditure (PCE) inflation when making policy decisions.

However, CPI and PCE are composed of essentially the same data and are roughly synchronized, differing only due to the different weights of certain components in the basket. CPI data is usually released about two weeks before PCE and usually attracts more attention.

2. What does this mean?

The latest CPI data was the lowest reading since the beginning of 2021 and was only 1% above the Fed's 2% inflation target.

This positive news means that the probability of a rate cut in September has increased. The main forecast market believes that the probability of a rate cut in September has risen to more than 80% after the data was released, compared with about 65% before the CPI was released.

3. What's next?

The Producer Price Index (PPI) is scheduled for release tomorrow (July 12), which will provide a view of US inflation from the producer's perspective.

PCE inflation will be released on July 26.

The next Federal Open Market Committee (FOMC) meeting will be held on July 30-31. Traders expect interest rates to remain unchanged at that time.

Source: U.S. Bureau of Labor Statistics

JinseFinance

JinseFinance