Written by: DUO NINE⚡YCC, compiled by Shenchao TechFlow

< span style="font-family: Arial, Helvetica, sans-serif; font-size: 18px;">Bitcoin recently broke through the previous high of 69,000, and even hit a record high of 73,000. As the market becomes hot, Maybe we should also decide in advance when to take profits.

Abstract of this article span>

Be sure to recoup your initial investment when key target price levels are reached

The best time to make profits seems to be between the end of 2024 and the beginning of 2025

Sell at least 10% of your assets every time the price rises 10 times

Profit close to all-time highs

If you buy late, don't think 10x is easy, it may not be the case

Use bottom price to calculate 5x/10x/20x, not your entry price

Please do not sell all your tokens if the cycle is not over yet. Leave some assets looking forward to rising prices

Some altcoins will never reach all-time highs due to inflationary token economics

Liquidate all altcoins after market top

Draft an exit plan now and stick to it later

Never sell all your Bitcoins

Text

There are two strategies you can pursue in this bull market To determine when to exit:

The first one is based on price

The second one is time-based

One is not better than the other , using both together can give you better results. Using just one may cause you to miss out on big things.

I will distinguish them below Each strategy is explained and then applied to examples of Bitcoin, Ethereum, and other altcoins.

Use price as exit Strategy

I mainly focus on Altcoins use price-based exits. This is because individual altcoins have their own mini-cycles and will not peak at the same time as Bitcoin. Some rise quickly, some rise slowly.

Waiting for Bitcoin or Ethereum peaking may be a waste of time as some altcoins have peaked before then. Therefore, keeping price in mind is key to ensuring profits. Regardless, the goal is to exit altcoins completely a few weeks after Bitcoin peaks.

Here's what you should Seriously consider these key moments to profit:

The price is close to the current all-time high

The price has increased 5x, 10x, 20x or more from the bottom (not measured by your entry price)

Guiding examples follow.

K line below The charts all represent altcoins with different momentum and targets. FLOKI is a good example of a meme coin that can grow 100x, RUNE is a solid project that can grow over 20x in this cycle, and AAVE will perform well if it reaches its current all-time high or grows around 10x very good. Use this guide to evaluate your altcoins in these three categories.

FLOKI

FLOKI has grown 65 since bottom times. If you bought at a bear market price, you should have at least withdrawn your principal.

Now the price is also close Historically high levels. It is better to take a portion of your take profit at this price and then leave a small portion of your capital to wait for a new high if it occurs. Buying here will give you exit liquidity and it's better to look for other opportunities.

RUNE

RUNE has risen 14 times since the bottom. If you haven't gotten your money back yet, you definitely should when the price approaches its all-time high of $20. RUNE is well positioned to rise further and hit new records. By then, you should have all your initial capital out and some profits. The rest you can sell after Bitcoin reaches its peak.

AAVE

AAVE has just woken up after a long period of consolidation and has risen 3x from its current bottom. Once the price reaches 5x the bottom or around $300, it’s time to gradually take profits. AAVE may reach all-time highs, but will have less momentum than RUNE or FLOKI. Don't expect a 65x growth like FLOKI here.

Just in case , leaving some funds to wait for new all-time high levels. Once Bitcoin reaches its peak, sell it all.

Use time as an exit strategy

Time means cycles, and the currency that sets cycles in cryptocurrencies is Bitcoin. If you didn't know, Bitcoin follows its halving schedule on a four-year cycle.

The halving has a huge impact on the price of BTC because it causes a supply shock = less coins = increased price. According to history, Bitcoin created a new all-time high price after the halving.

However, this year An exception has occurred!

Bitcoin in 2024 It hit a record high for the first time before the planned halving in April. This is because the approval of the ETF in January could be viewed as an early halving event, resulting in a demand shock = index demand = higher prices.

Only yesterday, ETF Just bought $1 billion worth of Bitcoin!

You should only Consider taking profits on BTC and ETH after the halving event in a specific cycle. Ideally, after about a year, the price is close to its peak level.

However, due to BTC Anomalies in ETFs, this cycle has accelerated. You could say we have two halving events in 2024. One has created a demand shock and the other will create a supply shock. Together they accelerate the cycle. This situation will be further exacerbated if Ethereum also adopts an ETF.

For this reason, If you calculate about a year starting in January 2024, rather than starting in April 2024, you can think that this bull market may peak in late 2024 or early 2025. Based on this, I believe that between October 2024 and March 2025 is a good time to take profits.

On this BTC chart, I've highlighted in red the 2016-2017 bull market, which lasted two years, and the current bull market, which started in January 2023. At the time of this post, the price of BTC appears to be moving faster than the red cycle.

Interestingly, The top of 2017 matched my exit time. I don't think Bitcoin will hit $1 million in 2025, but I would be pleasantly surprised if it does. Regardless, if the price ends the monthly candle under the yellow parabola, then Bitcoin will most likely peak there.

Once the price reaches us of the exit zone, you should start selling. I recommend exiting using DCA:

Sell 15% monthly or 4% weekly starting in October 2024. This will give you until the end of March 2025 to all opt out.

If Bitcoin and Ethereum are trading above a certain price, start selling early, especially if you make life-changing profits.

Before I mentioned that the price and Time to combine for a better exit. If for some reason Bitcoin exceeds $200,000 and Ethereum exceeds $10,000 before October 2024, I will start taking profits early. This cycle may come sooner than expected!

If so, Try to recover your principal and some profits. I plan to liquidate all my altcoins, Ethereum, and possibly sell some Bitcoin that I hold from my altcoin profits. Now, if I make 10x on an altcoin, I will move that profit to Bitcoin or Ethereum. I will then sell them when the price reaches my exit range or reaches the trigger price.

I may also decide Not selling any Bitcoin. The only reason to speculate at the top of Bitcoin is to buy more later. But it is risky and you may suffer losses. Never sell all your Bitcoins.

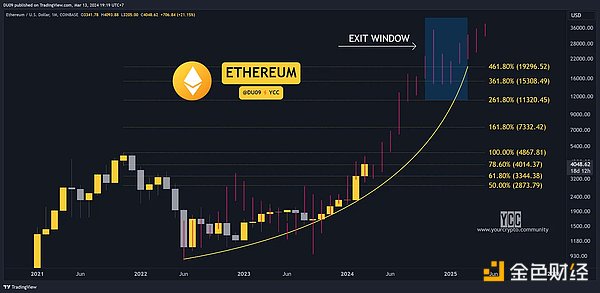

Use the last bull market A similar prediction was made for Ethereum, showing that our exit window appears to be quite accurate as well. Interestingly, it also shows that Ethereum could go well above $20,000. This is an optimistic scenario, but it could become a reality if an Ethereum ETF is approved this year.

Make your exit plan now

If you want to leave this bull market successfully and satisfied, you need an exit plan. If not, create one now. Success means you adhered to your exit plan, not reaching a specific dollar value.

Ask yourself, How much money do you want to make in this bull market? Set a goal, but make it realistic. Check out what your crypto portfolio is worth today, what is it? Then increase this value by a factor of 2 to 10. If you increase it 10 times, you may not be realistic. If you increase it by 2x you will most likely hit your target. Choose your scope and risk appetite. This is your price target.

If in 2024 If the target is not reached in the time period between October and March 2025, seriously consider whether your price target is realistic. I think 2025 is likely to be the year this market turns bearish, so don't delay too long once we get into next year. Profit on the way up. Exit using dollar-cost averaging.

If your target Achieve it and you stick to the plan and you will leave this bull market satisfied. Control your greed because as prices increase you will be tempted to change your goals. This is how long you miss your exit.

Don’t let FOMO Return to the market at the end of 2025. If the market tops, forget about it for one to two years. You can re-enter the market during the next bear market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Miyuki

Miyuki Miyuki

Miyuki JinseFinance

JinseFinance fx168news

fx168news Cointelegraph

Cointelegraph